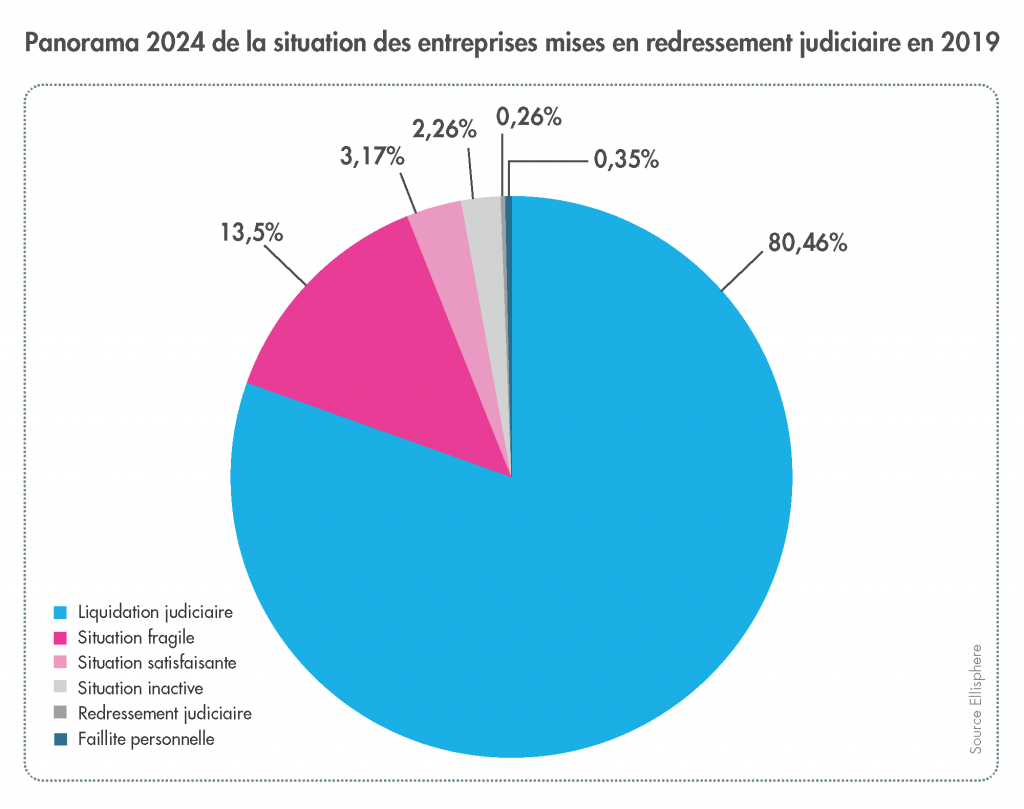

In 2019, over 15,500 companies went into receivership. Five years later, in 2024, Ellisphere conducted a study on the future of these companies. The results are alarming: 80% have been liquidated. But what has become of the 20% of companies that have survived? Who are they, and how did they manage to get back on their feet?

Five years after receivership, only 1 company in 6 is still in business

Of the 20% of companies that survived receivership in 2019, the Ellisphere study reveals contrasting fortunes:

- 17 % are still in operation today.

- Of these, only a small minority ( 3% of the 20%) are in a healthy financial position and appear to be on the road to sustainable recovery.

- However, the vast majority(14% of the 20%) remain in a fragile and vulnerable situation.

- Other companies (i.e. 3 % of 20%) are doomed to an early end:

- 2.6% are in the process of liquidation or personal bankruptcy.

- 0.4% remain in receivership.

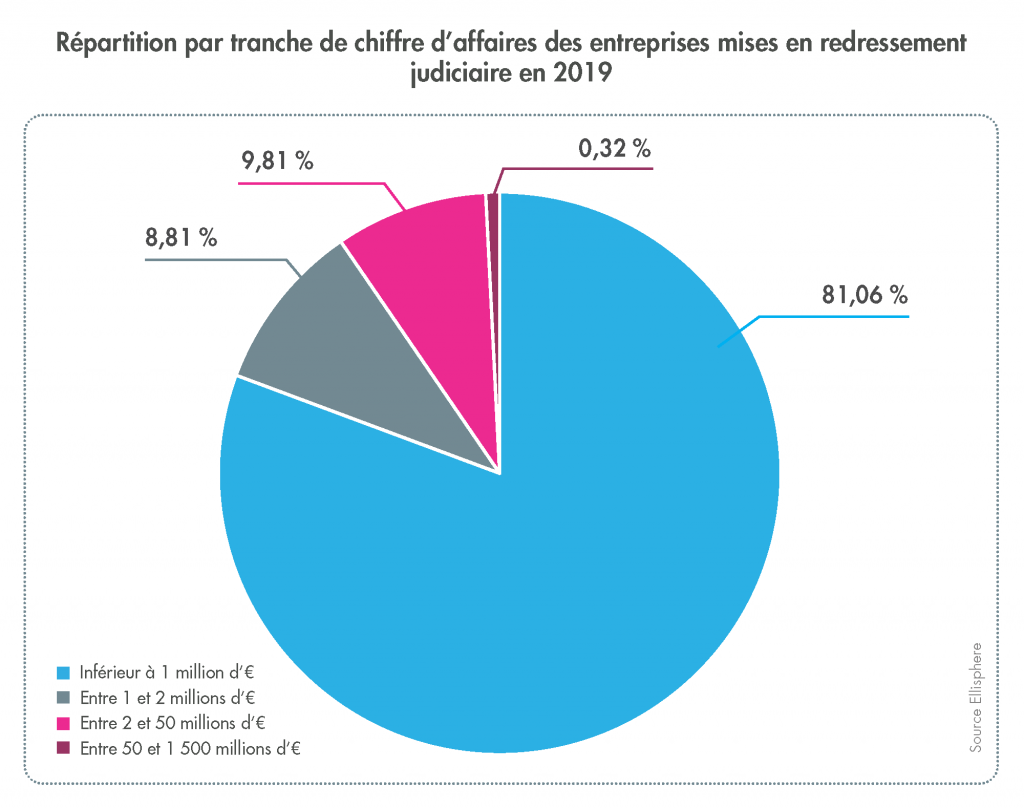

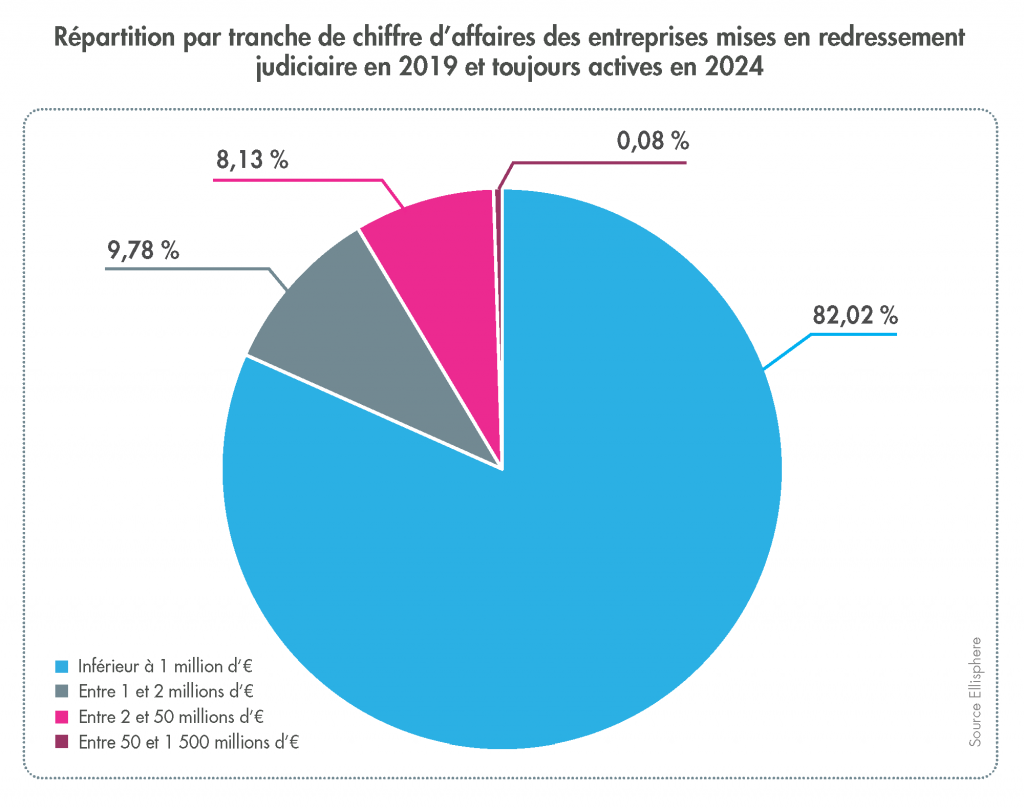

Following their RJ in 2019, the vast majority (81%) of micro-businesses with sales of less than €1 million are still active in 2024 (82%). An increasing propensity, reflecting a certain resilience .

Entities with sales between €1 and €2 million (9% of RJs in 2019) are also resilient, with 10% of companies still active in 2024.

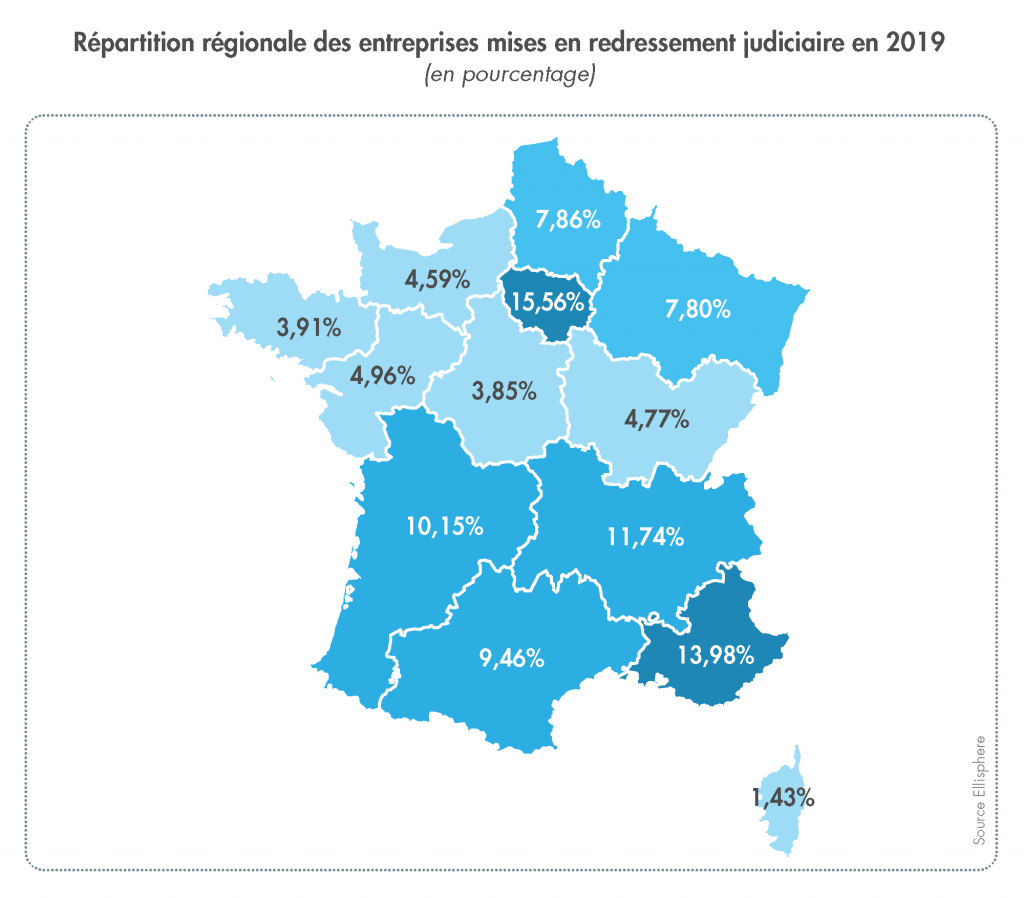

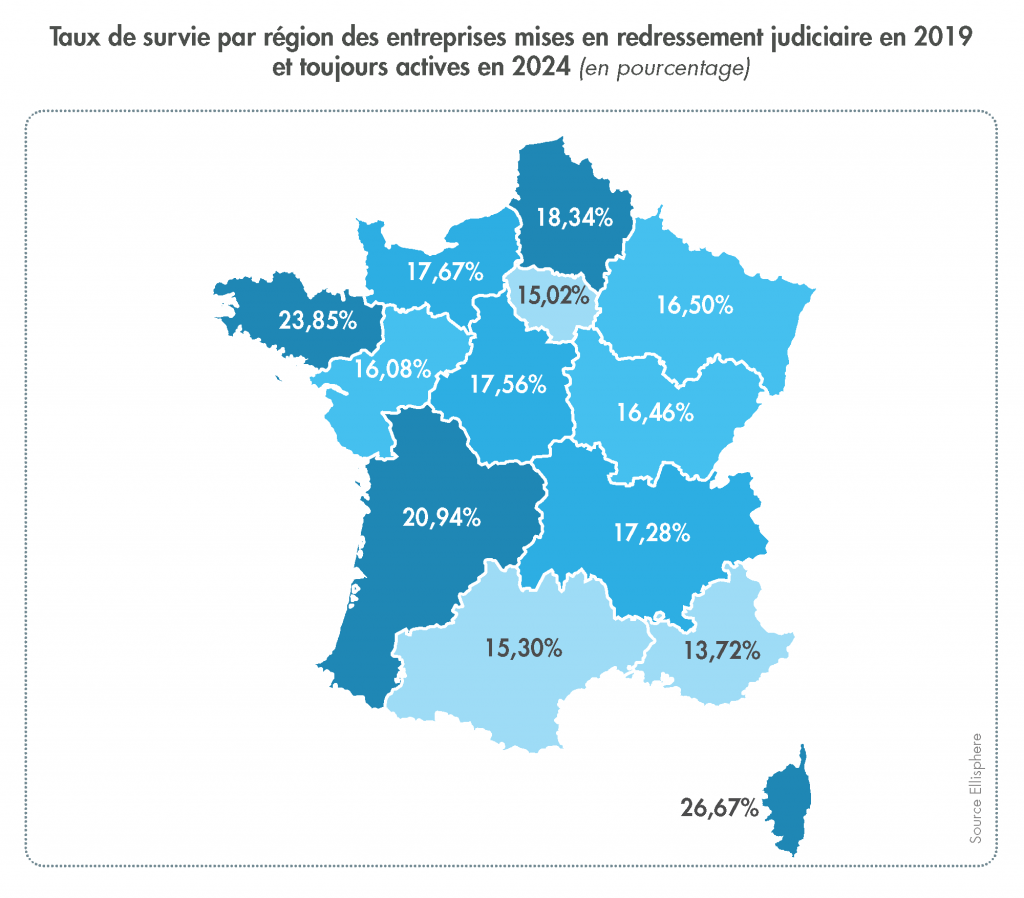

Regional mapping of company resilience after RJ proceedings

While 80% of companies placed in receivership in 2019 did not survive, Ellisphere's study reveals strong regional disparities in survival rates five years later.

New Aquitaine, champion of resilience

New Aquitaine stands out from the rest, with a survival rate of 21%. More than one company in five is still in business, well above the national average. This is a remarkable performance, all the more so as the region accounted for just 10% of all receiverships in 2019. This success is explained by the region's dynamic local economy and the strength of its industrial sectors, notably agrifood and transport equipment manufacturing.

Other regions

- The Auvergne-Rhône-Alpes region boasts a survival rate of 17%.

- Île-de-France stands at 15%.

- The PACA region has the lowest rate, at 14%.

The special case of the PACA region

PACA' s low survival rate is largely due to its heavy reliance on the tourism sector, which accounts for 13% of its GDP. The Covid-19 pandemic had a severe impact on this sector, leading to a wave of bankruptcies and considerably weakening the regional economic fabric.

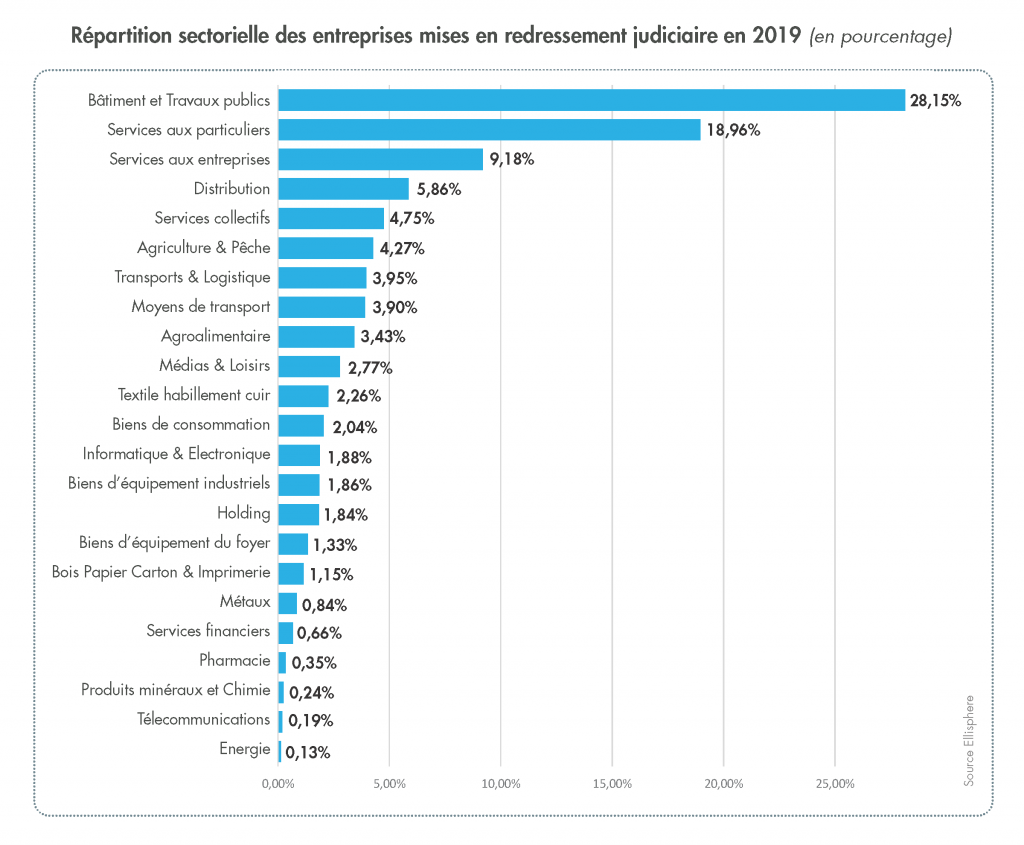

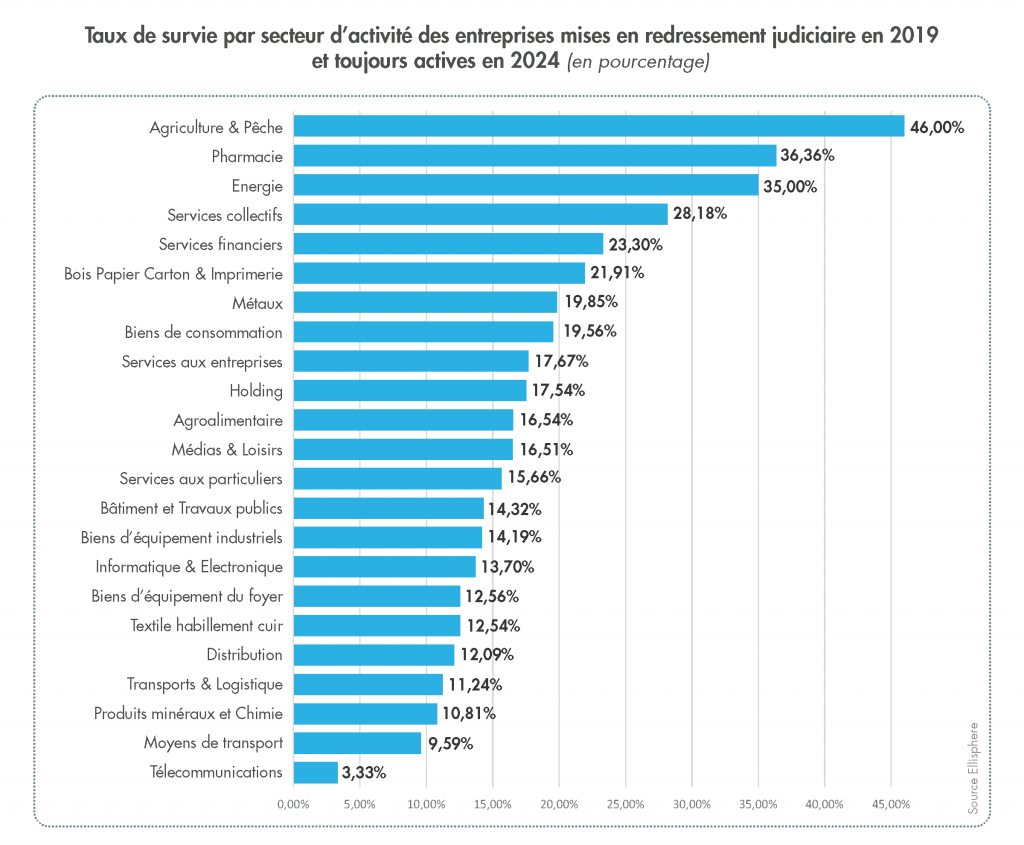

What are the business survival rates by sector in 2024?

Agriculture and Fisheries: a fragile resilience

In 2024, five years after the receiverships of 2019, theAgriculture and Fishing sector (which accounted for just 4% of receiverships) had a survival rate of 46%. This above-average resilience is due in particular to the predominance of sole proprietorships, which demonstrate greater flexibility.

However, the situation remains very precarious for these companies:

- Only 8% are in a healthy financial position.

- However, 37% are still in a fragile situation.

This sector continues to face many challenges, such as lack of profitability, strong international competition, the need for substantial investment and the burden of debt.

Financial services: between resilience and challenges

The financial services sector, which accounted for a small share (0.66%) of receiverships in 2019, has a survival rate of 23%.

However, the situation of these companies is highly contrasted:

- 18% are considered to be in a healthy financial situation.

- 5% are still in a fragile situation.

The sector faces many challenges:

- Insurers have to cope with the rising costs of natural disasters.

- The banks are facing several major challenges:

- An increase in bad debts, due in particular to longer payment terms.

- The impact of health crises (Covid-19) and geopolitical tensions.

- Growing competition from online players, undermining the traditional banking model.

Pharmacy: a sector under pressure

Pharmacies, which accounted for just 0.35% of receiverships in 2019, show a high survival rate of 36.3% in 2024.

However, this resilience is fragile:

- Nearly 30% of surviving pharmacies remain in a precarious situation.

- Only 16% are considered to be in a healthy financial situation.

The government's recent decision to reduce the ceiling on rebates for generic drugs has exacerbated these difficulties. This measure threatens pharmacies' profitability and cash flow, increasing their vulnerability and risking job cuts to cope with the situation.

Wood, paper and cardboard: a sector in difficulty

The wood, paper and cardboard sector, which accounted for 1.15% of receiverships in 2019, will have a survival rate of just 22% in 2024.

Two businesses in particular have been hard hit:

Logging

This sector accounts for the highest number of insolvencies. In 2024, 73% of surviving businesses were liquidated. The remaining 26% were in a fragile situation, and only 1% were considered healthy. These difficulties are the result of a number of challenges:

- Shortage of manpower.

- Climatic hazards (storms, droughts).

- Strong foreign competition.

The printing works

The sector is also hard hit by falling demand and soaring raw material costs, which are eroding margins. As a result, all printing companies still in business in 2024 are considered fragile.

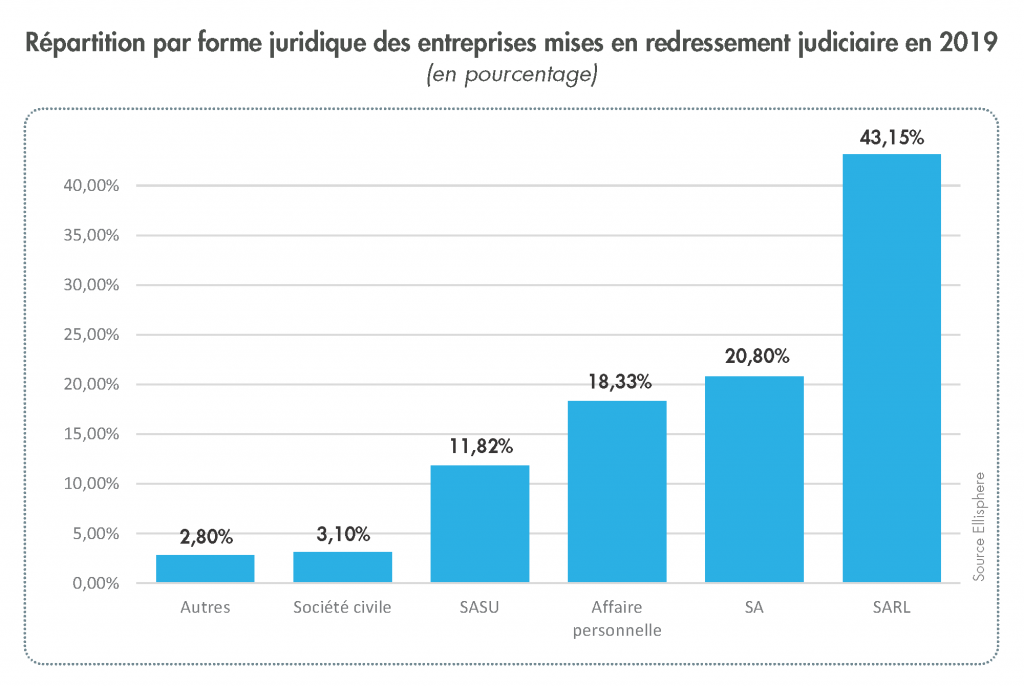

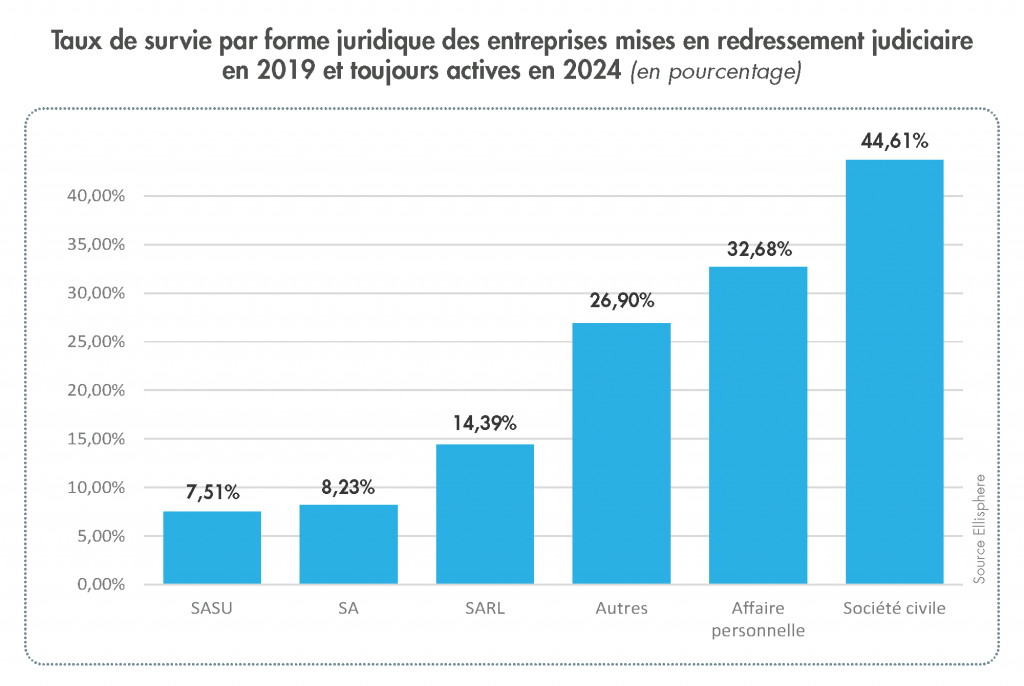

What legal form do resilient companies take?

In 2024, non-trading companies and personal businesses stood out for their ability to overcome difficulties. They had the highest survival rates after receivership, at 44.61% and 32.7% respectively.

This resilience is largely due to their structural flexibility, which enables them to adapt more easily than other legal forms of enterprise.

Download the full study free of charge