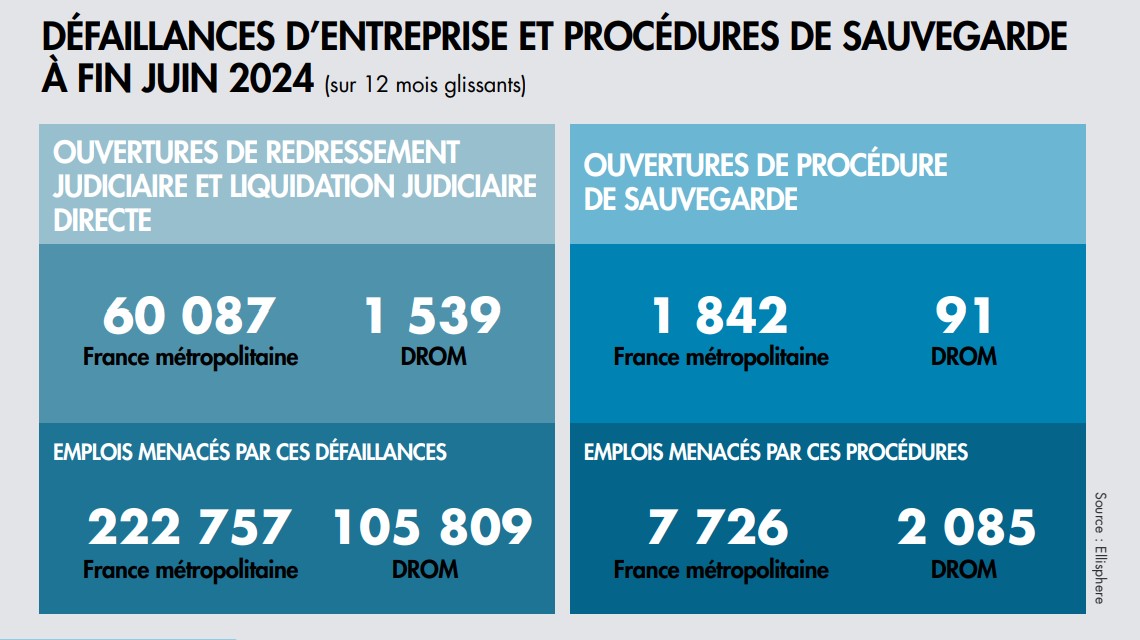

Over a sliding 12-month period to the end of June 2024, the number of insolvencies in France rose by 25% (including the opening of receiverships and direct judicial liquidations), compared with +35% over 2023 and +48% over 2022. These insolvencies represent 0.5% of the entrepreneurial population in metropolitan France. As usual, commercial companies account for the majority of insolvencies, with 85% of the total. Insolvencies in this category followed the same trend as for all economic players. As in previous months, entities created after the Covid-19 pandemic (18.7% of all insolvencies) recorded the sharpest rise in the number of insolvencies, up nearly 141%.

Companies aged between 5 and 10 years (nearly 19% of French entities) account for 30% of all insolvencies in mainland France. In contrast, companies over 20 years of age, which account for around 29% of all businesses in metropolitan France, represent just 11.5% of all insolvencies. In terms of size, VSEs, which account for some 57% of businesses nationwide, remain the most vulnerable. They account for 87.9% of insolvencies in metropolitan France (+17% over the last 12 months to end June 2024).

In the region

The top three are the three regions with the highest number of businesses: Île-de-France (around 22% of French businesses), which accounts for 24% of insolvencies in France as a whole. Auvergne-Rhône-Alpes (nearly 13% of businesses) accounts for 12.3% of insolvencies. And finally, Provence-Alpes-Côte d'Azur, with 10% of national companies, accounts for 10.6% of insolvencies in mainland France.

Sector analysis

The three sectors most affected by insolvencies in terms of numbers remain Construction & Public Works (27.6%), Personal Services (18%) and Business Services (10.1%). However, the upward trend in the number of insolvencies is less marked at the end of June 2024 over a sliding 12-month period, compared with those recorded in 2022/2023.

Insolvencies in French overseas departments and regions

At the end of June 2024, the Frenchoverseas departments and regions recorded an increase of nearly 27% in insolvencies, compared with 25% for mainland France.

As in France, growth in insolvencies is lower over the last 12 months, compared with +43.1% over 2022/2023.

Commercial companies accounted for only 80.7% of insolvencies (85.7% in mainland France), followed by sole proprietorships at 14.1% (11%).

The business population is also different in terms of age distribution. Businesses less than 3 years old account for just 11.6% of insolvencies (18% in mainland France), but the increase in this age group is much greater, at +214% (+140%).

As in mainland France, the oldest are the strongest, accounting for just 14.8% of insolvencies (up 13% to end June).

In terms of size, VSEs account for the majority of insolvencies, with 83% (vs. 88% in France). Insolvencies in this population rose by 19% (+17%).

Reunion Island (around 33% of the total) accounts for more than half of all insolvencies, followed by Martinique (23.7%) and Guadeloupe (15.6%).

The three business sectors most affected by insolvencies are "Building and Public Works", which accounted for 30% of insolvencies (27.6% in France), "Personal Services", which accounted for 13.9% (18%), and "Business Services", which accounted for 9.4% (10.1%). The increase in insolvencies has also slowed, with respectively +20.9% (+28.2% in 22/23), +17.4% (+74.2%) and +37.3% (+81.9%).

"As of June 30, 2024, the number of insolvencies was still rising, but more slowly. Our economy had been on a life-support system, thanks to public aid and EMPs. However, it continues to evolve in a climate of uncertainty, given the political situation at home and the omnipresence of geopolitical risks..."

- Max Jammot, Business Unit Manager at Ellisphere