In the third quarter of 2025, despite some positive signs in certain business sectors, corporate payment behavior continues to deteriorate. This confirms a trend observed at the end of 2024. Over the year to the end of September 2025, payment delays worsened significantly. The average payment delay has risen to 18.08 days, an increase of +3.2%.

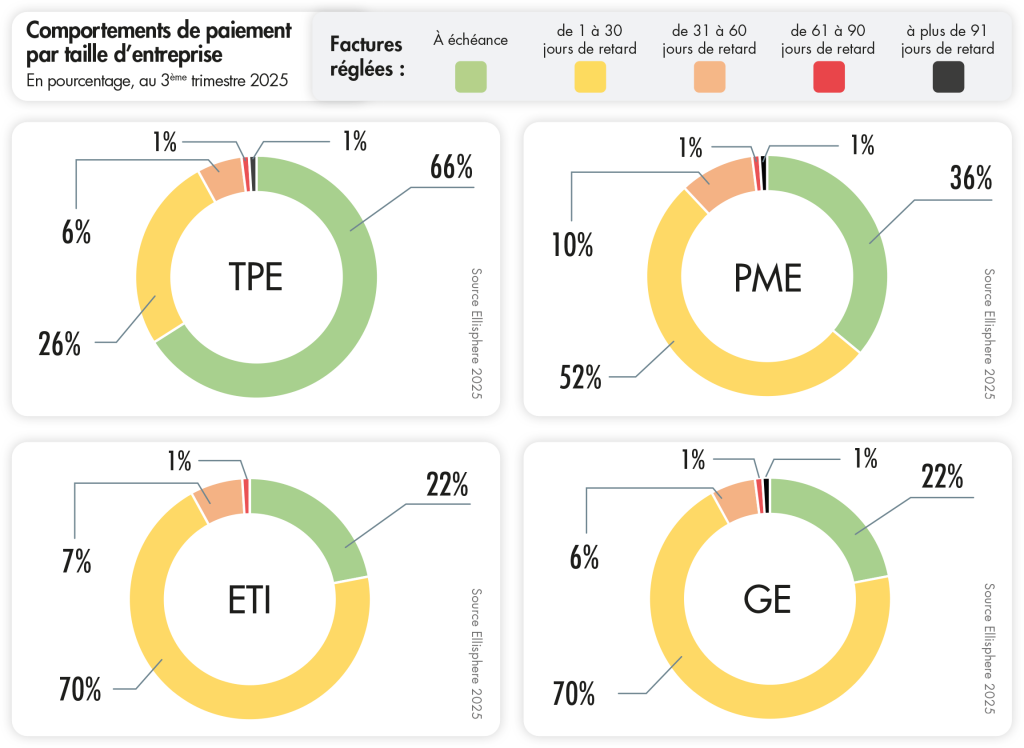

Payment behaviour :

VSEs confirm their improvement, while SMBs are falling behind

While late payment is set to become widespread by 2025, very small businesses (VSEs) remain the most virtuous. Indeed, VSEs pay their invoices on time, far ahead of SMEs, ETIs and large corporations. The latter, after a marked improvement in 2024, fall back into their old ways: only 22% of their payments are made on time, a level equivalent to that of 2023.

This deterioration highlights a structural imbalance. Large public- and private-sector clients benefit from long contractual lead times, while small and medium-sized businesses have to meet shorter deadlines. As a result, the latter are under increasing cash flow pressure, to the point of becoming, according to analysts, "the unwilling bankers" of more powerful structures. Stricter regulation of payment terms is now considered necessary to restore economic equilibrium between players.

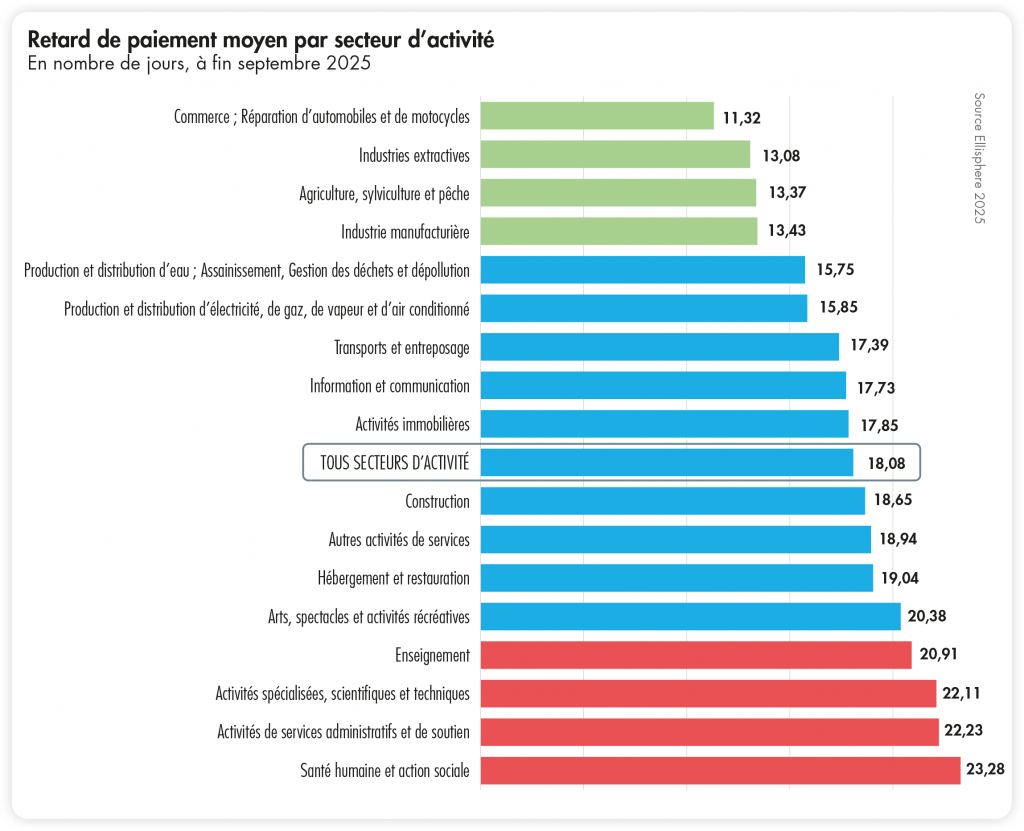

Late payments :

virtuous sectors confirmed, healthcare worries

In the third quarter of 2025, the most punctual business sectors remain unchanged. Trade/Automotive Repair (11.32 days late), Mining (13.08 days) and Agriculture/Fishing (13.37 days) remain in the top three. Construction continues to show positive momentum, reaching an all-time low (18.65 days).

Conversely, Healthcare is now the sector lagging furthest behind, with an average of 23.28 days, up 12%. Scientific and technical activities are also deteriorating sharply (+42% year-on-year). By contrast, the Real Estate and Information & Communication sectors are showing signs of improvement after several difficult quarters. These trends confirm the importance of sector monitoring in preserving corporate cash flow.

Download the complete study free of charge - Corporate payment behavior in Q3 2025