Background and challenges

Transparency of property information continues to be at the heart of the concerns of governments and the public, as demonstrated by media coverage of data leaks in recent years. These leaks have often shown that lack of transparency hides crimes such as tax evasion, money laundering, terrorist financing or attempts to avoid potential sanctions.

Let's take as an example the last Arab revolutions which revealed the financial arrangements of former leaders monopolizing billions at the expense of their own countries: the Ben Ali clan in Tunisia, Hosni Mubarak and his family in Egypt and the Gaddafi family in Libya.

In the fight against money-laundering, the financing of terrorism and corruption, it is important to identify the natural person who controls, directly or indirectly, the target body.

In France, the CARP Sanctions Commission decided that it was up to the organisation to investigate whether one or more persons exercised de facto control over the administration of the client company in order to identify the beneficial owner(s)(Decision CS Axa France Vie - n°2015-08).

Beneficiary, who are you?

The beneficial owner is defined as the natural person (or persons) who owns or controls, directly or indirectly, the targeted company. In no case may the beneficial owner be a legal person. The beneficial owner is either:

- the natural person(s) who owns, directly or indirectly, more than 25% of the capital or voting rights of the target company;

- the natural person(s) who, by other means, exercises control over the management, administration or management bodies of the target company or the general meeting of its members or shareholders;

- only if there is no identification of a beneficial owner according to the two preceding criteria. The natural person(s) who directly or indirectly (through one or more legal persons) occupies the position of legal representative of the target company.

For enterprises without capital (individual enterprises, associations, etc.), the beneficial owners are the legal representatives of the target company.

Why are we looking for a beneficial owner?

For a financial institution or a company, it is very important to know the natural person(s) who owns or controls third-party companies with whom they are dealing. Non-knowledge can lead to the risk of penalties for corruption, money laundering, tax fraud, as well as reputational risks that are often unrecoverable.

The latest scandal around Isabel Dos Santos and the Luanda leaks, as well as the vast network of tax evasion and money laundering, is mainly based on "Shell Companies" based in Malta, Mauritius and Hong Kong. These empty shells, which have no activity, have nothing and generally have only the purpose of hiding people (the actual beneficiaries) and often illegal activities. There is proof of this, some Portuguese financial agencies that are in the eye of the cyclone for allowing the development of such a network, with its lot of suicides or murders. Are we heading, again, straight to a scandal that resembles that of Odebrecht?

The Ellisphere methodology

Case study: seeking the beneficial owner

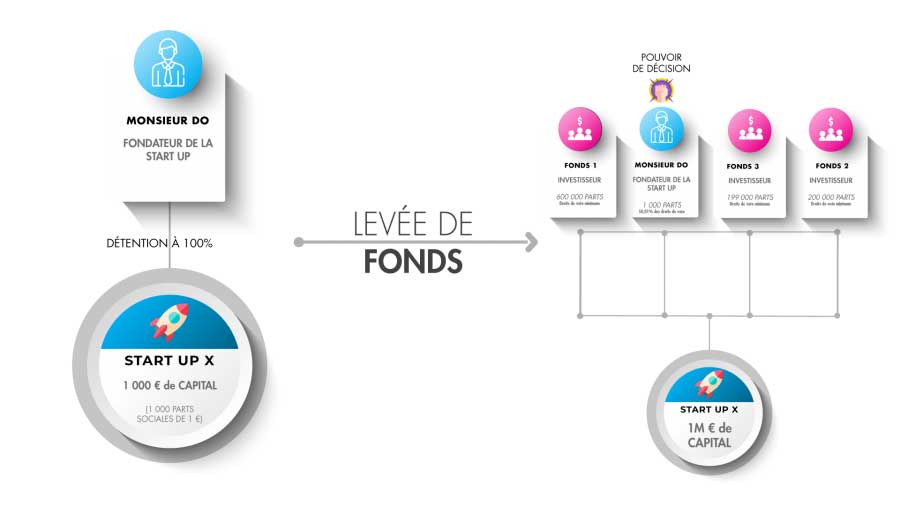

The start-up

Mr. Do creates a start-up with a capital of €1,000. His company is growing and he therefore needs to call on investors.

Investors bring capital and receive shares of the company in exchange. Mr. Do thus becomes a minority shareholder in the capital. However, the shares he holds are called "preferential shares" (PDA).

In conclusion, Mr.Do is a minority shareholder, but his shares give him more power than the other shareholders (common shares).

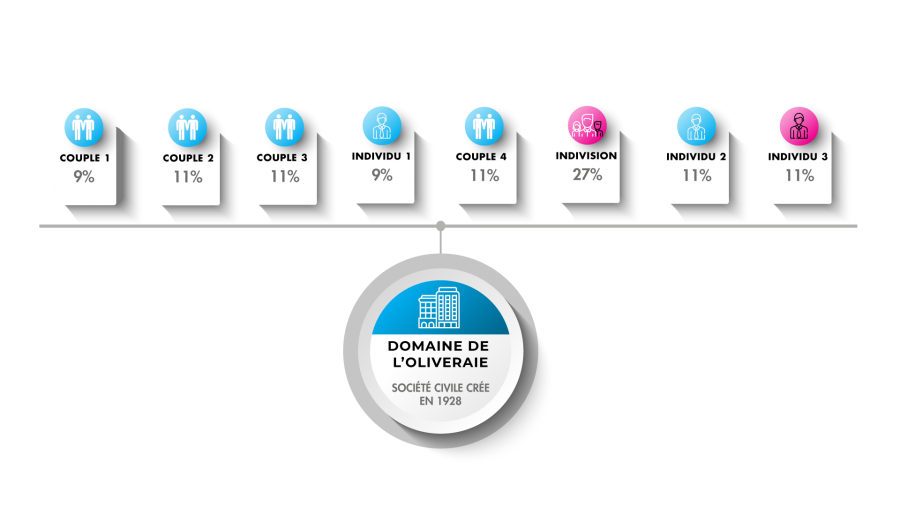

A civil society

A forest estate belonging to the same family for decades has been divided into parcels. Several pairs or individuals each hold a parcel of it. When a person dies, an estate individual is created. Each member of the indivision is then co-owner of the parcel.

Any person holding more than 25% of the capital will be identified as beneficial owner. This is also the case if he/she co-constitutes these shares in indivision. A person holding less than 25% of the capital can be considered beneficial owner only if he/she is part of an indivision (example: cumulation of percentages).

What conclusion?

In the context of the search for beneficial owners, it is therefore vital to have reliable and sourcing information. The identification of the shareholder chain which enables the beneficial owner to be identified is essential. Indeed, the quality of the incoming data must therefore be irreproachable in order to guarantee lasting economic relations.

Human work is at the heart of this analysis. The structuring of the data by the human is inseparable from the machine's calculation work. That is why today, this complementarity allows us to have optimal and accurate information.

Read more

Our Compliance support

Discover now Ellisphere's expertise on your compliance issues and master your due diligence...