Simplifying the valuation of third parties in BtoB is a major challenge for all companies subject to the law. However, a number of obstacles stand in the way, such as the operational complexity of implementing this assessment. But they also need to raise awareness among in-house teams of the challenges of compliance and exposure to corporate risks (financial, reputational). To meet these challenges, Ellisphere is launching a new version of its Compliance for Business online platform.

It's a fact that the majority of companies subject to the regulatory requirement to assess third-party risks (suppliers, customers, intermediaries) are not compliant in terms of anti-corruption, money laundering or the financing of terrorism. At the same time, with the arrival of the Corporate Substainibility Reporting Directive (CSRD) under European impetus, the spectrum of third-party integrity assessment is broadening to cover not only ethics, but also environmental, social and societal issues.

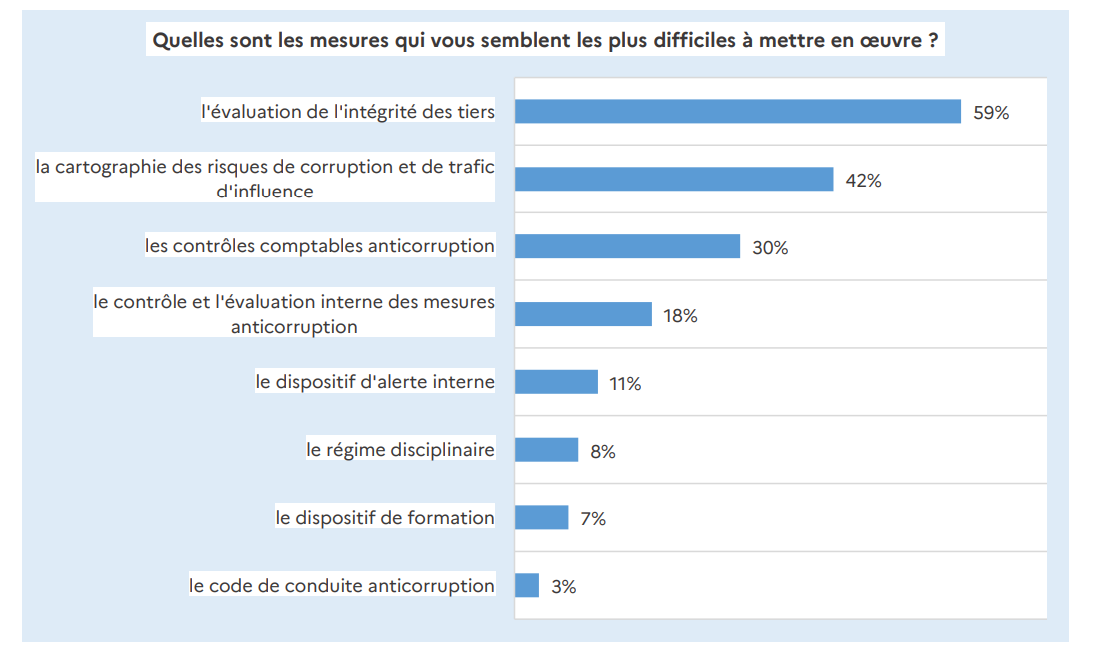

Furthermore, companies find it very difficult to evaluate their third parties, as highlighted by the French Anti-Corruption Agency (AFA) in its national diagnosis of anti-corruption measures (September 2022)

Image from AFA

Digitalization at the service of third-party valuation

There are three major obstacles to assessing third-party risks:

- The ability to gather all available data for due diligence purposes

- The number of third parties to be analyzed, often in different countries

- The multiplicity of players involved in the company and the "change" this requires

Several years of development and discussions with customers have enabled Ellisphere to remove these three obstacles and build the new version of Compliance for Business.

Compliance for Business: the right solution for all operational staff

Ellisphere, whose mission is to promote a reliable economy and sustainable growth, wants to make life easier for companies by helping them to comply with regulations.

The Compliance for Business platform responds to this regulatory challenge with 4 innovations:

- Customized scoring

The score (over 150 indicators available) and the decision-making model are parameterized as closely as possible to the company's risk mapping and internal organization.

- Simplified due diligence

The third party's KYB (Know Your Business) score is calculated directly, highlighting all the risk factors and their impact on the overall score.

- Adapted workflow

Each user can call on the Compliance department or seek the advice of his or her line manager to finalize his or her assessment.

- Optimized portfolio management

The power of the solution lies in its upstream parameterization and the quality of its data.

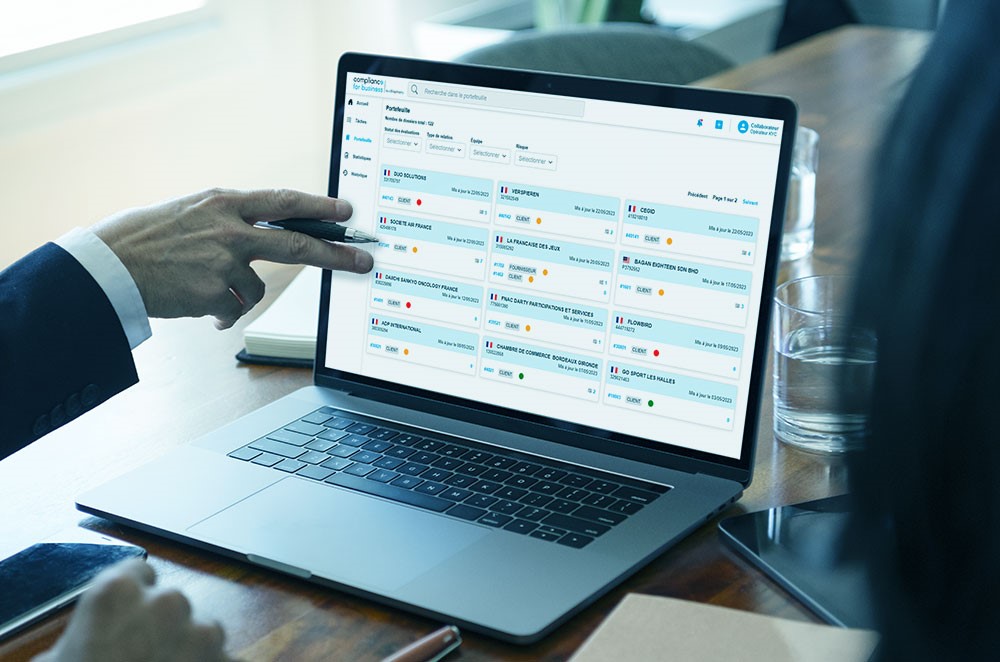

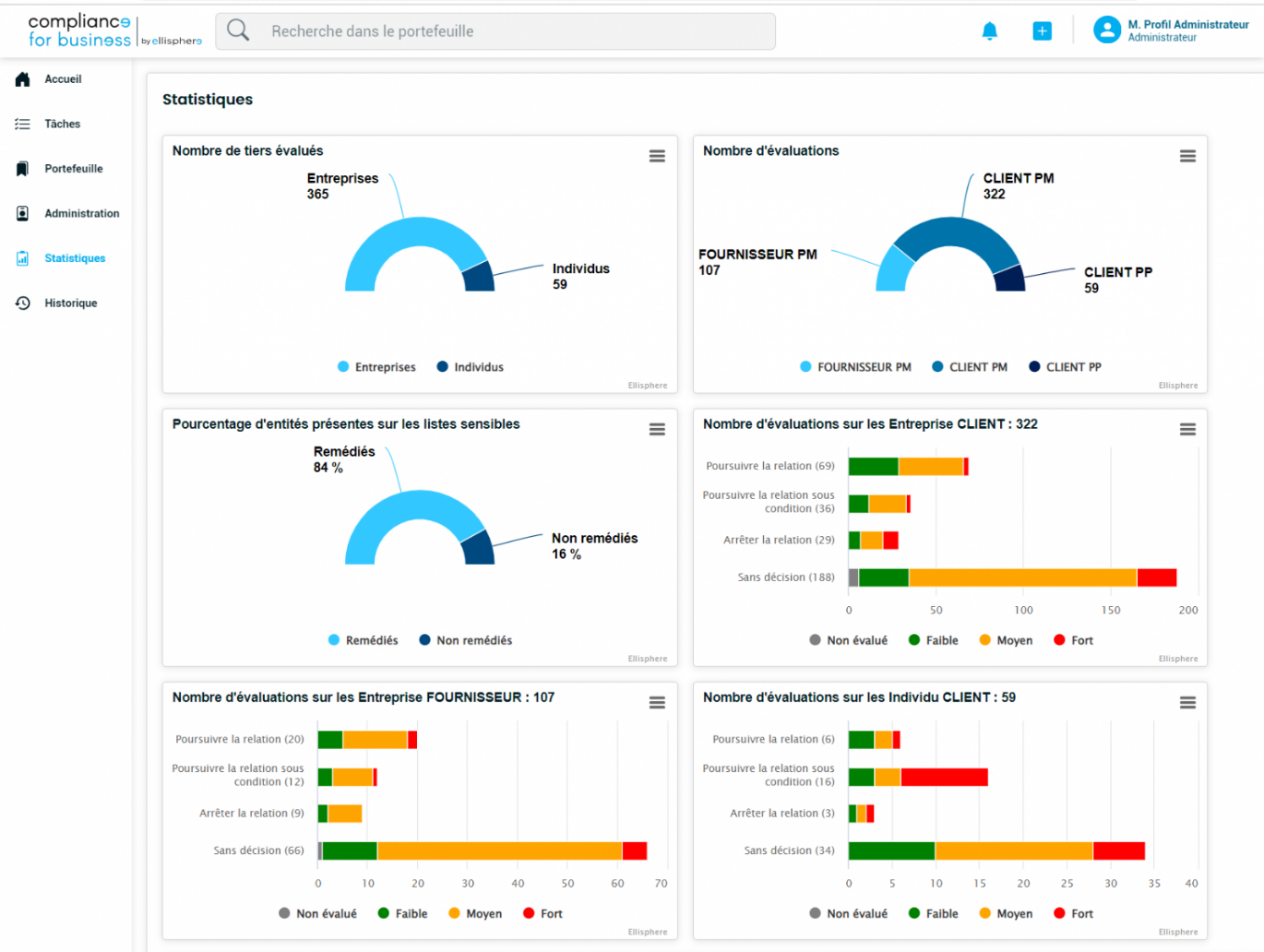

User environment extracted from the Compliance for business platform

Relive our webinar on thematics :

Operational staff: how can you best apply your risk mapping to the assessment of your third parties?

The Ellisphere webinar organized by Option Finance looks at how to apply risk mapping to the valuation of third parties. Watch the replay.