Assessment of insolvency proceedings at the end of 2023

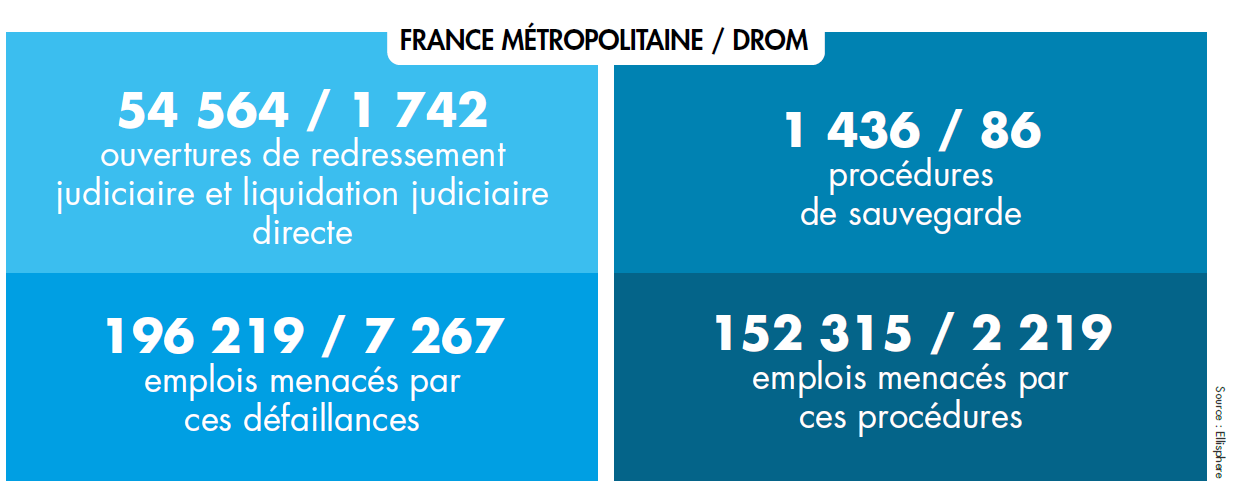

As estimated at the beginning of last year, 2023 saw a slowdown in activity, particularly in the Services and Construction sectors, while Industry held up better. This slowdown weighed on French growth, with activity finally tipping into the red in the third quarter of 2023. GDP contracted by -0.1%, as households' purchasing power declined and they revised their consumption decisions. However, after a slight rebound in the 4th quarter, which reached +0.2%, GDP growth for the whole of last year is estimated at 0.9%. In 2023, in mainland France, 56,000 receiverships, direct judicial liquidations and safeguard procedures will be opened, representing an increase of +34.8% compared to 2022. If we add the procedures recorded in the French Overseas Departments and Regions (DROM), we reach a figure of 57,828 in 2023, an increase of +35.6% over one year.

In fact, a recent Senate report refers to the probable link between the repayment of PGEs, which for many VSEs can lead to cash-flow problems and the risk of insolvency... It should be pointed out, however, that VSEs and SMEs were able to apply for an extension of the PGE repayment schedule until December 31, 2023... And that on January 7, Bercy announced a further three-year extension of the scheme, until 2026. The increase in the number of court-ordered liquidations highlights a deterioration in the situation of companies already in difficulty, with SMEs and Intermediate-Sized Companies (ISCs) the hardest hit. But these figures are misleading. In fact, we are witnessing a phenomenon of catching up with the number of insolvencies that occurred after the end of the subsidies that had artificially kept many companies afloat; a fact already mentioned in our previous analyses.

And let's not forget another crucial point: energy prices. The year 2023 will have thrown the energy market into turmoil, notably due to geopolitical conflicts and EDF's energy production difficulties. These hazards caused a historic rise in electricity and natural gas prices. However, there was some good news for France's electricity production potential: at the end of December 2023, EDF finally confirmed that the Flamanville EPR would be connected to the grid in mid-2024, with nuclear fuel loading in March.

"On a national level, against a backdrop of inflation, and even though repayment of State Guaranteed Loans (SGLs) has been extended until 2026, the cash flow pressures experienced by some companies are clearly a cause for concern. Internationally, while geopolitical uncertainties and oil production cuts by Saudi Arabia and Russia are raising questions, it is clearly the slowdown in the global economy that is causing concern..."

- Max Jammot, Business Unit Manager at Ellisphere

The upturn in insolvencies continues to vary from region to region. Unsurprisingly, the top three are Ile-de-France, followed by Auvergne-Rhône-Alpes and PACA. The first two regions each recorded a 37% increase in the number of insolvencies. The Ile-de-France economy was generally buoyant in the second quarter of 2023, with the hotel and catering sector holding up well. However, certain sectors suffered, such as the agri-food sector, which was severely hampered by a downturn in demand. In Corsica, tourism, the island's economic mainstay, was not spared, with accommodation on the island recording a drop in visitor numbers of over -8% during the summer of 2023. On the agricultural front, bluetongue wreaked havoc over the past year, creating major difficulties for the sector. Against this backdrop, the number of insolvencies in Corsica soared by 70% over the year, a trend that needs to be put into perspective given the small number of structures involved (378 entities).

At national level, from a sectoral point of view, Building & Civil Engineering (BTP) unsurprisingly recorded a +26.1% increase in the number of insolvencies in mainland France, with 14,220 structures concerned. This was followed, as every year, by Personal Services (up 18.8%) and Business Services (up 10%). With its large population of businesses, the building and civil engineering sector has historically accounted for nearly a quarter of all insolvencies recorded in mainland France. House prices have been falling in the eurozone since the fourth quarter of 2022, mainly due to interest rate rises that have reduced the ability of households to borrow, and thus acquire property. Unfortunately, the sector is facing an accumulation of negative impacts, including rising raw materials and energy prices, supply and recruitment difficulties, and rising interest rates on mortgages. All of these factors are hindering serenity in the construction industry, and in the building and public works sector in general.

Download our complete study now.

Every month, our business unit deciphers the latest news on the entrepreneurial dynamic in mainland France and the French overseas departments and territories, and shares its findings with you.