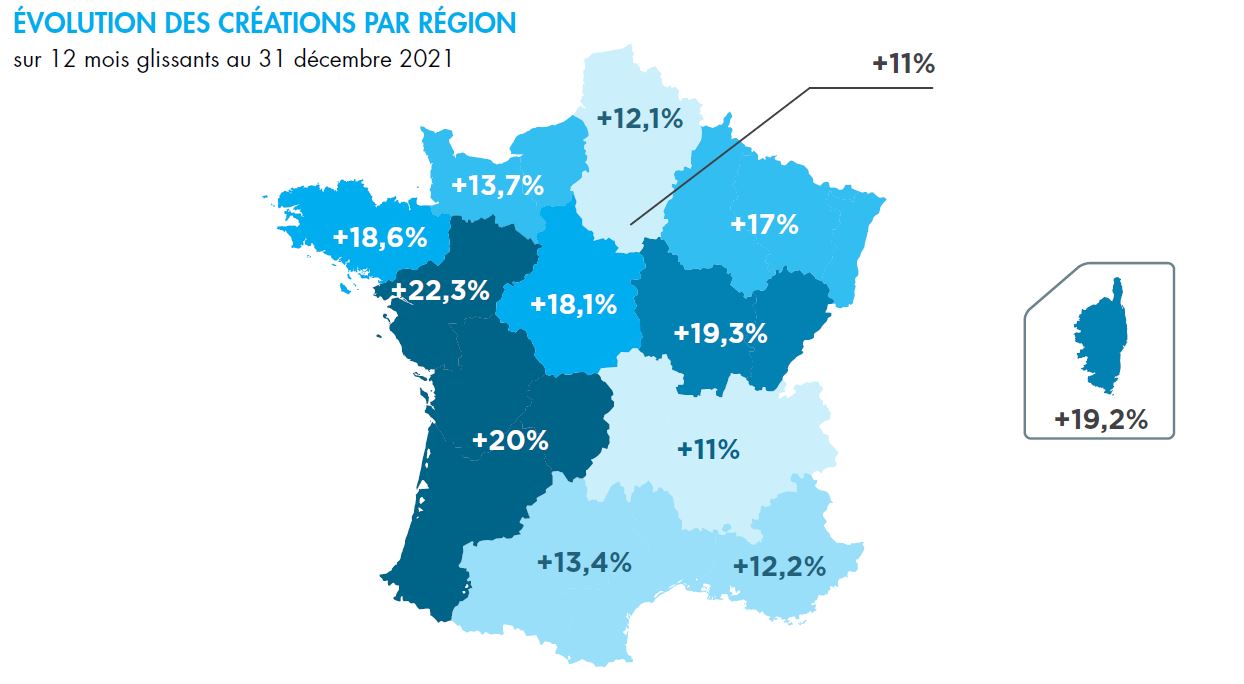

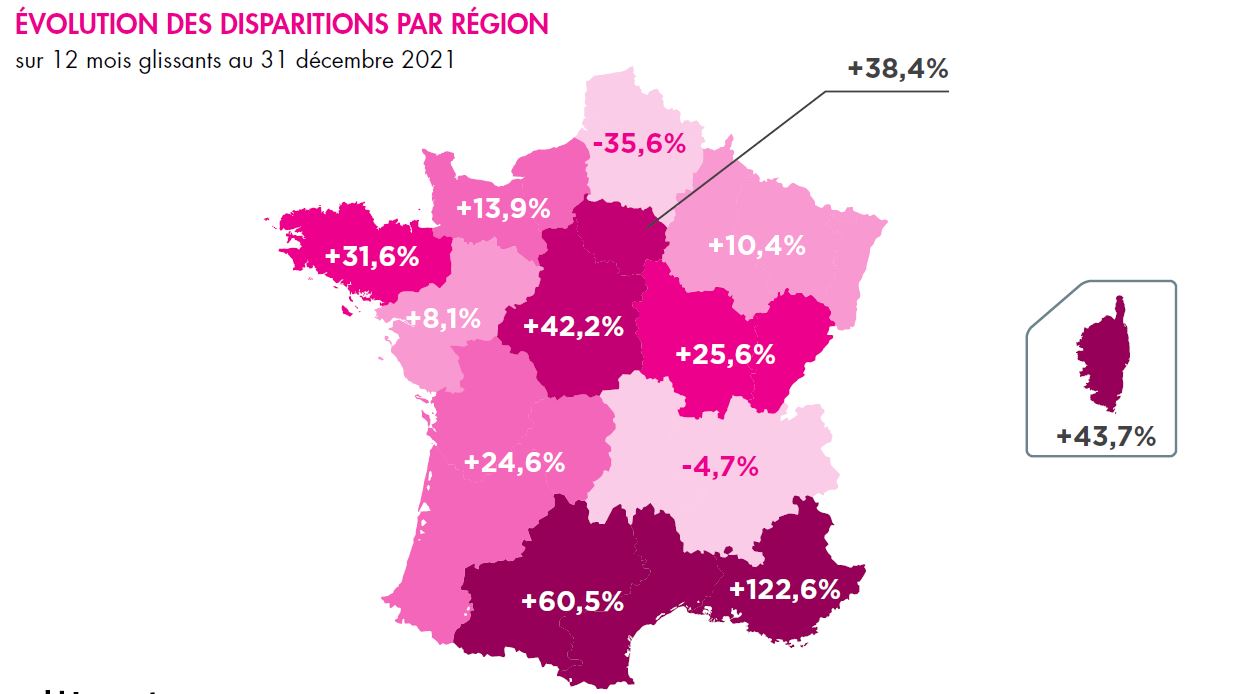

2 812 950 ! That's the number of establishments (head offices and secondary establishments) present in the real estate sector. As of February 28, 2022, over a rolling 12-month period, there were no fewer than 1,592 business failures, an increase of 8.9% compared to the same date the previous year, threatening approximately 1,310 jobs . In terms of the Entrepreneurial Dynamism Index, the sector had 172,500 business creations (+14.44%) and nearly 90,408 disappearances (+29.05%) as of December 31, 2021 over a sliding 12-month period.

France, a country of private owners

Stone remains a safe haven, whether for personal use or as an investment. In fact, France has long been a country of homeowners. According to INSEE, there will be approximately 36.3 million homes in metropolitan France in 2021. This housing stock is growing by an average of 1.1% per year and is divided between 55% single-family homes and 45% multi-family homes. 82% of the housing stock are primary residences, 10% are secondary residences and 8% are vacant. INSEE indicates that 58% of French people own their primary residence and that 38% of them no longer have a current mortgage.

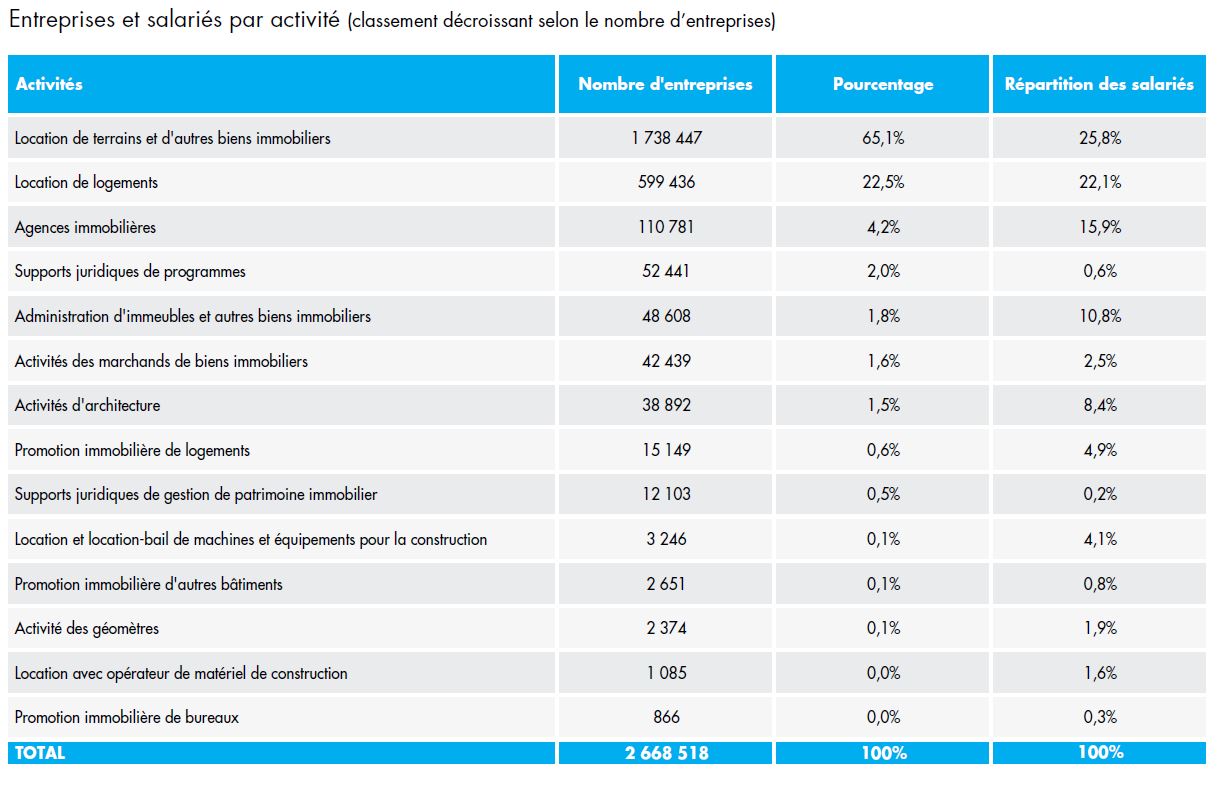

Including the Building and Public Works (BTP) sector, the Real Estate sector studied here includes a large number of players: developers, architects, real estate agents, etc. This activity has a little more than 2.7 million active entities, with 87.7% of players linked to the rental of land or housing, accounting for 47.9% of the workforce.

2020-2021, a turbulent but resilient real estate market

In terms of cumulative revenues, 46.4% of Real Estate revenues are generated by land and housing rental activities, and 23.8% by development activities. Due to the large number of small entities, the Real Estate sector remains relatively unconcentrated, with companies with more than 50 employees accounting for only 33% of total revenues.

The year 2019 is marked by a record with more than 1 million sales of old homes. In 2020, despite fears related to the various confinements, the Real Estate market is proving resilient, even if the number of transactions is down, both in the old and new.

In 2021, with 1.2 million transactions, the existing home market will set a new record. However, it remains under pressure, due to strong demand in the face of a shortage of supply in the new housing market, while sales prices continue to rise in both the new and existing housing markets.

In 2020, in the midst of the Covid-19 crisis, the number of authorizations will fall sharply; many construction sites will not be started. In 2021, supply is back on track. Nearly 104,500 new homes were put up for sale, up 21% from 2020, but still down nearly 9% from 2019. 471,000 new homes are authorized for construction (+18.9%), and approximately 386,700 homes are started (+10.7%).

Insolvencies on the rise again in 2021

In 2020, the massive support of the state and the banks, and the slowdown in the activity of the registries, caused the number of insolvencies in the real estate sector to fall sharply, as in the rest of the economy. However, the period 2021 is more unfavorable, with the number of insolvencies on the rise again (+14.5%), a trend that continues over the last 12 months to February 2022 (+8.9%). The recent period has been less favorable for real estate services: +35.2% for architects, +17% for real estate agencies and +14.7% for property managers.

The property development sector as a whole is also suffering, with insolvencies up 15.4%, including 24.6% for housing development alone. The increase in the number of insolvencies was less pronounced in the rental sector (up 2%), but still peaked at 14.3% for lessors of residential property. These operators are suffering from strong tensions in their market, with a shortage of new programs, a drop in authorizations and delays in construction starts, all in the face of strong competition in both the private and professional rental markets.

2022, a constrained outlook

In 2022, difficulties in accessing property may increase, pushing potential buyers to abandon or postpone their purchases. Indeed, the credit conditions (duration and debt rate) are more regulated since the summer of 2021. Lenders must be more careful about opening real estate loans, giving preference to the best profiles (activity, income level, contribution and savings). In addition, a rise in lending rates is underway.

Finally, for builders, there is the added cost of new construction due to new environmental regulations applicable as of 2022 (energy savings, air quality, insulation, carbon impact). In this context, sales prices are likely to increase further, reducing the potential customer base.