A cloudy environment

The Wines & Spirits sector seems to be holding up well, but there are concerns in the short, medium and long term. In the long term, professionals are suffering from the decline in wine consumption in favor of other beverages such as beer or strong spirits. While the wine industry continues to overproduce, the consumption of red wine has decreased by -32% over the last 10 years and -70% over the last 60 years.

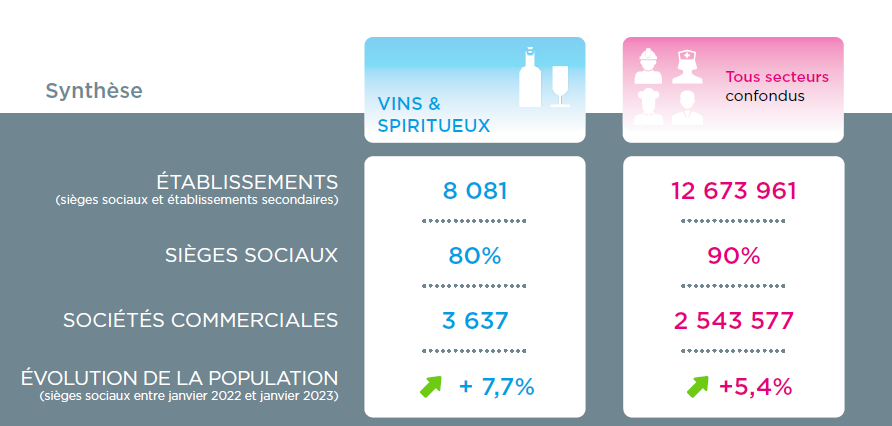

A narrow population of companies

The Wines & Spirits sector is concentrated: 71% of sales are generated by companies with more than 50 employees, including 44% by those with more than 250 employees. While upstream, it is supplied by a network of 133,800 winegrowers who provide the raw material, the Wines & Spirits sector itself has only about 6,500 companies in metropolitan France with 32,700 employees.

It should be noted that although the production of sparkling wines, mainly champagne, represents only 6.5% of companies, it still employs nearly a quarter of the sector's workforce and accounts for 28% of sales.

"Proof of the current slump in the wine industry: the State has just authorized the uprooting of vine stocks, while instituting a wine distillation campaign endowed with €160 million; the surpluses will thus be transformed into alcohol, mainly for bioethanol use."

- Max Jammot

Head of the economic division at Ellisphere

Wines, beers... a dynamic sector!

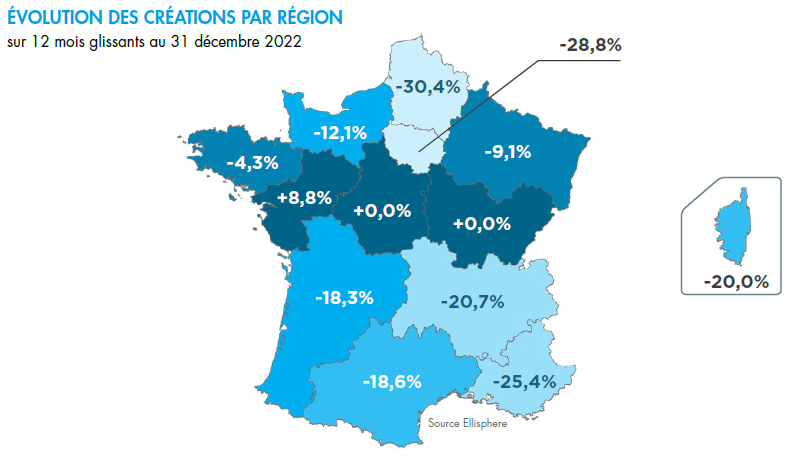

The Wines & Spirits sector remains dynamic. Its population of active companies is growing steadily. Commercial companies represent 68.2% of the creations against 30.3% of individual companies. The dynamics is most important in the production of beer. With nearly 370 new businesses created in 2022 compared to 170 that have disappeared, there have been 2 new entities for every 1 that has disappeared.

Next come distilled alcoholic beverages with almost 3 new businesses for every one that has disappeared, i.e. 141 new businesses for 48 that have disappeared over the last 12 months. The dynamic is most important in beer production. With nearly 370 new businesses created for every 170 that disappeared in 2022, there were 2 new entities for every 1 that disappeared.

A limited number of claims

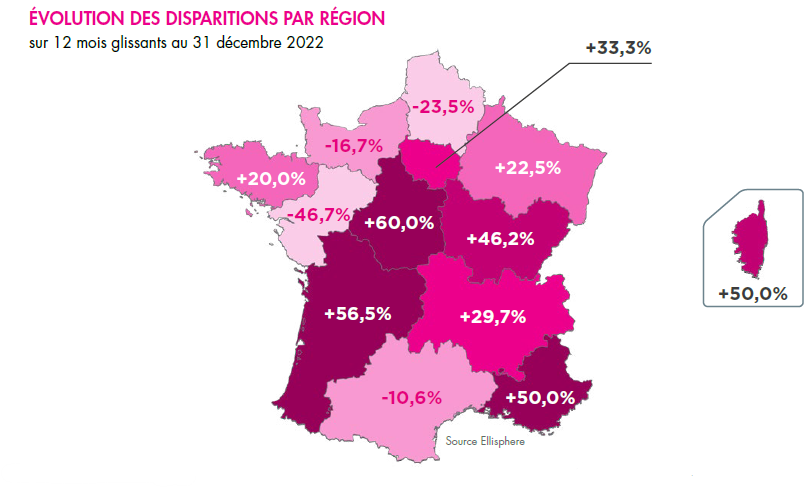

Since 2013, the loss ratio in the Wines & Spirits sector has remained limited, even though the period 2020-2021 has seen an increase in this loss ratio, while at the same time the number of insolvencies has remained on a downward trend at national level thanks to government protection measures. The sector has been particularly affected by the drying up of its main distribution channels, hotels, restaurants and cafés, and to a lesser extent food retailing and nightclubs.

In 2022, the number of business failures in the Wines & Spirits sector increased again, by 15%, mainly due to beer manufacturing (+45.5%). In this activity, local micro-breweries, often recent to the market, have not been able to withstand the crisis.

Download now our complete study.

Every month, our economic division decrypts the news of the economic sectors and gives you its lessons.