The economic climate in the second quarter of 2025 continues to be marked by instability: geopolitical tensions, trade wars, a gradual rise in interest rates... an environment that is having a major impact on cash flow. Although business insolvencies are stabilizing, with fewer overall at the end of June 2025, they remain high in France, testifying to the fragility of economic players.

Sharp drop in safeguard procedures in France

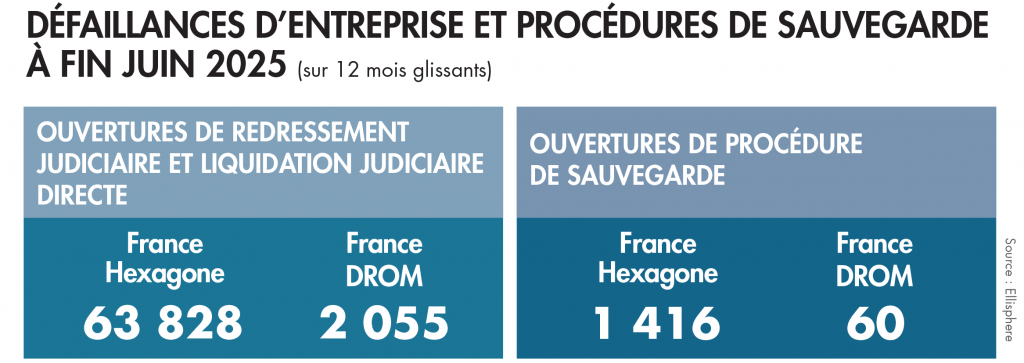

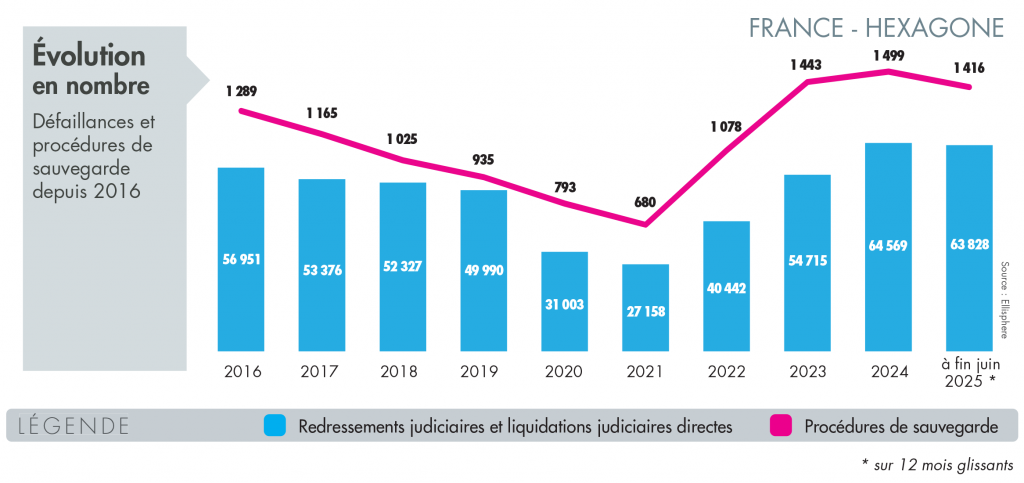

Over a sliding 12-month period to the end of June 2025, the number of insolvencies (i.e. the opening of receiverships and direct judicial liquidations) in France rose by +5.2%, compared with +11.8% over a sliding 12-month period to the end of March 2025. The trend is still upward, but the slowdown is confirmed. The trend is even more marked for safeguard procedures, where the number of entities involved fell by -4.8% to end June 2025.

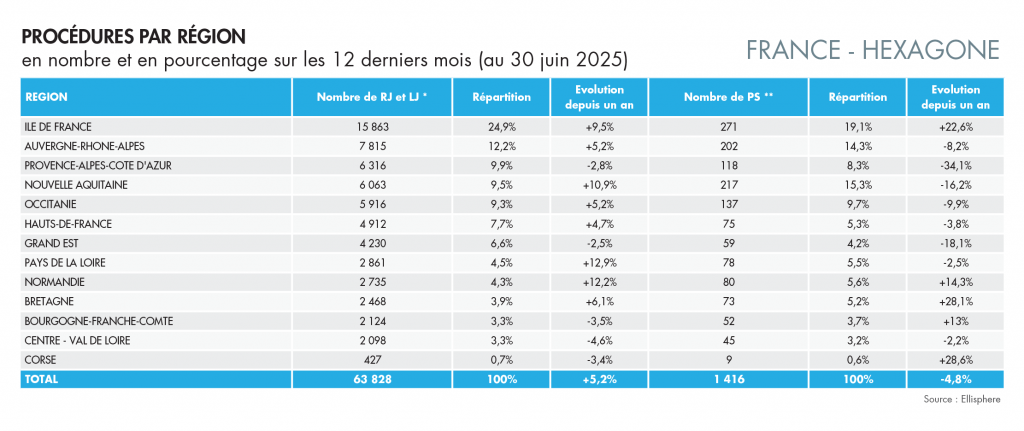

Over the same period, the Auvergne-Rhône-Alpes, Occitanie and Hauts-de-France regions saw their number of insolvencies rise by +5%, an increase equivalent to that recorded nationally. The Ile-de-France region posted a +9.5% rise in the number of insolvencies, while other major regions such as Nouvelle-Aquitaine, Pays de la Loire and Normandie saw increases of over 10%. On the other hand, the Provence-Alpes-Côte d'Azur and Grand-Est regions performed well, with insolvencies down by -2.8% and -2.5% respectively.

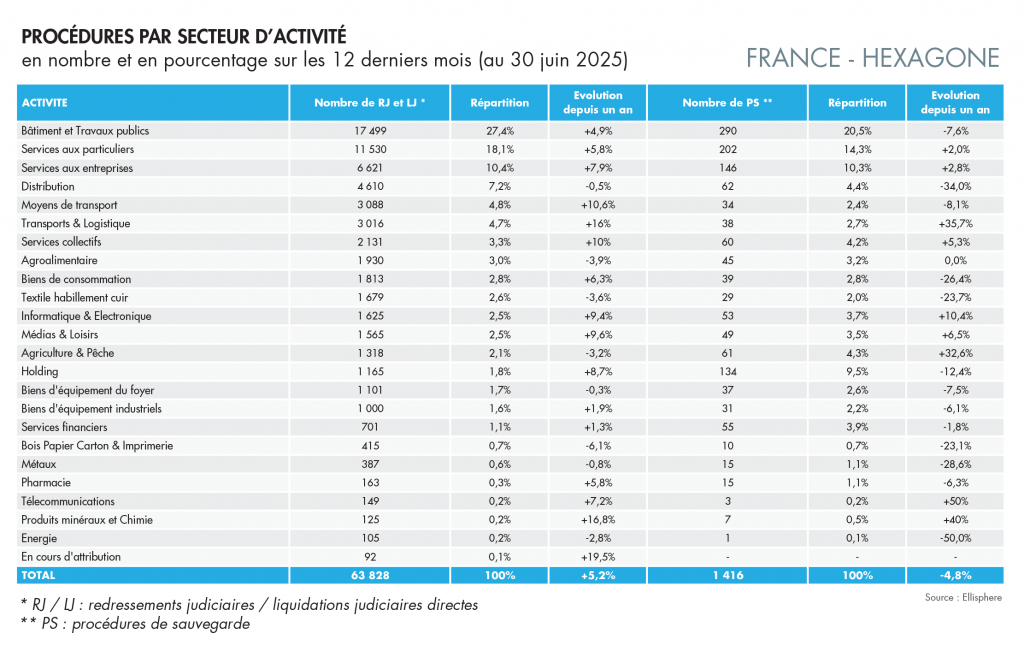

At the end of June 2025, the upward trend in the number of insolvencies is slowing for all business sectors. In the building and civil engineering sector, the number of bankruptcies has been divided by five over a sliding 12-month period to the end of June 2025. This trend is notably in line with a slight upturn in the new construction market. However, for certain sectors, the increase in the number of insolvencies exceeds +10%. This is the case for Means of Transport (+10.6%), a victim of falling demand, Transport and Logistics (+16%), penalized by labor shortages and rising costs, and Mineral Products and Chemicals (+16.8%), which are suffering from a lack of competitiveness vis-à-vis Asia and European environmental regulatory pressure.

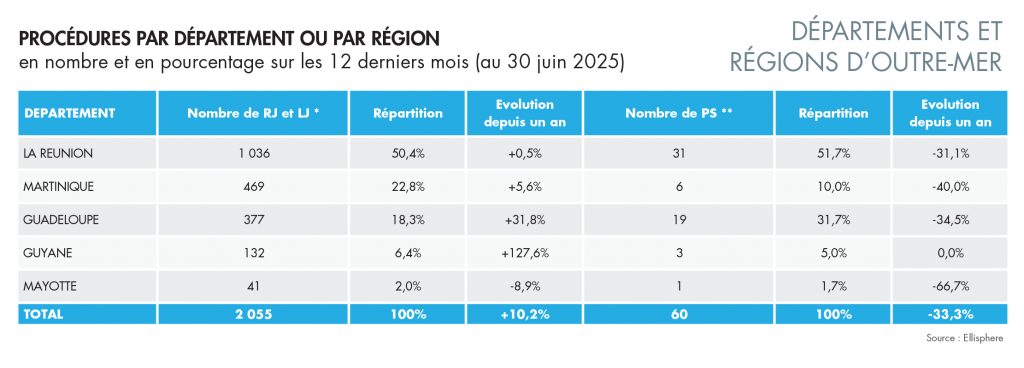

Insolvencies continue to rise sharply in French overseas departments and territories

In the French overseas departments and territories (DROM), at the end of June 2025, over a sliding 12-month period, the number of insolvencies was up by more than 10% (+5% in France). French Guiana recorded a spectacular rise in insolvencies of 127%, as a result of industrial action in major ports, which disrupted supply chains in many sectors. In Guadeloupe, the number of insolvencies rose by almost +32%, in Martinique by +5.6%, and on Reunion Island, the increase was virtually nil (+0.5%), compared with +27% at the end of 2024.