With the deconfliction, after nearly two months of strain on corporate treasuries, the economy is gradually getting back on track. Most sectors of activity have been impacted, despite public support measures (short-time working, postponement of tax expenditures, etc.). Faced with this shock to activity, the question arises: how will the economic recovery take place? It is clear that no one can predict it, but it is certain that its pace will not be uniform.

What are the possible scenarios for economic recovery depending on the sector of activity?

Each sector will have its own economic recovery scenario and will likely follow either a V, U or L curve.

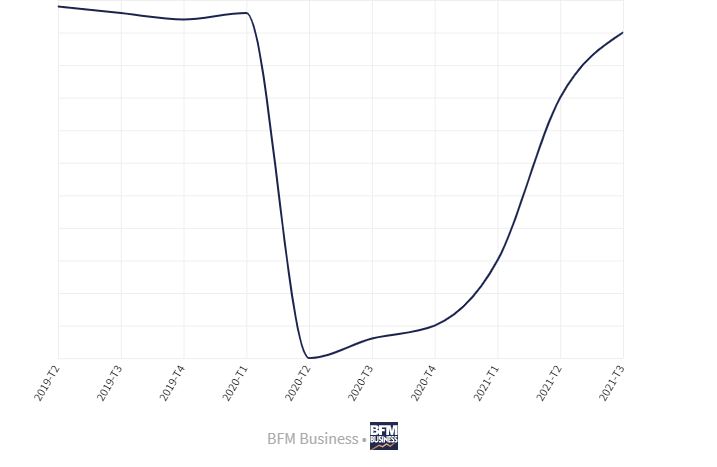

- The V-curve is the scenario everyone wants and is similar to a sharp drop in activity followed by a quick rebound usually in less than twelve.

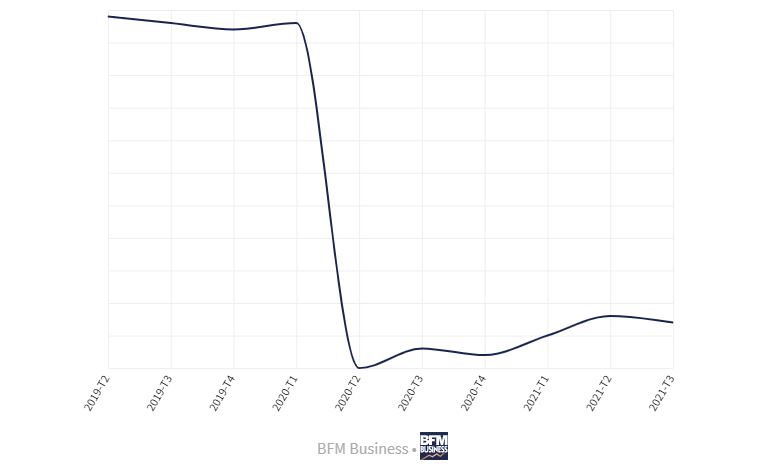

On the other hand, with the U-shaped curve, after an equally sharp fall, the downturn lasts longer, around one or two quarters, followed by a recovery lasting more than a year. In this cycle, the speed of recovery depends on the confidence of households and companies to return to consumption and investment.

- As for the L-shaped curve, this scenario is not very reassuring. After a sharp downturn, a phase of stagnation follows. This shape follows the worst-case scenario where the downturn is followed by a long period of low economic growth stretching over many years.

But it is not impossible that none of these curves will be realized. The "real" scenario will depend on the new priorities of the companies whose confinement has slowed down the activity for some.

Economic recovery strongly linked to the ability of companies to adapt and transform

Today, the main concern of entrepreneurs is to get back to business and generate revenue. This future is directly correlated to the priorities and the different strategies that companies will put in place in this exit of crisis. They will have to adjust to the different current and future government policies, on short (4 to 6 weeks), medium (2 to 3 months) and long term (end of year) operational strategies.

The period of confinement has also upset consumer certainties and accelerated new uses: "click & collect", e-commerce, local purchasing... It has been a powerful gas pedal of digital transformation within companies, highlighting the large-scale experience of teleworking with the application of new relational modalities with customers. Moreover, in a continuity of service, companies have demonstrated their ability to adapt and their resilience even in the most complex situations.

Faced with these organizational and managerial changes, where organizations have learned by walking, the growth scenarios envisaged before the crisis have been undermined. Companies must accelerate their digital transformation, particularly around the "Order to Cash" processes in cash management, without neglecting their barely sketched out societal revolution: because tomorrow will not be like yesterday! We have to reinvent ourselves to adapt. Those who will succeed will be those who know how to transform themselves by confronting the reality of the facts while reinforcing their contact with their clients as well as their vision of the company and of business. This crisis is perhaps the opportunity for companies to modernize and to do business differently in the digital age.

The role of the credit manager in the business recovery strategy

In this unstable world, where economic recovery will not be linear, the credit manager becomes asales facilitator in a cash culture. They are no longer satisfied with simply assessing the solvency* and liquidity** of customers or prospects. They are now involved in support and upstream of contract execution in order to facilitate revenue growth. In order to gain in productivity and efficiency, it is now time for dialogue with customers and binding agreements. This new reality requires the credit manager to have a :

- Knowledge of state aid to understand and measure the impact on the short-term solvency of companies where many economic actors in difficulty are on public funds

- Collecting important information on the ground, both forecast and sectoral, for each client in order to anticipate perilous financial situations in terms of solvency or liquidity

- Careful monitoring of outstanding credit limits and payment terms

This multi-tasking approach aims to bring serenity to decision making when no company is immune to bankruptcy. Instilling a cash culture associated with a strong vigilance of payment default requires an approach that rethinks the codes of the organization in which all the collaborators of the sales chain are stakeholders. While many companies are already feeling the effects of late payments on their cash flow, it is in the coming months that they could experience real cash flow difficulties with the gradual end of government aid measures.

Conclusion

The crisis is accelerating the digitalization and transformation of companies. The time has come for French companies to consolidate their equity, to take on debt with confidence and to control their liquidity.

In this crisis, companies with liquidity will have a competitive advantage to strengthen their existing business while expanding through acquisitions or investing in innovations. As a reminder, in the post-Covid economic recovery, controlling revenue growth and managing credit risk requires a focus on the evolution of business sectors while engaging with customers.

*Liquidity is the ability of a company to repay its short-term debts, which are due immediately.

** Solvency represents the ability of a company, in the perspective of a cessation, to pay all its debts by liquidating all its assets. A company can be solvent without having liquidity.