From an entrepreneurial point of view, New Aquitaine is the 5th region with nearly 10% of all active French companies and 7% of employees. The region has an unemployment rate of 6.6% compared to 7.4% for France as a whole (INSEE 2021 figures).

Gironde, the region's main economic engine

The Gironde department represents nearly 30% of regional companies and employees. It is followed by the Pyrénées-Atlantiques and Charente-Maritime, which together account for 24% of regional companies and 20% of employees.

As far as agglomerations are concerned, Bordeaux Metropole comes out on top with a quarter of the region's business population. Bordeaux, the regional capital, is ranked among the top 10 cities in France in terms of number of companies and employees. It is followed by the Agglomeration Community of the Basque Country around Bayonne.

An important place for agriculture

The sectoral podium of New Aquitaine differs from that of metropolitan France as a whole by putting Agriculture in third place after Construction and Public Works (BTP) and Public Services. The agricultural sector accounts for 10% of the region's businesses, compared with an average of 6.3% nationally, and for 4.1% of the workforce, compared with 1.5% for the whole of France. Cereal cultivation, viticulture and cattle breeding are very present in this region.

A good regional dynamism

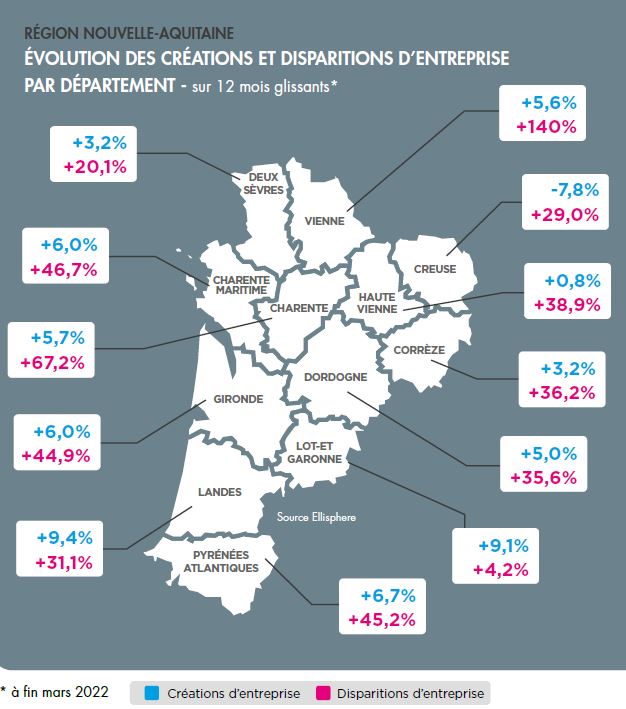

The New Aquitaine region remains dynamic. The number of active companies in the region has increased by 5.7% between 2021 and 2022, slightly below the national trend (+6.3%). However, the departments of Gironde, Pyrénées-Atlantiques, Landes and Haute-Vienne have seen increases of over 6%.

The Transport & Logistics and Energy sectors have evolved strongly over the same period, with many small micro-businesses entering the market. In Transport, the boom of internet orders and home deliveries has attracted a lot of independent delivery companies. In the Energy sector, with solar energy in particular, many individuals have registered to sell their production to the existing networks.

Over the period 2012-2022, the New Aquitaine region has renewed its business population. On average, 1.5 companies were created for every one that disappeared. The Covid-19 crisis period that began in 2020 did not dampen this dynamism.

Over the year to the end of March 2022, nearly 82,400 companies were created in the region (+7.5%), compared with 55,200 that disappeared. However, the latter have risen sharply (+45% year-on-year), particularly in construction, business services and transport & logistics. In a still difficult and uncertain economic context, where support measures are fading, more and more companies are voluntarily ceasing their activities, in particular sole proprietorships (+56% of closures).

A rise in claims in 2022

At the end of April 2022, with nearly 2,700 receivership or direct judicial liquidation procedures opened, the New Aquitaine region ranked 4th nationally with 8.8% of all insolvencies recorded in mainland France. The broad financial, fiscal and social support granted during the Covid-19 crisis is coming to an end; this now has a direct impact on the real solvency of companies. Over the last 12 months, the region has seen a 13% increase in the number of insolvencies, above the national average (+9%). The increases have been particularly strong in the food processing (+48%), distribution (+36%) and transport (+31%) sectors.

The leading agricultural and forestry region in France

New Aquitaine is the largest region in France and has a wide variety of agricultural production.

New Aquitaine is thus in 1st place in many areas:

- 1st wooded region of France with 2.8 million hectares of forests; the Landes de Gascogne massif is the largest in Western Europe.

- The leading region for livestock farming with nearly 67,000 farms; with nearly 50,000 direct jobs, the meat industry is largely positioned on "top-of-the-range" breeds (Limousin, Blonde d'Aquitaine, Bazadaise, Parthenaise, etc.)

- Europe's leading vineyard with renowned wines; the vineyards are mainly located in the two basins of Bordeaux and Cognac. Via the VitiREV project orchestrated by the region, 50 million euros have been granted for the agroecological transition of viticulture, with among other objectives, to preserve biodiversity by financing actors (French and European) working on alternatives to phytosanitary treatments. Another expected action concerns adaptation to climate change. A vast program...

- France's leading region for the cereal industry (corn, sunflower, etc.), which has the densest network in France with nearly 200 storage organizations and a hundred or so processors.

- 1st oyster basin in France with a majority of family businesses, essential links of tourism. Nevertheless, this activity is suffering, as the cash flow of the companies testifies, without forgetting, as in many other sectors, a shortage of manpower. In addition, there are the challenges of global warming (which endangers the production of oysters), the strong impact of the Covid-19 pandemic (closure of restaurants in 2020), certain periods of prohibition of marketing of products (toxins, pollution ...). Without forgetting the permanent threat of thefts on the oyster beds, as well as an important specificity of the profession: almost half of the annual oyster production is sold during the Christmas and New Year period; at the slightest problem, even very punctual, local companies sometimes clearly stake their survival.