Among the various schemes used, the Ponzi scheme remains one of the most famous and pernicious. Named after Charles Ponzi, the swindler who brought it to prominence in the 1920s, it continues to flourish in various forms, seducing investors with promises of unrealistic returns. In this article, we take an in-depth look at how the Ponzi scheme works, its underlying mechanisms and the crucial lessons to be learned.

Let's take an example:

You invest €1,000 in an investment offered by Luc, a fraudster. After just one week, you receive a cheque for €100 from Luc, who explains that this is the income generated by your €1,000 investment.

Unfortunately, in reality, no return was made on your €1,000. In fact, Luc used part of your investment to pay you €100 in fake "profits". By doing so, he hopes you'll invest more in the investment or convince others to invest in it. So Luc spends a good part of the money you pay him himself.

The foundations of pyramid fraud

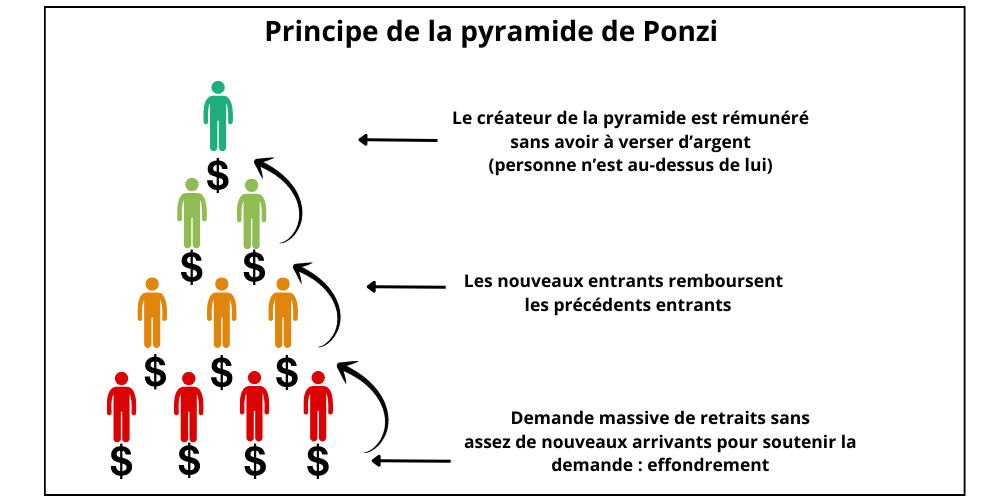

Pyramid schemes are based on a simple, deceptive scheme. First-time investors are remunerated with funds brought in by new investors, creating the illusion of lucrative returns. Fraud promoters encourage investors to recruit more participants, promising high returns or financial rewards in return. The system inevitably collapses when the flow of new investments can no longer offset payments to existing investors.

Source Google

What is a giving circle?

We offer you the chance to join a self-help, sharing, insider or privileged group. To become a member, you need to make a donation, say €5,000. In return, you could receive a much larger sum by recruiting participants. But beware! This approach can be a scam.

A giving circle is a pyramid scheme. It's illegal to take part. The person offering you to take part is often someone close to you, and may be part of a group active on the web or in certain networks. They may not tell you right away that you'll need to recruit members in order to pocket large sums of money. She'll start by seducing you with a project that might interest you. Then she'll dangle the prospect of a financial "bonanza" in front of you.

Giving circles can take many forms, depending on the imagination of the malicious initiators. For example, circles can look like an investment or charity project, or offer the chance to become your own "boss". They can go by many names, such as "gift circle", "dinner with the girls", "birthday gift", "cloud gift" and so on.

Despite the claims of the promoters, and even if the group's amusing name hides the scheme well, giving circles are indeed pyramid schemes.

Characteristics of a Ponzi scheme

A Ponzi scheme has several key characteristics:

- Unrealistic returns: promoters promise extraordinary returns, often well above those of traditional investments, to attract new investors.

- Lack of transparency: details of how returns are generated are often vague or non-existent, concealing the true nature of the scheme.

- Continuous recruitment: investors are encouraged to recruit new participants to keep the system afloat, creating a pyramid structure.

- No real product or service: unlike a legitimate investment, a Ponzi scheme is not based on the creation of value or the provision of tangible goods or services.

The disastrous consequences

When a Ponzi scheme collapses, the consequences are devastating for investors. Funds are usually lost, and those who recruited other participants may face legal liabilities. What's more, the economic impact can be widespread, undermining confidence in the financial markets and resulting in losses of millions or even billions of euros.

Beware of the following situations

Potential revenue is based solely on member recruitment. This is illegal. This is a pyramid scheme. Not only is it illegal to implement this kind of scheme, it's also illegal to participate in it!

- You're promised big profits with little effort. It's too good to be true.

- We encourage you to use a pseudonym to participate.

- We ask you to pay in cash.

- We urge you not to let this opportunity pass you by.

- We play on your feelings.

Pyramid schemes remain an ever-present danger. By understanding its underlying mechanisms and remaining vigilant, investors can protect themselves against such scams and help prevent their spread. The key is undoubtedly education, transparency and effective regulation, ensuring the integrity and confidence of the world's financial markets.