Open banking offers significant opportunities for companies to optimize their credit management. New technologies have enabled financial institutions to share their customers' banking data securely with third parties, such as corporations, startups or fintechs.

This opening of banking data creates new possibilities for companies to manage their credit risk. Indeed, the use of open banking allows companies to access more accurate and real-time information on the creditworthiness of their customers, which facilitates risk assessment and ultimately the granting of credit.

Better control credit risks with open banking

In terms of business-to-business credit management, open banking could also provide benefits to companies as a complement to traditional valuation models that rely on financial statements, payment behavior and default risk scores.

Open banking could improve the approach to customer credit management by offering open banking data that would allow for more accurate customer knowledge. This new data would facilitate the assessment of the creditworthiness and financial situation of the company, which would facilitate the granting of credit and the definition of payment terms.

In addition, open banking would improve risk rating models by more quickly assessing the real risks of non-payment or default for companies previously considered too risky or in receivership.

With a precise knowledge of their customers thanks to open banking, companies could discover new untapped commercial opportunities while respecting their logic of solvency risk and the fight against fraud. This would contribute to the growth of their turnover and the improvement of their cash flow.

Expanding from Open Banking to Open Finance

Open Banking, which is a regulated framework for sharing banking information, has become an international business paradigm with different levels of maturity.

It offers many benefits to banking and non-banking players by enabling the integration of new value-added services around payment and account data, while ensuring secure access and user consent.

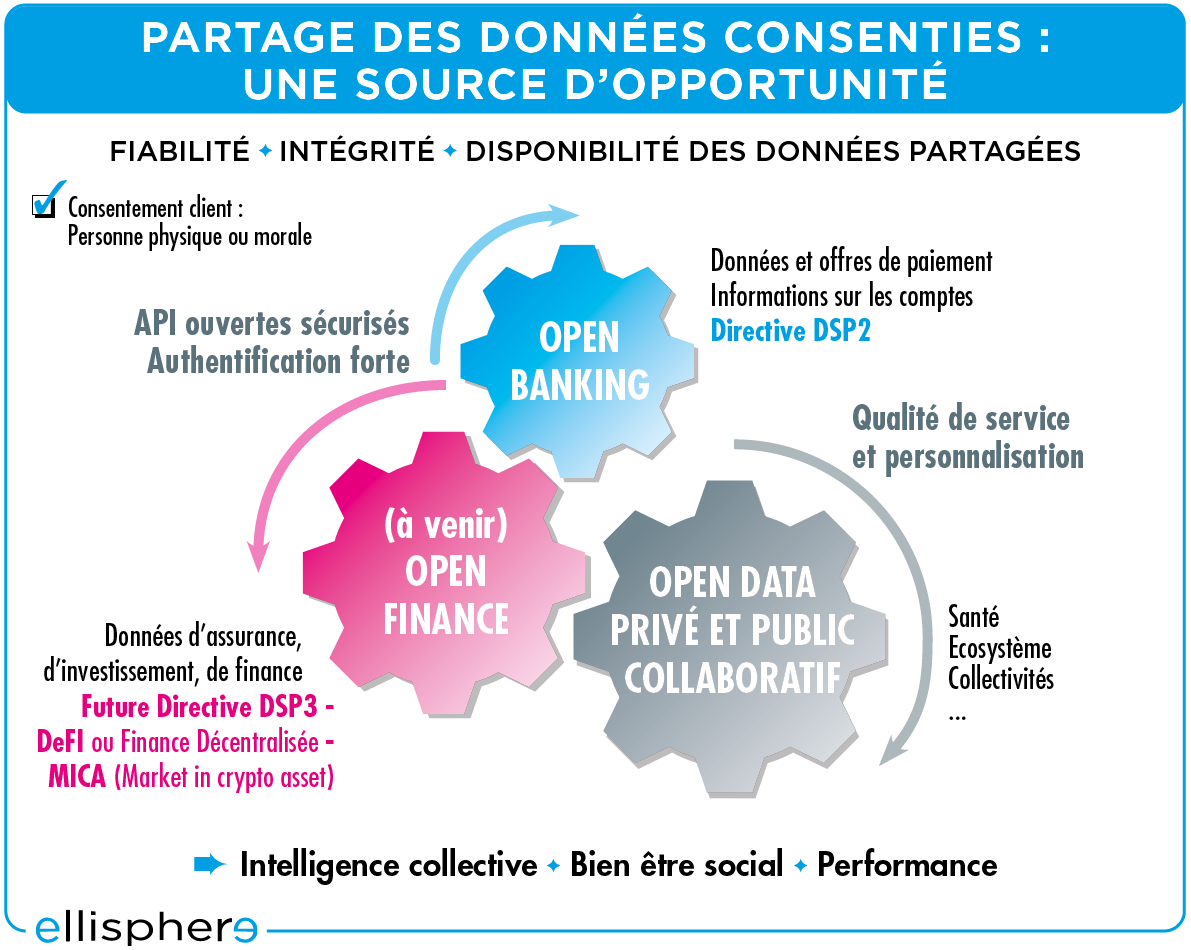

Market players are pushing for the evolution of this regulatory framework towards Open Finance, which integrates information from other areas such as insurance or savings. Open Finance, a broader concept than Open Banking, aims to extend the openness of consumer and business financial data beyond banking information.

In addition to payment and account data, Open Finance would include information on insurance, savings, investment, loans and all types of financial products such as savings books, life insurance, stock savings plans (PEA), company savings plans, etc.

Open Finance represents an important shift that must be taken with caution. Although this initiative aims to open the financial market to new players, it can paradoxically reinforce the concentration of data in the hands of certain players and increase the risk of losing digital sovereignty.

The upcoming PSD3 directive will accompany the full opening of financial and insurance data. This will bring many benefits to the financial markets in terms of innovation, better products, more targeted advice and more efficient business-to-business transactions.

Open finance marks an important step in the collaborative movement of open data, where each individual or company can control access to their personal or business data by choosing who to share it with.

A revolution in the market perception of the banking and financial sector

Open Banking allows organizations to access, within a regulated framework and with customer consent, banking data, and tomorrow with Open Finance, all financial data. This represents a huge opportunity for service providers, but also a major challenge in the implementation of a personalized, transparent and multi-channel customer experience.

Beyond the simple digitization of existing banking and financial services, data sharing requires more than just ensuring data security and customer privacy. It requires increased transparency and real added value for customers.

This major evolution is creating profound changes in the market for traditional financial institutions and services by creating new financial service providers. It stimulates innovation, radically transforms the notion of credit and considerably reduces the time needed to collect information.

In addition, artificial intelligence and machine learning will increasingly be used to make real-time decisions. Globally, the open banking market is expected to reach $43.15 billion by 2026.

The Open Banking of decision tools for the digital transformation

The Payment Services Directives (PSD) are regulatory requirements that drive innovation in Open Banking. Banks are required to allow customers to share their account data and initiate payments from third-party platforms such as payment service providers (PSPs) or Fintechs.

In Open Banking, the banking data belonging to a customer is neither the property of the bank nor of the Fintech, but of the customer himself. They can use it as they see fit and share it with an approved service provider to benefit from it. In addition to this, Open Banking promotes competition in a changing banking market.

To counter the threat of BigTechs, European banks are partnering with Fintechs to transform their ecosystem towards Open Finance, enabling secure exchanges of financial data beyond just payment data. This evolution allows for a better understanding of customers and is a useful innovation catalyst for them, using consented data.

In an environment of trust and consenting data sharing, B2B Open Banking could be an important topic of reflection in the field of credit management, especially for business-to-business credit decisions.

Webography: