The concept of scoring in BtoB risk management

Scoring is the process of assigning a score to a customer, supplier or prospect based on various criteria. This score makes it possible to establish the profile of the entity according to defined criteria. In customer/supplier risk management, scoring aims to establish the context in which the company operates. It also allows to identify and evaluate with a simple indicator the risks linked to this company in order to protect itself. The score is therefore both an important decision-making tool and a means of editorializing the data for the decision-maker.

At Ellisphere, we use the corporate default score to establish the probability of default at 1 year as a standard, as well as possibly at various horizons of 2, 3 or 5 years. One of the possible applications is also the assessment of risks related to late payments.

Scalable score: make sure you get paid on time!

An adapted scoring, designed for you and with you

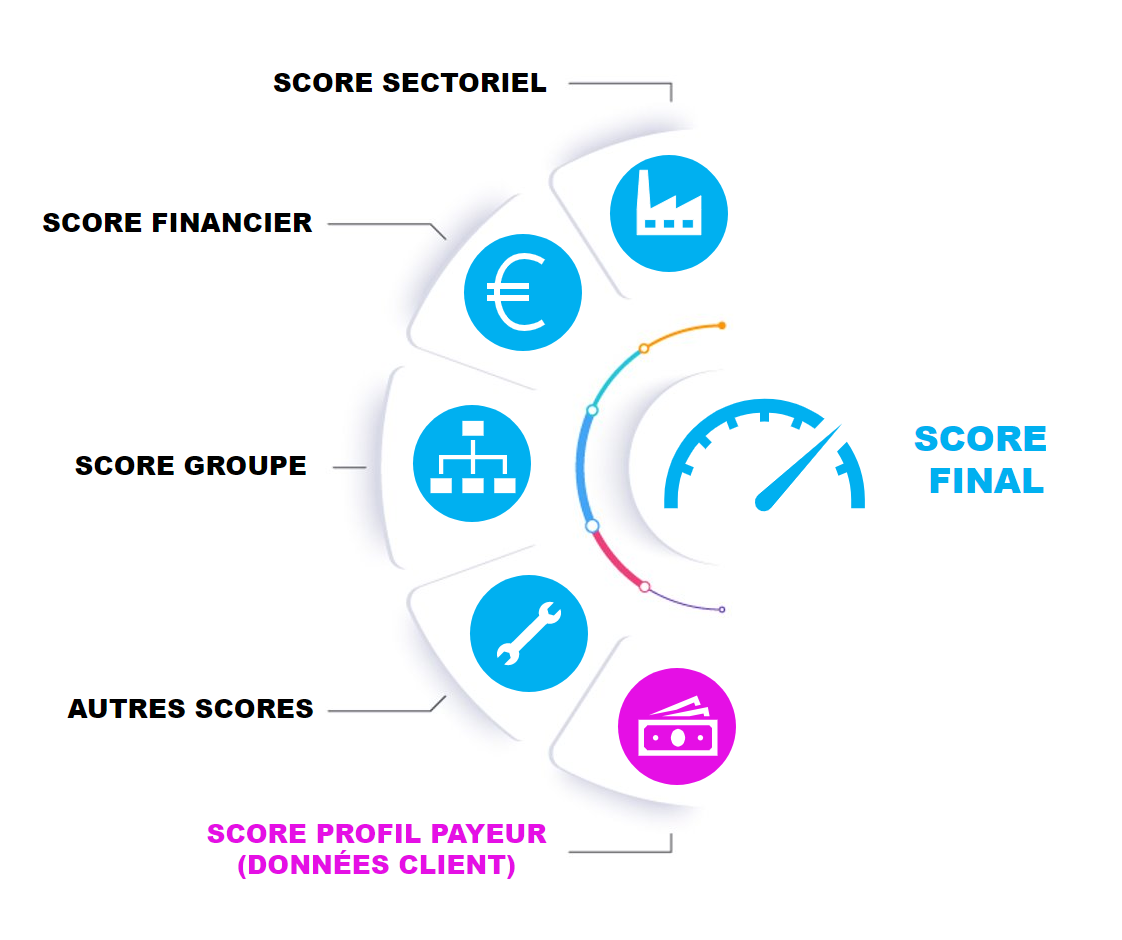

The modular score proposed by Ellisphere is currently composed of 4 independent modules: the sector score, the financial score, the group score and the payer profile score. Other scores are to come, such as the CSR (Corporate Social Responsibility) score.

The business at the center of your customer/supplier risk measurement

The level of risk is often attributed to the profile of the clients in a portfolio. It must therefore be measured differently depending on the composition of the portfolio. It is also necessary to identify the nature of the activity linking the company to its customers. This is why business expertise plays an essential role in risk measurement. Indeed, it is during exchanges between the business and the financial experts that a personalized and reliable risk management indicator is created.

What methodology?

Sector score

The sector score is used to estimate the resilience of a company in a sector to a potential crisis. This score is now calibrated to measure resilience to the Covid-19 crisis. It can be adjusted for different crises such as a commodity crisis or a war.

Financial score

The financial score measures the economic performance and financial health of the company. It takes into account different financial indicators of the company. It takes into account various classic indicators (for example, intermediate management balances), and adds others to allow for better customization. The idea? To give an account of the financial health of the company studied in the most accurate way possible.

The financial score is itself composed of 4 groups of indicators representing: structural risk, liquidity risk, business risk and analysis of the Operating Working Capital Requirement (OWCR).

The weight assigned to each of these indicators can be customized with the advice of Ellisphere's financial experts according to the portfolio studied.

Group score

The group score is used to indicate group membership and size to highlight the financial security of a parent company.

Payer Profile Score

The Payer Profile Score is based on your own data. It concerns outstanding and overdue payments, and indicates the ability to pay on time. Different indicators within the score can be customized, especially in relation to the company's sector of activity. For example, if the customer is a retailer, it is very common for payments to be late, so the weight of the indicators must be adapted to the customer's needs.

Customer score (final score)

Each of these 4 modules generates its own score. By weighting these scores in a personalized way, the final adjustable score, also called client score, is obtained. The association of this client score with risk ranges, which can also be customized, allows us to obtain a risk level.

Based on this level of risk, we can recommend a credit opinion, i.e. a suggested amount of credit that can be allocated to a company while minimizing the risk of loss.

Customized score: industrialize your decision making

Co-construction of your customer/supplier risk management solution

The custom score allows you to meet more specific needs. Indeed, it mixes data from Ellisphere with your own data. This solution is built with you in order to be as close as possible to your customer/supplier risk management needs. The customized score can be based on different methodologies. For example: business rules, artificial intelligence algorithms or a rigorous mix of both.

Scoring technology integrated directly into your ecosystem

Once the score has been created after various workshops with our financial experts and data scientists, it is made available to you via a connector allowing you to integrate it directly into your existing ecosystem. A simple call to the connector will automatically give you access to the customized score.

In addition, it is also possible to add additional indicators concerning the company studied (financial indicators, company profile or other KPIs from your own data), in accordance with current legislation.

Automated decision support

This personalized score is a real decision-making aid in managing the risks of your customer/supplier portfolio. The automation of the scoring process allows you to quickly report on the risk related to a company by integrating directly into your ecosystem.

Read more

Our support in risk management

Discover Ellisphere's expertise on your customer/supplier risk management issues with our dedicated approach.