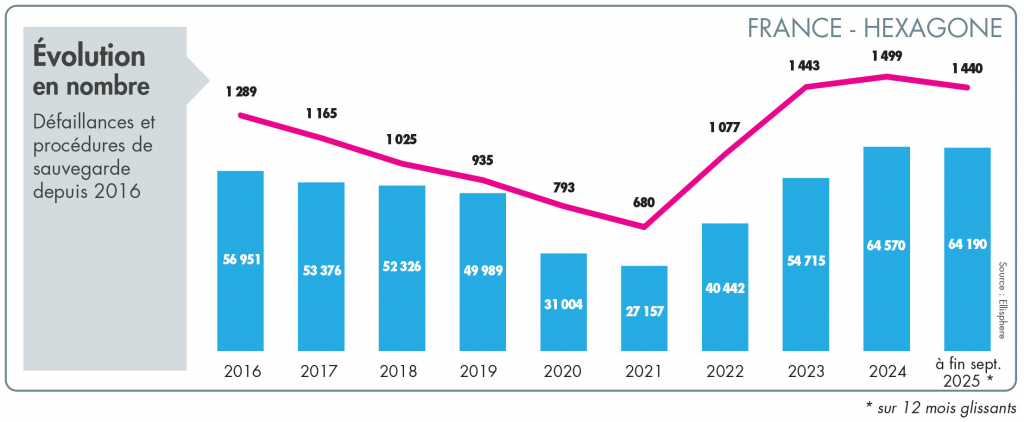

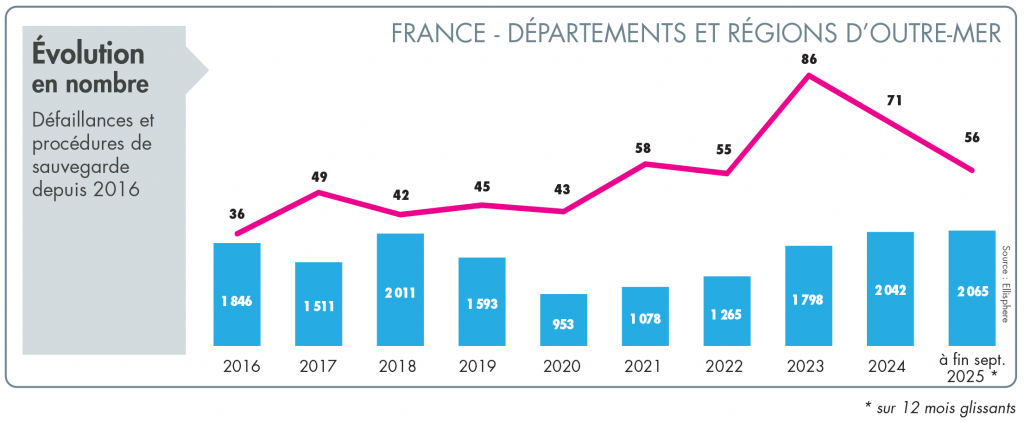

Over a sliding 12-month period to the end of September 2025, the number of insolvencies (opening of receivership proceedings and direct judicial liquidation) remains very high in mainland France. However, the increase has contracted to "only" +2.2%, compared with +17.4% at the end of December 2024. Surprisingly, the number of sauvegarde procedures fell by -4.4% over 12 months to the end of September 2025, to 1,440 procedures (1,499 to the end of December 2024). In the French overseas departments and territories (DROM), the increase in the number of insolvencies over the period under review is, as in France, less marked, with +5.6%, compared with +10.2% at end June 2025.

Only five territories recorded a significant drop in the number of insolvencies: Mayotte, Région Sud, La Réunion, Bourgogne-Franche-Comté and Grand Est.

With a 31.1% drop in the number of bankruptcies, Mayotte recorded the sharpest fall in the number of bankruptcies, after a particularly difficult period. The Provence-Alpes-Côte d'Azur region also stands out, with a -7.5% fall in the number of insolvencies over 12 months to the end of September 2025, perhaps due to the dynamism of industrial activity and market services in the first part of the year. Last but not least, Reunion Island will fare particularly well, with a significant -5.6% fall in the number of insolvencies in the region at the end of September 2025.

By contrast, the regions of Ile-de-France and Auvergne-Rhône-Alpes will see their number of insolvencies rise by +4.3% and +5.1% respectively by the end of September 2025. This upward trend is set to continue over the coming months until the first quarter of 2026, due in particular to the tumultuous international business climate and domestic political turbulence.

Insolvencies soar in French Guiana, and to a lesser extent in Guadeloupe, Pays de la Loire and Normandy

While the trend in the number of insolvencies is negative for Reunion, Martinique and Mayotte, the increase is particularly worrying for French Guiana, at +125.4% (+127% to end June 2025). The situation in French Guiana is said to be the consequence of strikes in the major ports, which have disrupted many sectors. In Guadeloupe, the number of bankruptcies has also risen significantly, by +31.5% to the end of September 2025. According to the Banque de France, in the first half of 2025, the island's construction sector is likely to have suffered a downturn.

At sector level in France, the building and civil engineering sector posted a virtually nil increase of +0.7% in the number of insolvencies at the end of September 2025, whereas a very significant rise of +26.7% was still recorded at the end of 2024. After the mortifying difficulties of recent years, a lull appears to have set in during the first half of 2025. The Metals sector, which has been hard hit for several years by the pressure of foreign competition, particularly from China, recorded an increase in insolvencies of more than +10% over a sliding 12-month period to the end of September 2025. The new European steel law currently in preparation could provide a glimmer of hope and help the sector to regain market share.

Overall, the most spectacular increases in the number of insolvencies were recorded at the end of September 2025 in the French overseas departments and territories. These include +58.3%% for Industrial Capital Goods, +39.3% for Household Goods, and +37.5% for Wood-Paper-Cardboard-Printing.