Notre promesse

Une prise de décision sereine

Révolutionnez votre politique de credit management avec Ellipro. Notre plateforme de Risk Management vous permet de prendre les bonnes décisions rapidement et facilement. Grâce à notre technologie de pointe et à notre expertise, vous disposez d’informations fiables pour minimiser les risques de non-paiement et optimiser votre trésorerie.

Avec Ellipro, vous bénéficiez d’une approche personnalisée pour gérer efficacement votre portefeuille client et garantir la pérennité de votre activité. Ne laissez plus les risques de crédit mettre en danger votre entreprise, découvrez dès maintenant les avantages d’Ellipro !

Notre proposition

Une information de qualité au service de vos opérationnels

Ellipro est une solution de gestion de crédit conçue pour aider les credit managers à améliorer la gestion de leur portefeuille client et à réduire les risques de crédit. Les avantages de la solution Ellipro pour les credit managers incluent :

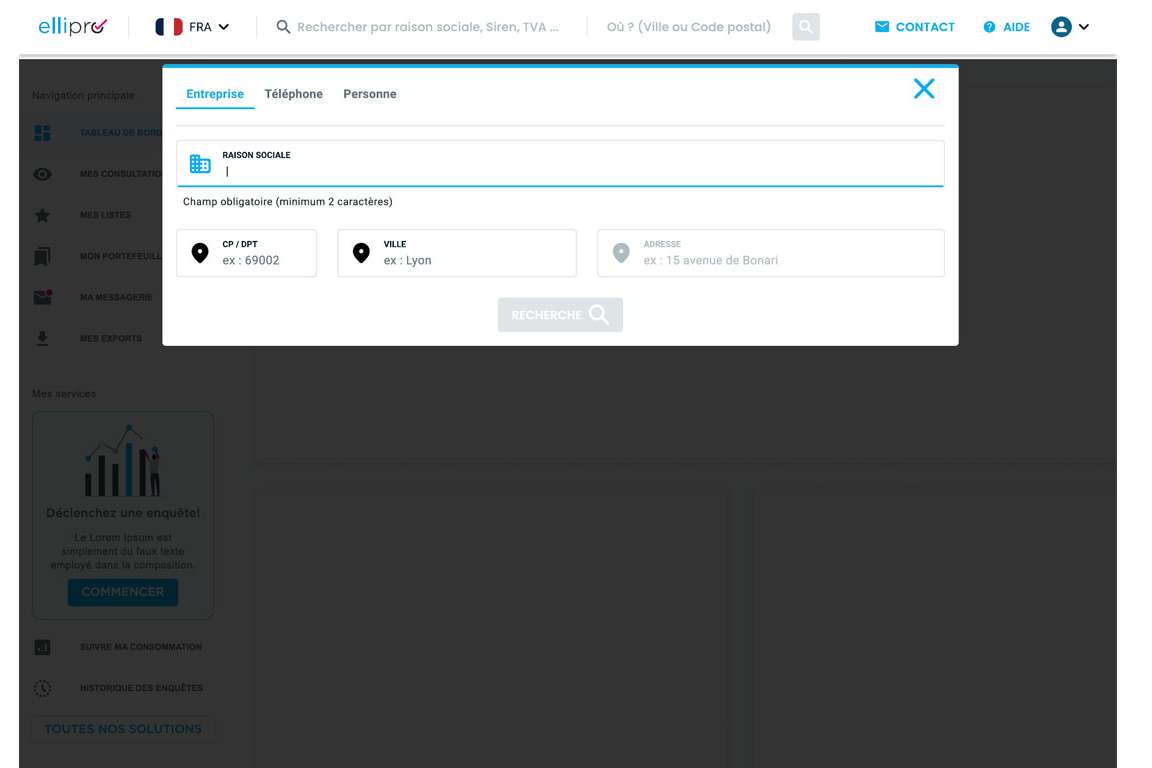

Une base de données internationale

Accédez en temps réel à de l’information fiable sur 250 millions d’entreprises et leurs dirigeants de plus de 230 pays, dont la France.

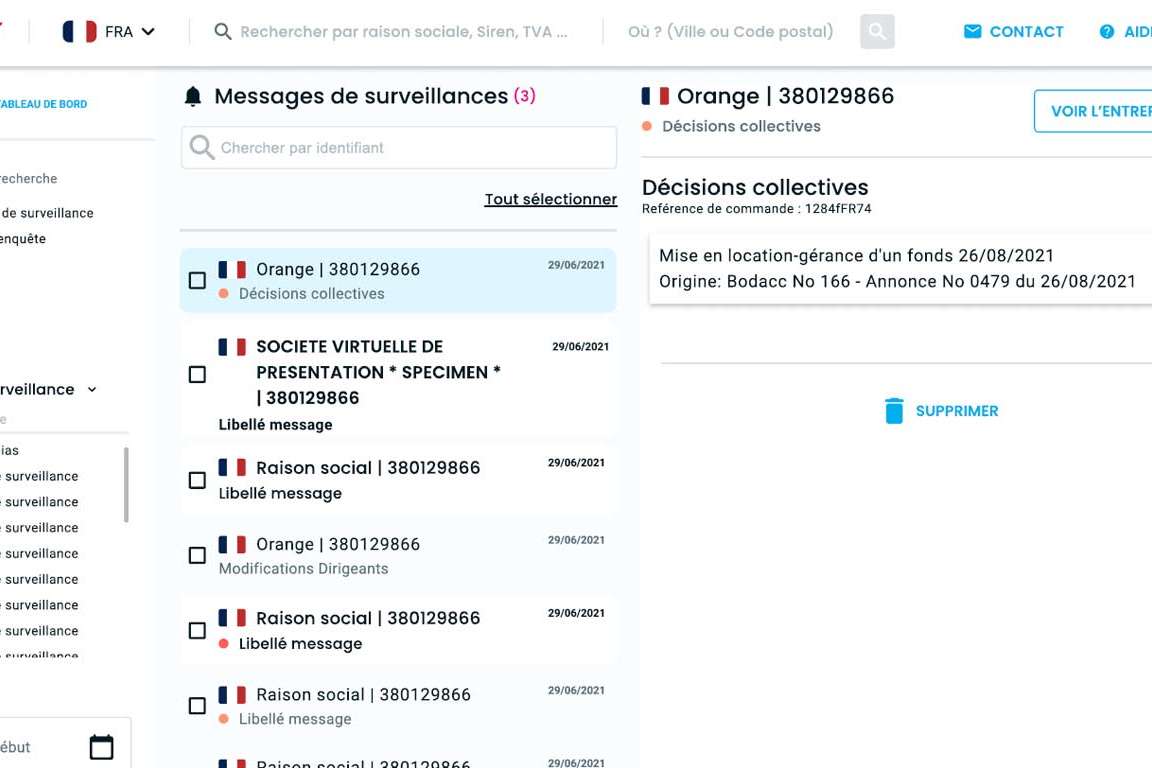

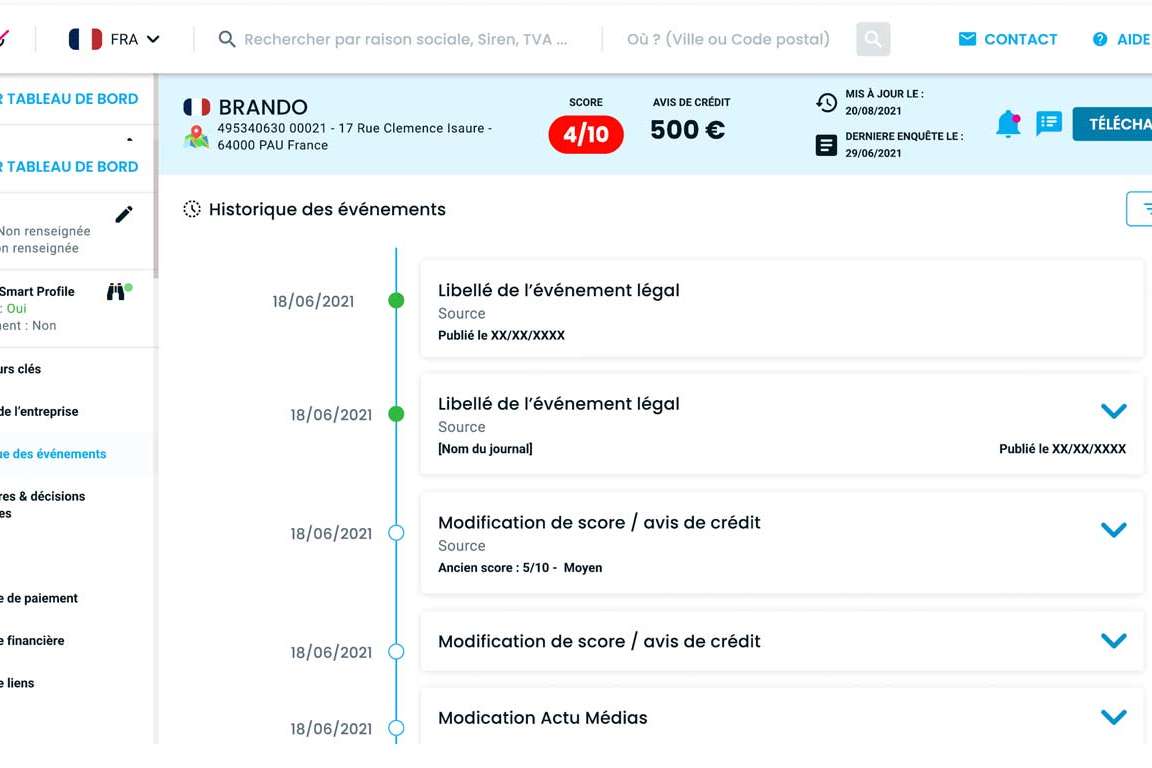

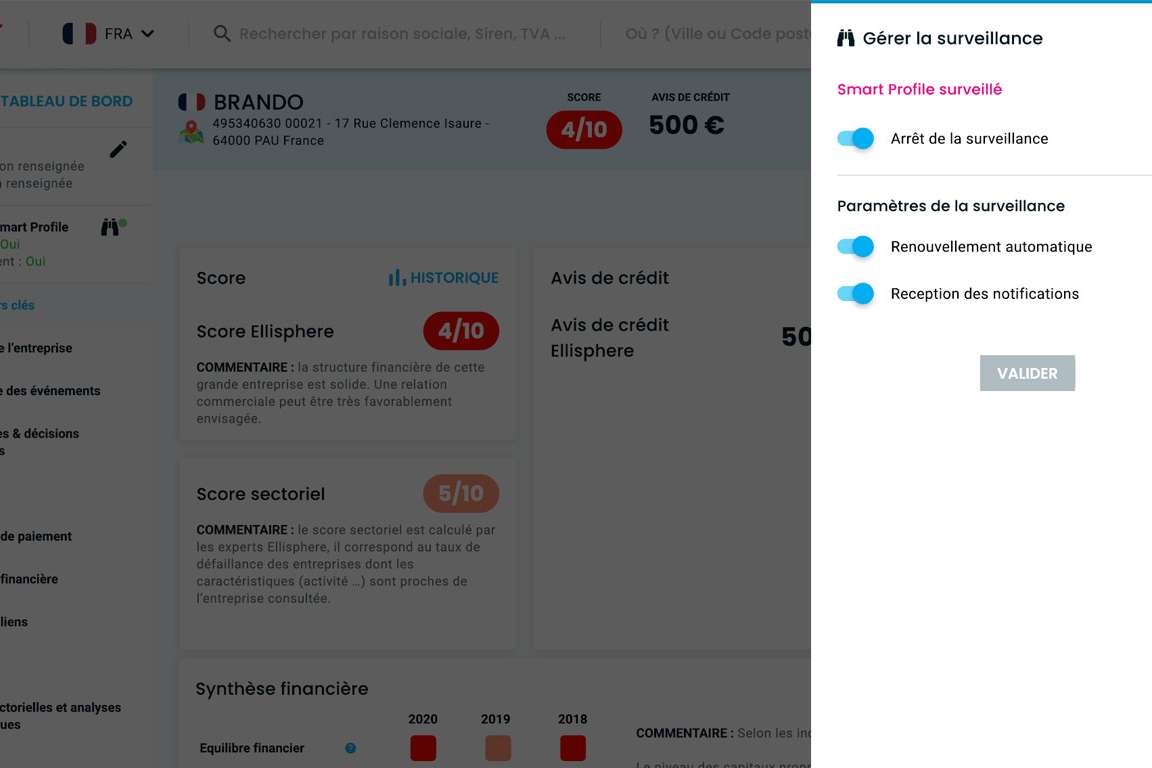

Surveillance en temps réel

Suivez les évènements des entreprises de votre écosystème grâce à des alertes e-mail paramétrables.

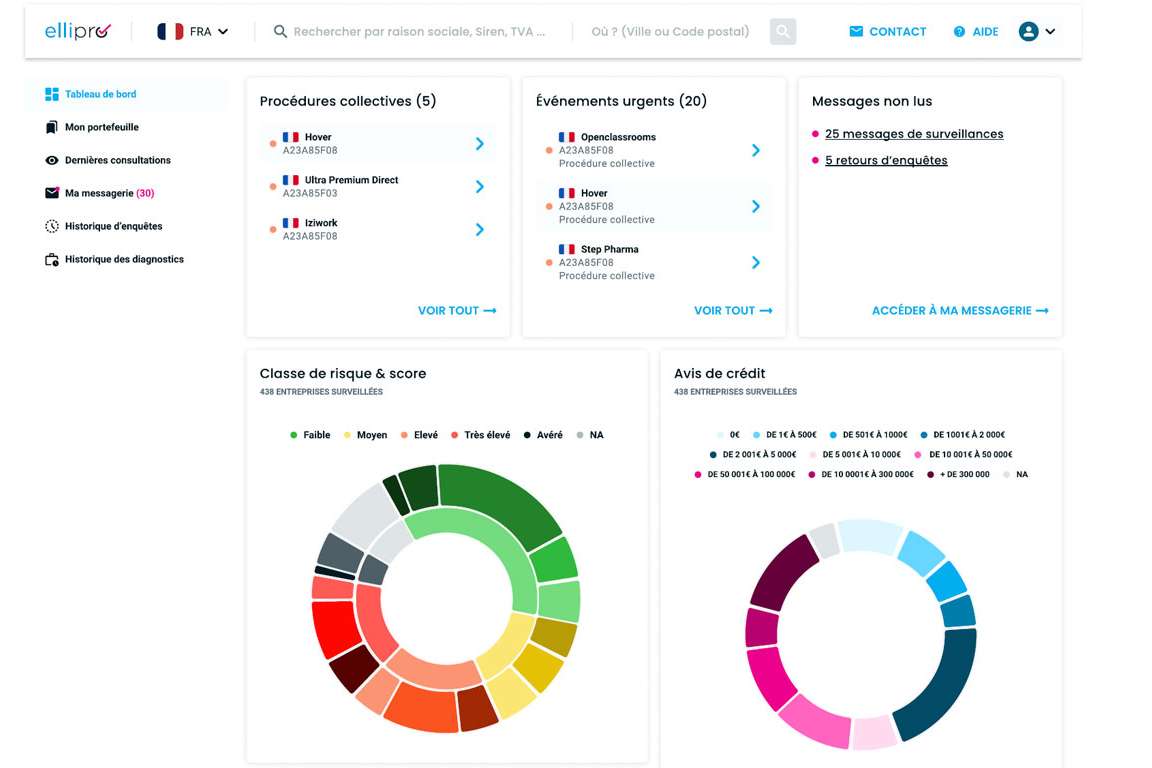

Un tableau de bord personnalisé

Pilotez plus efficacement vos actions de gestion de crédit à travers un outil d’analyse et d’aide à la décision.

Nos atouts

Une plateforme qui répond à vos besoins

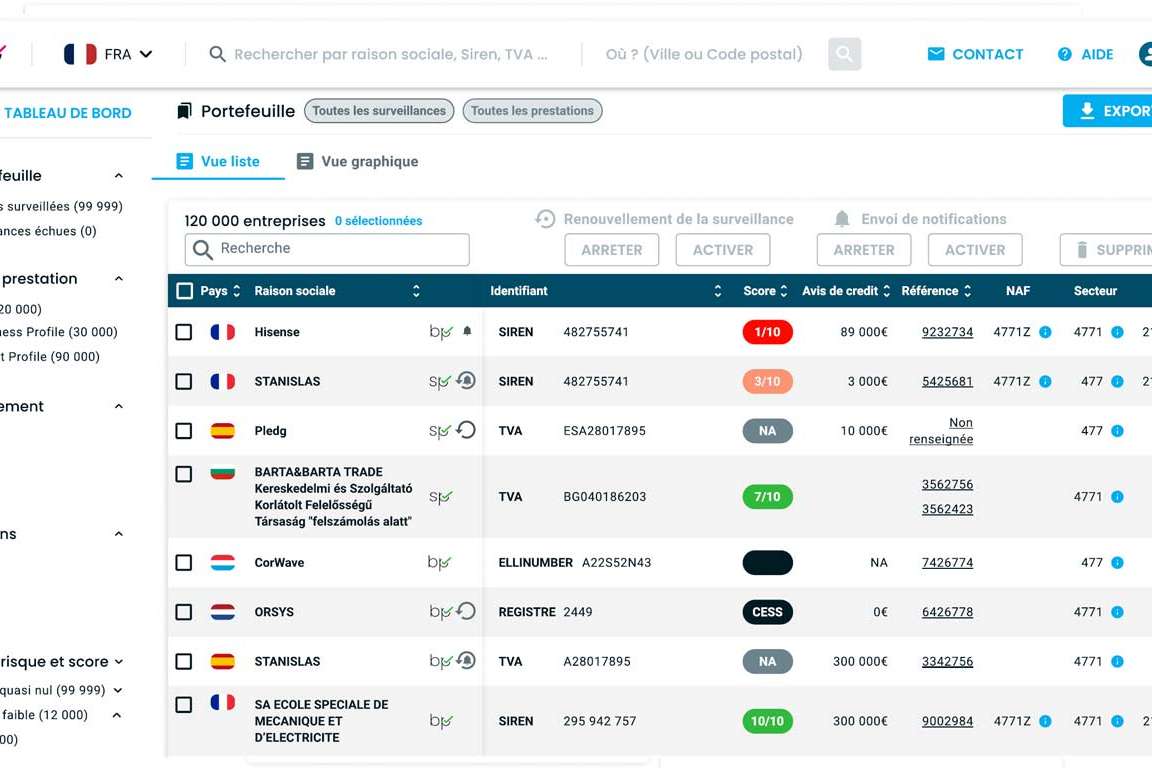

Intuitive

Une interface simple avec un parcours intuitif qui vous permet d'évaluer efficacement le niveau de risque de votre portefeuille client/fournisseur.

Personnalisable

Un paramétrage et une personnalisation au cœur de votre expérience utilisateur, pour s’adapter à vos différents besoins.

Innovante

Un accompagnement personnalisé pour la mise en place de la solution dans votre environnement organisationnel, technique et technologique.

Des indicateurs adaptés à vos prises de décision

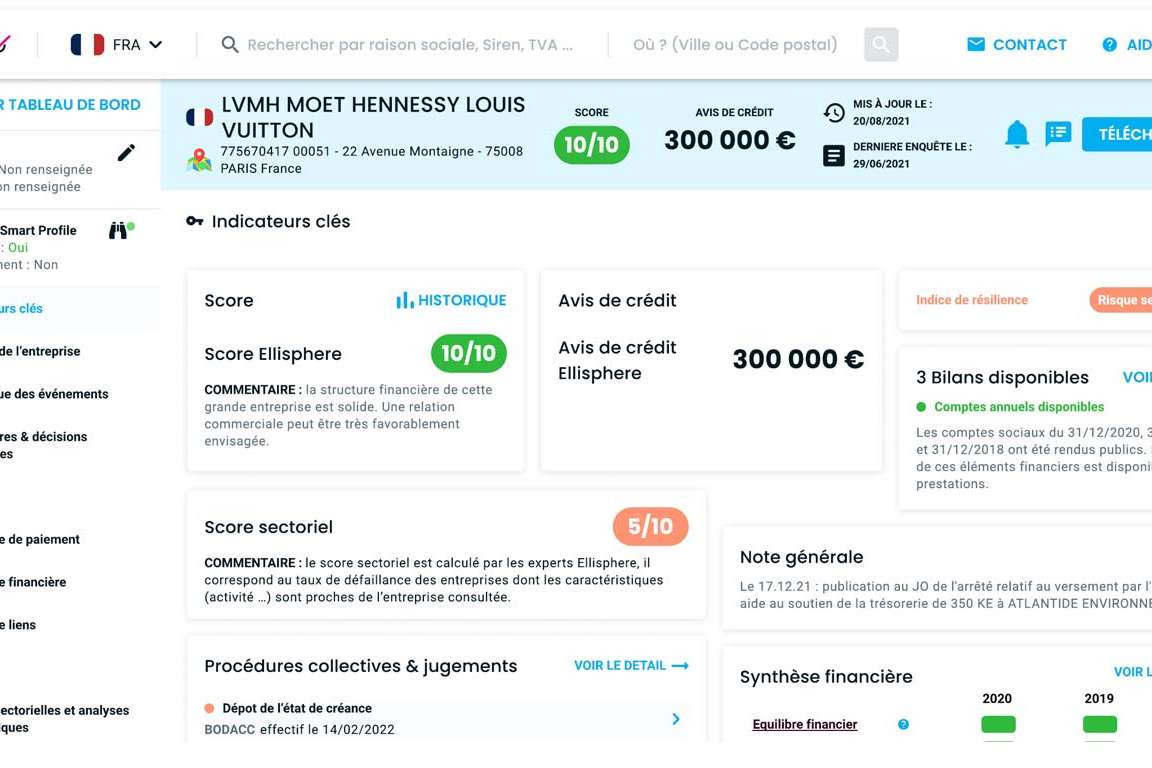

Score de défaillance

Le score de probabilité de défaillance des entreprises mesure le risque de défaillance d'une entreprise à des horizons divers. Il repose sur différents indicateurs calculés selon un modèle de machine learning.

PayTREND

L’indice PayTREND a pour objectif de détecter les signaux faibles de comportement de paiement. Il traduit un nombre de jours de retard de paiement qui apprécie la qualité des entreprises à payer dans les délais.

Indice de résilience

Indice qui mesure la capacité d'une entreprise à faire face aux chocs économiques et financiers, basé sur une analyse statistique de différents indicateurs financier et sectoriel.

Avis de crédit

Il recommande un encours plafond pour accepter un client en toute sécurité en accordant un délai de paiement adéquat.

Analyse financière

Elle évalue les risques et les opportunités en étudiant plus particulièrement des ratios financiers précis sur la solvabilité et la rentabilité de l'entreprise.

Liens capitalistiques

La solution d’Ellisphere offre une visualisation des données sur les filiales et les actionnaires d'une société, complétées des informations sur l'appartenance à un groupe.

" Avec Ellipro, pilotez sereinement votre poste client au quotidien grâce à des indicateurs de qualité mis à jour en temps réel. "

— Sandrine Chardenon, Responsable Marketing Produit Risk Management

Demandez une démo dès maintenant !

Pour en savoir plus sur Ellipro, contactez-nous pour bénéficier d'une démonstration par nos experts.