The year 2025 was marked by a high degree of uncertainty, which weighed on growth. International conflicts continue to fuel a generally gloomy climate, while the introduction of "floating" customs barriers has destabilized international trade flows. At the national level, the wave of corporate failures (commencement of receivership and direct liquidation proceedings) linked to state-guaranteed loans is coming to an end; those taken out in 2020 (70% of the total) should be repaid by summer 2026, which would enable the companies that used them to replenish their cash reserves. For the second consecutive year-end, the late passage of the finance bill has led to delays and even cancellations of projects due to a lack of visibility, conditions that have contributed to a further increase in the number of bankruptcies.

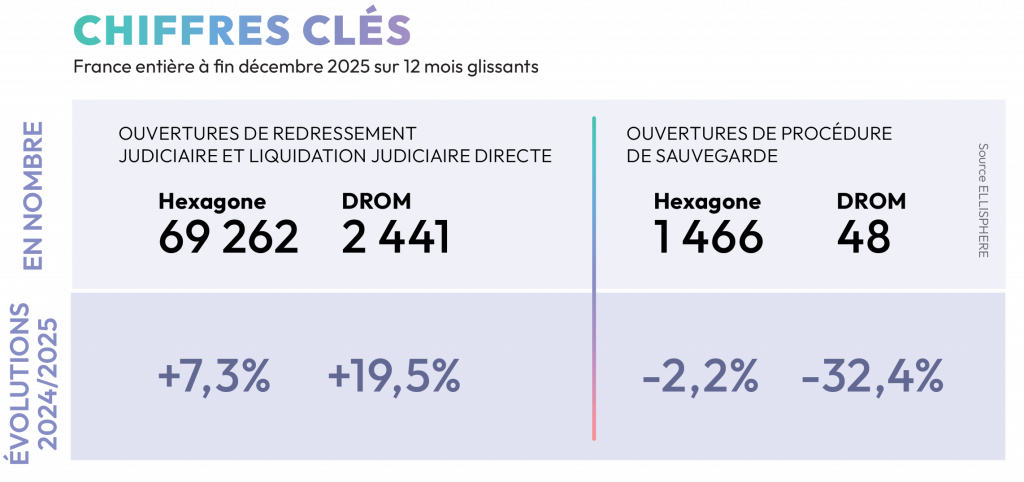

Conversely, with 1,514 entities affected by the end of 2025 in France, the number of safeguard procedures is declining: -2.2% in mainland France and -32.4% in the overseas departments and regions. Reserved for structures that are not

in default, these developments may suggest that companies are now sinking too quickly to have time to resort to this procedure.

The entrepreneurial dynamism index (EDI) calculated by ELLISPHERE, which is based on the ratio between the number of new businesses created and the number of commercial companies that have ceased trading, remains above the renewal threshold at 1.2 in mainland France and 1.1 in the overseas departments and regions. However, throughout 2025, the increase in the number of start-ups remained much less dynamic than that of closures; the index is therefore expected to decline in the first quarter of 2026. In addition, the proportion of judicial liquidations in business closures remained high throughout 2025.

France: the number of bankruptcies continues to rise, but less sharply than in 2024

Over the 12 months to the end of 2025, France recorded 69,262 insolvencies, up 7.3% compared with 2024. However, this figure remains well below the 18% increase recorded at the end of 2024. As always, there are many regional and sectoral contrasts.

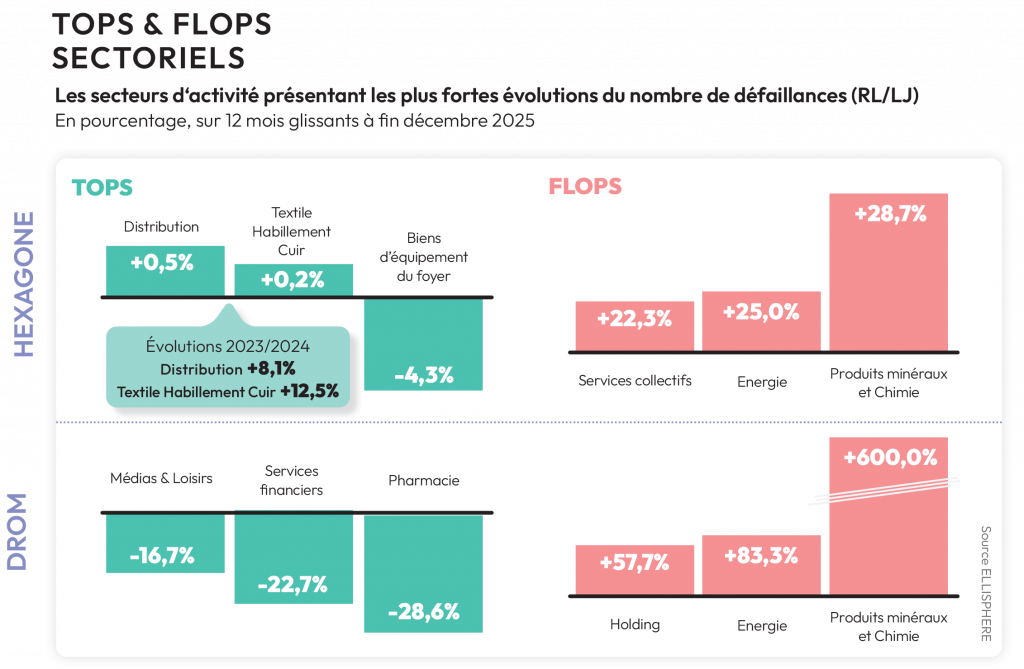

Various sectors have suffered the consequences of fluctuations in US customs barriers, starting with the European automotive industry. Already affected by weakening demand, the sector saw its customs duties rise to 27.5% between April and August 2025, before falling back to 15%. At the same time, despite customs duties already having been increased at the end of 2024, Sino-US negotiations led to a more pronounced influx of Chinese models into Europe. The market share of Chinese car brands in the European Union is said to have more than doubled in one year, rising from 3.3% in September 2024 to 7.4% in September 2025. This has prompted automotive equipment manufacturers to push for legislation on a minimum percentage of EU-made parts in vehicles, with a decision from the European Commission expected in late February 2026.

The aerospace sector, for which exports outside the European Union are essential, fared better. The 15% tax on exports to the United States only had an impact during the period from April to July 2025, during which a stockpiling policy was implemented. According to INSEE figures, in the third quarter of 2025, aerospace exports, excluding military equipment, reached €17.3 billion, up 17.7% compared to the second quarter of 2025, contributing to a 0.5% increase in growth.

The Transportation sector shows a 12-month rolling change of +11.5% in the number of insolvencies and an EIR of 1.1 compared to 1.3 at the end of 2024. More than 39% of these insolvencies relate to the car and motor vehicle trade, with a 16.3% increase in the number of insolvencies (+19.3% over the rolling year to the end of 2024). In fact, French consumers are still taking a wait-and-see approach to new vehicle purchases, partly because of rising vehicle prices in an economic climate that is encouraging households to save, and partly because of regulations concerning the transition to more environmentally friendly vehicles, which do not necessarily meet their needs and for which they will not necessarily benefit from government subsidies, which are often highly targeted.

The Utilities sector has also been severely affected, with a 22.3% increase in insolvencies over the 12 months to the end of December 2025. Furthermore, FDI in this sector will fall to 1.3 at the end of 2025, compared with 1.5 in 2024. Among the activities affected are childcare facilities (+121.7% in bankruptcies), which are facing recruitment problems and high costs, and are also beginning to suffer the consequences of the decline in the birth rate (-22% in 15 years, including more than -3.5% in 2025).

The sorted waste recovery business (+43.3% increase in failures) has been affected by massive imports of recycled plastics from countries where production costs are lower.

DROM: territories subject to terrible tensions

The French overseas departments and regions (DROM) recorded a 19.5% increase in the number of bankruptcies over a 12-month rolling period ending December 2025. Regional inequalities remain glaring. While French Guiana is sinking with an explosion in the number of bankruptcies of +184%, mainly due to its dependence on public procurement, Réunion is seeing a slowdown in the upward trend: 7% increase in bankruptcies in 2025 compared to 27.2% in 2024, thanks in particular to reconstruction projects following Hurricane Garance.

In the overseas departments and regions, French Guiana has been affected by the downturn in the construction and public works sector (nearly 9% of its GDP), which has suffered from a decline in public orders (around 65% of the market) due to budgetary constraints. In addition, excessively long payment terms from public bodies are causing significant cash flow problems and a decline in investment. Despite previous measures, the average payment term for the construction and public works sector in French Guiana is currently 44 days, compared with 18.91 days for the construction and public works sector in mainland France in Q4 2025. In response, a charter was signed in October 2025 by socio-professional organizations in an attempt to improve the situation.

Small businesses are the first victims, accounting for 86% of business failures

Small businesses, whose cash flow is often more fragile due to reduced margins, account for 86% of bankruptcies. These small structures are particularly affected by late payments, which averaged nearly 18 days in Q4 2025 (+1.4% compared to Q4 2024). It should be noted, however, that the 10 largest corporate failures account for combined revenues of more than €1.6 billion, leading to the loss of more than 8,000 jobs.