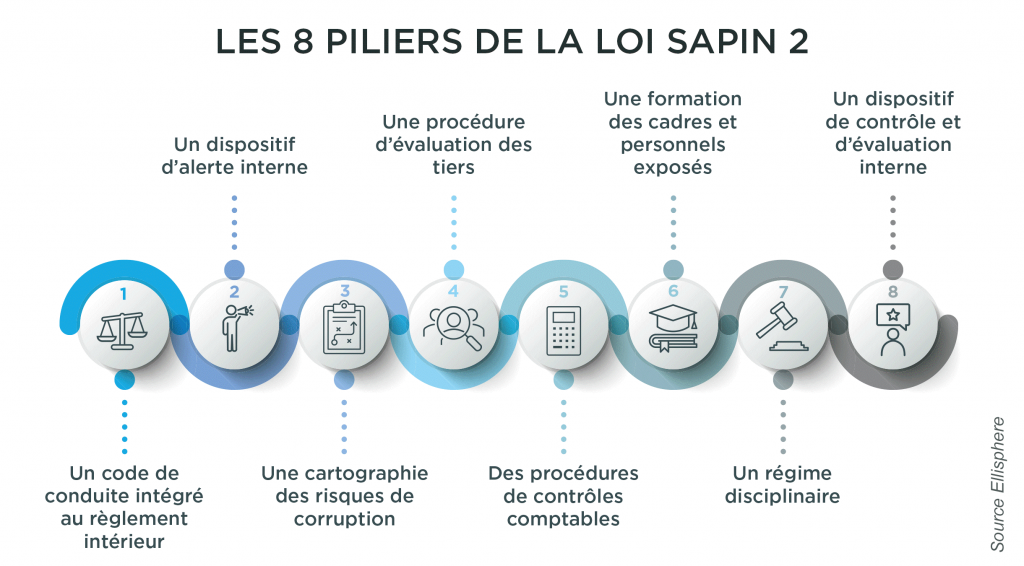

Too many companies consider that an anti-corruption code of conduct and a whistleblowing system protect them sufficiently, but to avoid the devastating scourge of corruption, it is necessary to embark on the 8 measures of the anti-corruption system of the Sapin 2 law, very well described in the AFA recommendations, and in particular the 8th measure of third-party evaluation.

A robust assessment of the integrity of third parties makes it possible to take an individual look at each partner at risk and prevent a problem before it arises. If this work is not carried out properly upstream, and proven facts produce an internal crisis or even a CJIP (Convention Judiciaire d'Intérêt Public), it's already too late. The manager then finds himself in the front line to justify why the necessary resources have not been put in place. While it's true that companies often initiate the third-party assessment process to "tick the box" of compliance, their motivations quickly change.

Alignment with corporate values, such as integrity, plays a powerful role in anchoring this practice. The requirements of major accounts also have a ripple effect throughout their value chain, as failure to have a third-party assessment policy means risking losing important tenders. Finally, there are employer branding issues, with major objectives such as attracting talent in search of meaning, or reassuring banks before granting financing.

What are the factors transforming third-party valuation?

Firstly, there is still a major gap between ambition and reality: 88% of AFA audits reveal shortcomings in the assessment of third parties, and only 29% of companies consider their own procedures to be effective. And for good reason: without a digital solution, the task is extremely time-consuming: searching for beneficial owners, cross-referencing them with international sanctions lists, analyzing negative press on every continent...

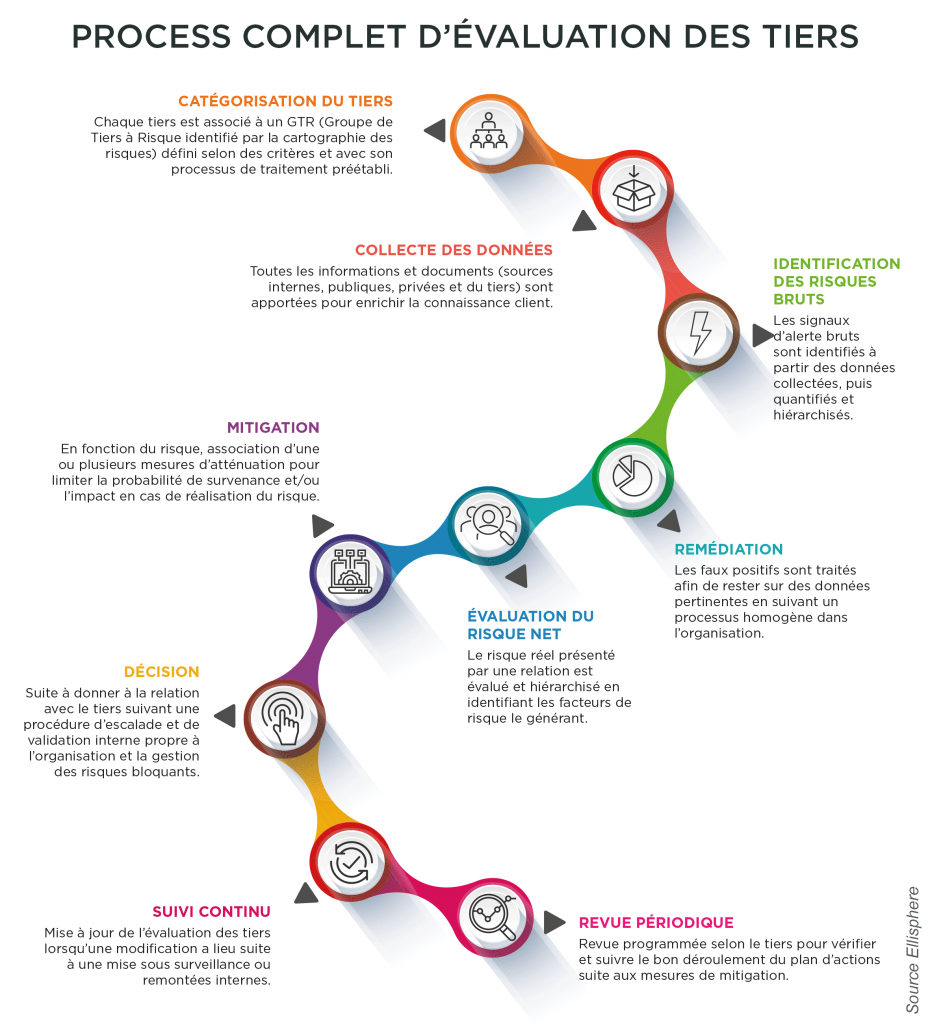

Several trends are emerging to meet these resource optimization challenges: the massive automation of tasks to free up human time and make the process manageable and relevant; the use of artificial intelligence for complex searches; the need for a 360° view integrating corruption, cyber, CSR and financial risk; the ability to adapt the depth of analysis to the risk level of the third party defined by risk mapping; and finally, the management of escalation workflows to ensure that sensitive cases are escalated to the right person so that a decision can be taken at the right level.

Whether your due diligence is centralized or decentralized, with one or hundreds of users in many locations, like some of our major customers, Ellisphere enables you to manage third-party compliance risks. What's more, our approach is scalable. For example, the platform will enable you to track the mitigation actions implemented to control an identified risk, such as an on-site audit or the reinforcement of a contractual clause. Because we are constantly innovating in co-development with our customers. Our latest breakthrough uses AI to analyze press coverage of duty of care issues (human rights, environment). Our aim is to make compliance not only feasible, but also acceptable and effective for everyone, from the legal expert to the subsidiary buyer.