It is well known that data has immense potential to create value, but many companies are questioning the value of collaborative third-party data sharing for effective operational management.

In this article, we focus on aged scale data and the importance of sharing it with business information firms. First, we discuss the role of aged scales in credit risk management, and then we examine the benefits of collaborative programs on payment behavior, using the example of Ellisphere's D3 program and its PayTrend indicator.

The ageing balance, an essential tool in the management of your receivables

How does it work?

The aged trial balance is a business management tool that summarizes information on accounts receivable and accounts payable. It is extracted from the general ledger and is useful for debt collection and cash management.

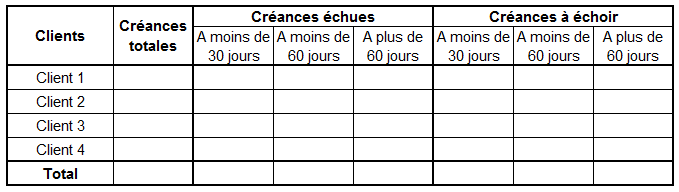

It takes the form of a table that gathers information on the open accounts of customers (receivables) and suppliers (payables) to get an idea of the company's future cash position.

By grouping the amounts due according to their age, this representation allows operational decisions to be made to prioritize the collection of receivables, avoid payment anomalies and ensure cash flow security. An invoice that is one day late does not represent the same risk as an invoice that is three months late.

Thus, in the form of a table, the aged trial balance is used to monitor the payment of invoices, to analyze risks, to forecast unpaid invoices, to plan reminder actions, or even amicable or legal actions.

For a more comprehensive view, this internal data analysis can be complemented with external data on payment behavior and industry data from business information companies.

Example of a client aged trial balance table

A necessary control to perpetuate its business

In an environment where accounts receivable represent approximately 40% of company assets, understanding customer payment behavior through internal analysis of payment history is crucial. It is a way to better control DSO and reduce risk by adopting appropriate and effective dunning strategies based on the customer's payment profile.

It is important to remember that abusive payment delays are punished by the Direction générale de la concurrence, de la consommation et de la répression des fraudes (DGCCRF). This government agency can impose fines of up to 2 million euros for late payments, with the publication of the names of the convicted companies on its website.

| Examples of customer payment behavior | Risk level |

| Always pays a week late | Predictable behaviour - Low risk |

| Payroll at very different times | Unpredictable behavior - High risk - Is the customer having cash flow difficulties? |

| Payroll always late at the end of the first quarter of each year | Predictable behavior - Risk to be studied by questioning. Is it due to a seasonality of sales with a temporary cash flow tension? Is the person in charge of payment on vacation during this period? |

Learn how collaborative senior scale programs improve your understanding of your customers' payment behaviors

Business information companies have developed collaborative programs to collect aged scales or ledgers in a trusted environment to understand business payment behaviors.

This pooled information serves as an early warning indicator for decisions on outstanding amounts and payment terms. It allows for the comparison of customer payment terms and payment trends with other companies and/or industry practices.

D3, Ellisphere's collaborative program

For example, in Ellisphere's D³ (Data-Donated) program, companies that submit their aging scales or ledgers have access to a descriptive analysis of these documents. This study combines the company's internal data with Ellisphere's company and industry data.

It provides a detailed view of the most at-risk and delinquent customers, with a focus on delinquencies, areas for improvement, customer dependencies and groups.

This analysis includes a classification of the credit risk of the customer portfolio according to the sector of activity, the amount outstanding, the region, the age and size, the risk class and the evolution, delay and payment period.

This detailed knowledge of customers, combined with descriptive segmentation, is invaluable to the company. It provides new insights and allows for quick operational decisions in terms of collection plans and updating outstanding strategies.

What are the benefits?

With this analytical understanding of the environment, credit management teams can identify the best ways to improve their DSO, target delinquency typologies and identify the best ways to improve them.

By joining collaborative information company programs, companies gain a better understanding of their operational payment data and customer metrics. This new information respects confidentiality and provides new insights to anticipate risk control and understand customers, without prevalence of external data over internal data.

Improve your credit decisions with weak signals from collaborative programs

In this logic of sharing payment behavior data, Ellisphere offers PayTREND, an indicator that tracks customer and supplier late payments.

The information disseminated through PayTREND includes the date of update, number of invoices analyzed (paid and unpaid), number of contributors, overdue amounts, share of invoices due and not due, and monthly payment history.

This indicator allows the credit manager to better understand the company's solvency and to take payment behavior into account when making decisions about negotiating settlement terms or outstanding amounts.

Payment data sharing: a key to understanding the payment behaviors of your prospects and customers

The pooling of aged scales in collaborative programs allows companies to share knowledge to better understand and assess corporate payment behaviors.

Companies can thus control all customer relationships upstream, by knowing the profile of their future business partner and its payment conditions in a global vision of outstanding amounts. Downstream, they can be aware of weak signals thanks to alerts allowing them to anticipate late payments or even non-payments.

This consolidated and analyzed collaborative data ensures the security of companies' financial interests; it participates in the implementation of a collective intelligence to identify and control credit risks and preserve cash.