KYC, a major issue for companies

All current studies show that the explosion of costs generated by KYC processes is increasingly impacting reporting entities. To contain this budgetary overhang, these companies are trying to find levers based on process automation, outsourcing and of course the new technologies offered by the numerous RegTechs on the market.

Optimize to better manage the financial impact

Until recently, these optimization policies were done at individual levels; each institution using whatever means available to reduce the financial impact and improve the efficiency of the teams in charge of managing KYC.

Much of the KYC processes are too sensitive to be outsourced or mutualized (example: customer remediation, relationship validation, etc.). However, since artificial intelligence and blockchain technologies have begun to assert themselves in these markets, some players have made the decision to partially mutualize their KYC processes.

The blockchain as a tool for mutualization

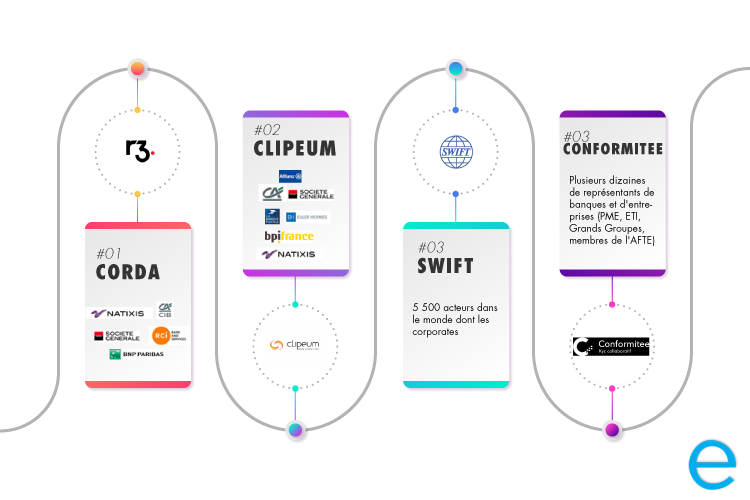

Private consortia have thus emerged. Their objective is to allow a member to have access to data recorded, secured and certified by other members and to enrich them for the benefit of others. Among the best known in France :

Technologies not yet firmly established in practice

Artificial intelligence and blockchain can reduce the need for successive collection and processing of credentials by facilitating the collection, control, alerting and allocation of data. On the other hand, talents mastering blockchain, data science and AI are still too few compared to the growing demand for this type of skills. They are scarce and expensive, so companies often opt for outsourcing.

Although these consortia are almost all in the development phase, and it is still too early to judge their effectiveness, some international experiences have not always been successful. The example of the Monetary Authority of Singapore, which recently announced that it was withdrawing its centralized KYC Utility due to insufficient returns on investment, demonstrates that this type of project is not without risk.

Technology, but not only...

Although technology remains a formidable performance lever, it cannot guarantee project success on its own.

Banks will quickly come up against existential questions related to the deployment of these projects. Indeed, the responsibility for the processing of these processes will have to be quickly clarified with respect to the regulator. Indeed, the consortium is only a platform for sharing KYC data, it does not theoretically carry out additional verifications and does not provide any seal of compliance.

What prospects?

The business model is also a key issue. The Singapore experience has shown that user buy-in was not as high as initially expected. The consortium will face a model that is expensive and does not deliver the required optimizations.

Finally, the relationship of trust between actors using the same KYC data will quickly arise. Since there is no guarantee that the data initially provided is correct, does the use of this data by a third party only engage the responsibility of the latter? Or on the contrary, is it up to the supplier to guarantee the quality of the information shared? Surely these cases have been defined regardless of the consortium. Time will need to be spent dealing with the many contentious cases that will inevitably arise.

If these obstacles are quickly removed and the technological advantage is there, it would be realistic to see more and more players join these collaborative platforms. However, they will have to reveal customer information that they would never have imagined sharing a few years ago.

Read more

Our support dedicated to compliance

Discover Ellisphere's expertise on your compliance issues and master your due diligence...