The fundamentals of the corporate failure score

Ellisphere's Business Failure Score predicts a company's failure within one year. However, Ellisphere also offers specific scores for a 2-year, 3-year and 5-year horizon. Indeed, the relationship between a supplier and its customers is often long-term.

A company's default may be a receivership, a judicial liquidation, or, since the decree of October 16, 2021, a crisis exit procedure. This evolution is already taken into account at Ellisphere.

New technologies and the ability to develop new high-performance solutions

Machine learning at the heart of innovation

Ellisphere's data scientists develop predictive models using Artificial Intelligence (AI), and in the case of the failure score, Machine Learning models. To be more precise, Ellisphere uses the Random Forest algorithm.

Knowing how to consider the right information for adapted scorings

A company with a proven risk of default represents a significant risk to its business partners: that of not getting paid or suffering a disruption in their supply chain.

And even if this company does not ultimately fail, it may have shown signs of weakness that scoring identifies and considers. This scoring requirement thus makes it possible to meet the requirements of preventive management of inter-company credit risk. In this respect, the development of customized or personalized scores can be an appropriate response to specific issues and situations.

Lastly, explicability is paramount. The Ellisphere team can in fact clearly explain the scores assigned, through detailed comments. Ellisphere's scoring is by no means a black box.

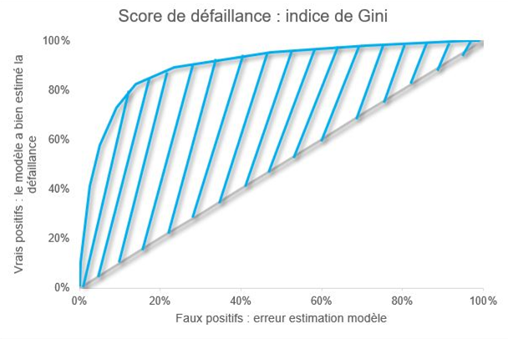

What is the Gini index?

The Gini index is the statistical indicator of the performance of a score. It is used to compare data science models.

Ellisphere's model continues to undeniably perform well, with a Gini index of 80%! A result that exceeds all others in the industry.

Advantages and benefits with Ellisphere's failure score

The most complete perimeter

Ellisphere considers all French companies to identify all possible signs.

A model working on the largest volume of data

To date, Ellisphere uses more than 500 indicators for each company, almost half of which are financial indicators. In addition, the Ellisphere team regularly improves its models to consider new indicators and new economic issues; a recent example is the inclusion of the impact of the Covid-19 health crisis.

A combination of expertise

The work of constructing the corporate default score was carried out with the contribution of numerous Ellisphere experts, and in particular financial analysts. The combination of know-how is indeed the key to obtaining very high quality scoring models.

The most modern techniques of AI

Ellisphere uses the so-called ensemble models, developed for less than 20 years, with very recent developments by the world's leading references (LightGBM developed in 2017 by Microsoft, Catboost developed in 2018 by Yandex).

A model working on a homogeneous population

The Ellisphere team focuses on French companies with the specificities of the French economy, quite different from other economies, for example the German economy, which benefits from an entrepreneurial fabric composed of more SMEs.

An ethical model

Finally, Ellisphere's model rigorously respects the General Data Protection Regulation (GDPR), and does not use data on individuals. Illustrating this commitment, Ellisphere has been awarded the Privacy Protection - Pact label for several years.