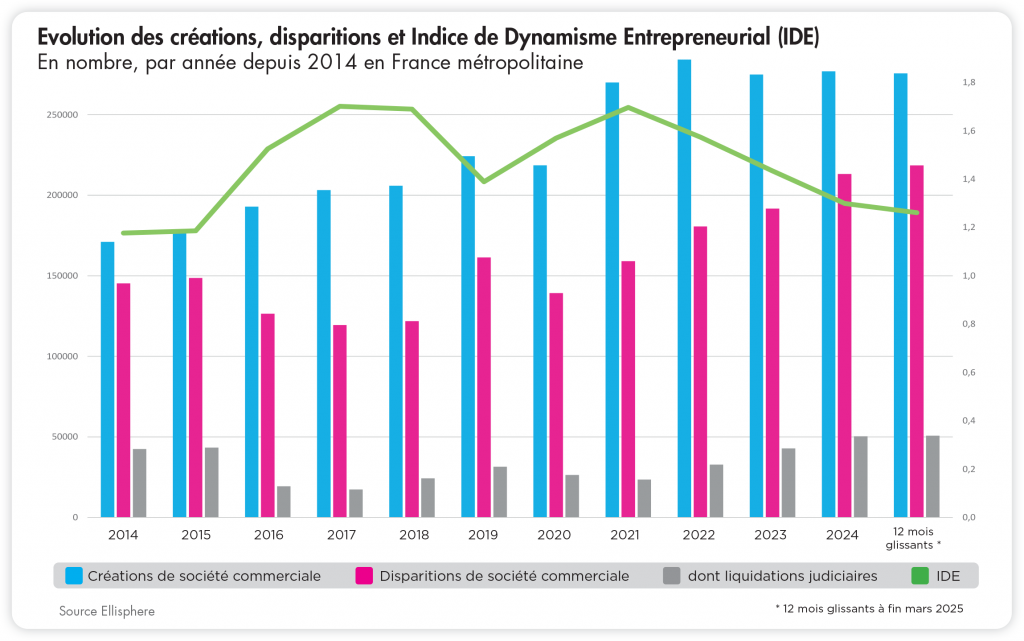

Over the 12 months to the end of March 2025, there was a slight increase of +0.2% in the number of business start-ups. At the same time, the number of disappearances has risen significantly (+9.6%); this deterioration has been underway for several months now.

Over the period studied, the Ellisphere index measuring the rate of renewal of the population of commercial companies stands at 1.3, as at the end of 2024, after a slight deterioration in January and February 2025 (index at 1.2). In fact, in the first two months of the year, there was a drop in the number of business start-ups, and a very significant increase in the number of business closures.

More and more people going into receivership as a result of disappearances

Another worrying sign is that the share of judicial liquidations in disappearances has stabilized at a high level, at 23.2% (23.9% at end December 2024).

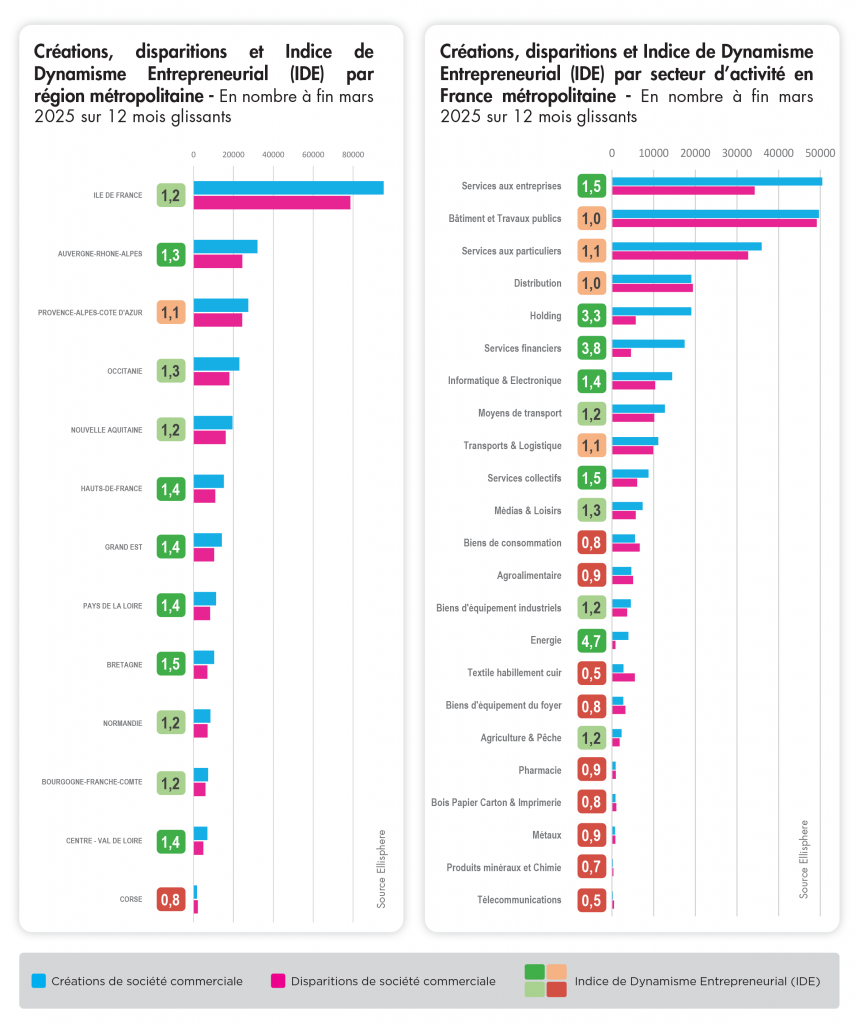

With a national index of 1.3, some regions fared less well, such as Corsica and PACA at the bottom of the ranking, with indices of 0.8 and 1.1 respectively, while other regions performed well, such as Brittany, which recorded the best entrepreneurial dynamism index at 1.5. The proportion of liquidations within disappearances remains high nationwide, with particularly worrying results in Centre Val-de-Loire, Grand-Est and Hauts-de-France, where over 30% of disappearances are now liquidations.

On a sectoral level, Financial Services and Energy performed well, with an Entrepreneurial Dynamism Index (EDI) of 3.8 and 4.7 respectively. At the same time, the proportion of liquidations in the number of disappearances remained moderate, at 11.9% and 10.7% respectively. The Transportation sector, weakened by low demand and lack of competitiveness, nevertheless maintained a respectable FDI of 1.2. However, the share of liquidations in disappearances has risen from 23.8% at the end of 2023 to 26.5% at the end of 2024, stabilizing at 26% at the end of March 2025 over a rolling 12-month period. After two turbulent years, at the end of March 2025, the building and civil engineering sector had stabilized at the threshold of renewal of its population of commercial companies, with an index of 1. However, the share of liquidations in disappearances remains high in this sector, at 28.5% (29.1% at the end of December 2024). Like the Building and Public Works sector, the Retail sector, which is heavily impacted by inflation and the disappearance of chains, is also positioned at the renewal threshold, with an index of 1 at the end of March 2025 over a rolling 12-month period.

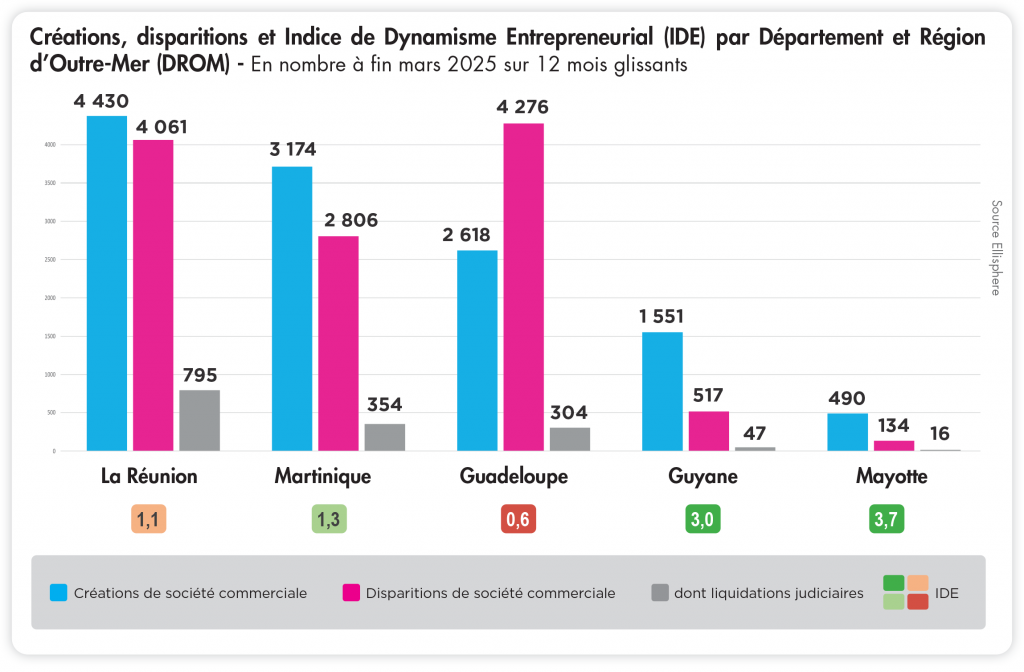

A stable situation in the French overseas departments and territories

At the end of March 2025, over a sliding 12-month period, despite the slowdown in economic activity, FDI in French overseas departments and territories stabilized at 1.1. Liquidation accounted for almost 13% of the total (12.2% at end-December 2024).

Over the period under review, Martinique maintained its FDI at 1.3, while Réunion saw its index fall to 1.1. Guadeloupe, severely affected by excessive payment delays (particularly in the public sector), maintained a negative FDI of 0.6; the renewal of the population of commercial companies is no longer assured in this territory. Despite the repercussions of Chido, Mayotte's FDI rises to 3.7 at the end of March 2025 (3.5 at the end of December 2024). Liquidations accounted for 11.9% of the total, compared with 20.6% at the end of December.