For a long time, late payments were considered a mere operational inconvenience. An irritant, sometimes costly, but rarely interpreted as a strategic signal. That interpretation is now a thing of the past.

After 2024, 2025 saw a deterioration in the payment behavior of companies in France.

For a long time, late payments were considered a mere operational inconvenience: irritating, sometimes costly, but rarely interpreted as a strong signal. That interpretation is now a thing of the past.

Late payments have become an advanced macroeconomic indicator, revealing deep-seated weaknesses in the productive fabric. They tell a much broader story: one of cash flow under pressure, a financing model that is running out of steam, and a risk of default that is insidiously spreading throughout the value chain.

Persistently high average payment delays in France

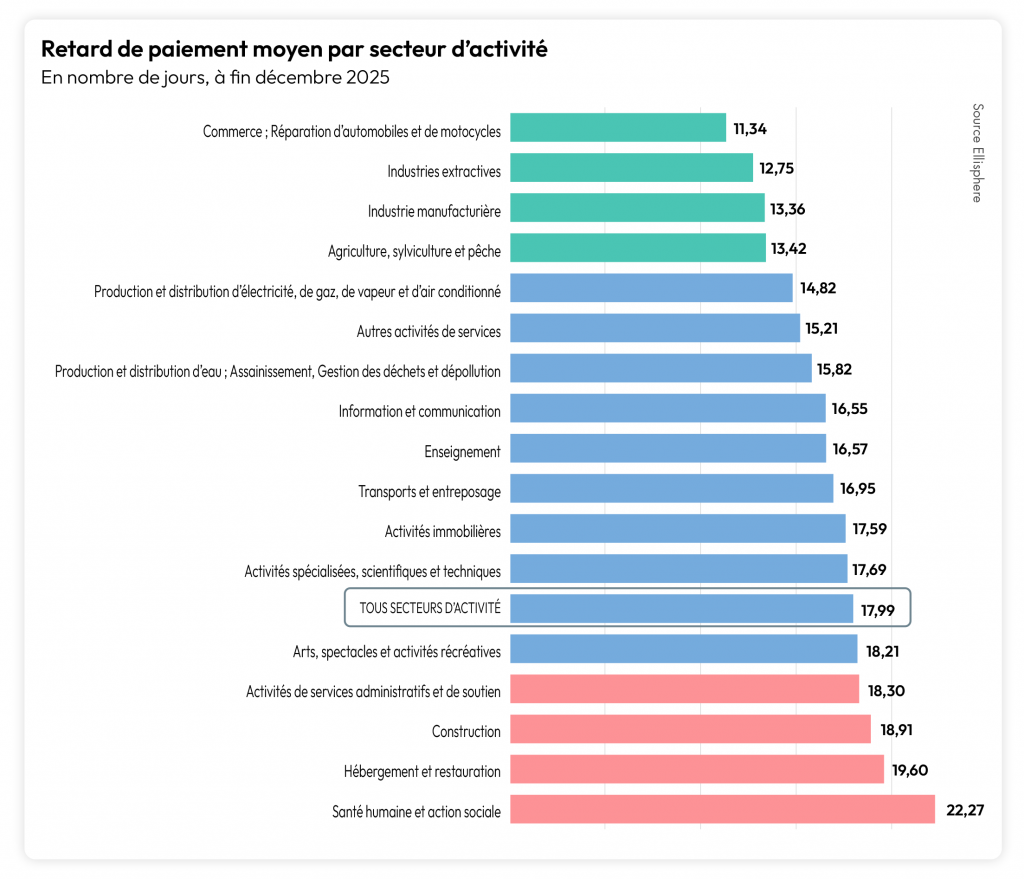

In France, in the fourth quarter of 2025, the average payment delay across all sectors of activity was 17.99 days.

At first glance, this figure may seem to be moving in the right direction, falling from 18.08 days in the third quarter of 2025 to 17.99 days at the end of the year. But this apparent improvement masks a much more worrying phenomenon: economic activity seems to have become accustomed to operating under constant pressure.

The historically high average level of late payments is no longer perceived as an anomaly. It is implicitly becoming the norm. However, when a system normalizes tension, it automatically becomes more vulnerable to shocks: slowdown in demand, rising interest rates, cost inflation, logistical disruptions, etc.

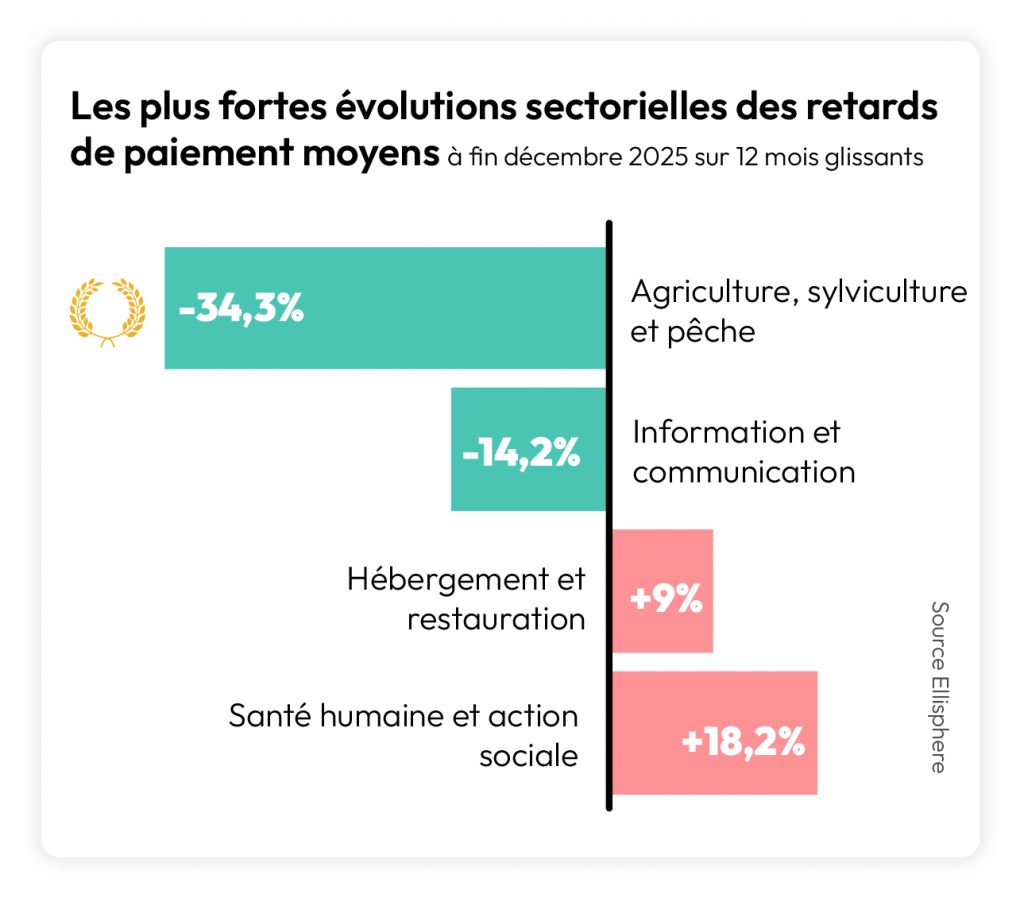

When certain sectors of activity tip into advanced fragility

Sector analysis reveals increasing heterogeneity of risks. Not all sectors of activity are under the same pressure, and some are now experiencing structural tension.

In Q4 2025, the sectors with the highest average payment delays are:

- Human health and social work: 22.27 days

- Accommodation and meals: 19.6 days

- Construction: 18.91 days

- Manufacturing industry: 13.36 days

- Extractive industries: 12.75 days

- Automotive trade and repair: 11.34 days

After two quarters out of the Top 3, Manufacturing makes a comeback at the expense of Agriculture. In first and second place in the Top 3, Trade and Mining and Quarrying remain the sectors with the lowest average payment delays.

The Construction sector saw its average payment delay deteriorate slightly, returning to the Flop3 in the last quarter of 2025.

The sharp deterioration in the healthcare sector in 2025 is confirmed at +18.25%, placing it at the top of the Flop3.

Finally, as a result of a deterioration in its average payment delay throughout 2025, from 17.58 days to 19.6 days, the Food Service and Accommodation sector has entered the Flop3.

The 20-day threshold is not symbolic. It is critical.

When an activity consistently exceeds this level, it is no longer a cyclical adjustment. It is a profound change. These sectors often combine:

- a strong dependence on dominant clients,

- long payment cycles,

- high capital intensity,

- low shock absorption capacity.

It is precisely these configurations that transform a simple delay into a vector for systemic failure.

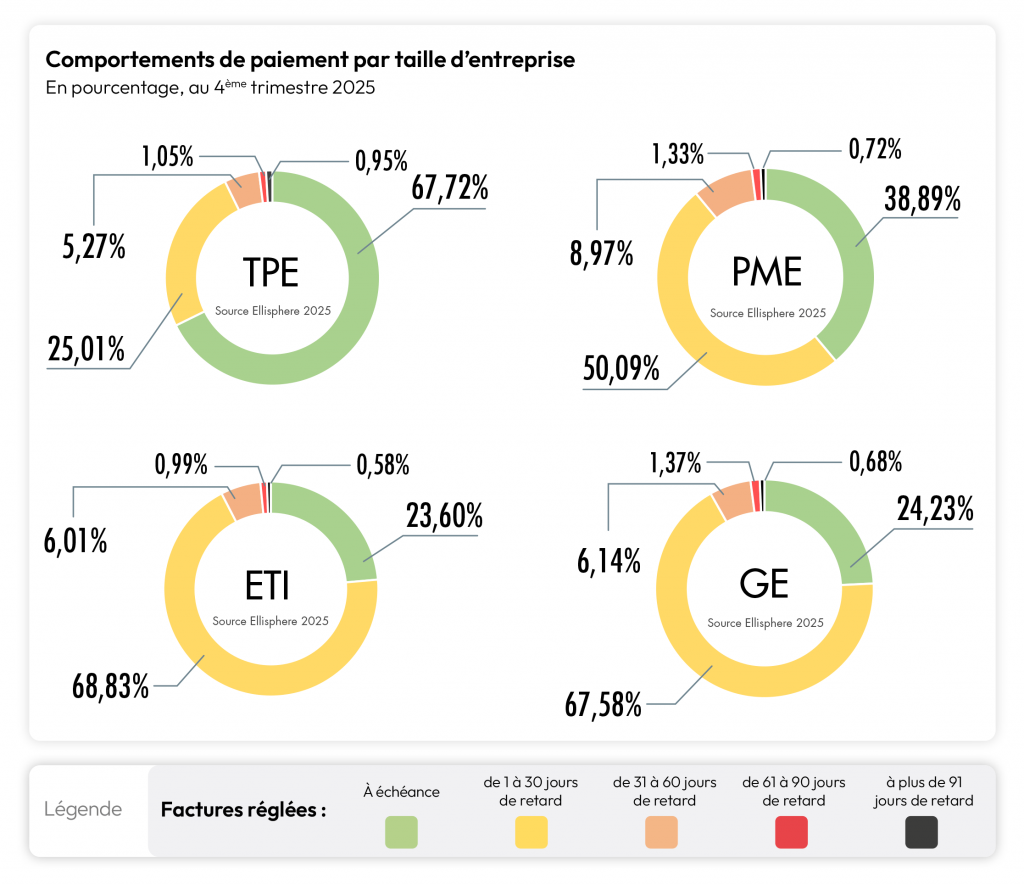

Microbusinesses, SMEs, mid-sized companies, large corporations: an unexpected divide, with microbusinesses still the most virtuous

One of the key findings of this study lies in the analysis of payment behaviors by company size.

Contrary to popular belief, smaller companies are not necessarily the worst payers.

In Q4 2025, average payment delays are as follows:

- TPE: 15.53 days

- SMEs: 14.87 days

- ETI: 12.71 days

- Large companies: 16.24 days

Mid-sized companies and large corporations are still lagging behind... The former remain stuck in a disconcerting state of inertia. As for large companies, although they recorded encouraging progress over the whole of 2025, they saw a sharp deterioration in the last quarter, falling from 12.39 days in Q3 2025 to 16.24 days in Q4 2025. This represents a break in their trajectory.

However, it is precisely these actors who have:

- the most sophisticated information systems,

- the most structured financial teams,

- the most advanced management tools.

These major contractors (public and private) benefit from significantly more favorable payment terms (45 to 60 days) than smaller organizations (15 to 30 days), without necessarily respecting their contractual commitments.

Some stakeholders therefore have high expectations for electronic invoicing, which should automatically improve payment behavior, but the impact is not expected to be visible for another 1 to 2 years.

Bad payment habits persist and are even increasing again for mid-sized companies and large corporations.

In Q4 2025, micro-enterprises remain by far the most compliant with their commitments and continue to improve their payment behavior... 68% of invoices are paid on time, compared to 66% in 2024.

Among SMEs, habits are improving slightly, but not enough... +1 point over 12 rolling months; however, there is still significant room for improvement.

The proportion of invoices paid on time by mid-sized companies, already low, has deteriorated further by 1 point compared to Q4 2024.

After a year marked by significant efforts in 2024, resulting in improved payment habits, large companies fell back into their old ways in 2025. This year was characterized by a sharp decline in the number of invoices paid on time for this category of companies, falling from 35% to 24%.

Late payment, the invisible mechanism of contagion

This trend in late payments is not insignificant. It has a domino effect.

When a major contractor delays payments, it automatically transfers its cash flow requirements to its suppliers. They, in turn, pass this pressure on downstream.

This mechanism creates:

- a chain reaction of weakening,

- an increase in working capital requirements,

- increased reliance on supplier credit,

- risk diversification.

We are facing a diffuse systemic risk here: it does not manifest itself suddenly, but gradually takes hold throughout the entire ecosystem.

Late payment: a predictive signal, not just an indicator of the past

A common mistake is to view late payments as an indicator of what has already happened. In reality, they are a signal of what is happening right now.

Before any failure occurs, the following is almost always observed:

- a gradual lengthening of deadlines,

- increased variability in behavior,

- an increase in incidents,

- a growing dependence on postponements.

In other words, a company's failure is never sudden.

Another pitfall is to confuse apparent stabilization with a real improvement in companies' payment behavior.

A company can maintain its level of late payments, often at a high level, for several quarters before going bankrupt. Why? Because it gradually mobilizes its buffers:

- available cash,

- credit lines,

- tax deferrals,

- renegotiations with suppliers.

But these shock absorbers are not inexhaustible.

It is precisely for this reason that late payments are one of the best leading indicators for preventive risk management, particularly in terms of the economic and financial fragility of companies.