A significant lack of visibility

The number of insolvency proceedings continues to grow despite the hope of a strong recovery marked by the end of the Covid crisis, the persistent deterioration of the economic and geopolitical situation is a cold shower for companies. In this context, the galloping inflation generates a decline in household consumption and further darkens the outlook. For some companies, the burden of reimbursing State Guaranteed Loans (SGP) has been added, a new sword of Damocles weighing on already overstretched treasuries.

An increase in collective proceedings in 2022

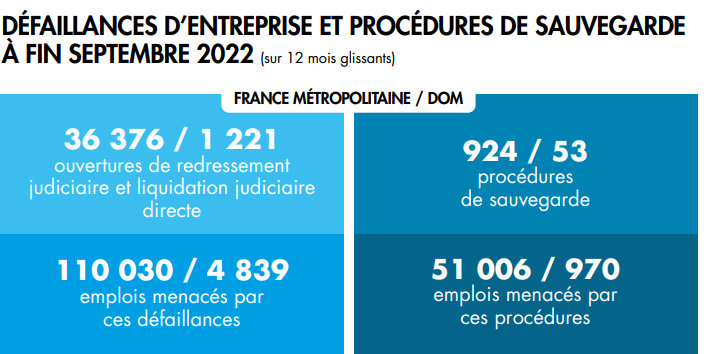

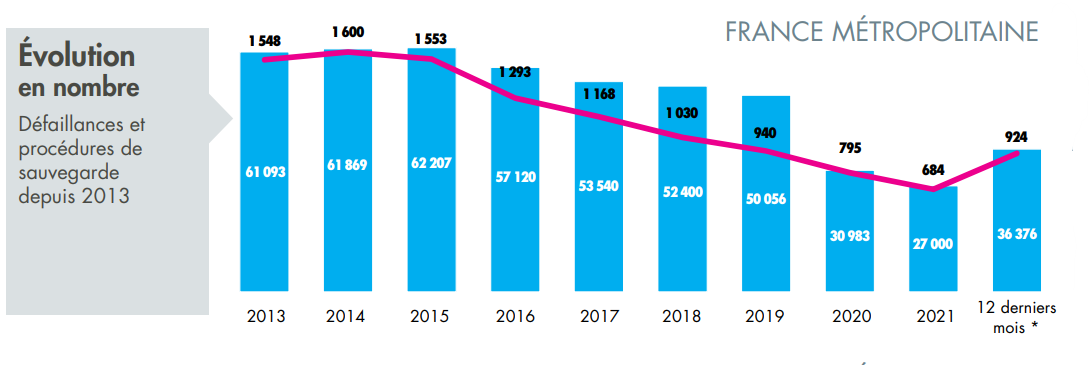

At the end of September 2022, over a sliding 12-month period, the number of insolvencies in mainland France (openings of receivership and direct judicial liquidation ) rose by 35%, now exceeding the 2020 and 2021 figures, but still remaining below the 2019 figures. The number of safeguard procedures has increased by 24% over the last 12 months to the end of September 2022.

All regions of France recorded an increase in the number of insolvencies. The Ile-de-France, Auvergne-Rhône-Alpes and PACA regions together accounted for 46% of all insolvencies in mainland France over the year. While the increase is limited for the first two economic regions, it is the Hauts-de-France region that is suffering particularly badly, with the number of insolvencies in its territory soaring by almost 72%.

Services to individuals, agri-food and distribution in weakened sectors

The Tourism sector is particularly hard hit (+61.4%), while in the Food sector, it is the industrialists and meat specialists who are suffering the most, with increases in the number of insolvencies of 87.5% and 74% respectively. In the Distribution sector, food retailers are experiencing a 65.5% increase in the number of insolvencies.

Faced with rising raw material and energy prices, all of these activities are also affected by household consumption decisions that limit spending. They are also among the activities that have made the greatest use of the State Guaranteed Loan (SGP), which must now be repaid.

Situation in the French overseas departments

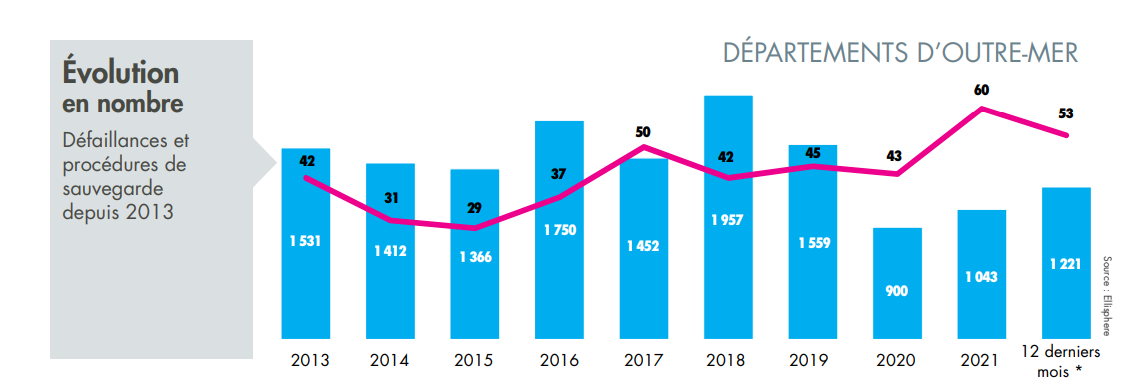

"At the end of September 2022, the overseas departments had accumulated a little more than 1,200 openings of receivership and direct judicial liquidation, i.e. 3.2% of French insolvencies."

- Max Jammot, Head of the Economic Division at Ellisphere

Reunion Island

In all of the French overseas departments, Reunion Island, with more than 640 business failures, accounts for almost 53% of the procedures recorded, with an increase of 29% over the year to the end of September 2022. The Building and Public Works (BTP), Industrial Equipment (including machinery and equipment rental companies) and Consumer Services sectors account for 63% of procedures.

Martinique

At the end of September 2022, over a 12-month period, Martinique accounted for 22% of insolvencies in the French overseas departments, a figure that has risen by 11% in one year; some 270 procedures thus threaten just over 1,200 jobs.

Guadeloupe

Over 12 months to the end of September 2022, Guadeloupe accounts for 18% of insolvencies in the overseas departments, with 219 judgments opened. The recent period has been economically difficult for the region, where the number of collective procedures has increased by 57.6%, now approaching the level of 2019 with approximately 1,000 salaried positions threatened.

Guyana and Mayotte

With nearly 60 business failures over the year to the end of September 2022, French Guiana accounts for only 5% of procedures in the overseas departments, with 320 salaried positions at risk. The three sectors most affected are the same as in Guadeloupe, with nearly a third of these in construction alone.

Download now our complete study

Every month, our economic division decrypts the news of the economic sectors and gives you its lessons.