Agribusiness, torn between inflation and raw material depletion

Today, at the crossroads of economic and structural difficulties, the agri-food sector must adapt to the scarcity and rising prices of raw materials. Cereals, rice, corn, potatoes, milk, oils (effects of the drought and the war in Ukraine), poultry and eggs (bird flu) are affected among others.

The professionals of the sector also deplore a recruitment problem. The food industry is one of the sectors most affected by minimum wages below the minimum wage, particularly in the industrial pork butchery and bakery.

In this context, faced with too much pressure on margins, site closures are envisaged and in the long term, shortages on the shelves are not excluded.

A mature and concentrated workforce sector

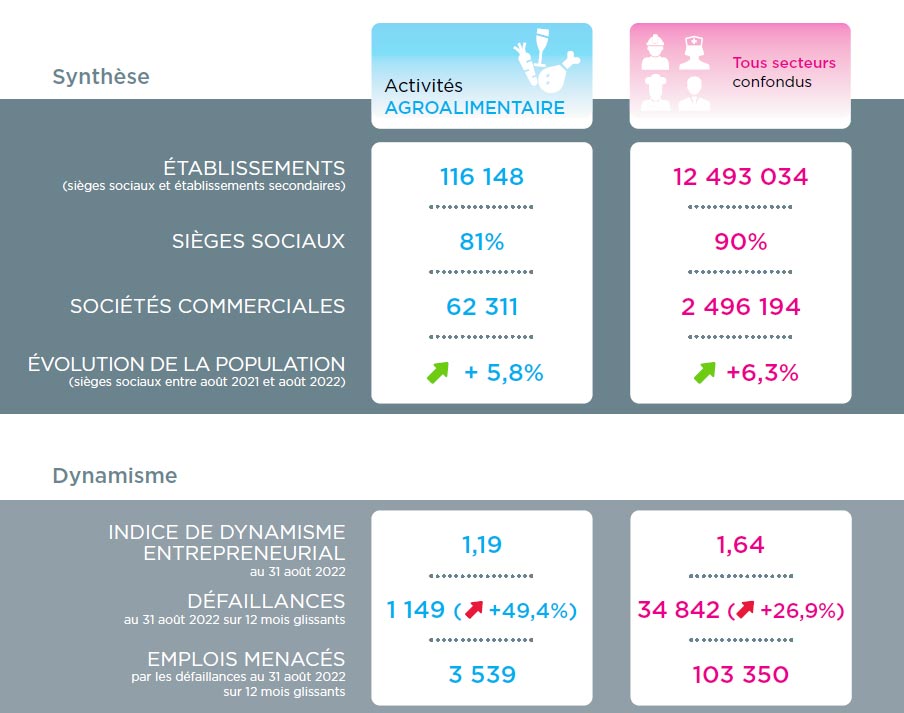

The Agri-food sector with 94,000 active companies represents 0.8% of the entrepreneurial fabric of metropolitan France, a modest 15th place (excluding holding companies) out of all sectors of activity. However, with 3.4% of the total number of employees, the agri-food sector is the 8th largest employer.

The agri-food sector remains largely composed of VSEs (65.1%) due to the large number of independent craftsmen. However, it has a higher percentage of SMEs and ETIs than the average for all sectors in metropolitan France, i.e. 14.3% compared to 3.5%. Concentration is significant, since companies with more than 50 employees account for 71.5% of the sector's cumulative turnover, including 44.5% from companies with more than 250 employees.

The sector is dominated by the food processing industries (excluding alcohol and meat) which represent more than half of the companies and employees, followed by 25% of the food trading activities.

- Max Jammot, Head of the Economic Division at Ellisphere

Limited dynamism, supported by the alcohol and prepared meals sector

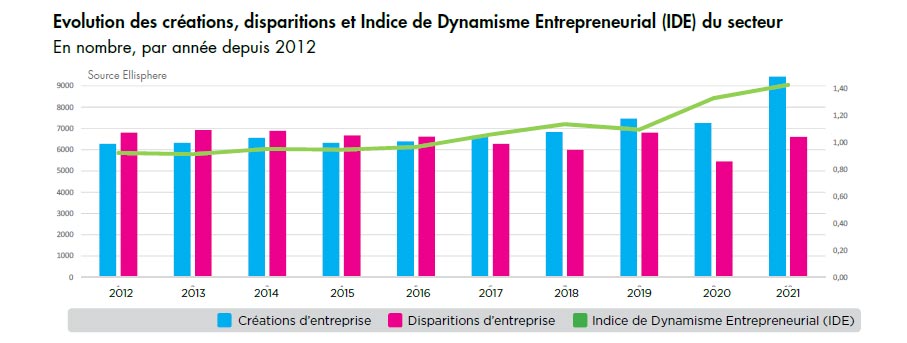

Between 2012-2022, the sector barely renewed its business population between creations and disappearances (cessations and liquidations). Over the period, an average of 1.1 companies were created for every one that disappeared. Despite the recent economic uncertainties, the agri-food sector remains attractive.

Thus, between January 2021 and January 2022, the number of active companies has increased by 5.8%, even if this result is below the national dynamism of + 6.3%. This progression all the activities of the sector and particularly that of the wines and spirits +11,6 %.

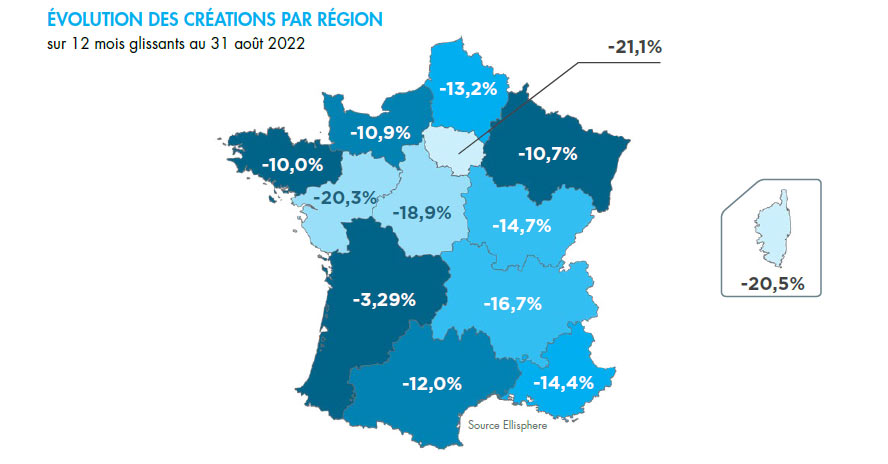

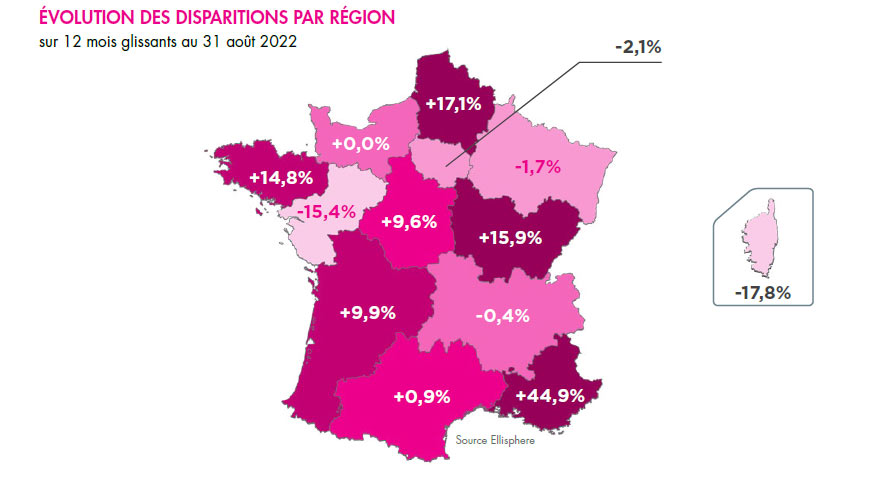

In the regions, in 2021, Auvergne-Rhône-Alpes, Île-de-France, Occitanie and PACA are the most active in terms of the number of business creations (more than 1,000 over one year per region); Île-de-France also recorded the highest number of business terminations.

Download now our complete study

Every month, our economic division decrypts the news of the economic sectors and gives you its lessons.