Public works dependent on a wait-and-see attitude on the part of contractors

The wait-and-see attitude towards public investment has had a major impact on the public works sector in 2022. Despite a theoretically favourable electoral cycle and a more flexible public procurement policy (raising the threshold for private treaty contracts), public works activity has not taken off. More generally, over the first six months of 2023, work completed rose by just 2.6%. Although public works professionals benefited from better order intake in the 1st half of 2023 (+13.8% compared with 2022), this dynamism needs to be tempered, as the increase is partly attributable to the single order for line C of the Toulouse metro. Concerns therefore persist in the face of a recovery that lacks tone and visibility on the part of local authorities. Against this backdrop, the Building & Public Works (BTP) sector is forecasting a further erosion in activity in 2023.

Decline in building permits and housing starts in new construction

It is in new housing, where activity is falling, that concerns are mounting. Non-residential new construction is waning, and the weak growth in improvement-maintenance, driven by energy-efficiency renovation, cannot make up for it all. Nevertheless, 2022 saw a peak in the number of permits issued, following an influx of applications submitted at the end of 2021, in anticipation of the entry into force of stricter environmental regulations. However, after this peak, the number of building permits issued over 12 months (August 2022-July 2023) fell to 397,000, according to the French Ministry of Ecological Transition, i.e. -22.8% over 12 months and -13.6% compared to the pre-sanitary crisis period (March 2019 to February 2020); a drop more marked for single-family homes (-30%) than for multi-family housing (-8%).

At the same time, the number of new housing starts also fell, by 13.2% to 333,100 over 12 months, according to the Ministry. This trend can be traced back to rising interest rates, which are limiting access to credit, especially for first-time buyers, rising construction costs as a result of successive crises and new environmental regulations, as well as the reduction in subsidies for new construction (Pinel law and refocusing of the zero-rate loan).

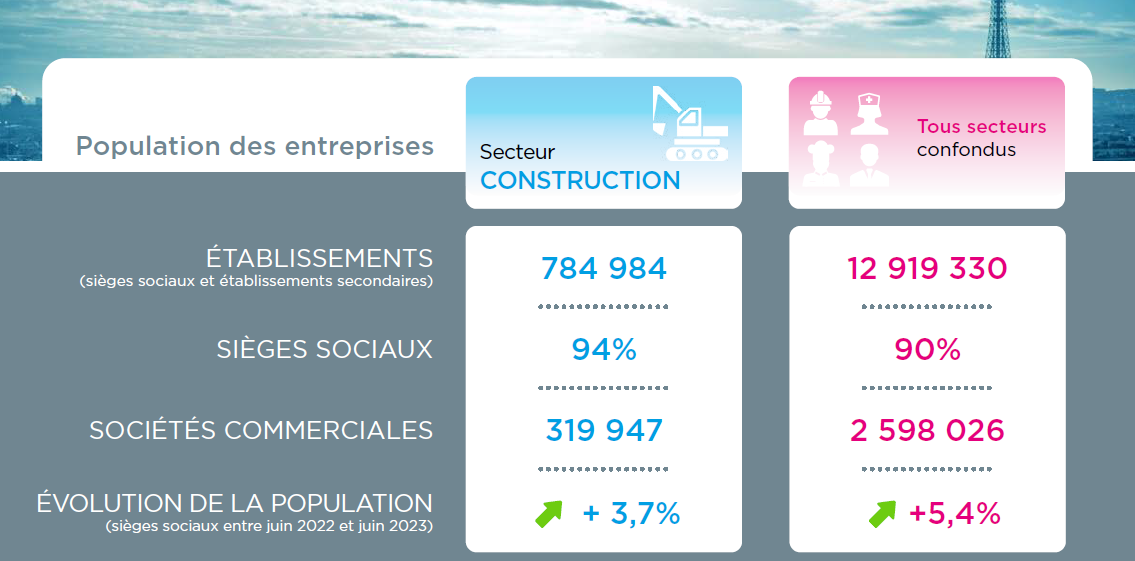

Business population still dynamic, but marking time

The Construction sector, which includes public works, building and civil engineering, remains dynamic. Between June 2022 and June 2023, its active business population grew by +3.7%.

This is less than in recent years, during which growth reached over +5% per annum, falling below the pre-crisis figure for 2019/2020. This trend reflects the growing difficulties facing the sector. However, the number of companies in the sector is rising sharply in segments driven by energy renovation and home improvement: waterproofing (+7%), heating and air-conditioning systems (+6.2%), electrical installations on public highways (+6.8%) and insulation (+4%). Numerically, the Construction sector remains the largest in France, accounting for just over 6% of companies and employees. The sector is dominated by structural and finishing work, including general masonry, which accounts for 16% of companies and 13% of employees in France. Electrical work, painting and glazing then account for a quarter of all businesses and 19% of all salaried positions in France.

A clear upward trend in claims

Company insolvencies in the Construction sector have risen sharply since 2022, by 39%. At the end of June 2023, over a sliding 12-month period, nearly 9,500 construction companies had filed for bankruptcy, a figure up 42% year-on-year. Significant rises in the number of business failures were recorded in general masonry (+42%) and single-family home construction (+30%). Rising raw material prices, supply delays and the gradual drying-up of new housing starts particularly affected these professionals, followed by their subcontractors in electrical installation (+61.6% in the number of insolvencies), painting and glazing (+43.2%), and wood and PVC joinery (+47%). Regionally, Ile-de-France accounts for nearly a quarter of all business failures in metropolitan France, followed by Auvergne-Rhône-Alpes, PACA and Occitanie. The latter region also saw one of the biggest increases in the number of business failures, up 51.6%, with the Hérault and Gard departments particularly hard hit, with business failures up 62% and 60% respectively. Business failures in the building sector

has returned to its pre-Covid-19 pandemic level, returning to its 2019 level. At the end of June 2023, over a sliding 12-month period, more than 36,000 salaried positions were threatened by insolvency. Against this backdrop, the French Building Federation (FFB) fears 150,000 job losses by 2025.

Download our complete study now.

Every month, our economic division decrypts the news of the economic sectors and gives you its lessons.