Fraud: what are we talking about?

Fraud can take many forms to exploit a company's weaknesses. Not all frauds have the same objective. Some frauds are designed to have material delivered to them with no intention of paying for it, while others are designed to directly trigger a large transfer of funds from the victim to the fraudster.

This makes risk management more complex, as it must adapt to increasingly innovative techniques.

Fraud as a raison d'être

One of the less well-documented forms of fraud involves companies set up specifically for fraud. These companies seek to obtain material without the intention of paying. This type of fraud affects all sectors of activity, from technology to textiles to construction.

Companies have even been created to cash stolen checks intended for URSSAF. Unlike identity theft, these fraudulent companies have a real legal existence and the supporting documents are legitimate.

Financial analysts must then conduct extensive research to identify suspected fraud. Unfortunately, these analyses are not always possible due to lack of time and data.

Detecting fraud, what methodology?

Some of Ellisphere's customers were raising concerns about fraud, which was a blind spot in their risk management strategy. We were then able to set up a collaborative R&D project to identify solutions for securing against fraud.

After a few weeks of discussion and testing, we were able to deploy a fraud risk score in production.

Multiple data sources...

Initially, we worked to create a database of companies at risk from several sources. Partners have sent us proven cases of fraud, excluding identity theft.

Through Ellisphere's investigation history, we have also identified companies where investigators and customers have deemed the risk of fraud to be high .

Finally, many online sources, particularly the regional press, regularly report on fraud-related judgments involving companies. The study of these risky companiesallowed us to better understand this phenomenon.

... not always in line with expectations

At the beginning of the study, one phrase was regularly used by the experts: "Companies defraud and then go into receivership". Thus, it was to be expected that a high proportion of these companies would default shortly after detection.

It was also hoped that a generalized failure score would be able to identify them. However, it turned out that a large proportion of these companies have thrived for many years, or are still active today.

This is because the amounts involved may not be sufficient to warrant full prosecution of the victimized company, allowing the fraudulent company to prosper by defrauding numerous targets.

In this case, we cannot expect the failure score to reject these companies. The following graph shows us that these companies score worse than the average, but their score spans a very wide range of values.

Comparison of the distribution of the default score between fraudulent companies and the rest of the French population

Profile of a fraudulent company

Since the risk of default cannot be used to estimate the risk of fraud, it is necessary to identify the overall characteristics of fraudulent companies. From the Ellisphere database, it is possible to create a profile of the fraudulent company.

Fraudulent companies, who are you?

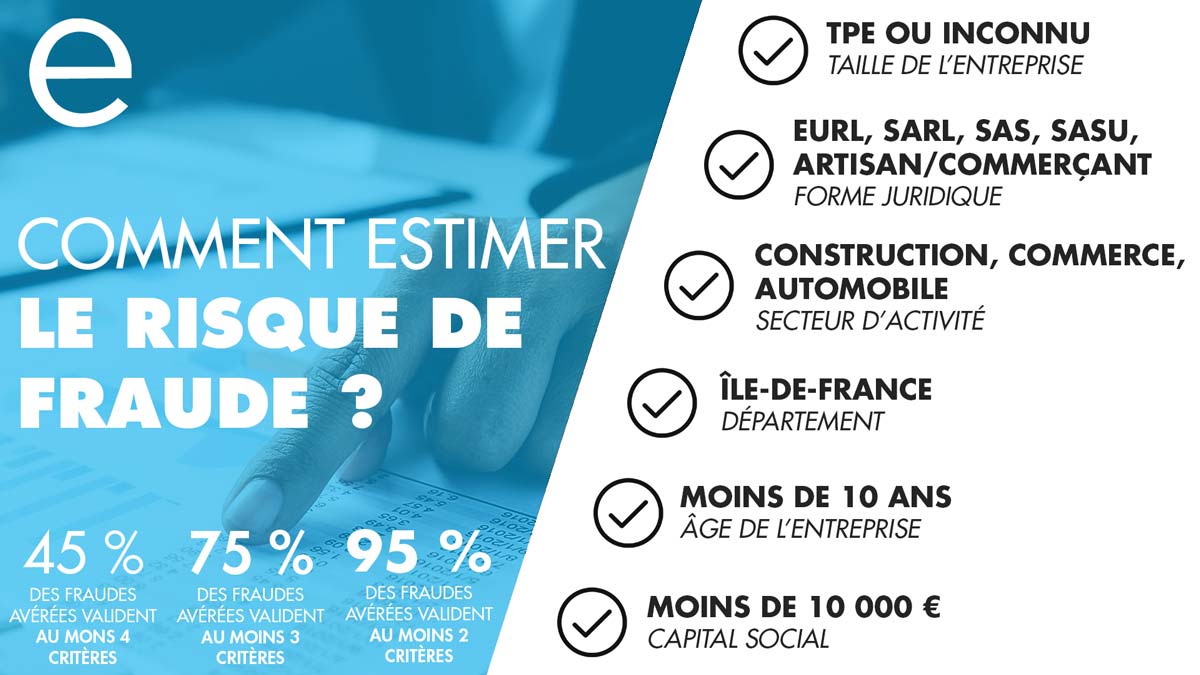

Fraudulent companies are mainly small businesses: VSEs represent 90% of the frauds detected. The most represented legal forms are in line with this observation. SARLs, SASUs, small business owners, EURLs and SASs also represent 90% of the frauds detected.

The view in terms of industry is less clear. As can be seen in the following image, the construction sector largely dominates this ranking, in agreement with the experts. After the motor trade sector, which has a clear demarcation, fraud tends to spread across many sectors.

Geographic data: essential indicators

The geographic aspect of fraud is also interesting. The following map shows the relative rate of fraud by department. The Ile-de-France region dominates the ranking, even considering that this region includes many more companies than the rest of France. Analysts should therefore be particularly vigilant for companies located in this region.

What lessons can be learned?

These first studies allow us to have a more global understanding of the fraud phenomenon. We can then use this knowledge to set up a first fraud detection system, easily usable by analysts.

Points to watch out for

This first system consists of evaluating 6 risk criteria of a company. The more criteria the company has, the more careful it will be necessary to be with it. The following map summarizes the different criteria and the rate of detectable fraud at several levels of concordance.

This map allows analysts to assess the risk of a company in a simple way. However, many non-fraudulent companies also pass the criteria, and generate an additional burden for analysts.

AI to the rescue in the fight against fraud

It is then necessary to find a compromise between the number of frauds actually detected and the number of legitimate companies falsely identified that generate additional analysis work. Artificial intelligence can then be used to create more accurate business rules and improve the separation between legitimate and fraudulent companies.

As an example, a simple AI model that is based on the same data recovers 40% of fraudulent businesses with 5 times fewer legitimate businesses compared to the previous map. The AI model is even 50 times more powerful than our simple rule engine if we only look at the most easily identifiable 20% of frauds, which already represent a significant financial loss.

The fight against fraud, a battle for today and tomorrow

Fraud costs companies (and therefore their customers) millions of euros every year. Some frauds are generated by companies created specifically for this purpose. We can then try to identify these companies to protect ourselves.

Fraudulent companies share many characteristics, but simple rules do not achieve a quality of identification that analysts can use on a daily basis.

AI can then be used to achieve performance levels that allow for the rejection of risky businesses without having to process too many cases.