An erosion of entrepreneurial dynamism over the last 12 months

The ever uncertain economic and international context, shaken by successive crises, now seems to weigh on the dynamism of the business population in France. Sole proprietorships account for 55% of new and existing businesses, compared with 30% for commercial companies. The recovery of 2021 had given a boost to business creation with nearly 1 million new entities, but on the other hand, the number of terminations had exploded by +42%; many companies having preferred to close their doors rather than end up in bankruptcy after two years of crisis Covid.

At the same time, the number of business terminations is still rising (+5.4%), a pace that is currently less sustained than in 2021. As a result, the Entrepreneurial Dynamism Index (EDI) has fallen from 1.7 to 1.5 new businesses for every one that disappears. Another unfavorable indicator is the loss ratio: at the end of September 2022, the share of liquidations in the number of business closures has risen to 5.8% after three consecutive years of decline, in particular as a result of the aid and loans granted under the "whatever it takes" policy. Nevertheless, at the end of September 2022, the figures remain well below the 11.5% average loss ratio of previous years.

Sectors struggling

A handful of major sectors of activity still account for the bulk of company movements. Construction and Public Works (BTP), Business, Personal and Community Services, and Distribution together account for 69% of business creations and disappearances over the last 12 months to the end of September 2022, with BTP alone accounting for a quarter of this figure. Some sectors of activity appear to be at half-mast, not renewing their business population, such as Agriculture and Fishing, activities for which the vagaries of the weather, quotas, rising costs and pressure on margins are slowing the entry of new players (-8%) and pushing more and more professionals to cease their activities (+5% after +11.7% in 2021).

Other sectors of activity, while still showing a favorable FDI, are nevertheless experiencing worrying trends. For example, a sharp drop in the number of business start-ups has been recorded in transport and logistics (-43%), particularly for small home delivery companies (food and non-food).

This decrease in the number of creations is also noted in Distribution (-25%), in Wood-Paper-Cardboard-Printing or Textile-Leather-Clothing (-20%). For other sectors of activity, the deterioration of the FDI is due to a higher volume of company disappearances, such as in the Food industry with +12.2% of disappearances, of which 16% were court-ordered liquidations, and in Personal Services with +16.6%.

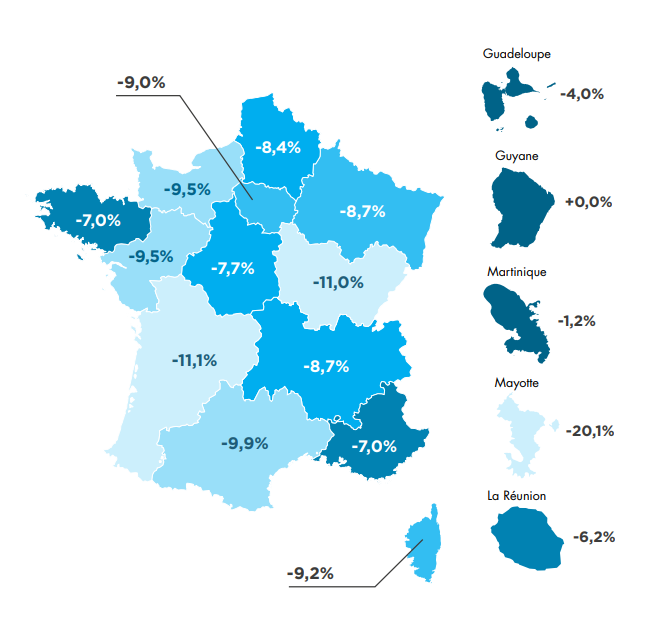

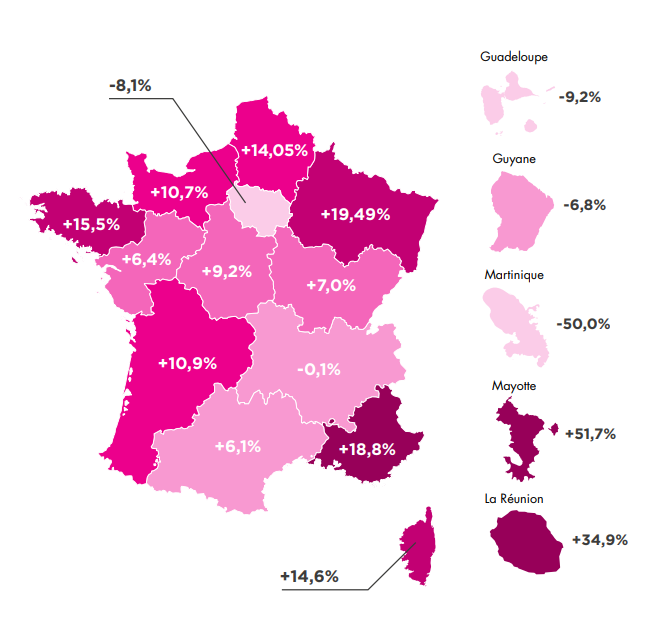

Resistance in the region

While the general erosion of the Entrepreneurial Dynamism Index and the increase in the number of cases can also be seen from a regional perspective, all metropolitan regions are nevertheless managing to renew their business population. Four regions account for most of the movements recorded: Île-de-France, Auvergne-Rhône Alpes, PACA and Occitanie, which together account for 58.4% of business creations and 57.2% of business disappearances in mainland France.

The Ile-de-France region is the only region where FDI has increased over the last 12 months to the end of September 2022, with 1.8 new businesses for every one that has disappeared. On the other hand, the PACA region performed the worst, with an index of 1.2 new businesses for every one that disappeared, due to the combined effect of a sharp rise in the number of terminations (+19%) and a significant drop of 7% in the number of new businesses.

"The deterioration in confidence in the macroeconomic outlook is impacting entrepreneurs, who are worried about supply and recruitment difficulties, rising raw material and energy prices and the impact on household purchasing power..."

- Max Jammot, Head of the Economic Division at Ellisphere

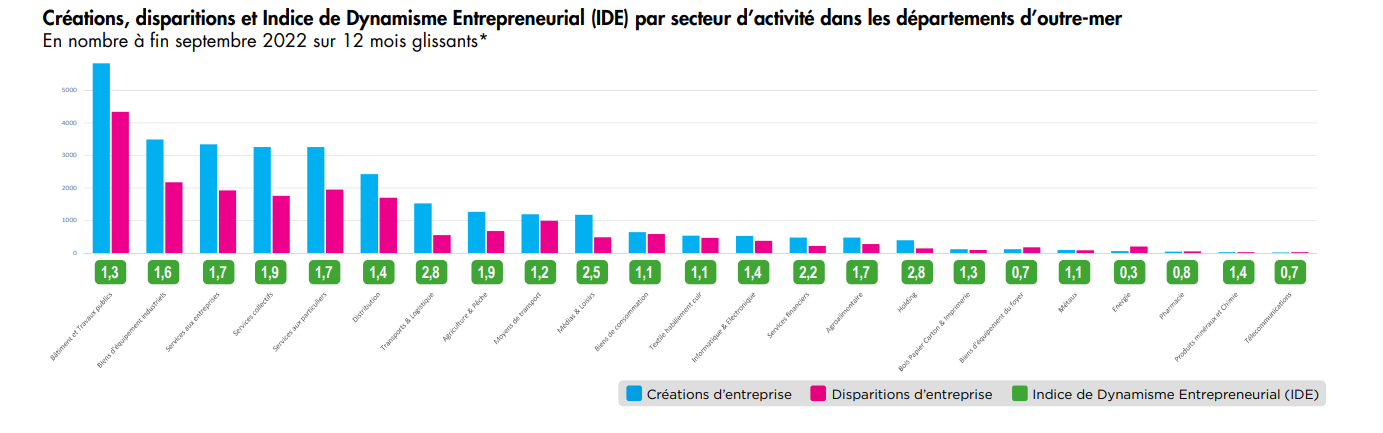

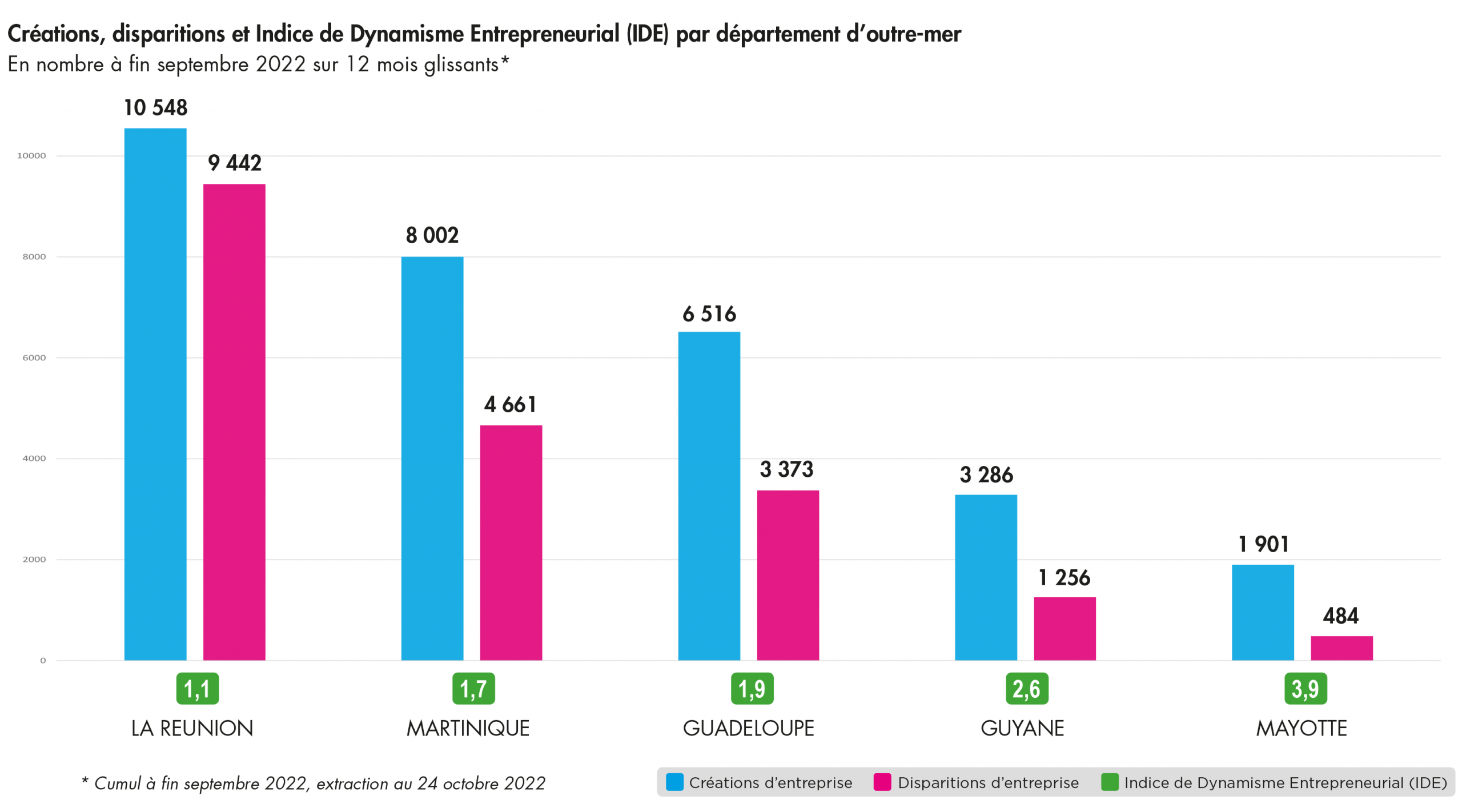

Situation in the French overseas departments

More dynamic DOMs

In contrast to mainland France, the business population in the French Overseas Departments (DOM) is more dynamic, rising from 1.5 to 1.6 new businesses for every one that disappeared over the last 12 months to the end of September 2022. Indeed, while the number of creations is down by 5%, the number of business disappearances is down very significantly (-11.5%). Moreover, the share of sole proprietorships and commercial companies is more significant (88%) and balanced (45% for both business creations and disappearances). For the DOM as a whole, the loss ratio has remained low and stable between 2020 and 2022, with businesses still benefiting from substantial state support.

In terms of business sectors, Household goods, Energy and Pharmaceuticals have not succeeded in renewing their business population.

Download now our complete study

Every month, our economic division decrypts the news of the economic sectors and gives you its lessons.