Transport & Logistics, an entrepreneurial dynamic marred by a surge in insolvencies

2024 was clearly a difficult year for the Transport & Logistics sector, with a sluggish European economy dragging prices down, and thus penalizing both margins and the ability to invest in decarbonization. This situation continues in 2025.

The sector faces many challenges: clean vehicles, reduced emissions, fuel costs, investments (mainly in new technologies), warehouse automation... And the problem of labor shortages persists.

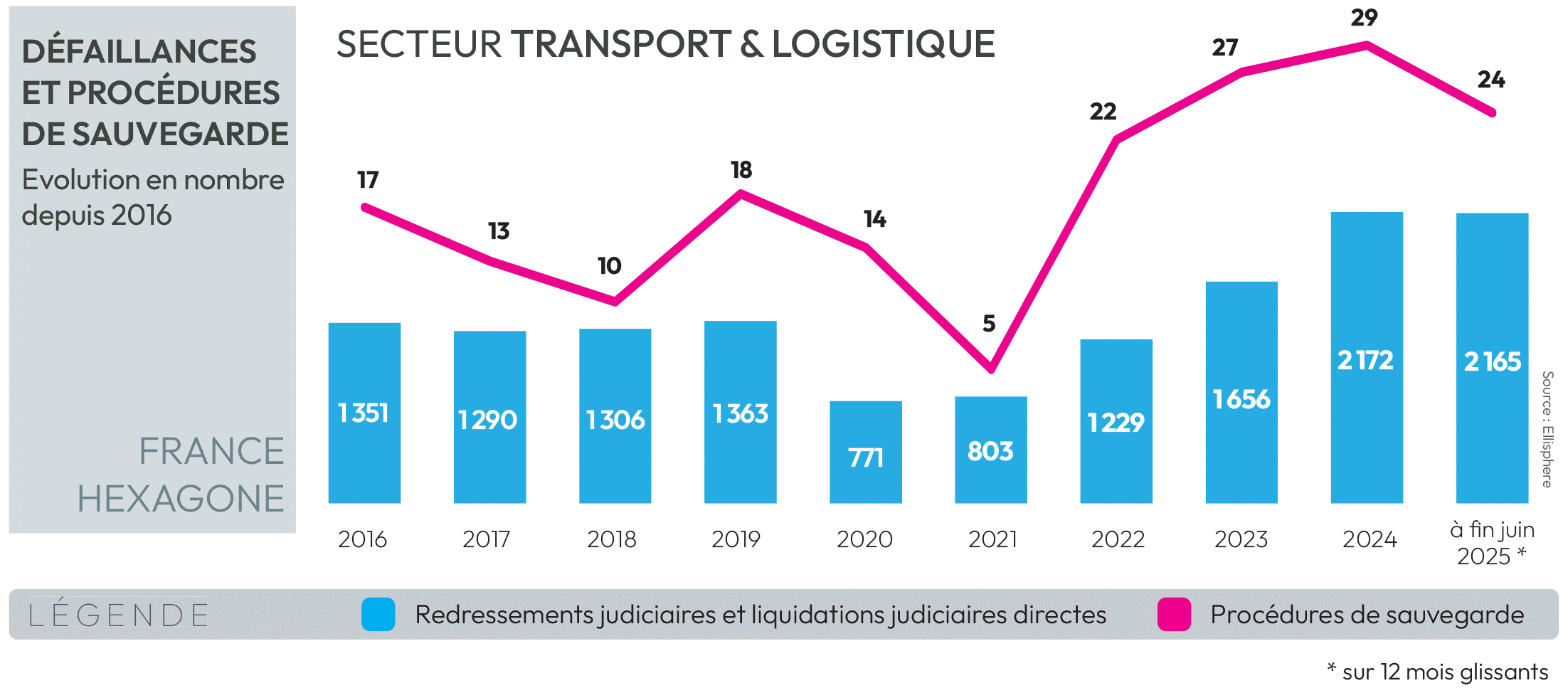

In 2024, the Transport and Logistics sector recorded 2,172 insolvencies (including receiverships and direct judicial liquidations), compared with 1,656 the previous year, a sharp increase of +31.16%.

At the end of June 2025, over a sliding 12-month period, 2,165 procedures were recorded in France, an increase of +10.6%.

One of the lessons to be learned from the period studied is that, whatever the age of companies in the sector, they are all likely to experience difficulties. At 35.8% in mainland France, structures between 5 and 10 years old were the most affected by insolvencies, followed at 24.2% by those created between 3 and 5 years ago.

After a +41.2% increase in the number of insolvencies between 2023 and 2024, it comes as no surprise that by the end of June 2025, the Paris region was the biggest contributor to insolvencies in the Transport & Logistics sector in France (38.4% of procedures), with 831 entities concerned.

Judicial liquidations such as that of DA PAIXAO in Saint-Didier (35) are indicative of the current slump. This company, set up in 2011, seemed to be doing well, but was in fact too badly affected by the vagaries of fuel costs and the exacerbated competition from bigger players in 2024.

Carriers pay the heaviest price

At the end of June 2025, carriers are clearly the hardest hit, with 2,000 failures over a sliding 12-month period.

Warehousing and storage, for their part, are showing 148 failures , including DISPEO in Beauvais (60), which has since been taken over by GROUPE LUNDI MATIN; the logic for this Montpellier-based group, which specializes in business management software, is to obtain the missing "brick" that should enable orders to be delivered.

The renewal of the business population is no longer assured

Since 2021, the ratio between company creation and disappearance has been falling steadily. In mainland France, the Transport & Logistics sector went from an index of 1.9 to just 0.8 at the end of March 2025, i.e. for every 1 business that disappears, 0.8 are created. The trend is similar in the French Overseas Departments and Regions (DROM), but to a lesser extent, with the ratio dropping from 1.0 to 0.8 over the same period.

Max Jammot

Head of Ellisphere's Economics Department, Max speaks on major microeconomic trends to the authorities, banks and the media. Trainer for the French Ministry of the Interior (microeconomics). He sheds light on economic issues with rigor and pedagogy. A recognized authority, he helps position Ellisphere as a key player in economic analysis.

Financial analysis of the sector: strengths and weaknesses

Weaknesses: transport is going through a difficult period

This analysis focuses on road freight transport (TRM). In France, this activity represents almost 90% of traffic in tonne-kilometres, is worth over 40 billion euros, and is made up of over 40,000 companies. It's a market in a phase of consolidation, with colossal challenges ahead, particularly those linked to the energy transition.

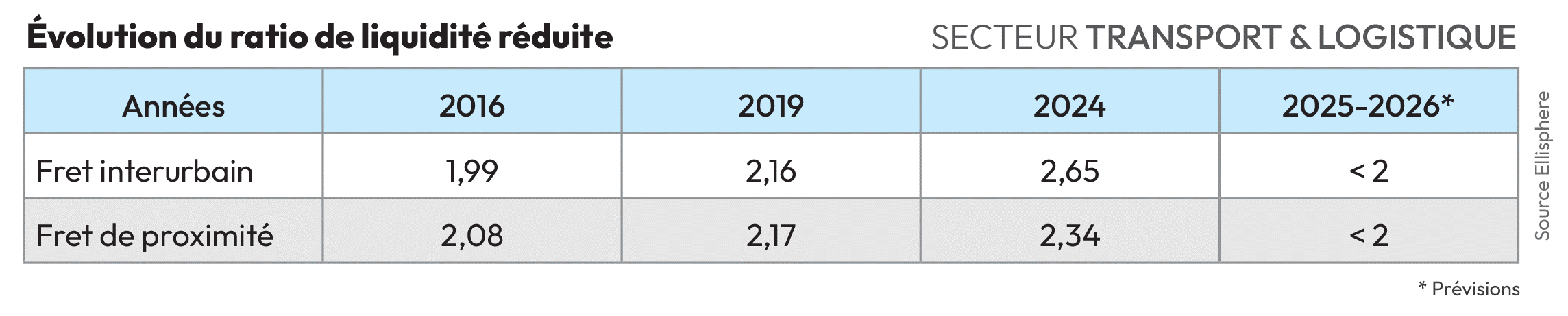

Intercity freight activities, whose professionals carry out long-distance transport (>150 kms), and local freight activities, which account for a third of goods transported in France, have been targeted as they are the most representative of the sector, while courier and express freight activities are positioned more on a niche market (7 billion euros in sales). These two activities have been going through a difficult period since mid-2022, with sales stagnating.

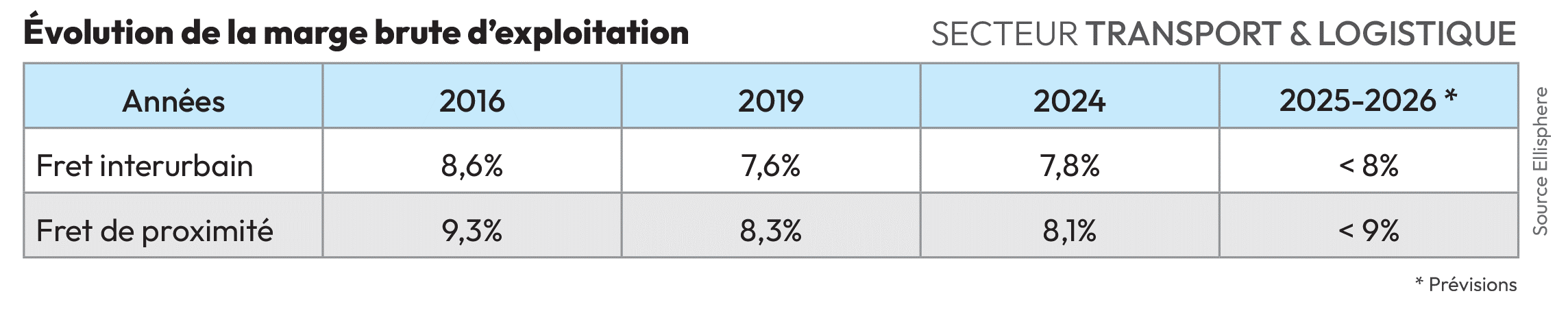

Gross operating margins remain low.

More worryingly, the rising cost of diesel, the second highest operating expense after salaries, has eroded margins. The average price of diesel peaked in 2022, topping the symbolic 2 euro/liter mark. In November 2024, it stood at 1.63 euros, a far cry from the May 2016 level of 1.07 euros. With the price per liter fluctuating around 2 euros in June 2025, the combined effects of rising wages, material costs and tolls have pushed up operating costs by +5.5% since the start of 2025.

Gross operating margins stagnated in 2024 and remained below their 2019 level. Little improvement is expected in 2025 and 2026.

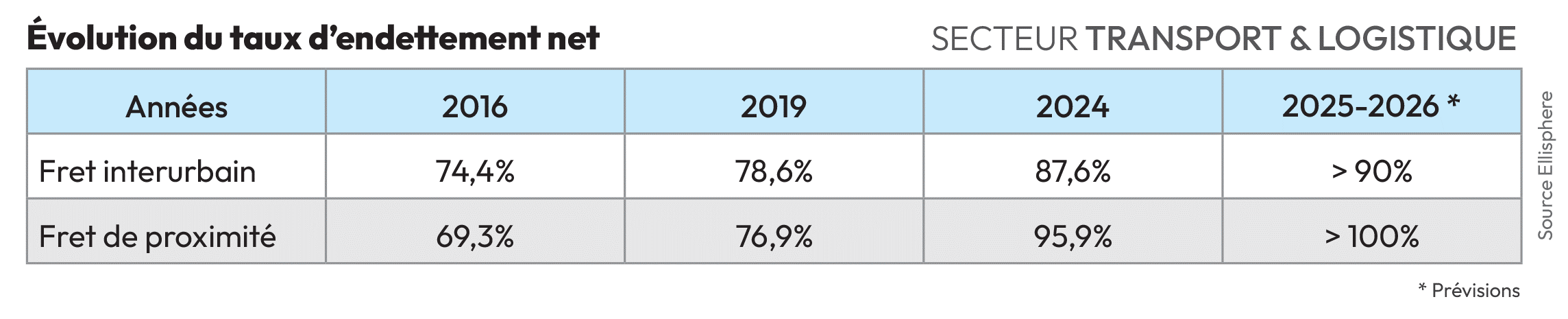

Financial debt

With a net debt-to-equity ratio of 78% for intercity freight and 76% for local freight, and in view of the margins generated, the rate of repayment required ofcompany directors remains high, but not insurmountable. However, over the next two years, significant investments will have to be made: fleet renewal with clean vehicles, driver recruitment, digital transformation, etc. This will lead to a high level of market concentration. In fact, the weight of the major groups is steadily increasing, to the detriment of family-run SMEs.

Reduced liquidity

That's the good news. The fragility of gross operating margins is offset by very good balance sheet liquidity, with ratios in excess of 2 in 2024. Current assets cover almost twice current liabilities, most of which are trade payables and tax and social security liabilities. So why so many insolvencies in the Transport sector? One explanation could be the quality of trade receivables (too high a level of outstanding debts), which influences the numerator.

Strengths: logistics, a fast-growing business

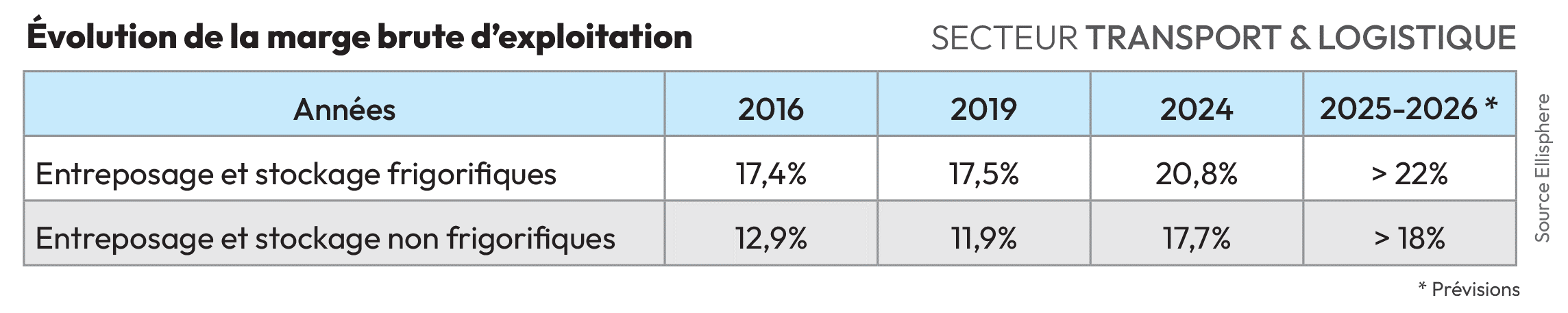

The two most significant activities are refrigerated warehousing and storage, and non-refrigerated warehousing and storage.

Both activities are growing fast. The market remains dominated by large groups and is highly concentrated in the Paris region, Europe's leading consumer area, which provides 375,000 jobs. More than 7 million Parisians buy online, and 84% of these purchases generate physical deliveries, with e-commerce growing by 15% every year. This is not without consequences. Asdeliveries becomemore individualized and lead times shorter, logistics real estate players are faced with a growing shortage of land, resulting in higher access costs.

Gross operating margins remain high, in line with the companies' high capital intensity. Unsurprisingly, it is the refrigeration sector that performs best, given its specific nature.

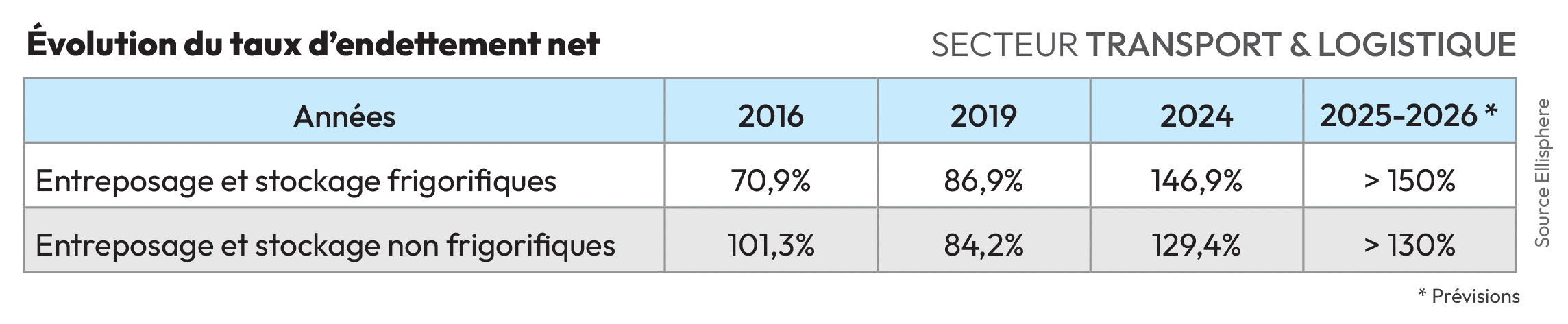

Financial debt

The level of debt is high, but does not compromise annual debt repayment, given the strong cash generation. Debt levels will remain high, as regulations and societal pressure place greater responsibility on investors in the sector to produce logistics facilities that are rationalized in terms of space consumption and nuisance limitation.

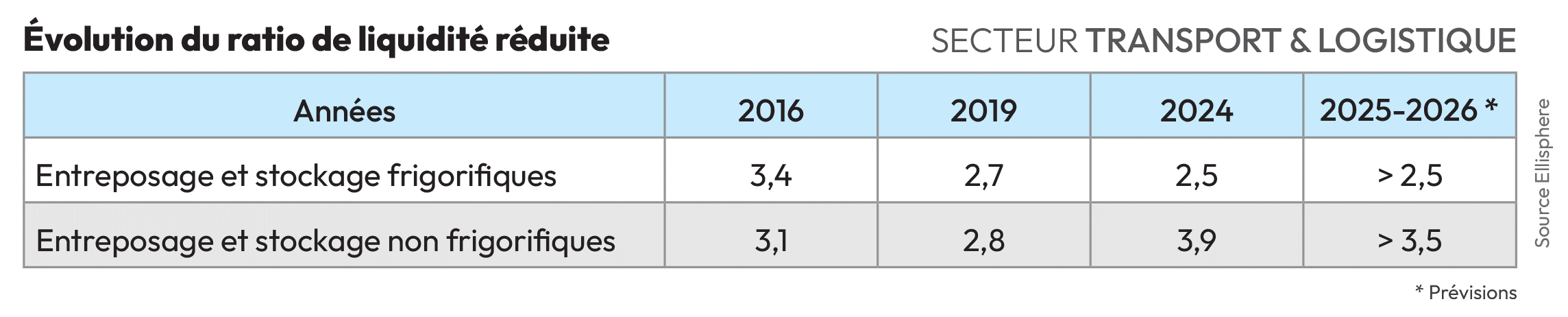

Reduced liquidity

Trade receivables and cash cover trade payables and tax and social security liabilities by a wide margin. This situation is set to continue into 2025 and 2026.

Alain Luminel

Head of the financial expertise department at Ellisphere, Alain assists companies with their BtoB credit risk issues. A former executive with the Coface group, he has managed complex credit management and financial rating assignments. A chartered accountant by training, he is ICCF & HEC certified.

Transport & logistics or the slippage of payment times

The Transport & Logistics sector stands out for its significant deterioration in payment times, well above the average observed in other sectors.

This trend can be explained in part by the resurgence of company failures, which automatically lengthen payment times. This phenomenon affects all players, regardless of size.

Less virtuous payment habits

The data show that, across all company sizes, the sector's payment behavior is less respectful of its commitments. The sector's very small businesses (VSEs), although more virtuous with 45% of invoices paid on time, are unable to match the performance of VSEs in other sectors.

As in other sectors, the situation of large and medium-sized companies in the Transport & Logistics sector is deteriorating sharply.

An uncertain outlook

In the short term, the sector could, at best, experience a freeze in payment behaviour, but the current trend suggests a further deterioration. Despite a still relatively high level of liquidity, companies are struggling to meet their commitments.

In the medium-to-long term, 2026 and beyond, the outlook is even gloomier. The sector faces a number of structural challenges: heavy investment requirements, a tense financial situation (low margins, high debt, stagnant sales), and uncertain economic conditions.

Electronic invoicing, still a long way off

The Transport & Logistics sector, made up mainly of VSEs and SMEs, is unlikely to benefit from the positive effects of electronic invoicing until 2027. Only the small number of large companies and ETIs in the sector are likely to see a significant improvement in their payment practices between 2025 and 2026.

Mikaël Delaporte

Mikaël is in charge of Ellisphere's Payment Experiences division, and runs the D³ program to raise awareness of payment behavior among companies. He optimizes data targeting to refine credit risk analysis. With international experience at Coface, he holds a Master's degree in law, economics and management.