How to preserve cash in a difficult environment

At the end of April 2023, over a sliding 12-month period, France recorded 45,655 receiverships and direct judicial liquidations (see Ellisphere study). In an economic context that remains complex, it is more essential than ever for companies to :

- Find out about the solvency of their customers before initiating or continuing a business relationship, with the aim of controlling and anticipating late payments or even non-payments. Monitoring a third party's solvency enables us to measure their ability to repay their debts in the short, medium and long term. Monitoring solvency can be combined with monitoring liquidity, thanks to the liquidity ratio*. Insolvency means not being able to repay debts as they fall due, or finding oneself in a situation where the sale of assets will not be sufficient to repay them.

- Making confident decisions based on reliable information is essential to the management and control of any business.

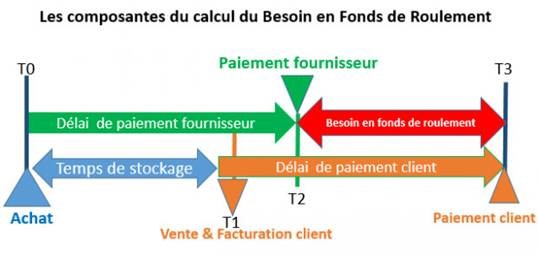

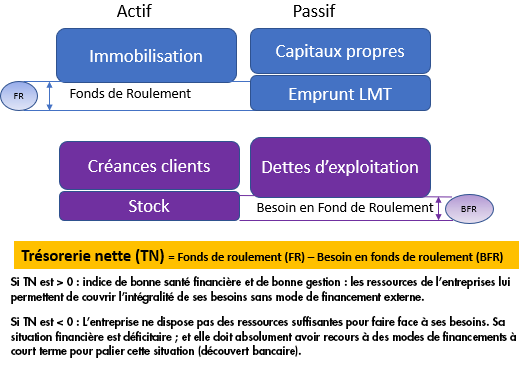

It is also important for companies to optimize their inventory and payment of trade receivables in order to control their working capital requirements while managing their cash flow. Cash represents the company's available liquidity. It is used to finance the fundamentals of the business, such as salaries, suppliers, the State, etc. Its calculation is simple: it's the difference between working capital (WC) and working capital requirements (WCR).

Cash flow problems can be caused by structural or cyclical factors. The key to good cash management is to anticipate all scenarios so as to be able to deal with them.

Optimal cash management involves assessing the working capital requirements of the operating cycle, i.e. the cash available to cover current expenses. Poor cash management can quickly put a company at risk. Indeed, a company that can no longer meet its short-term debts (lack of liquidity) will find itself in a situation of suspension of payments, even if it is solvent.

A positive cash balance is one of the key indicators of a company's financial health. What's more, it's a well-known fact that late payment has a negative short-term impact on a company's cash flow.

Actions taken by the government to regulate payment terms and support the financial health of companies

Invoicing and late payment can also have a negative impact on the cash flow of companies, particularly VSEs and SMEs. It is commonly estimated that in France, late payment and non-payment are responsible for almost 25% of business failures.

Although complex and often difficult to master, compliance with payment deadlines has a significant impact on the smooth running of businesses, as well as on their financial situation, not to mention their reputation. Since 2018, public authorities have taken up this issue, with the number of checks and fines steadily increasing. To combat late payment, the State has introduced financial penalties based on the DGCCRF's "Name & Shame" principle, which consists of:

- Draw up a list of companies that fail to pay their suppliers on time (available online),

- Impose dissuasive fines of up to 2 million euros (4 million euros for repeat offenders) for legal entities.

The DGCCRF's "Name & Shame" goes hand in hand with the promotion of good practices, expressed in particular through the "Name & Fame" concept, as well as the "Relations Fournisseurs & Achats Responsables" label and charter set up by the Médiateur des Entreprises and the Conseil National des Achats.

In line with this general objective of reducing late payments, the Banque de France has also begun to downgrade the credit ratings of 10% of subsidiaries of ETIs and large corporations in 2022, i.e. around 100 companies. In 2023, this institution aims to examine three times as many companies and possibly downgrade the rating of some of them due to their poor payment behavior.

What about payment times with the roll-out of electronic invoicing between French companies subject to VAT? The roll-out process for this measure will begin for targeted companies on July 1, 2024, for invoices received. On this date, large companies will also be obliged to issue their invoices in electronic format. The obligation to issue invoices in electronic format will be gradually extended to SMEs and VSEs until January 2026.

The aim is to make companies more competitive by reducing the administrative burden associated with invoice management, while at the same time making commercial relations more secure: reducing administrative costs associated with the invoicing process and limiting disputes linked to payment deadlines. Electronic invoicing will also help combat VAT fraud, thanks to automated cross-checks.

Shareholders' equity and gearing - indicators to be taken into account in financial solvency analysis

The State Guaranteed Loans (SG Ls) set up at the start of the health crisis in March 2020 have proved their effectiveness in helping companies survive. However, in a complex economic context marked by inflation and rising raw material and energy costs, the question of companies' resilience remains unanswered when it comes to strengthening their equity capital**.

The aim of this strategic orientation is both to protect companies from bankruptcy by strengthening their liquidity and cash position, and to position them offensively so that they can grow through investment.

In this dynamic, the main role of shareholders' equity, supplemented by long-term debt known as permanent capital***, is to support a company's activity, finance part of its investments and strengthen its cash position. In addition, sufficient equity reflects a company's credibility, stability and independence vis-à-vis third parties such as suppliers, customers and banks. With this in mind, the debt-to-equity ratio is a key indicator of a company's solvency, measuring its level of financial dependence by comparing its debts with its equity. All the information needed to calculate this ratio can be found in the company's balance sheet.

Interpretation of the debt-to-equity ratio must take into account a number of factors, such as the company's sector of activity, size, context and maturity. Generally speaking, an acceptable gearing ratio is between 30% and 36%. So, for a company operating in a sector subject to uncertain economic conditions and with high fixed costs, it is preferable to have as low a gearing ratio as possible.

* Liquidity ratio = Current assets / Current liabilities; the liquidity ratio measures a company's ability to meet its short-term commitments. It is calculated by dividing current assets by current liabilities. A liquidity ratio below 1 may indicate insolvency.

** Shareholders' equity - accounting definition. Equity is recorded on the liabilities side of a company's balance sheet, and comprises share capital, legal and statutory reserves, and retained earnings.

***Permanent capital or stable resources represent all the funds available to a company over the medium to long term. They are made up of shareholders' equity plus provisions for risks and charges, plus medium- and long-term debts, including blocked shareholder current accounts.

Solutions adapted to your needs

Customized solutions

Customized solutions adapted to your needs to optimize your decision making.

Receive the best news from Ellisphere every month, free of charge.