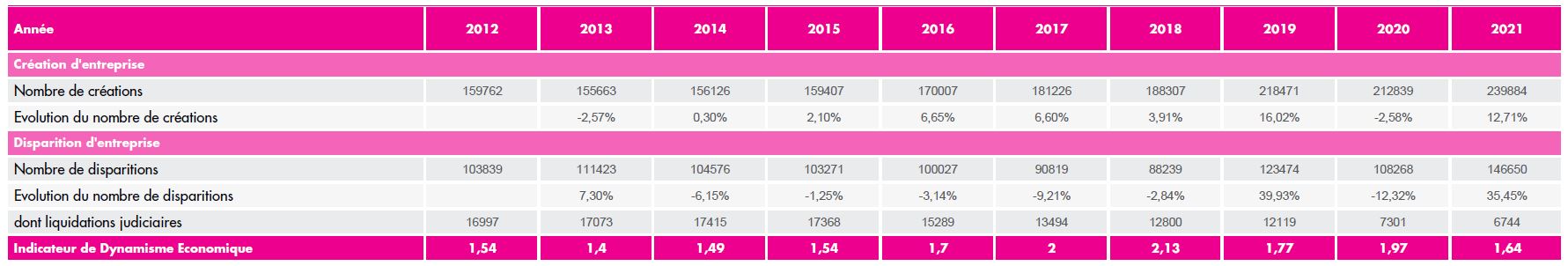

As of January 24, 2022, over a 12-month period, the sector that has created the most companies is "Construction and Public Works" with more than 200,000 creations. It is also the sector most affected in terms of company disappearances, with nearly 150,000 entities gone. At the second place of the podium, with nearly 150 000 company creations, we find the sector "Services to the Companies" . The sector of the "Telecommunication" is, as for him, the small last one of the list, with hardly more than 600 creations and almost as much disappearances of company .

Spotlight on each major sector of activity:

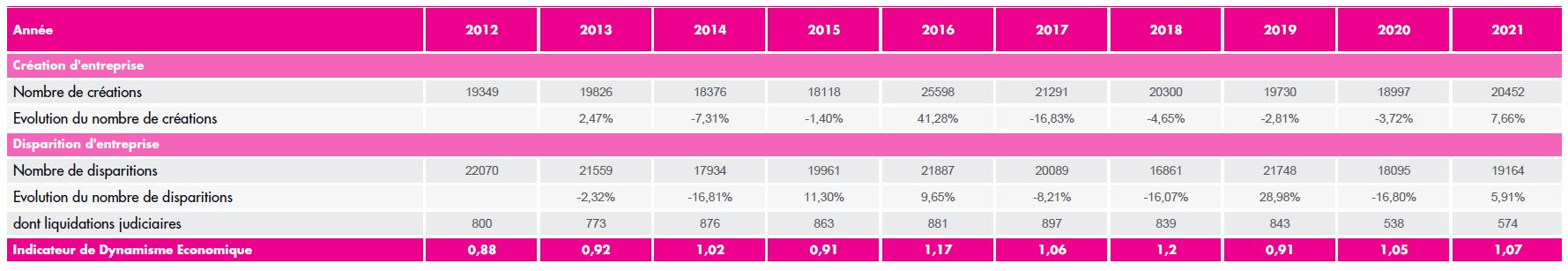

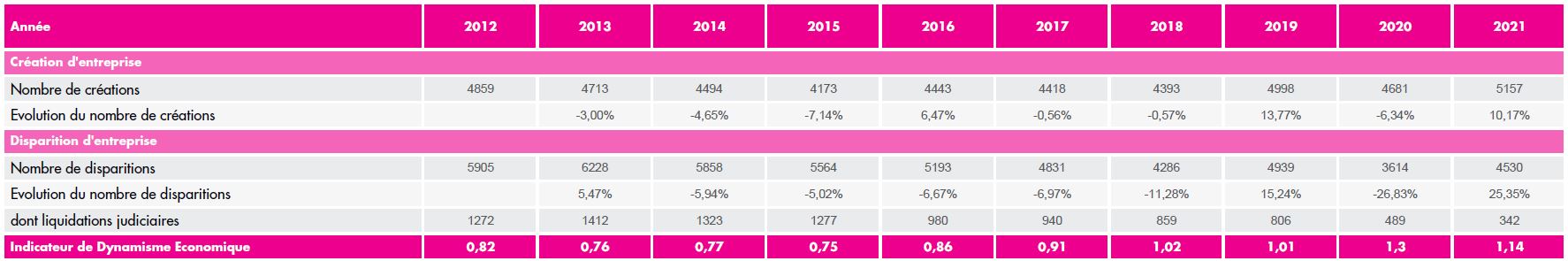

Since 2012, the Agriculture and Fishing sector has not renewed its business population. Its entrepreneurial dynamism index is 1.02 creations for 1 disappearance over the decade studied.

France is losing farms in a context of aging farmers, difficult transmission, increasing debt and low profitability. In addition, many industries are also suffering from deregulation or recurrent health problems: pork, poultry, dairy and sugar industries.

On the fishing and aquaculture side, the situation shows a frank and inexorable decline in the number of enterprises between 2012 and 2021. In recent years, the issue of fishing quotas, and the loss of licenses in the context of the Brexit have left many fishermen docked. And as for agriculture, the transfer of businesses is difficult, not to mention the chronic lack of manpower.

As for the trading of agricultural products, after a period of decline in its business population until 2018, a certain dynamism is gradually resuming, in a context that is more favorable to imports than to exports, and of rising prices of agricultural raw materials that benefit rather large groups and collectors.

Until 2016, the annual balance of active businesses was negative across the Agribusiness sector. Since 2017, the sector's dynamism has been improving, but it remains unfavorable between 2012 and 2021, with less than one company created for every one that disappeared. Before 2020, the sector also had a high loss rate with 22% of liquidations for all business disappearances. However, the introduction of government protection measures has reduced the number of insolvencies. However, this trend remains very disparate depending on the activity.

In the food industry (excluding meat and alcohol), the entrepreneurial fabric suffered until 2017, not ensuring its renewal in a context of high loss. The meat industry, faced with a persistent downward trend in meat consumption and marked by several food scandals, suffered until 2019. However, the Covid-19 crisis in 2020-2021 has revived its momentum, with the emergence of a demand for proximity. However, over the period studied, the meat industry lost entities.

At the same time, food trading activities have benefited from a continued favorable trade balance. The growth of its business population has been maintained over the period 2012-2021, with 1.2 new businesses for every 1 disappearance.

But it is the Wines and Spirits sector that has the most favorable balance. On average over 10 years, 2.4 companies have been created for every one that disappears. It is the export that supports these activities because on the French territory, the traditional consumption of wines is in decline, unlike what is observed for spirits and beer.

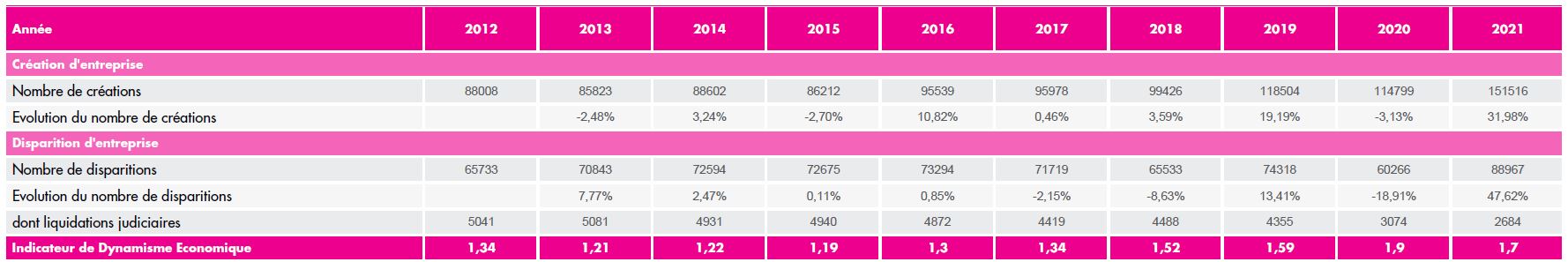

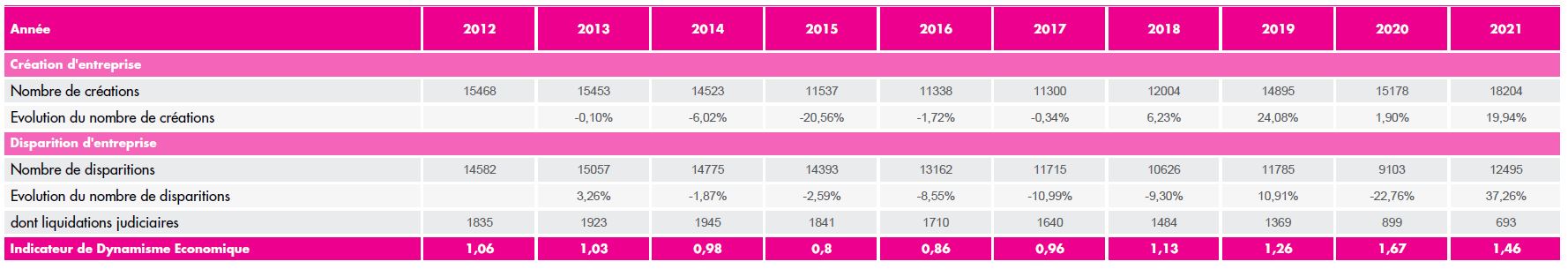

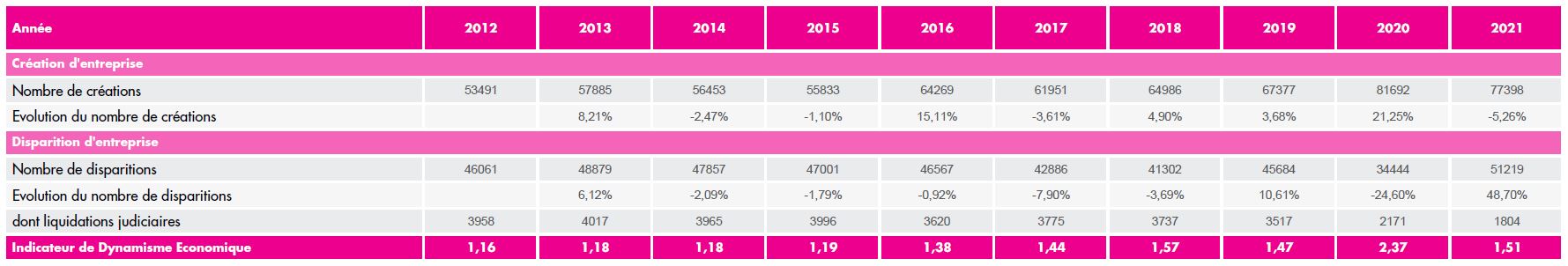

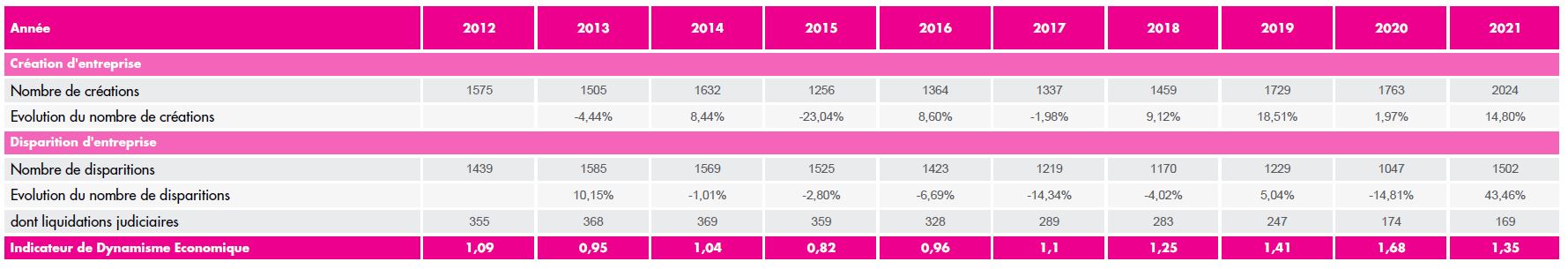

The Building and Public Works (BTP) sector has continued to show excellent entrepreneurial dynamism since 2012. It is the sector of activity where the most companies are created in metropolitan France year after year - 180,400 on average. This sector is particularly popular with micro-entrepreneurs, especially in construction and services. However, there is also a high turnover, with a significant number of cases of insolvency: 13% of the disappearances are the result of judicial liquidations. Over the decade studied, the balance of companies has always remained largely favorable, with an average of 1.5 companies created for every one that disappears, despite a loss ratio higher than the average for all sectors combined.

For the construction and public works sectors, the dynamism has been on the wane over the decade studied, even if, in the end, new companies are replacing those that have left. Over the period, 1.1 companies were created for every one that disappeared.

For upstream and downstream real estate service providers, the period remained strong with a good dynamism, i.e. 2.4 entities created for every 1 disappearance; a dynamism driven by investment in stone (SCI and rental activities), as well as by a significant number of transactions in the former. While with the political deadlines (municipal elections in 2020) and the crisis in Covid-19, new construction has slowed somewhat. Over the recent period, the number of building permits and new housing starts has slowed, resulting in a decline in momentum.

The most sluggish activity is that of building materials (mining, production and trading), where the population of companies has dwindled over ten years, with 0.8 new companies created for every one that disappears. Moreover, the rate of failure is the highest in the entire building and public works sector, with an average of a quarter of the disappearances recorded as judicial liquidations. While the Covid-19 pandemic had a negative impact on mining activities and the production of materials for construction and public works, the context was more buoyant for trade and distribution, with sustained demand for renovation and home improvement work, as well as the "do-it-yourself" phenomenon, particularly during periods of confinement.

For this very disparate sector of activity, the dynamism remains limited: low renewal of the business population, but a loss ratio contained at 12% between 2012 and 2021.

Producers have been wiped out by the rise of imports and "made in China", such as sports articles or games and toys, even if for the latter, the fashion of "made in France" supports the dynamism of the sector in recent years.

At the same time, in the land of luxury, watchmaking, jewelry and body care (perfumery and cosmetics) are keeping their heads above water, with respectively 1.5 and 1.4 companies created for every 1 disappearance.

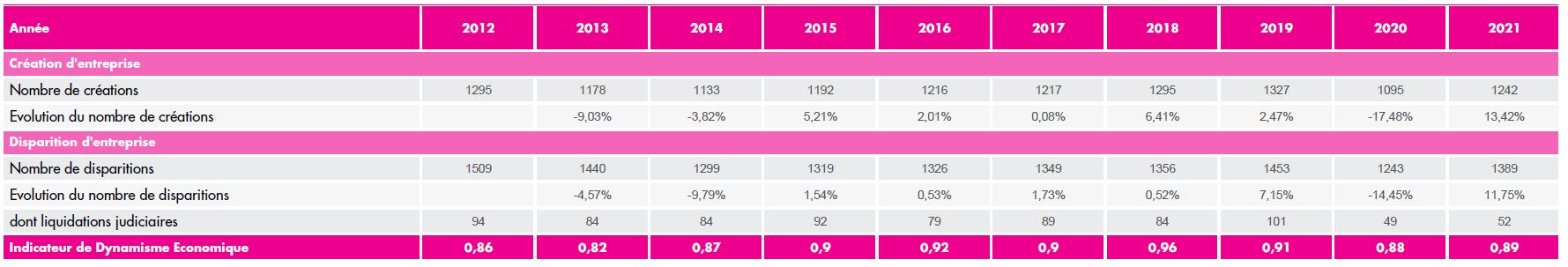

Over the 2012-2021 period, this mature sector sees its business population decline, with 0.9 units created for every 1 disappeared, and a significant loss ratio of 19%.

In a context of household consumption arbitration and pressure of constrained spending, the Household Appliances & Consumer Electronics and Furniture businesses have lost companies to the rise of e-commerce and operator restructuring (takeovers and closures).

Against a backdrop of foreign competition, relocation of principals and low levels of innovation, French industrial capital goods are losing ground and their business population is shrinking. Between 2012 and 2021, only 0.9 entities were created for every 1 disappearance. The loss ratio remains contained at 16% for the time being.

Mechanical engineering is suffering the most, especially due to the crisis in automobile and aeronautical production, leaving many specialized subcontractors out in the cold.

The Measurement & Precision activity, including medical equipment, is renewing its business fabric.

Lastly, the electrical equipment sector is the most dynamic, with 1.2 new jobs created for every 1 disappearance, but with the highest loss rate in the sector (17%).

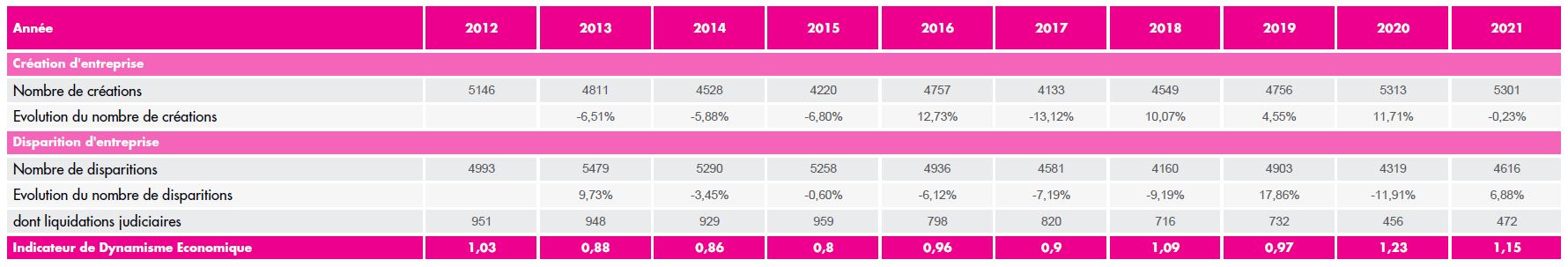

The Wood, Paper and Cardboard sector has remained dynamic over the period 2012-2021, with an average of 1.2 new companies for every one that disappears, and a moderate loss rate (12% of disappearances). The sector is benefiting from ecological pressure (sustainable development, recycling), strong international demand and the growing use of paper and cardboard for e-commerce. Its dynamism remains however very linked to the economic situation (packaging, construction), and to the consumption of paper progressively supplanted by the use of digital technology.

The Covid-19 crisis has led to a sharp drop in demand for graphic paper, as well as problems of supply of raw materials. Fiscal year 2021 has thus been marked by a sharp rise in business closures (+40%).

The Wood and Forestry activities were the most dynamic with respectively 1.4 and 1.8 entities created for 1 disappearance.

Paper & Cardboard (industry and trade) has also resisted, even if it has not created many new companies.

The printing industry is affected by the decline in the press and paper advertising market. It has seen a significant drop in the number of new businesses created between 2012 and 2020. This downward trend has been accompanied by a still significant number of disappearances, with a clear increase in the latter in 2021. In fine, the activity barely maintains its business population over the 2012-2021 period.

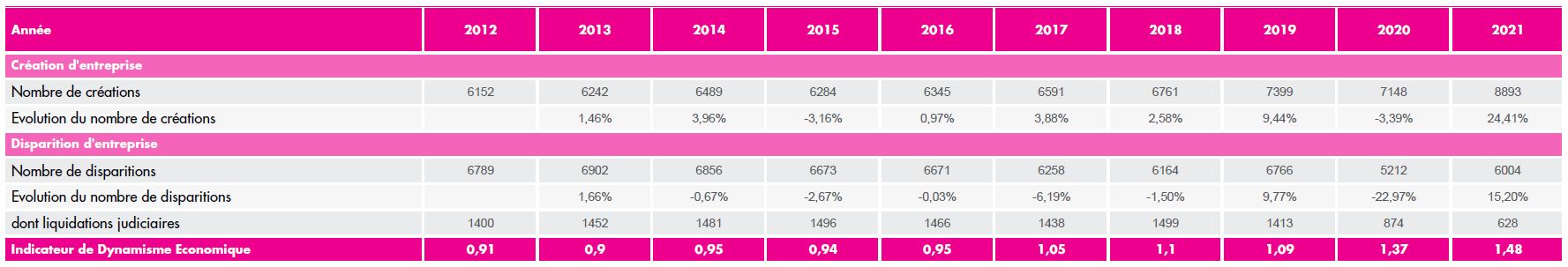

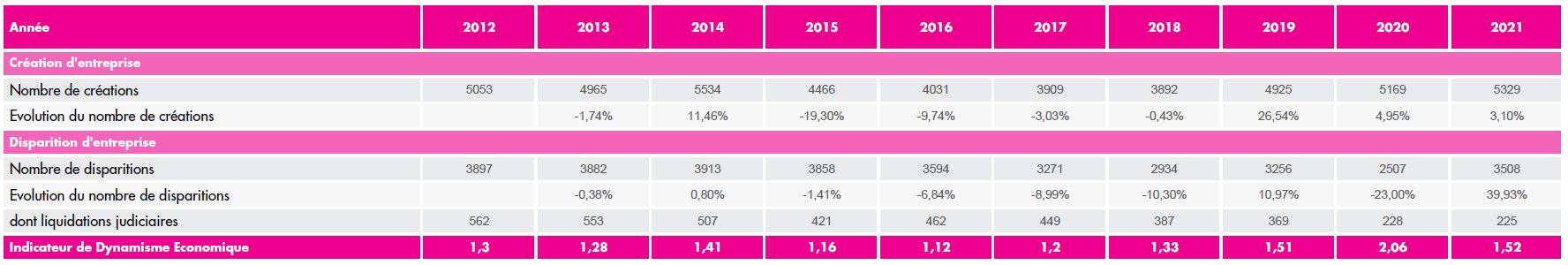

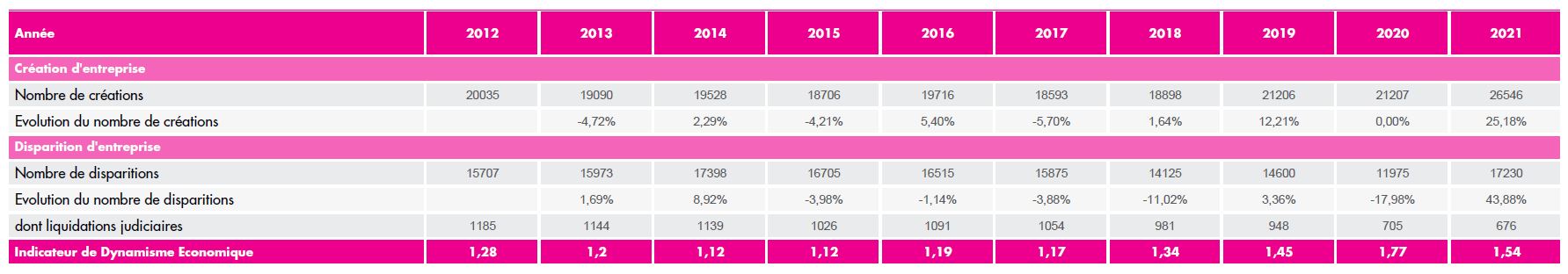

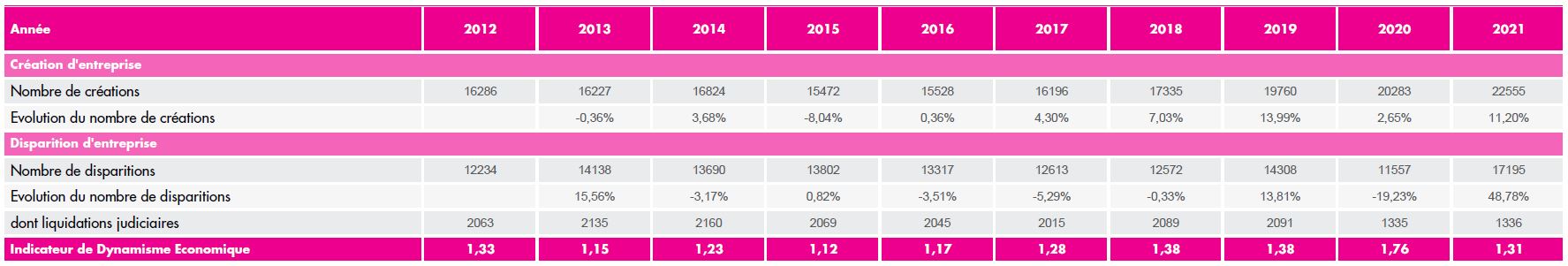

Overall, the retail sector (specialized department stores, food and non-food) has remained dynamic, with an average of 1.3 new stores for every one that disappears between 2012 and 2021, combined with a low level of losses (8% of liquidations among those that disappear). This sector is mature and suffers from strong competition between players, and from the weakening of physical points of sale in the face of the development of e-commerce.

Significant disparities remain, particularly in food distribution. The population of small food retailers such as greengrocers, butchers, bakeries and fishmongers is declining; they are losing business. Fewer businesses are being created than are disappearing.

In non-food retailing, the dynamism is significant, with 1.6 new businesses created for every 1 disappearance, driven by new online retailers. In this sector, which is often driven by self-employed entrepreneurs, the number of losses remains limited, although the number of closures can change rapidly. Thus, at the end of 2021, after two years of crisis, disappearances have increased by 54%.

Finally, the retail sector, whose model is in crisis, is maintaining its development with 1.3 new businesses created for every one that disappears, but with a high loss rate: more than a quarter of the disappearances are judicial liquidations.

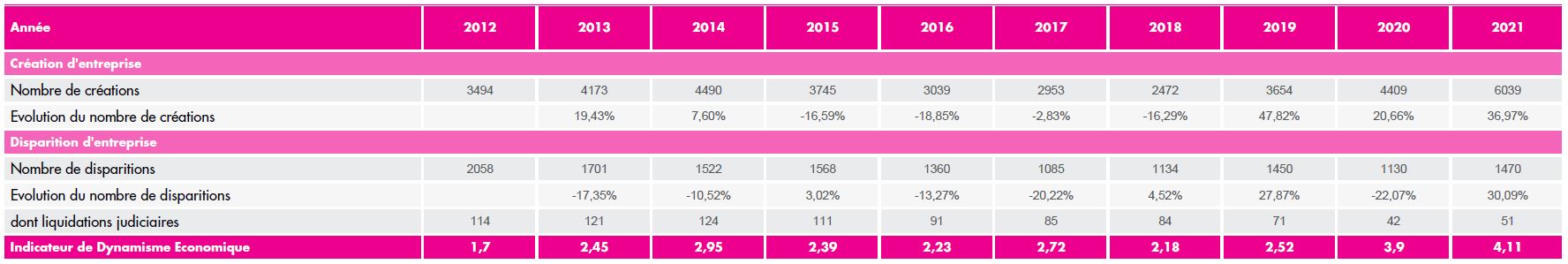

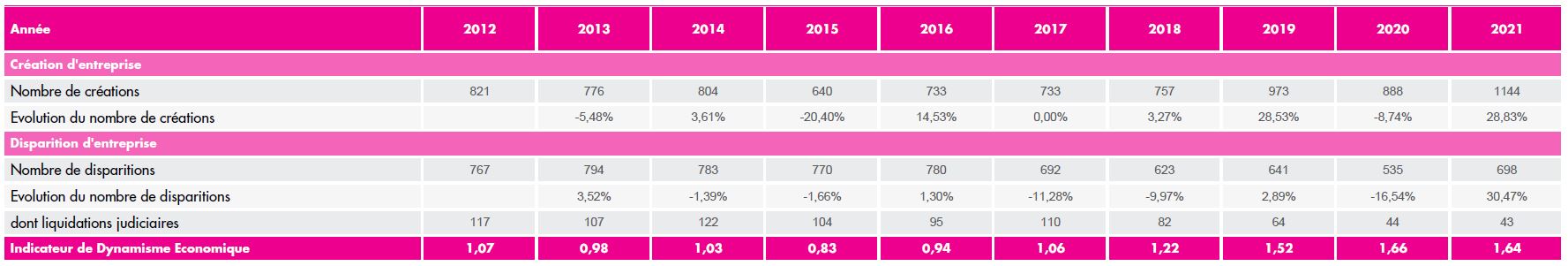

This market, dominated by a few large international groups, is under growing ecological pressure. The "traditional" energy sector - nuclear, coal, oil or gas - must change its model in a context of falling profits, overcapacity and price volatility. Renewable energies (wind, solar and hydraulic), through the multiplication of small players or the diversification of large groups, are ensuring the strong dynamism of the sector, where 2.3 companies are created for every 1 person who disappears. However, high debt, volatile prices and uncertain profitability remain obstacles to their development.

Unsurprisingly, it is the Electricity activity that shows the greatest dynamism. Between 2012 and 2021, an average of 3.6 entities were created for every 1 disappearance.

At the same time, Oil and Hydrocarbons has consistently lost entities, and is not renewing its entrepreneurial fabric over the 2012-2020 period.

Other energy products, including gas and coal, are maintaining their business population for the time being.

The sector continues to be driven by the widespread availability of Internet access worldwide, the innovation brought about by artificial intelligence, connected objects and the 5G technology under development. The pandemic has highlighted the value of remote working in the workplace, for business continuity and productivity gains.

However, the sector is confronted with the maturity of certain markets (tablets, smartphones, PCs), and in the long term, with access to the rare minerals it consumes.

France remains largely outside this scope of activity, except for trade. Few companies in metropolitan France are manufacturers of computer and electronic equipment. The crisis of components in the industry was a sad illustration of this.

The dynamism allows the maintenance of the business population. However, the Electronic Components activity is sluggish, generating very few creations, and presenting a constantly decreasing business population.

The IT sector is more representative in number and more dynamic with 1.3 new companies for every one that disappears. This activity is driven by service providers and software development (games).

Overall, the Media & Leisure sector has remained very active over the decade studied, with an average of 1.8 new businesses for every one that disappeared. It also has a limited number of losses, with only 7% of liquidations in the number of company disappearances. The media (press, television and radio) remain very dependent on the advertising market and advertisers. They have also been challenged for several years by the Internet and new entrants (streaming platforms), as well as in their content and their audience (young people in particular). TV and traditional press audiences are on the decline.

In this context, the concentration of operators has accelerated within capitalist groups, calling into question their plurality and independence.

For the entertainment and recreational activities, the health crisis was an economic shock for many stakeholders, bringing to a partial or total halt an entire section of the entertainment and leisure park world. However, the "dynamism" remained high: 2 creations for 1 disappearance, supported by the registration of many artists and sports professionals in individual companies.

Music, film and television production is also holding up well, with 1.8 new jobs created for every one that disappears, mainly in film production and related services, against a backdrop of the arrival of new pay-TV platforms.

The Press & Publishing activities are the least buoyant. They are just renewing their population of companies, 1.2 creations for 1 disappearance. Paper publishing is suffering the most while purely internet content is developing.

In a context of deindustrialization of the territory, which has led to a decline in French production of metallurgical raw materials, the metals sector remains relatively undynamic and unattractive, and the number of new businesses is still limited. The population of companies in the Metallurgy and Iron and Steel sectors continues its slow decline, generating almost no new entrants, with a significant level of unemployment between 18 and 20%.

Metalworking (transformation and technical parts) is still active, and maintains its entrepreneurial population, but the difficulties encountered by its clients, including the automotive industry, have generated a significant level of claims of 22%.

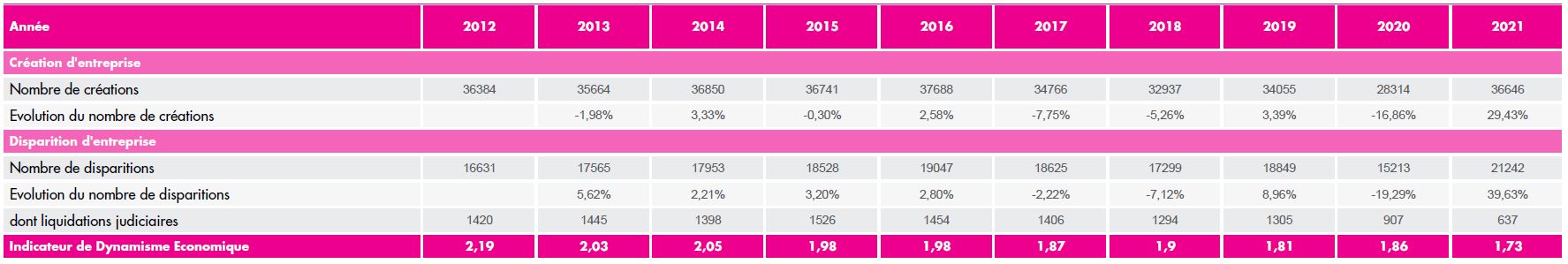

The Means of Transport sector (construction and distribution) remains dynamic despite the ecological transition, which it is experiencing more than it is supporting, particularly in the automotive sector.

The automotive sector, along with production and trade, remains the most active activity in terms of the number of new businesses. It is thus renewing its entrepreneurial population with, between 2012 and 2021, 1.3 creations for 1 disappearance. Recently, the effects of the Covid-19 crisis have been significant, with the shutdown of production lines, also caused by the lack of components, and the reduction in the number of units produced. In the context of the transition to electric vehicles, further restructuring on the part of manufacturers could further affect the dynamism of the automotive business.

The aeronautics and space industry is economically significant, with two national champions with an international presence (Airbus and ArianeGroup). However, the aviation segment is experiencing an air pocket with the Covid-19 epidemic, which has grounded the aeronautics sector for nearly two years. The space sector is facing the arrival of new American competitors. Highly capital-intensive and labor-intensive, this activity does not generate many new companies, even if it does manage to renew its population. It also has the highest loss ratio in the sector, at 16%.

Lastly, shipbuilding, where new businesses are still limited, has benefited from the demand for pleasure boating and cruising, as well as for military vessels, while the fishing industry is suffering. This activity remains globally dynamic and succeeds in renewing its entrepreneurial fabric, year after year.

The pharmaceutical sector, locked in by a legal and administrative straitjacket (numerus clausus, drug price controls), is not very active in terms of the number of new companies created. It is gradually losing entities over the decade studied.

In the pharmaceutical industry, activity is largely concentrated around a national champion and a few specialists. The manufacture of basic products has been largely delocalized, making France dependent on Asia (India and China). Market entry remains difficult both in terms of regulations and capital requirements. In fact, business start-ups are very limited, and recent regulatory changes have weakened certain specialists, including those in homeopathy.

On the distribution side, the most significant movements are on the pharmacy side. The number of operators and businesses is gradually decreasing, a situation that benefits the growth of multi-site pharmacy groups.

For wholesalers and distributors, the dynamism remains limited to the simple renewal of the business population, in a market that is highly regulated by regulations unfavorable to commercial margins. This sector also has a high loss ratio (15%).

Like the Metals sector, the Mineral Products and Chemicals sector generates low company movements - few entrants and few exits - The company population thus remains stable over the 2012-2021 period.

The Ceramics activity, technical or utilitarian, appears to be the most active in terms of number of companies. Nearly 2 companies are created for every one that disappears; the number of claims is very limited.

Next come Chemicals and Plastics & Rubber, activities largely marked by relocation. These two activities have not been able to renew their business population over the decade, and have high levels of claims, respectively 14 and 20%.

Finally, the Glass activity, limited in new entrants, just maintains its population of economic actors.

Unavoidable but sensitive to the economic situation, the Business Services sector is one of the most active in terms of the number of companies after the Building and Public Works sector; this allows it to renew its population with 1.3 companies created for every one that disappears, all with a low level of unemployment (6%).

Legal, accounting and management activities make the largest contribution in numerical terms. A stable base that generates a satisfactory renewal with a low level of judicial liquidation.

For their part, Advertising and Communication also remain dynamic activities, even if in recent years the advertising and events market has suffered the effects of various crises, and in particular the most recent one of Covid-19.

Finally, the temporary employment business, although largely concentrated around a few international players, continues to attract new entrants, both in the niche and on the new Internet media. It has a good dynamism index of 1.6 but remains competitive, and in the front line for absorbing economic shocks. The loss ratio is significant at 12%.