Dans l’imaginaire collectif du risque, la défaillance d’une entreprise met sous tension à la fois ses fournisseurs et ses clients. Les fournisseurs subissent la diminution de leur chiffre d’affaires, mais également la perte sèche des crédits clients accordés. Rappelons que pour compenser cette perte sèche, un fournisseur doit générer 10 fois le chiffre d’affaires généré par l’entreprise défaillante auprès d’un autre client (avec une hypothèse de 10% de marge). D’un autre côté, les clients doivent faire face à une rupture de leur chaîne d’approvisionnement, qui peut mettre en péril leur activité.

Des entreprises connectées entre elles grâce à des intermédiaires

L’article « Bankruptcy propagation on a customer-supplier network : An empirical analysis in Japan » propose une étude du risque de défaillance des partenaires d’une entreprise défaillante, et se fonde sur des données d’entreprises japonaises. Faisons un rapide tour d’horizon de cette étude ainsi que de ses résultats.

Celle-ci observe la mise en relation de deux bases de données. La première est l’équivalent de la base de données Ellisphere : un historique des événements légaux et des informations financières des entreprises. La deuxième est une base de relations client-fournisseur ; elle liste des contrats entre entreprises ainsi que leurs montants. Finalement, plus d’un million d’entreprises sont étudiées, pour plus de quatre millions de relations client-fournisseur.

Ainsi, l’analyse de l’ensemble des deux bases de données montre des relations intéressantes. Premièrement, il y a relativement peu de liens directs entre les entreprises. Seulement 0,000338% des liens possibles entre les entreprises existent effectivement. Néanmoins, l’écosystème des entreprises est très connecté puisque 80% des entreprises sont connectées via un ou plusieurs intermédiaires. Le nombre d’intermédiaires est même plutôt faible, trois le plus souvent.

La structure du réseau d’entreprises, un élément clé

Pourquoi s’attarder autant sur la structure du réseau d’entreprises ? Parce que la structure est essentielle pour comprendre comment le choc d’une défaillance est supporté par l’écosystème. Etudions un cas simple en ne considérant que le choc financier lié à l’impayé suite à la défaillance. Si l’entreprise partenaire n’a pas d’autres partenaires, elle doit subir seule la perte (de chiffre d’affaires et de matériel). Si elle a d’autres clients, la perte représentera une plus faible part de son chiffre d’affaires, mais elle pourrait aussi inciter ses autres clients à réduire leur durée de paiement pour rééquilibrer son cash disponible. Ainsi, le choc est en parti porté par l’ensemble des autres clients.

L’entreprise peut également mettre ses fournisseurs à contribution en allongeant ses délais de paiement ; ce qui réparti l’impact de la perte sur encore plus d’entreprises. On voit ainsi que les liens commerciaux permettent d’atténuer le choc en le répartissant entre plusieurs acteurs. Reste à comprendre le réel pouvoir d’atténuation de ces liens commerciaux ainsi que la différence entre une connectivité directe et indirecte.

Zoom sur le cas japonais

Au Japon, le réseau possède une faible connectivité directe (chaque entreprise a peu de partenaires), mais une forte connectivité indirecte. Qu’en est-il alors de la cascade ?

Un modèle de survie, technique pratiquée notamment en médecine pour évaluer l’efficacité des traitements, a été utilisée pour estimer l’impact que pourrait avoir la défaillance d’un fournisseur ou d’un client sur la probabilité de défaillance de l’entreprise cible. Il a été mesuré qu’une entreprise triplait sa probabilité de faire défaillance si 50% de ses clients faisaient eux-mêmes défaillance. L’impact d’une perte de 50% de ses fournisseurs est légèrement plus faible : un facteur 2.

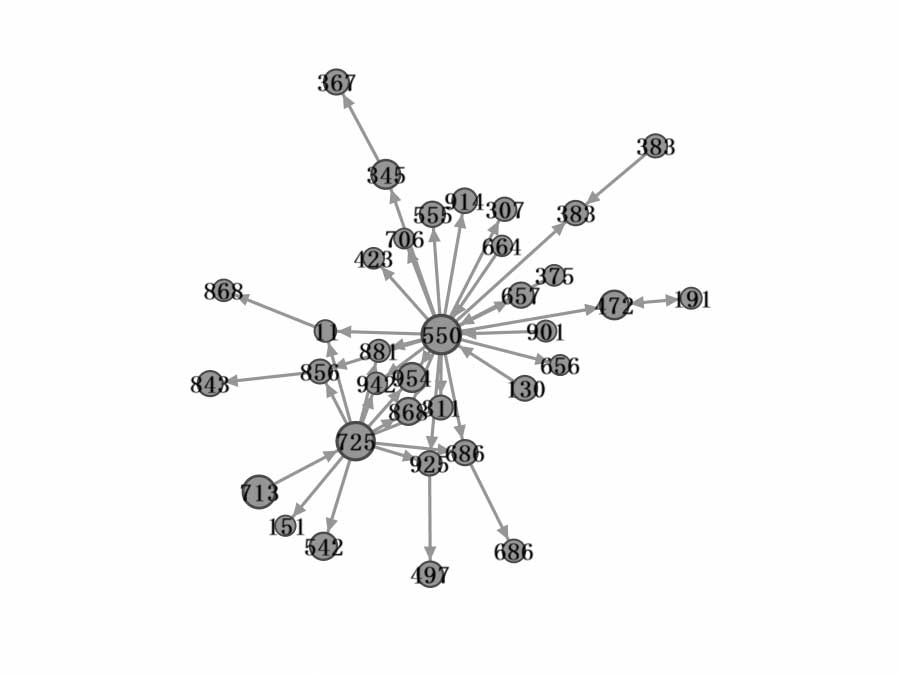

Ces résultats témoignent d’une augmentation du risque, mais pas de la probabilité effective du nombre de cascades de défaillances. Pour étudier ce dernier point, l’auteur de l’étude a étudié les liens directs entre les entreprises défaillantes. Il a été observé que 90% des entreprises défaillantes n’entraînent aucune autre dans leur chute. Parmi les 10% restantes, une écrasante majorité de cascades n’implique que deux entreprises. Enfin, l’auteur a quand même découvert quelques structures un peu plus complexes. Le graphique ci-dessous montre le cas le plus complexe qui implique 35 entreprises. Les flèches représentent la direction fournisseur->client, et les numéros, les dates de défaillance par rapport à une référence arbitraire.

Défaillances en cascade, quel impact pour l’économie ?

Défaillances en cascade, quel impact pour l’économie ?

La défaillance en cascade est donc un risque significatif au niveau des entreprises. Elle représente 10% des défaillances. Mais qu’en est-il sur le plan économique plus globalement ? L’auteur a effectué de nombreuses simulations pour différents types de réseaux, en prenant ou non en compte l’effet de cascade mesuré. Il apparaît que les défaillances en cascade sont très peu fréquentes. Les simulations ont en effet montré qu’une grande connectivité (même avec des intermédiaires) entre les entreprises permettait d’amortir le choc généré par la défaillance d’une entreprise. Chaque niveau d’intermédiaire dilue la perte sur toujours plus d’entreprises.

Que peut-on retenir ?

Cet article sur l’étude des défaillances en cascade des entreprises japonaises permet de mettre en lumière de nombreuses intuitions du domaine du risque. En particulier, l’auteur montre que la défaillance d’une partie significative des clients et/ou fournisseurs d’une entreprise augmentait de manière significative (d’un facteur 2 à 3) son risque de défaillance. Cependant, sur le plan de l’écosystème, les nombreux liens entre les entreprises offrent une structure qui permet de répartir le choc sur un grand nombre d’acteurs et donc de limiter le nombre d’entreprises possiblement prises dans une cascade de défaillances.