As we enter 2022, let's take a look at the state of the data marketing market in France. This is also an opportunity to highlight a notable fact to be considered at the global level in 2021: the opening of the1st global data exchange in Shanghai, giving China a head start on the new black gold of the 21st century.

What happened in the world?

At the end of November 2021, more precisely on November 25, 2021, thefirst global data exchange in China was inaugurated with great fanfare: the Shanghai Data Exchange (SDE). The role of the SDE is none other than to value and monetize this new factor. Moreover, China is not the first to try to structure this market, but it is the first by its ambition and originality. This meets the expectations of the Chinese government, which, as early as 2017, qualified data as the "fifth factor of production", after capital, labor, land and technology.

As a result, some 20 companies have put their data on the exchange since day one: telecom operators, airlines, online retail giants, electricity providers, a bank, a geolocation application, etc. A hundred companies are also in the loop, including the Anglo-Saxon consulting firms Deloitte and PricewaterhouseCoopers. In addition, one of the first transactions carried out on the Shanghai Data Exchange (SDE) was the acquisition of Shanghai's electricity network data by a Chinese public bank.

Similar to our RGPD, China has implemented a personal data regulation, which requires companies to apply two rules:

- The seller must ensure that the data sold cannot be transferred abroad without the consent of the data owners, which makes the exchanges more complex to value.

- No transaction will be made if the data purchaser cannot explain the exact scenario in which the data will be used.

Indeed, in the information age, data has become a key medium to activate the flow of people, goods, technologies and capital.

France VS Covid-19: how did the market fare?

According to the study conducted by ISOSKELE and BVA, the Data Marketing market has seen a decline in growth of 1.46% in 2020 to reach €2.185 billion against €2.21 billion in 2019. Despite a market impacted by COVID, the latter shows a dynamism by the enthusiasm of the players, with 386 players against only 301 in 2019.

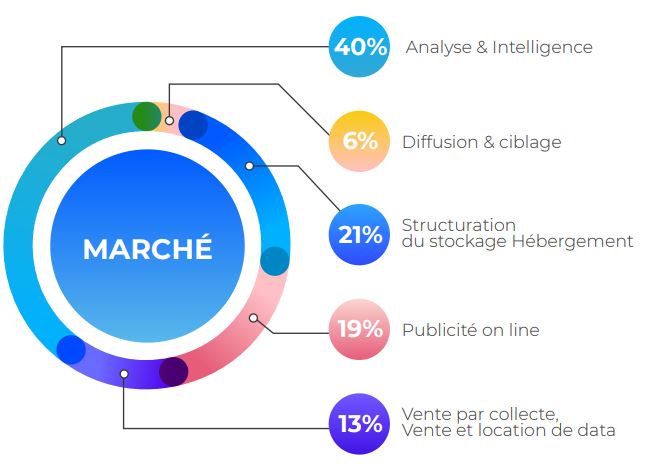

The market is divided into five major segments, all of which are growing:

- Broadcasting & Targeting: CRM

- Sale by collection, Sale and rental of data: Data marketing, onboarding, broking, enrichment & collection, retargeting, proprietary database, lead generation, affiliation

- Structuring storage, Hosting : Hosting Solutions, Hosting Services Data Quality Solutions, Data Quality Services, Data Management, Compliance

- Online advertising: Data Media, Online Advertising, Trading Desk, adexchange SSP DSP, Native Advertising, Search Engines, Social Networks

- Analysis & Intelligence: Datamining, Consulting, AI, Data Visualition, Studies & Surveys

Storage structuring and hosting

In figures: 90 players with a turnover of 470 million euros.

A slight increase in sales (+0.68%), driven in particular by marketing database hosting tools and services. Revenues from services related to Data Quality are also growing faster than the average for this segment. The data storage market is slowing down after experiencing sustained growth in recent years. This sub-market is driven by the rise of CDP (customer data platform), which is proof of the value that is now widely given to first party data and its reconciliation. The development of this type of tool, combined with the large number of players on the market, is democratizing usage.

Broadcasting and targeting

In figures: 46 players with a turnover of 132 million euros.

A segment with the largest decline in turnover compared to the 3rd edition (-4.85%). The broadcasting and targeting market is concentrated and remains since 2018 strongly influenced by regulatory changes (GDPR, Cookies, Bloctel ...) that weigh on the players present. Advertisers are also experiencing a drop in performance, notably due to deliverability concerns, and more than ever, the challenge is to operate on increasingly sophisticated tools.

Analysis and intelligence

In figures: 153 players with a turnover of 885 million euros.

A market that only decreased by 1.9%, which is a good performance in the context of the pandemic. In spite of strong media coverage, AI is experiencing a stable growth rate that has not been able to reverse the trend in the face of the unfavorable pandemic context. The very mature market for traditional "data" research is the one that is decreasing the most and where the trend is more towards "in-house" than outsourcing.

Sales and rentals

In figures: 73 players with a turnover of 296 million euros.

This is a segment undergoing strong restructuring and concentration. The significant drop in retargeting (-36%) weighs heavily on the activity, which is finally down by only 1.16%. The drop in marketing investments is putting a lot of pressure on 2020. After having experienced strong growth, lead generation and retargeting activities are pulling the market down, impacted by the pandemic and increasingly restrictive legislation. Despite this context, the growth of this sub-market remains relatively stable, driven by the sale of enrichment services on first party customer bases.

Online advertising

In figures: 92 players with a turnover of 432 million euros.

This segment of online advertising does not include revenues linked to online space purchases. After strong growth until 2016, the multiplication of adblocks has limited the development of the activity. This trend will be reinforced in 2020 by a restrictive legislative reinforcement.

The continent is notably impacted by social platforms that are increasingly integrating data exploitation solutions, thus leaving less room for external players. Native advertising has suffered the biggest decline (-5%).

In the end, an ever-growing market?

The data market is still a sector where the appetite of states and companies is growing, with increasingly specific expectations. The pandemic and regulatory changes in France explain the decline of the data marketing market in 2020. A market that nevertheless remains dynamic and weighs more than 2 billion euros in the French economy. For the players, adapting to this difficult year has involved concentration and external growth, enabling them to offer a wider range of solutions and services.

Read more

Our data marketing support

Discover Ellisphere's expertise on your data issues to meet your customer knowledge, prospecting and data management challenges.