The State Guaranteed Loan (SGL) is a formidable tool for cushioning the difficulties of companies seeking cash flow. However, inflation and in particular the explosion in energy costs, tensions on recruitment, all against the backdrop of the war in Ukraine, have aggravated the difficulties encountered. Some companies will not be able to repay their loans, while others will be weakened by the level of debt that will prevent them from investing. This is an additional concern for credit managers in the management of outstanding loans.

Intended to safeguard companies in the face of various hazards, the EMP has been and remains a valuable aid in these complicated times for companies. However, one question must be asked: what about the solvency of these borrowers at the time when the repayment of the loans began?

What is a Government Guaranteed Loan?

In order to support French companies affected by the various crises, the French government has set up a state guarantee program for business loans. This guaranteed loan program (offered by banking institutions) aims to protect and preserve the cash flow of the most fragile companies. These loans are offered in two distinct situations:

- One is made following the Covid-19 crisis

- The other to the war in Ukraine (PGE resilience)

The PGE, known as Covid-19, is generally granted to companies with fewer than 5,000 employees or with sales of more than 1.5 billion euros in France. Loan repayments begin after the second year for a maximum of 6 years. For SMEs, the bank rate is between 1 and 2.5%, including a government guarantee on an amount representing a maximum of 25% of the turnover of the company concerned.

To this EMP Covid-19, which ended in its accession on June 30, 2022, has been added the so-called Resilience EMP. The latter is open to companies with significant cash flow needs due to the economic consequences of the Russian-Ukrainian conflict. This conflict generates in particular:

- An increase in the price of certain raw materials (cereals, metals, energy, etc.)

- A break in supply chains

- A suspension of payments from Russia or Ukraine

- A loss of commercial opportunities due to international sanctions

Its maximum amount is 15% of average annual sales. It can be cumulated with the PGE Covid for a global coverage of 40% of the turnover. The amortization period of the loan is 6 years; the company starts to repay the loan after 1 year.

Companies affected by the conflict in Ukraine should contact their bank to benefit from this loan.

The bank examines loan applications on a case-by-case basis according to the company's financial situation and its financing needs.

| Key figures of the PGE - State Guaranteed Loan | ||

| Information Title | PGE Covid-19 | PGE Resilience |

| Start date | May 6, 2020 | February 24, 2022 |

| End date | Closed on June 30, 2022 | December 31, 2023 |

| Duration of the loan | 6 years maximum | 6 years maximum |

| Start of repayment | 1 year after graduation | 1 year after graduation |

| Amount | 25% CA 2019 | 15% CA cumulative with PGE Covid 19 |

| Guaranteed Percentage of State Coverage | 70 to 90%, depending on the size of the company | 90% amount |

| State guarantee rate | 0.5 to 1% depending on maturity | 0.5 to 1% depending on maturity |

| Bank loan rate including state guarantee | 1 and 2.5 | ? |

| Reimbursement deductible | 12 months | 12 months |

| Number of EMPs granted | 699 401 | 1200 companies in 2022 |

| Amount of EMP granted | 143 billion | 570 million |

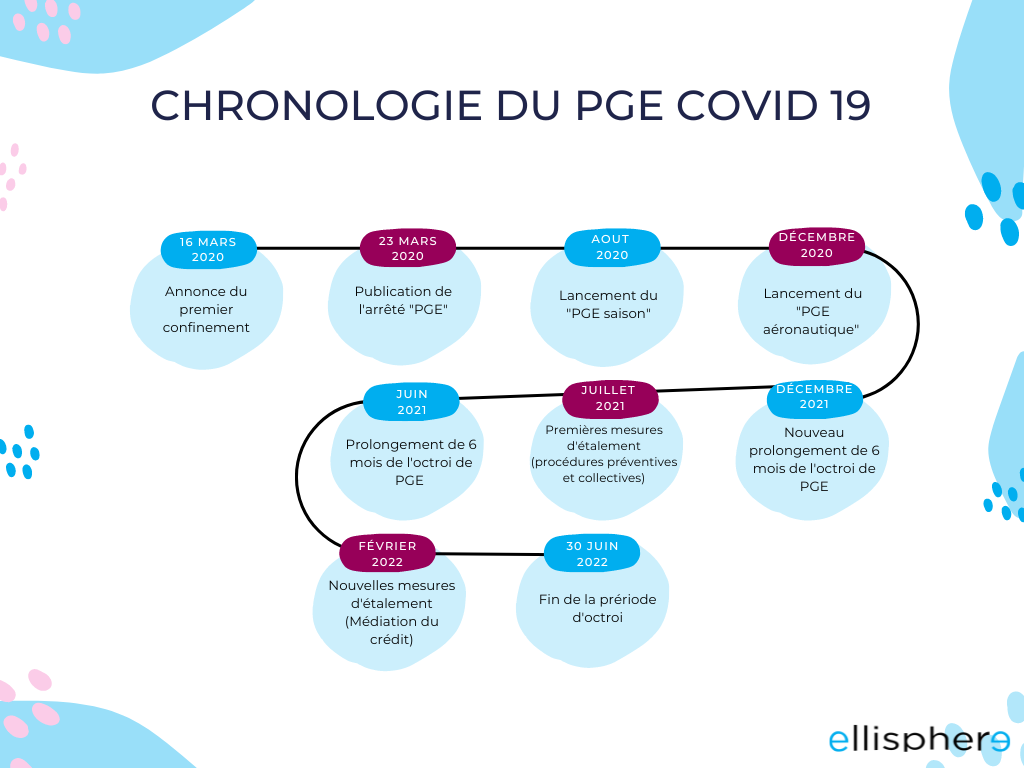

PGE Chronology - Covid-19

Status and figures of the Covid-19 EMPs

With a bank rejection rate of 3%, the number and amount of Covid-19 EMPs clearly prevented a drastic reduction in the supply of credit. They have supported the cash flow of companies affected by the crisis and have made it possible to keep payment delays at an acceptable level.

At the beginning of 2023, 98 billion euros of EMPs remain on companies' accounts, out of the 143 billion granted since the beginning of the Covid-19 crisis and closed on June 30, 2022. Today, more than 95% of companies are properly repaying their EMPs according to the Banque de France.

According to the latest Bpifrance, Le Lab and Rexecode barometer published in November 2022, 11% of companies that have obtained a Covid-19 EMP have already repaid it in full, with 80% expecting to amortize it over several years. However, it is important to note that 9% of SMEs and VSEs fear not being able to repay it.

Analysis of the use of EMPs shows that a large number of companies have used them as a precautionary measure and have only consumed a small proportion of their loans. In this distribution of credit, it should be noted that :

- The scheme has effectively supported viable companies affected by the crisis

- EMP recipients have seen their debt levels increase, with the healthiest ones seeing a sharp increase in their cash flow

- According to the Cour des Comptes, VSEs and SMEs accounted for 88% and 6% of EMP beneficiaries respectively. This population accounts for approximately 75% of the amount of loans granted under €50,000

- Zombie" firms also benefited from this assistance. They represent less than 2.5% of borrowers and their number was limited by the selection made by the banks. For the record, the OECD defines a "zombie" as a mature company (at least ten years old) that is experiencing recurrent difficulties - its gross operating surplus does not cover all of its interest expenses for at least three consecutive years.

- The cost of the Covid-19 EMPs is less than €3 billion for the State; this loan has supported approximately 700,000 businesses to the tune of nearly €143 billion.

According to the BPI study of January 2023, VSEs have drawn on their EMP to cushion cost increases, in particular energy costs; 57% of them had used it by the end of 2022. In addition, over the whole of 2022, after having had recourse to credit mediation, nearly 260 companies benefited from an extension of their EMP. It is important to note that this request for an extension, which can last up to 10 years, can have an impact on the Banque de France rating.

A difficult context when it comes to repaying your EMP

In fact, the EMP is not a productive debt (investment - NPV and IRR); it is considered a survival debt. It has been the lifeline for hundreds of thousands of companies with cash flow problems. What was a real windfall for highly exposed companies is now proving to be a "trap" for some when it comes to repayment. In a context of inflation and possible lengthening of payment deadlines, the monthly repayments are beginning to weigh more and more heavily on the accounts of companies.

According to the Cour des Comptes, microenterprises that have benefited from the PGE and URSAFF facilities will have to devote more than 9% of their monthly turnover to repaying their debts. Aware of the problem, the government has put in place a plan to help companies emerge from the crisis. Since its implementation, more than 10,000 companies have benefited from this individualized support. The content of this assistance, in addition to financial support and adjustments to the company's social and fiscal debts via credit mediation, also includes adjustments to legal procedures in order to best deal with the difficulties of very small companies with less than 20 employees. It is in this sense that the simplified judicial liquidation procedure for small businesses was created on October 18, 2021. The opening of this procedure can be requested until June 2, 2023. This procedure is shorter in its maximum duration, 6 months, and less costly for the liquidated company.