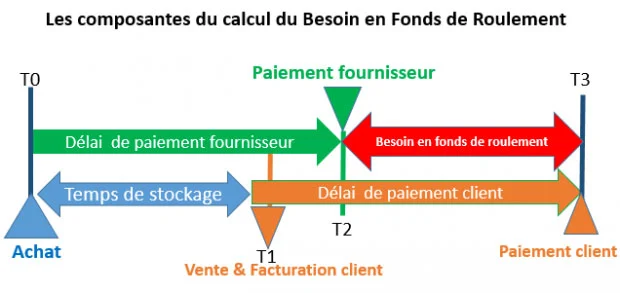

By definition, the Working Capital Requirement (WCR), directly linked to the operating cycle, represents the amount that a company must finance to cover the need resulting from cash flow offsets, which correspond to disbursements (expenditure) and receipts (receipts) related to its business.

It is the balance of the balance sheet accounts, i.e. customer, supplier and stopentrck items. Calculated on the date of drawing up the accounts, the financial analysis breaks down the BFR into two elements:

- WCR of Exploitation (WCRE) = receivables receivable + inventory – supplier and tax debts,

- WCR without Exploitation (WCRWE) = balance of other circulating assets and liabilities.

WCR = WCRE+ WCRWE

Working Capital Requirement

Differences between WCRE and WCRWE

The WCRE corresponds to the financing necessary for the operation (current business of the company). It consists of stocks, customer claims and financing related to supplier debts, i.e.:

- a structural part attached to the payment deadlines for customers and the settlement of suppliers,

- a cyclical part determined by the level of activity or any change in turnover resulting in a change in BFRE.

WCRE = stocks + accounts receivable – operating debts

Working Capital Requirement of Exploitation

While the WCRWE takes into account the means made available to the undertaking without direct connection to normal operation such as:

- Circulating assets such as:

- other claims,

- charges recorded in advance.

- Resources from:

- other debts,

- revenue recorded in advance.

WCRWE = off-farm debt – off-farm debt

Working Capital Requirement Without Exploitation

Impacts of the WCR on a company’s financial health

The financial analysis of the company’s balance sheet is based on working capital, working capital requirements and net cash flow. The WCR is an indicator of a company’s financial health:

- If the WCR exceeds 0, it is said that the operating cycle absorbs cash,

- If the WCR is less than 0, it is said that it generates cash,

- If the WCR is zero (= 0), it is said that there is stability.

In short, a WCR that explodes is a sign of poor health that can very quickly lead to irremediable cash flow difficulties for a company if the financing is not found.