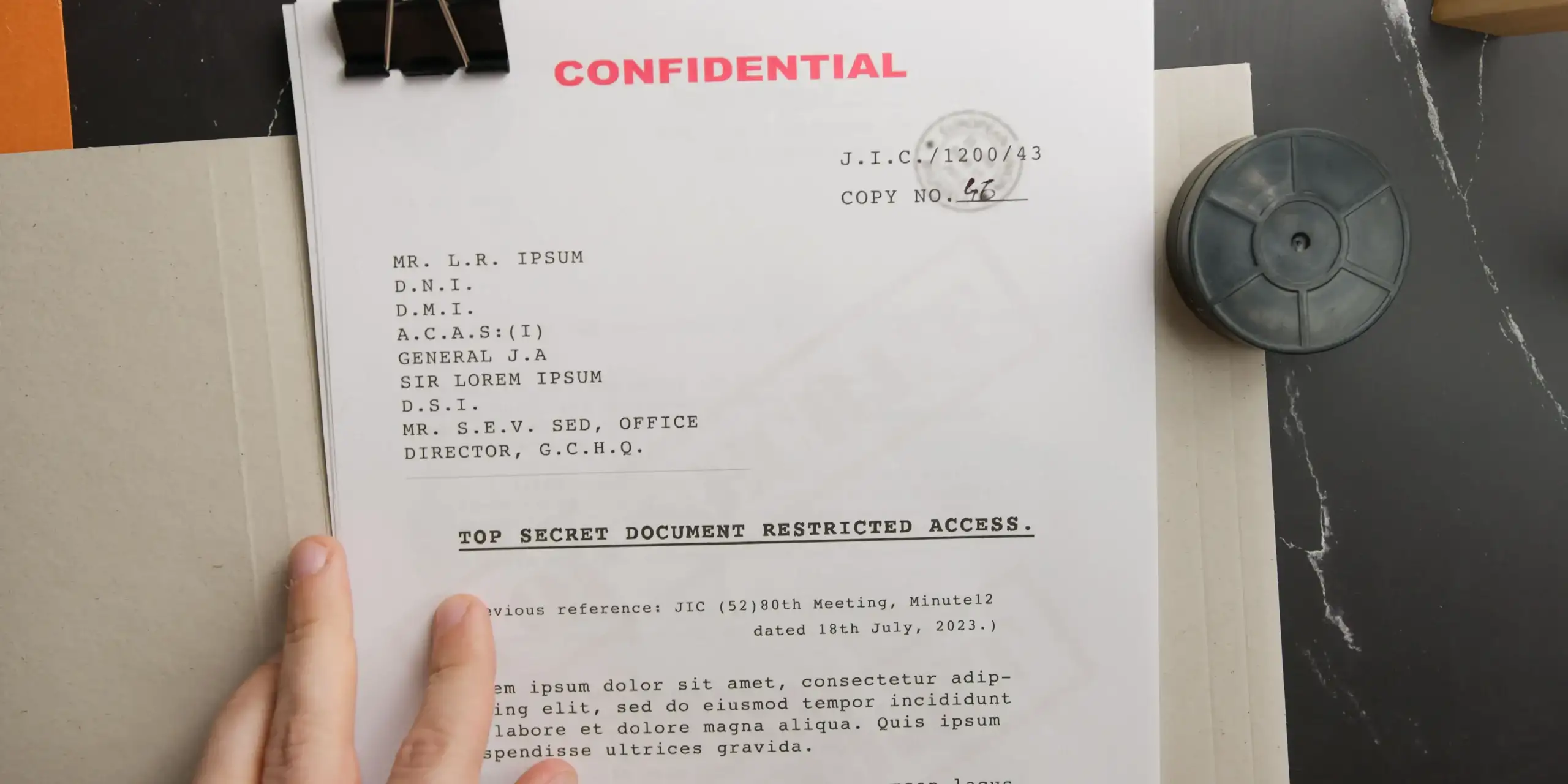

Transport aérien et spatial

A sector still in recovery

In Air Transport, ten years of uninterrupted growth driven by tourism were wiped out by the Covid-19 pandemic, both in France and at European level. Fiscal 2022 saw an upturn in air traffic compared with 2021 (+122% in European Union countries), but traffic was still down on 2019. In France in 2022, 174 million air travellers passed through France, 74.4% of them from international destinations, and 53.3% via Paris airports.

Limited dynamism

With just under 2,400 players and 77,000 employees, the French air and space transport sector now appears mature and concentrated. Its business population has grown by only +2.3% between 2022 and 2023. Passenger airlines account for 40% of companies and 62% of employees, followed by auxiliary services with 20.3% of companies and 36.5% of employees. In mainland France, the sector is dominated by the Air France-KLM conglomerate, which, with its subsidiaries Hop and Transavia, employs 55.1% of the country's workforce.

Limited claims experience

Over the past 12 months, to the end of February 2023, the Air Transport sector has only recorded around ten business failures, a figure that is stable year-on-year, and even slightly below the pre-Covid-19 crisis level of 2019. These insolvencies mainly affected the auxiliary transport services sector (60%), mainly in the Paris region. For almost two years, the air transport sector had to withstand the headwinds imposed by the Covid-19 crisis, which grounded a large proportion of commercial fleets, crippling international tourism and, by the same token, airlines' social accounts, with losses running into billions of euros.

"According to the International Civil Aviation Association (ICAO), global passenger traffic should gradually return to its pre-pandemic level, then exceed 2019 activity by the end of the year. It should be remembered that by 2022, passenger numbers had reached 74% of the volume recorded in 2019."

- Max Jammot , Ellisphere Business Unit Manager

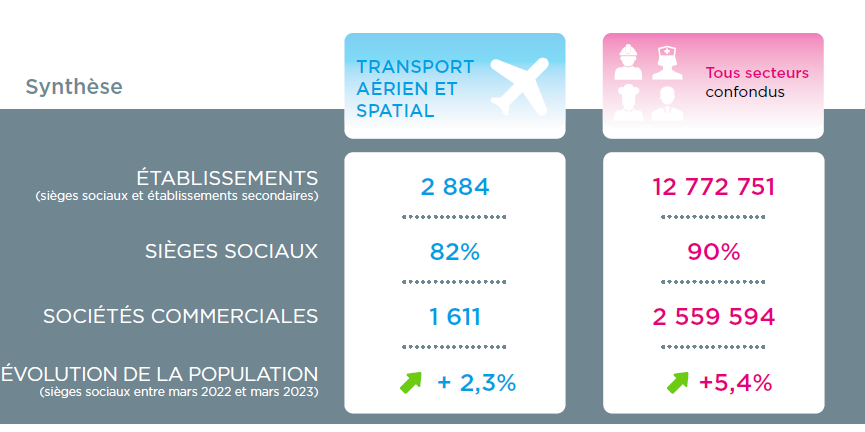

Construction aéronautique et spatiale

A saturated sector...

Since the Covid-19 crisis, supply chain tensions have been hampering aircraft manufacturers' production rates. In the best-case scenario, it will take until 2024 to return to the pre-pandemic pace. On paper, the crisis seems to be over, and order books are full. At the beginning of 2023, Airbus announced more than 7,200 aircraft on order, compared with nearly 4,600 for Boeing. In addition, the European aircraft manufacturer's design offices are working on the ecological transition with the "green aircraft".

...But mature and focused

In mainland France, the aerospace construction and maintenance sector, in the strict sense of the term, comprises just over 900 companies employing more than 120,000 people.INSEE, which includes industrial subcontracting and the service sector (engineering and IT), lists just under 4,500 operators and 263,000 employees. The aerospace industry is structured around nine major

around nine major industrial companies responsible for the overall design and assembly of both civil and military airplanes and helicopters; these are the main, and sometimes almost exclusive, principals for a myriad of suppliers and subcontractors. If the aerospace industry is still creating new businesses, it's mainly in the repair and maintenance sector, which accounts for 63.5% of operators but only 10.3% of the workforce.

Which is experiencing a rise in insolvencies

While the aerospace industry may appear resilient, with just 10 insolvencies over the past 12 months to the end of February 2023, the number of insolvency proceedings has risen sharply over the past year (+67%). This has tripled for manufacturers, affecting almost 2% of the sector's players. This trend brings us back to the levels seen in the pre-crisis period of 2017-2018. The construction industry was a major consumer of the aid granted during the Covid-19 crisis(State Guaranteed Loan, deferral of tax and social charges, short-time working, etc.).

"Airbus and Boeing are still locked in a fierce battle for 2022. A slight advantage for the European aircraft manufacturer, which is also forecasting around 13,000 new recruits worldwide. Thales and Safran are also expected to be very active in 2023 in terms of employment; proof of the excellent recovery of the aerospace industry."

- Max Jammot, Ellisphere Business Unit Manager