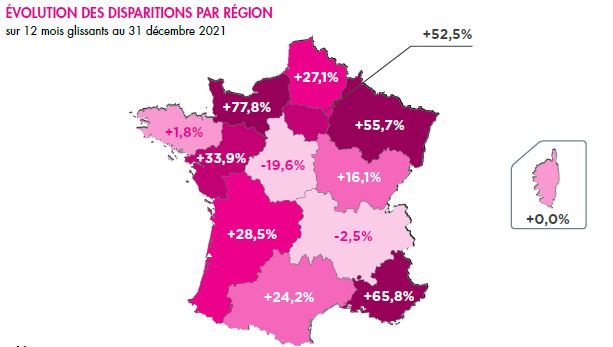

The energy sector has 120,615 establishments (head offices and secondary establishments). As of February 28, 2022, the number of insolvencies over a rolling 12-month period stood at 55 (up 17% on the same date last year), threatening 164 jobs.

France is largely dependent on the outside world

According to the French Ministry of Ecological Transition, the energy sector represents 2% of the value added in France, but accounts for €25 billion of France's trade deficit. The energy expenditure is about 9% of the household budget, a share that is increasing significantly in the current difficult geostrategic context.

Since the first oil crisis in 1973, the rise of nuclear power has halved oil imports. This implementation of the nuclear program has allowed France to export electricity for about 40 years. However, the country's energy independence has not improved in the last quarter century.

Currently, the national primary production represents a little more than half of the energy supply of the territory. Since the definitive end of their exploitation on the territory, France imports almost all the fossil fuels it consumes (coal, gas and oil). It has gradually diversified the geographical origin of these fuels. The current geopolitical events are pushing France to a new round in order to ensure its short and medium term supply.

An entrepreneurial fabric still concentrated, driven by solar and private initiative

In France, the Energy sector remains concentrated among the major historical energy production and distribution operators: electricity (EDF and ENEDIS), gas (ENGIE) and oil (TOTAL, ESSO). In this sector, 67% of the activity is carried out by companies with more than 250 employees.

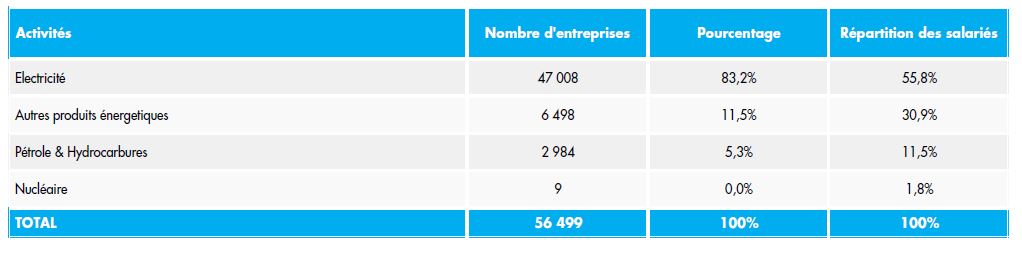

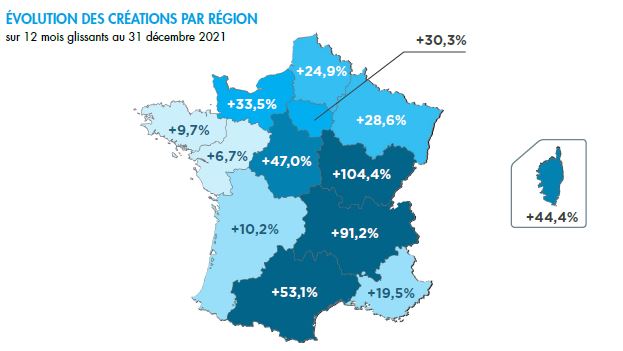

The number of active companies, even if it increases by 13.7% between January 2021 and 2022, remains limited with nearly 56,500 entities, operating just over 120,600 establishments (commercial agencies, technical operating sites or retail sales). Electricity-related activities, and in particular production, are the most dynamic, driven by connected networks that offer individuals, businesses and collective housing the possibility of reselling renewable energy (solar, wind, geothermal, hydraulic, etc.) to the historical distributors or to operators who have been established since the market was liberalized.

Between 2012 and 2021, nearly 38,500 new entities were created in the Energy sector, 83.6% of which were for the electricity sector (80% of which were for the sole activity of electricity production). This is an important level supported by the connected networks of resale from which benefit from now on the private individuals with 57,3% of the companies created in the form of individual companies. On the other hand, the oil and hydrocarbons sector has declined in terms of the number of companies over the decade studied; it is currently the retail network that is paying the heaviest price, with almost 1,330 fuel retailer funds disappearing.

The difficult emergence of renewable energies

Although electricity and natural gas, which emit less greenhouse gas, have gradually replaced coal and oil in many sectors of activity, oil remains the dominant fuel in transportation.

Representing 75% of energy production, nuclear power was down 8.7% in 2020 compared to 2019, affected by numerous unavailability of plants for maintenance. This situation was aggravated by the Covid-19 pandemic, which caused numerous process delays: nuclear production thus fell to its lowest level since the late 1990s. After a slight recovery in production in 2021, the trend will not improve in 2022, with new outages scheduled.

Renewable energies have a growing share in the national energy mix, representing 19.1% of gross final energy consumption in France in 2020, below the target of 23%. The growth in primary production of renewable energy is mainly due to the development of biofuels, heat pumps and wind power. In 2021, France produced about 24% of its energy from renewable sources, in descending order: hydro (12%), wind (7%), solar (3%) and bioenergy (2%).