What is a SPAC?

A Special Purpose Acquisition Company (SPAC) is a publicly traded company formed to raise funds to acquire an existing, usually unlisted, business, rather than engaging in a traditional initial public offering(IPO). Shareholders of SPACs invest in the company knowing that it is seeking to make an acquisition, but they have no knowledge of the target business that will be acquired.

The investors will provide funds (between 200 and 300 million euros). These funds are then put in escrow for the time of the acquisition of the target. The timeframe for an acquisition can be up to 24 months. If the acquisition of the target fails, the SPAC is liquidated, and the investors divide the capital.

The founders of this SPAC, generally entrepreneurs and/or leading investors, will identify the sector of activity of their future target, the place of stock exchange listing, and thus draft the listing prospectus. Once the acquisition operation is completed, the SPAC takes the name of the acquired company, which gets its hands on the funds raised.

What are the specificities of SPACs?

What are the benefits?

SPACs have several advantages:

- Quick access to the stock market: companies targeted by SPACs can quickly access the stock market without the complexity and costs of a traditional IPO.

- Flexibility: SPACs generally have a defined period of time to find a company to acquire, which allows them to remain flexible and adapt to market opportunities.

- Transparency: SPACs are required to disclose financial information and details of the proposed acquisition to shareholders, providing greater transparency to investors.

- Liquidity: Publicly traded SPACs offer increased liquidity for shareholders, which means they can easily buy or sell shares of the company.

- Cost savings: SPACs can save on the costs of a traditional IPO because they do not need to pay an underwriting fee for investors.

From an investor's perspective, SPACs are reassuring. Indeed, the capital deposited in an escrow account will be returned with interest if the sponsors do not succeed in the acquisition.

What are the disadvantages?

However, despite the advantages mentioned above, raising funds through SPACs can also be risky:

- Blind investment: the investor relies on the trust, experience and reputation of the sponsoring team that created the SPAC.

- Lack of transparency: investors do not know the company that will be acquired.

- Risk of failure: SPAC undertakes to acquire a target within an agreed timeframe (usually 24 months); the company is dissolved if it fails.

SPACs: what is the situation in practice?

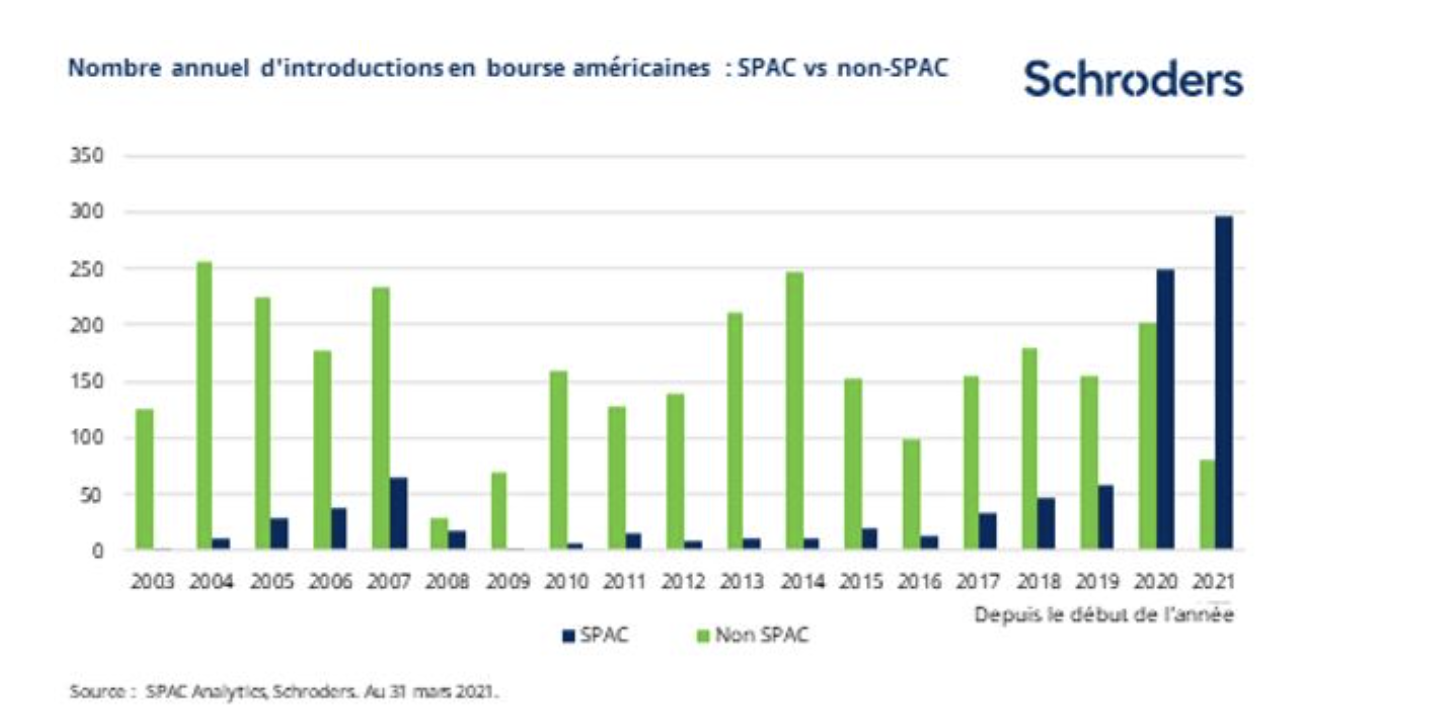

In the US, there is a real craze for SPACs, gradually moving away from private equity. In 2019, there were 59 SPACs, 248 were listed in 2020 and nearly 300 initial public offerings (IPO) of SPACs were recorded in the first quarter of 2021. By the end of 2021, there will be about 600.

In France, there are 8 SPACs, 7 of which are still listed at the end of 2022:

- MEDIAWAN SA:1st SPAC to be listed on the Paris stock exchange in 2016. It raised more than €250 million to acquire GROUPE AB (audiovisual production and distribution in French-speaking Europe and Africa). MEDIAWAN was delisted from the Paris stock exchange at the end of 2020.

- 2MX Organic: its vocation is to invest in the production and distribution of sustainable consumer goods; it raised €300 million during its IPO in 2020 and completed its merger with Invivo Retail. 2MX Organic is now called TERACT.

- DEE Tech: intended to invest in a high-potential technology company. The acquisition of the private parcel that was the target company of SPAC did not come to fruition due to a lack of agreement on the terms of implementation.

- EUREKING: Europe's first SPAC in healthcare, dedicated to bioproduction.

- MYHOTELMATCH: enters the TravelTech world in 2022 with the acquisition of the assets of MyHotelMatch.

- TRANSITION: the first European SPAC dedicated to the energy transition.

- ACCOR ACQUISITION COMPANY: it targets acquisitions in one of the following sectors: food & beverage, flex-office, wellness, entertainment and events, or hotel-related technologies.

- I2PO: created in 2021, it is dedicated to the entertainment and leisure sector; it was renamed DEEZER following the merger with its target DEEZER acquired in 2022.

By the end of 2022, 4 out of 8 SPACs have found their target.

What does this mean?

While IPOs of SPACs in the United States have increased over the past three years, the number has remained significantly lower in Europe. Some say that a speculative bubble is bursting. To be continued.