A tense second quarter

After a slight improvement in the first quarter of 2025, the second quarter saw a marked deterioration in the payment behaviour of French companies. Analysis of the data from our observatory confirms a general hardening of the situation, driven by growing cash flow pressures.

General deterioration in payment behaviour

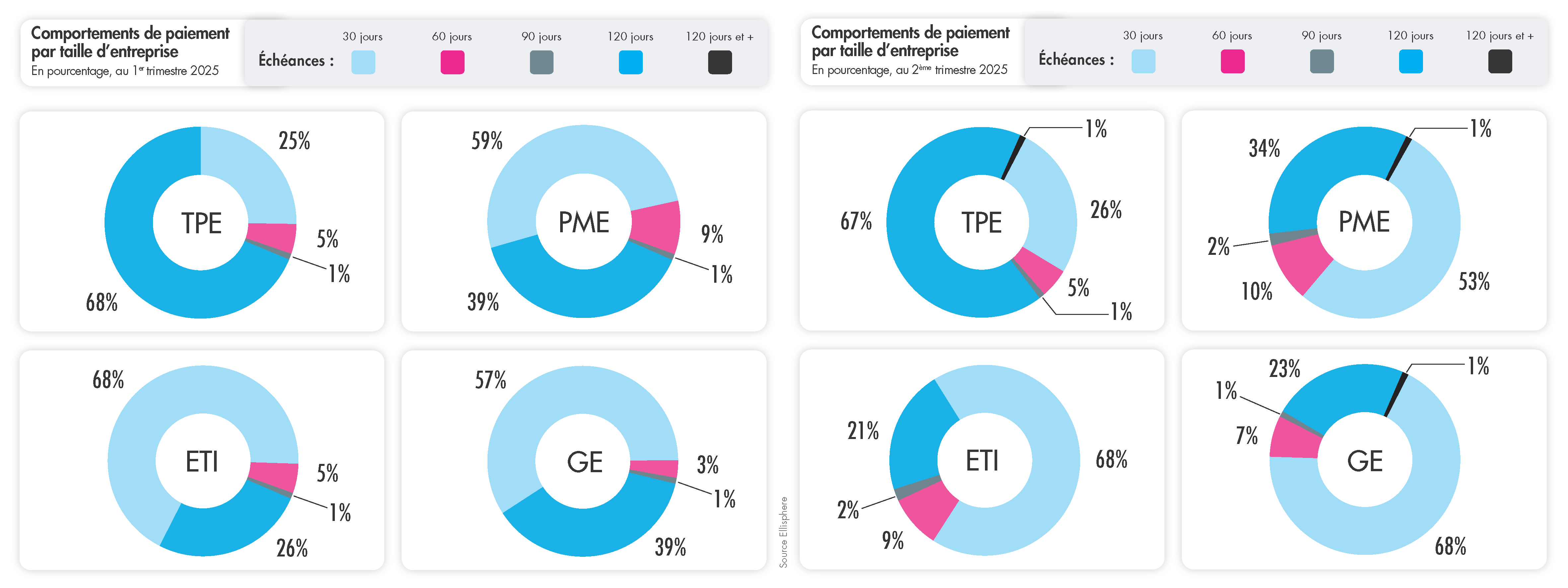

At the end of June 2025, the average payment delay for all company sizes rose from 16.48 days to 19.07 days, i.e. +15.7% in one quarter, and +6.30% over 12 months. This result wipes out the improvements of previous quarters, and brings us back to the level observed at the end of 2023.

Large-scale enterprises (LSEs) are primarily responsible for this deterioration: the proportion of their invoices paid on time has fallen from 37% to 23% in a single quarter. Their average payment delay climbs to 14.79 days, an increase of +22.5% compared to the first quarter of 2025.

Intermediate-sized companies (ETI) are not to be outdone, with an increase of almost 25% in their average late payment. Delays of 60 days or more are also on the rise.

SMEs saw their payment on time rate fall by 5 points, while VSEs remained the most respectful of their payment terms, despite a slight deterioration (-1 point).

This situation is partly explained by the sharp deterioration in the cash position of ETIs and large companies, as revealed by the joint survey conducted by Rexecode, Meti and Afte.

Focus on hospitals: a European alert

The CJEU ruling of June 18, 2025 condemning Greece for failing to pay its hospitals on time has put the spotlight on the French situation.

For France, our analysis reveals :

- 31 days late payment on average for public hospitals

- 18 days for private hospitals

These levels are still very worrying. If these practices persist, proceedings similar to those against Greece cannot be ruled out for France.

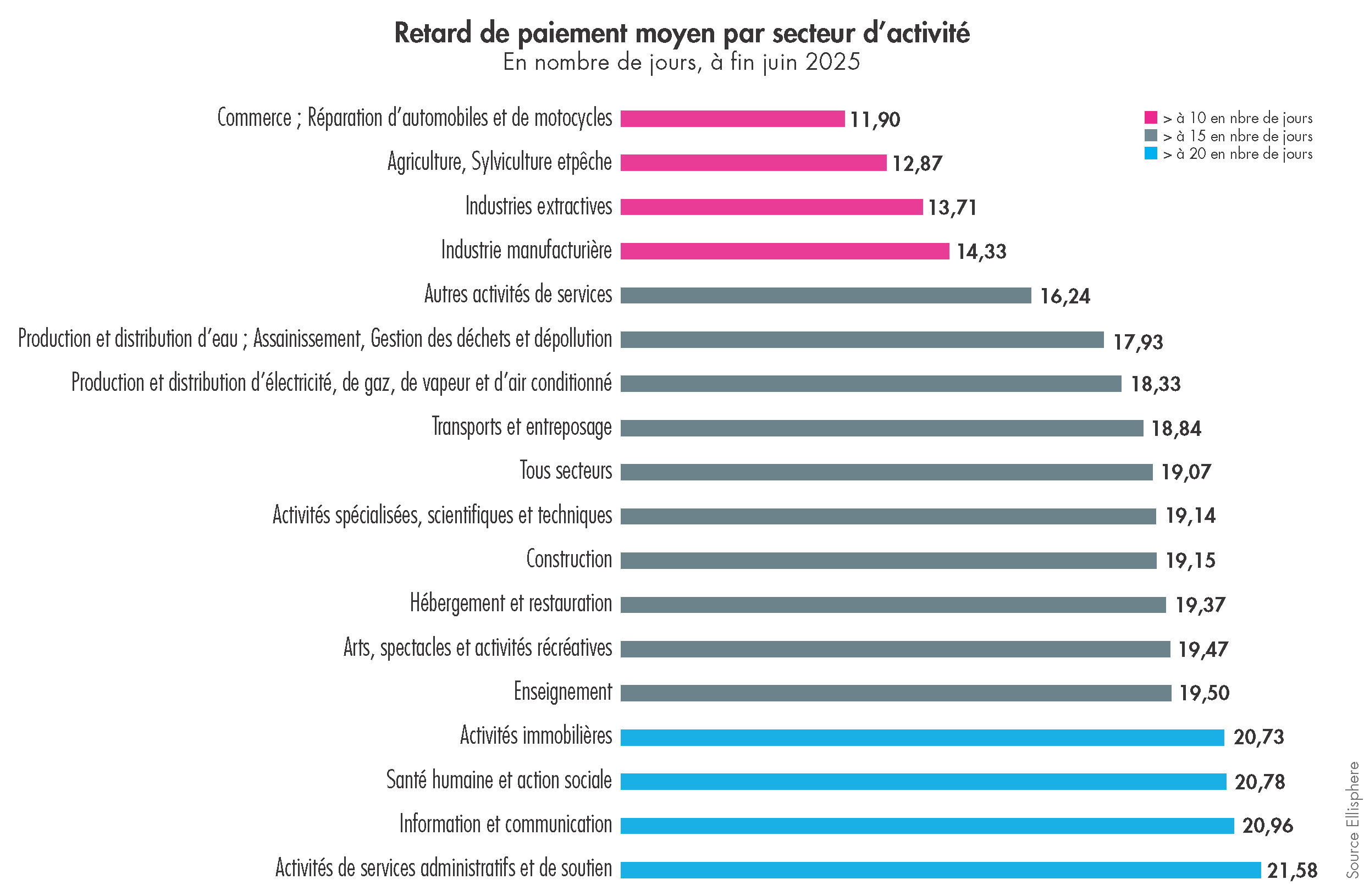

Sector focus

The most virtuous business sectors :

- Motor trade and repair: 11.9 days

- Agriculture, forestry, fishing: 12.87 days

- Mining and quarrying: 13.71 days

The most troubled business sectors :

- Administrative and support services: 21.58 days

- Information and communication: 20.96 days

- Human health and social work: 20.78 days

The Construction sector, long at the bottom of the rankings, is continuing its efforts. This policy is bearing fruit, and means that it is no longer ranked among the least virtuous business sectors. Conversely, average payment terms in the Information and Communication sector have deteriorated sharply: +25% from the first quarter to the second quarter of 2025, and +36% over 12 months to the end of June 2025. This sharp deterioration propels the sector into the circle of the least payment-time compliant businesses.

Worrying drift

... With Real Estate activities recording a +35.85% lag between the first and second quarters of 2025 (+41% year-on-year).

If the trend continues, this sector could enter the flop 3 of the least virtuous sectors as early as next quarter.

In summary

| Average payment delay end June 2025 |

Year-on-year change | |

| TPE | 15.75 days | +2,61 % |

| SME | 15.92 days | +8,45 % |

| ETI | 14.35 days | +23,81 % |

| GE | 14.79 days | +18,51 % |

The second quarter of 2025 confirms a worrying trend reversal. In a tense national and international economic context, late payments are likely to amplify cash flow difficulties for even the most virtuous small businesses. Increased vigilance and collective action are needed to halt this trend.