Why and how to be careful with your business-to-business credit in 2022?

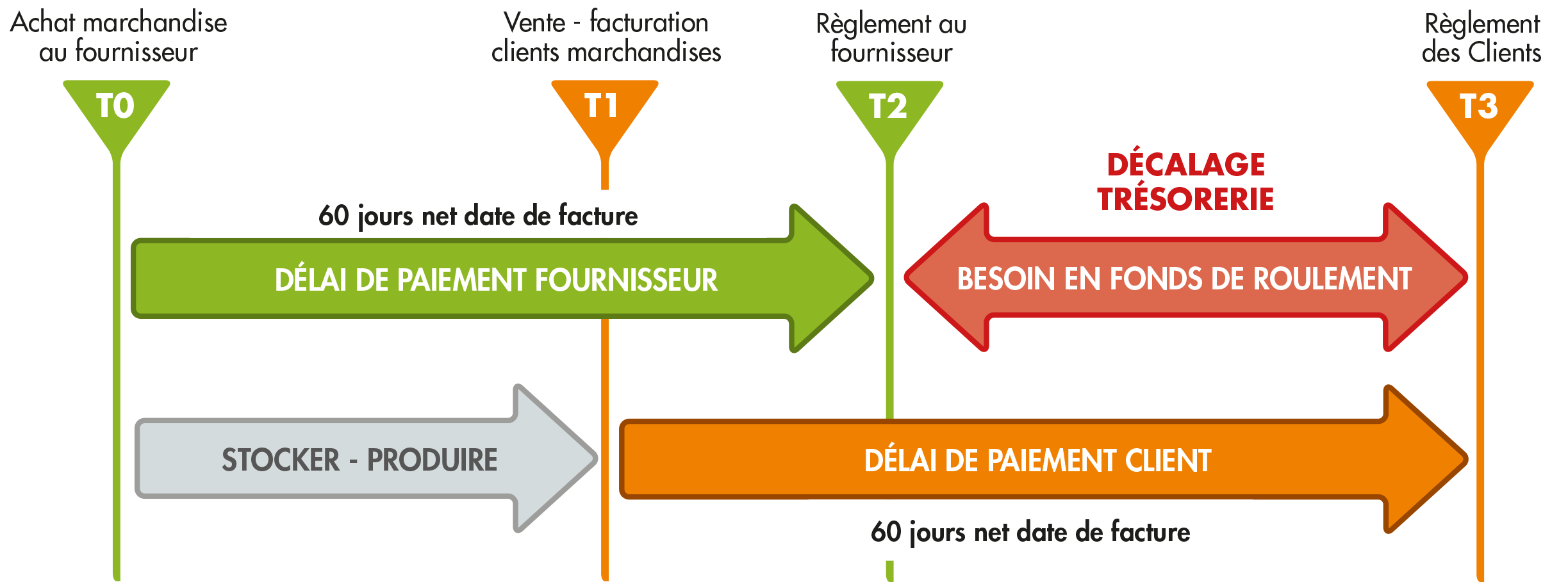

Intercompany credit corresponds to the payment terms that companies grant each other in the context of their commercial relationship. It is essentially :

- Customer credit: payment terms granted by the company to its customers

- Supplier credit: payment terms granted to the company by its supplier

Every year, a large number of companies suffer from cash flow problems and run the risk of being declared bankrupt. In 2022, in a still uncertain context, companies will have to control their credit management policy more than ever to fully benefit from the economic recovery.

Which points of vigilance to observe in the management of its inter-company credit in 2022?

The end of state aid and the reimbursement of EMPs

The end of state aid, and for some companies the start of repayments, should result in the reappearance of an increased risk of default. In some sectors, requests for rescheduling have been made to the State by companies wishing to extend the repayment period of their PGEs (State Guaranteed Loans) in order to avoid being caught in the debt trap.

Without an overall and sustainable structural improvement of their balance sheet (customer and cash positions), some companies will not be able to meet these deadlines. They will also not be able to finance their Working Capital Requirements (WCR) to take advantage of the opportunities of the recovery. More generally, they will not be able to withstand the slightest additional difficulty.

Cash supply to finance the recovery and develop growth

Following the Covid-19 crisis, some activities are currently facing a shortage of raw materials or even labor. In this context, the acceleration of cash receipts is all the more sensitive and important. Indeed, it helps prevent late payments and ultimately the risk of non-payment.

Recent studies show that the treasury function is not yet sufficiently developed in France, particularly in small and medium-sized companies. The objective of this function is to anticipate what will happen tomorrow, to accelerate cash inflows in order to preserve or improve cash flow, and to finance working capital. Especially as the deadlines for the reimbursement of state aid arrive, their cash flow risks melting like snow in the sun.

Payment delays, an indicator to be closely monitored

Payment terms have a significant impact on the financial health of companies. DSO (Days Sales Outstanding) is the time during which invoiced sales remain uncollected.

Since January 1, 2009, the Law of Modernization of the Economy (LME) has introduced a legal payment limit of 60 days from the date of issue of the invoice or 45 days end of month for commercial contracts.

If not specified in the general terms and conditions of business, the payment period of 30 days following the date of receipt of the goods or performance of the requested service shall apply.

In the local public sector, the statutory payment period is 30 days. It is divided into 20 days for the authorizing officer (the buyer) and 10 days for the public accountant. Compliance with these payment obligations in both the public and private sectors ensures good cash management and avoids potential default.

Adjust the amount of short-term bank loans according to the ability to repay

In a context where the foreseeable rise in interest rates is strongly linked to the level of inflation, borrowing will become more expensive for companies. Short-term financing is intended to reinforce and anticipate the company's cash flow shortfalls, thus providing it with the necessary liquidity for its current expenses.

Sometimes, a too fast development of the activity or the arrival of certain economic events triggers a deterioration of the cash flow. This cash flow is then no longer sufficient to finance the operating cycle. In this case, the company needs short-term financing to continue its activity.

Moreover, adjustments in bank interest rates will be made in parallel with a reduction in banks' leeway. Indeed, as of April1, 2022, the ECB will lift the relief on corporate capital and leverage ratios that had been granted to them since the beginning of the pandemic.

Monitor receivables to optimize cash flow

In 2021, approximately 60% of companies have chosen to keep their financial statements confidential. By making their financial statements confidential, companies choose not to expose their economic situation.

However, in times of crisis, the publication of corporate financial statements helps to consolidate confidence in the credit that companies grant each other. This principle of transparency has the virtue of giving partners, suppliers or customers, visibility on the economic situation of the companies with which they will enter or continue their relationship.

In order to protect oneself from the risk of default linked to one's commercial partners, the economic, legal, financial and extra-financial information offers on companies are the solution to evaluate and control the risks of solvency, compliance and fraud, linked to the environment of the economic actors.

The purpose of this assessment is to qualify risks, assign the right payment terms, and make decisions on credit limits and outstanding loans. It aims to assess the company's solidity and to measure the financial risk by :

- Examination of predictive failure scores

- Financial analysis of the corporate accounts

- The implementation of an active monitoring of the life of the French and international client and prospect portfolios

Having sufficient cash flow, the best preventive weapon against default

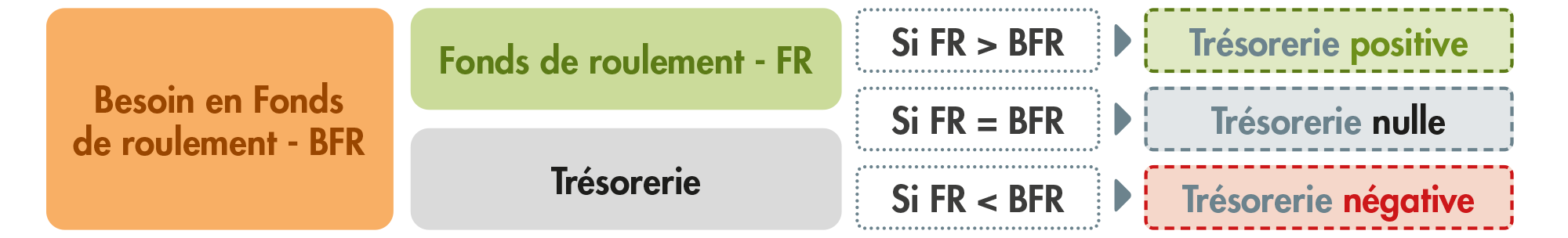

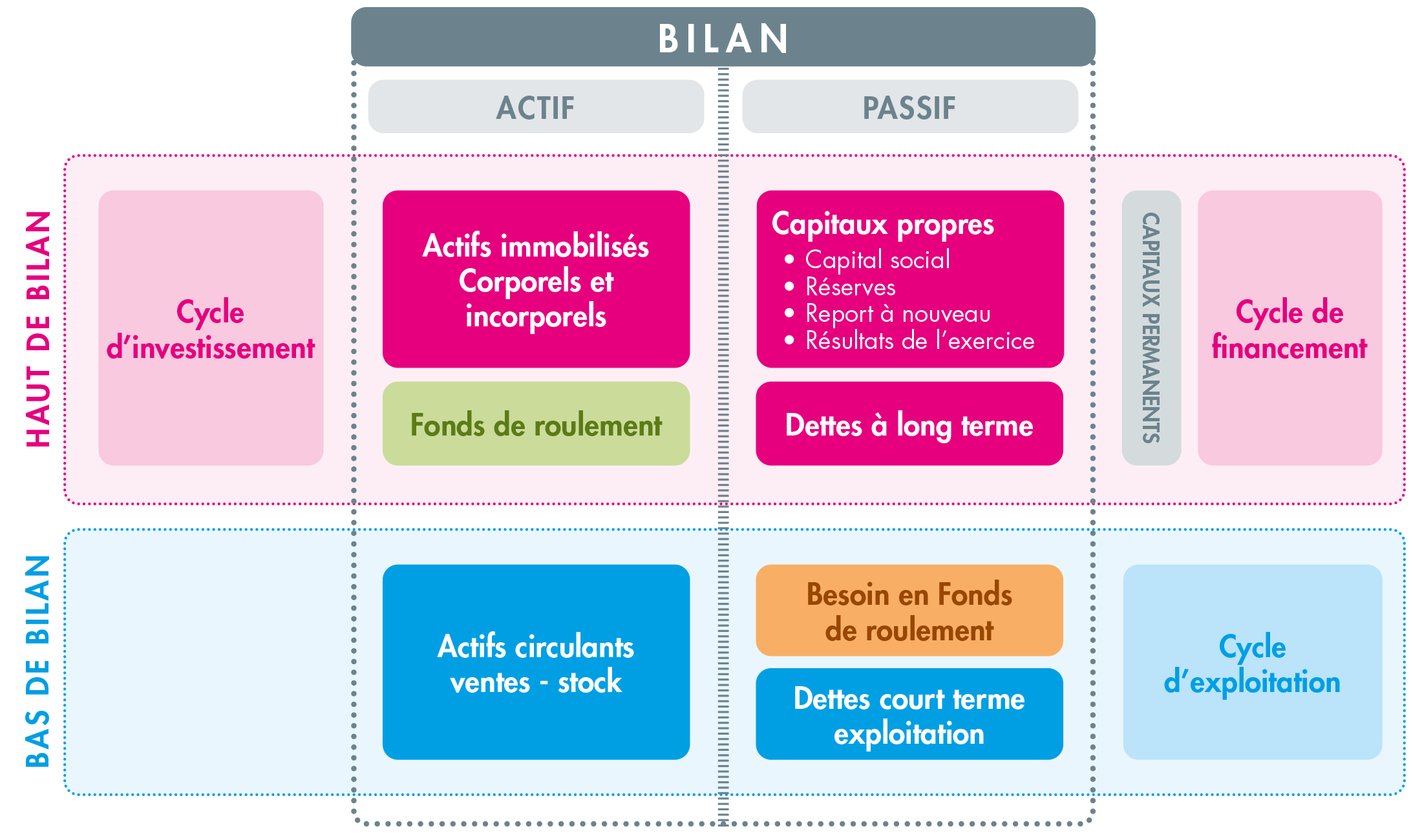

Cash management within the company will become essential in the right balance between inventory management, collection of receivables, payment of suppliers' debts and short-term loans around the Working Capital Requirement (WCR).

It is important to note that when the Working Capital (WC) is greater than the WCR, the company has a positive cash flow. Conversely, when the WCR is greater than the working capital, the company has negative cash flow.

In the latter case, the situation is not good for the company, which will have to take out a loan or increase its equity in order to be able to finance its cash flow and its operating cycle. Of course, every company must always have sufficient cash to meet its financial commitments.

If working capital does not cover WCR, cash flow is negative and the risk of default is high.

Monitor the level of companies' equity and their ability to absorb unfavorable cash flow situations

The level of equity is a guarantee for third parties. Indeed, the higher it is, the more third parties (banks, suppliers, social and fiscal organizations) have confidence in the solvency of the company and are reassured about its sustainability.

During a financial analysis, an increase in working capital is often associated with a weakness in equity. The company is then particularly exposed to the vagaries of the economy and to the risk of default.

In addition, the lack of equity capital also hinders access to financing for companies. Thus, the refusals of banks in an uncertain context are likely to contribute to making them more vulnerable to the risk of bankruptcy.

The lack of equity, when it is long-lasting, is the first cause of fragility of companies. Therefore, strengthening the equity capital of companies is a necessity to ensure their solvency and development.

Carry out a corporate recapitalization if necessary

When a company is experiencing significant and prolonged cash flow difficulties, recapitalization is sometimes necessary to keep the business going. Corporate recapitalization is a solution aimed at consolidating confidence in business-to-business credit. It can be done by bringing in funds from a new partner or by raising funds.

This contribution of funds is used to finance the need for working capital, but also the investments necessary for the development and growth of the company. It is also a means of communication. The recapitalization demonstrates to customers, prospects and competitors a will to perpetuate its activity. It also ensures an increase in guarantees for creditors.

Mastering the fundamentals of inter-company credit management, a key element of serene growth in 2022

At the beginning of 2022, intercompany credit covers a wide range of realities. It cannot be reduced to a strictly financial function in a rebounding economy, and even involves the assessment of the risk of default by its commercial partners.

After a significant drop in the number of insolvencies in 2021, companies will have to be doubly vigilant in 2022 as government aid is gradually phased out. Difficulties in sourcing raw materials and electronic components, rising energy and transportation costs, shortages of available manpower and skills, not to mention soaring prices in general, are all challenges that companies will have to face.

Will these elements weaken the cash flow of companies and if so, in what way? It is still too early to answer these questions precisely. However, one thing is certain: companies will have to remain vigilant by deploying credit policies supported by the use of risk prevention tools adapted to the specificity of their challenges.

What are the solutions to protect oneself against possible unpaid invoices and business failures? This question will be the subject of a future article.