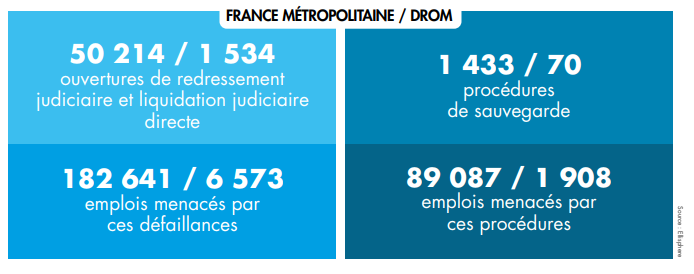

As expected, at the end of September 2023 over a sliding 12-month period, the number of insolvency proceedings in mainland France had returned to its pre-Covid-19 crisis level (2019), with a cumulative total of 51,700 judgments, a figure that rises to 53,300 if those recorded in the French Overseas Departments and Regions (DROM) are included. Insolvencies, i.e. the opening of receivership and direct liquidation proceedings, now total over 50,200 in metropolitan France over the year, a further increase of +37.2%. The number of jobs threatened by these insolvencies is at its highest level for 10 years, with almost 183,000 jobs affected, a trend that should be seen in the context of the sharp rise in the number of bankruptcy filings by small and medium-sized businesses. The increase in safeguard procedures is even greater, with +46%, or some 1,400 procedures opened over 1 year to the end of September 2023. Compared with the 3rd quarter of 2022, the number of insolvencies has risen by 23.6%, and the number of safeguard procedures by 18.2%. The lethality of opening procedures is worsening: almost 75% of procedures are direct liquidations, compared with 69% in 2019.

The Ile-de-France, Auvergne-Rhône-Alpes and PACA regions together account for 45% of insolvencies. In the case of sauvegardes, the ranking differs slightly, with Nouvelle-Aquitaine ahead of PACA. In the Occitanie region, receiverships and liquidations rose by over 45% year-on-year, particularly in Haute-Garonne (+58%). In the Grand Est region, particularly in Bas-Rhin, a +67% increase was recorded around the Strasbourg metropolis, while in the Centre-Val de Loire region, the Loiret département posted a +73.8% rise in the number of insolvencies. In terms of safeguard procedures, the Ile-de-France and Auvergne-Rhône-Alpes regions paid the heaviest price, with respectively +91.5% and +87.5% of procedures opened over the period studied. This is a particular situation for these major economic regions, which are home to a large number of decision-making and industrial groups.

A disparate vision of the sector

Over the last 12 months to the end of September 2023, Building & Public Works, Consumer Services and Business Services accounted for 54.2% of insolvencies and 41.4% of safeguard procedures in mainland France. Three sectors are particularly hard hit, with bankruptcy filings rising by more than 50%. At the top of the list is the food industry, with an increase of +58.4%, fuelled by the cascade of bakery-pastry shop bankruptcies. This was followed by Utilities with +51%, in which Healthcare business defaults rose by +55%, particularly among dentists and ambulance drivers. Finally, the Financial Services sector has been hard hit by the tightening of credit conditions affecting retail financing intermediaries.

Four sectors accounted for 53.4% of safeguard procedures: construction and public works, personal services, distribution and business services. In Retail, the number of safeguard procedures almost tripled (+191.5%), against a backdrop of increased difficulties for minimarkets, supermarkets and food retailers. In the Textile-Clothing-Leather sector, the number of procedures more than doubled (+113.3%), with unsurprisingly sharp increases in the number of claims for clothing and textile retailers in specialized stores.

"As expected, the number of insolvency proceedings in mainland France and the French overseas departments and territories has returned to its pre-Covid-19 crisis level, with 53,300 judgments recorded at the end of September 2023 over a rolling 12-month period." "

- Max Jammot, Business Unit Manager at Ellisphere

Focus on French overseas departments and regions

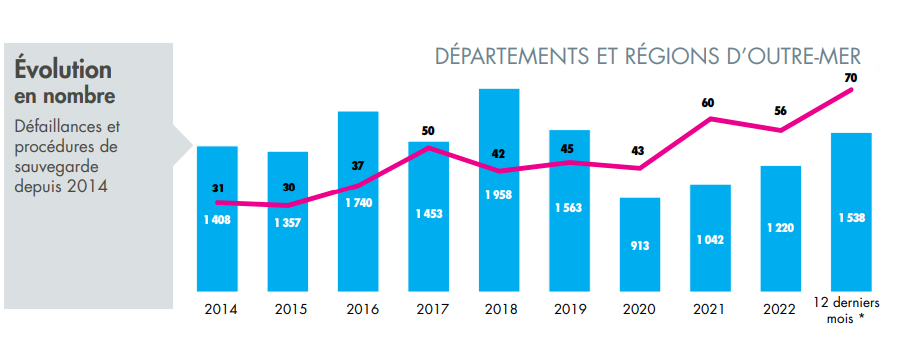

In the five French Overseas Departments and Regions (DROM), insolvency proceedings over a one-year period to the end of September 2023 totalled almost 1,610 entities. There were just over 1,540 bankruptcies (+23.4% year-on-year) and 70 safeguard procedures (+32%). Réunion is the département most affected by these procedures. It accounts for almost 50% of receiverships and liquidations, and 54% of safeguard procedures. Reunion is followed by Martinique, which accounts for more than a quarter of insolvencies (26.7%) in the French overseas departments and territories, a share that has risen by 54%; the figure for safeguard procedures is 10% over the same period. In third place, Guadeloupe accounts for nearly 17% of insolvencies and 23% of safeguard procedures in the DROMs.

Across all these regions, construction and public works, personal services and business services account for the majority of insolvencies over the last 12 months to the end of September 2023, with 55% of insolvencies and 47% of safeguard procedures respectively. There has been a sharp increase in the number of insolvencies in the Personal Services and Business Services sectors, with +53% of receiverships and direct liquidations, and a 2 to 3-fold increase in the number of safeguards. Among other significant increases, the number of insolvencies in utilities and distribution jumped by 73%.

Download our complete study now.

Every month, our business unit deciphers the latest news on the entrepreneurial dynamic in mainland France and the French overseas departments and territories, and shares its findings with you.