Les comportements de paiements

AVIS DE NOTRE EXPERT

“La détérioration progressive du retard de paiement moyen, mois après mois, est un signal évident de tensions de trésorerie, voire d’une potentielle défaillance. Dans une logique de gestion du risque crédit client en B2B, l’évolution des retards de paiement moyens est donc un indicateur significatif et pertinent, notamment pour les Grandes Entreprises (GE), les Entreprises de Taille Intermédiaire (ETI), et les Petites et Moyennes Entreprises (PME).”

— Mikaël Delaporte, Chargé de collecte de données chez Ellisphere

Comportements de paiement par secteur d’activité

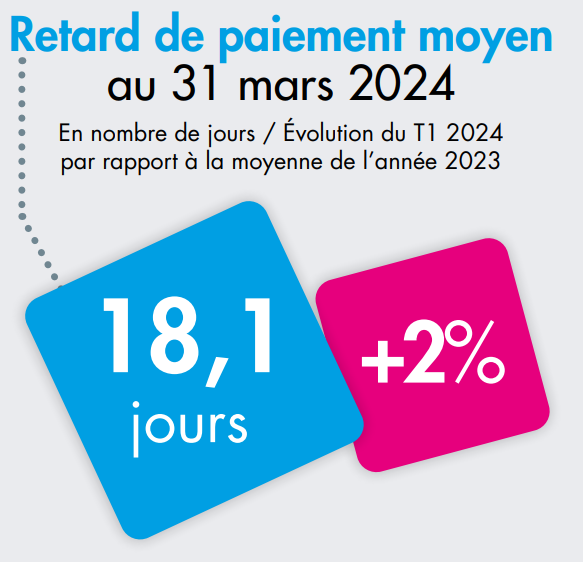

Après une année 2023 plutôt positive en matière de retard de paiement, un dérapage est noté sur le 1er trimestre 2024. Les plus fortes détériorations sont constatées dans les secteurs de l’Energie, des Arts & Spectacles ainsi que des activités Hébergement et Restauration. Concernant le secteur de la Construction, une faible amélioration est enregistrée. Toutefois, le secteur accuse, et de loin, le retard de paiement moyen le plus élevé. Avec le retard de paiement moyen le plus faible (11,7 jours), le Commerce enregistre quant à lui une détérioration de +4% de son retard de paiement moyen sur ce début d’année 2024.

Focus sur un secteur d’activité, Transports & entreposage : le délai de paiement moyen du secteur est l’un des moins bons (10,05 jours vs 5,46 jours tous secteurs d’activité confondus). Cependant, le retard de paiement moyen est sensiblement meilleur que celui de l’ensemble des secteurs (16,41 vs 18,12 jours). Par ailleurs, 62% des entreprises du secteur paient majoritairement leurs factures à échéance. Malgré un délai de paiement moyen plutôt négatif, le retard de paiement moyen du secteur est dans la moyenne ; les habitudes de paiement du secteur sont également plutôt positives.

Habitudes de paiement

Coté habitudes de paiement, on constate que le pourcentage des plus petites entreprises payant globalement à échéance diminue. Le pourcentage des TPE et PME payant à échéance se détériore de presque 1 point sur le 1er trimestre 2024. Cette détérioration des habitudes de paiement se reporte vers la part des retards légers de 1 à 30 jours (+1,77 point). Du coté des ETI et Grandes Entreprises (GE), une légère amélioration des habitudes de paiement est enregistrée. Cependant, ces catégories restent, de loin, les moins rigoureuses dans le respect de leurs échéances, puisque les deux tiers de ces entreprises règlent habituellement avec un retard léger de 1 à 30 jours. Ces retards même légers ont un impact très négatif sur les petites structures. En effet, leurs liquidités sont généralement réduites, ce manque de trésorerie peut les conduire à s’endetter pour financer une activité courante, voire à terme menacer leur pérennité.

L'indice de dynamisme entrepreneurial des sociétés commerciales en France

AVIS DE NOTRE EXPERT

" En France pour l’année 2023, l’Indice de Dynamisme Entrepreneurial d’Ellisphere (rapport entre les créations et disparitions d’entreprise) calculé pour les sociétés commerciales est de 1,4 contre 1,6 en 2022, et 1,7 en 2021. A fin février 2024 sur 12 mois glissants, l’indice est toujours de 1,4. Toutefois, les prévisions d’Ellisphere pour l’année en cours confirment une poursuite de l’évolution baissière avec un indice probablement à 1,3 en fin d’année ; nous retrouverions ainsi le niveau de… 2019. "

— Alain Luminel – Responsable du pôle expertise financière chez Ellisphere

Baisse des créations conjuguée à l’augmentation des disparitions d’entreprise

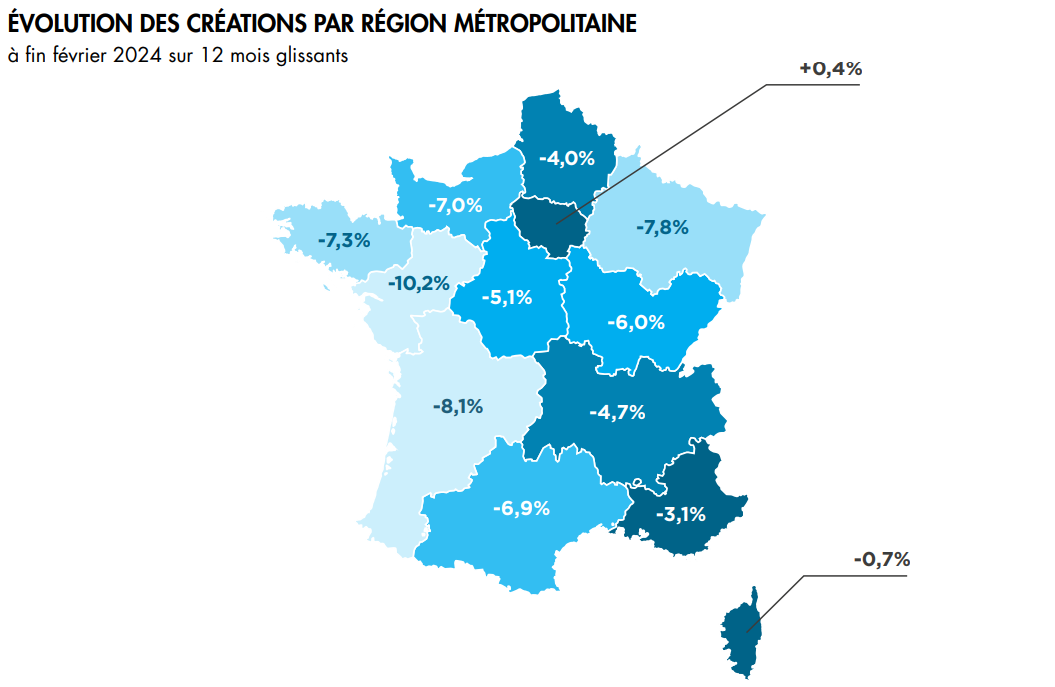

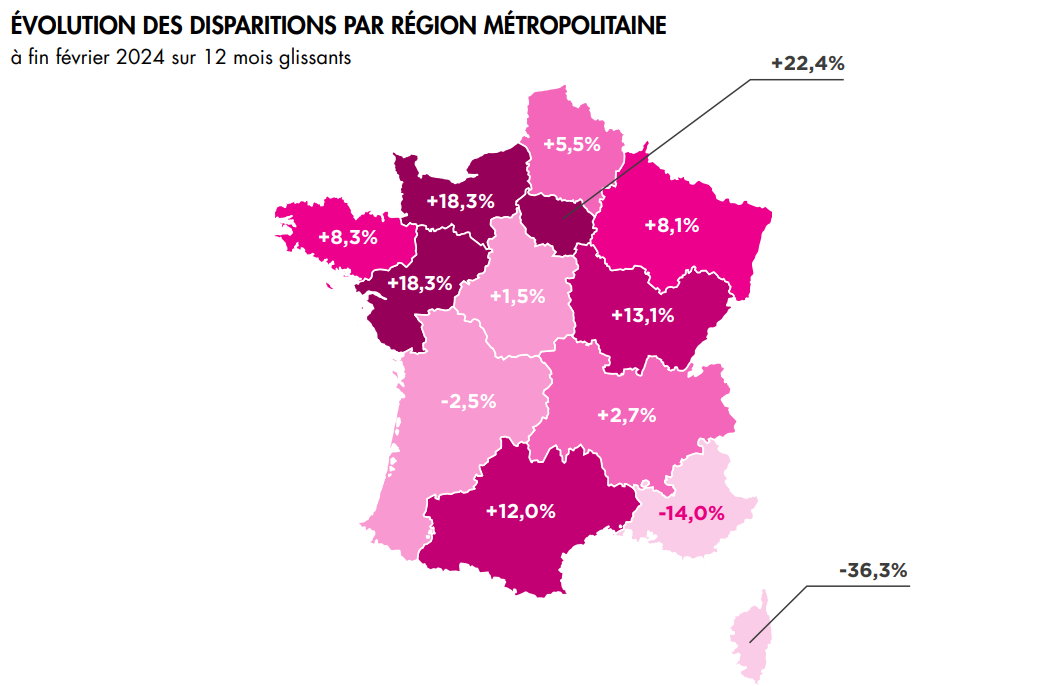

Le faiblissement continu du dynamisme entrepreneurial cache une autre réalité plus inquiétante : l’augmentation progressive des disparitions de société commerciale. Près de 192 397 entreprises disparaissaient en 2023 ; à fin février 2024 sur 12 mois glissants, ce chiffre est passé à près de 199 000, soit +8,5% d’entités concernées. Deuxième constat qui interroge, 22,5% de ces disparitions à fin février 2024 sont le fait de liquidations judiciaires, contre 22,3% à fin 2023. Il s’agit ici du plus mauvais résultat enregistré depuis 2015. Parallèlement à l’augmentation significative du nombre de disparitions, le nombre de créations de sociétés commerciales continue de baisser, soit -3,9% à fin février 2024 (contre -5,3% fin 2023). Ce résultat est toutefois à nuancer au vu du nombre de créations particulièrement élevé en 2021 et 2022. Ces deux dernières années, la baisse de l’Indice de Dynamisme Entrepreneurial est donc essentiellement portée par l’augmentation très significative des disparitions d’entreprise.

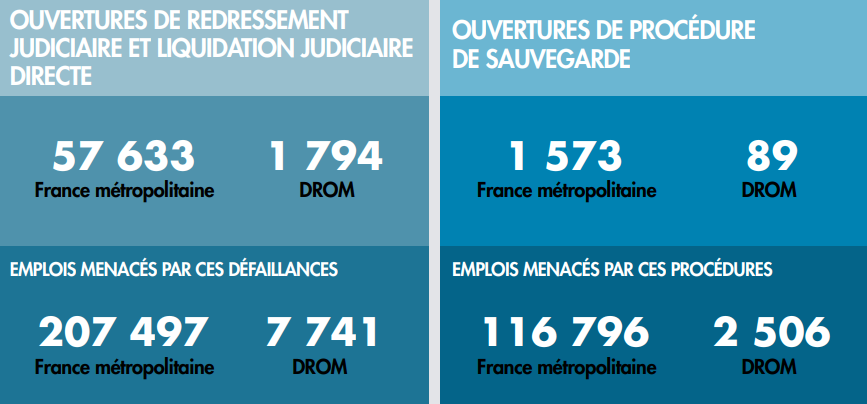

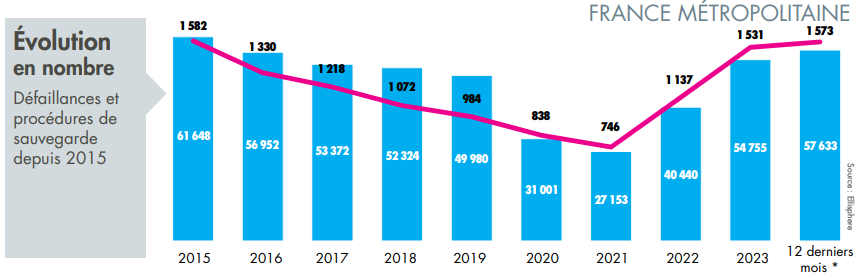

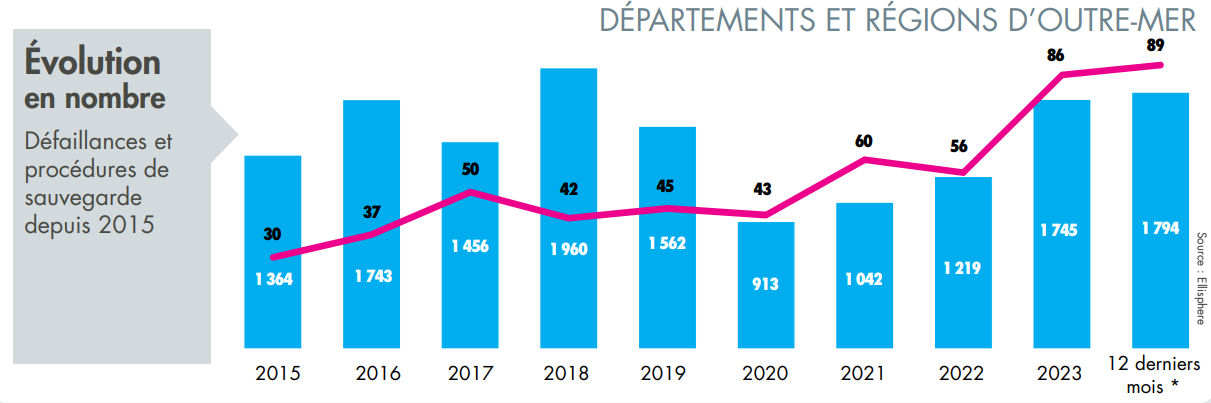

Procédures collectives au 1er trimestre 2024

L’année 2023 marque un tournant économique majeur pour les entreprises : hausse des taux d’intérêt, ralentissement économique, remboursement des PGE… Alors que l’environnement inflationniste génère peu de croissance et altère la trésorerie de nombreuses entreprises. Le nombre de défaillances d’entreprise a donc – sans surprise – fortement augmenté, après une période très atypique articulée autour d’un arsenal économique et juridique (le « quoi qu’il en coûte ») qui, s’il a évité une vague de défauts, a brouillé considérablement l’interprétation de l’évolution des défaillances jusqu’à aujourd’hui… A fin mars 2024, sur 12 mois glissants, 57 633 défaillances (redressements judiciaires et liquidations judiciaires directes) en France métropolitaine sont enregistrées, soit près de +29%. Dans le même temps, les Départements et Régions d’Outre-Mer (DROM) subissent une envolée des défaillances de +39%, soit 1 794 entreprises concernées.

Analyse régionale

La remontée du nombre de défaillances est toujours inégale selon les régions. Sans surprise, nous retrouvons le trio habituel de tête à savoir l’Ile-de-France, suivie de l’Auvergne-Rhône-Alpes et de PACA. La 1ère enregistre 23,4% du total des défaillances, et 12,3% pour Auvergne Rhône-Alpes. Les territoires les plus épargnés semblent être les moins dynamiques économiquement (Lorraine, Basse-Normandie, Bourgogne, Limousin). Les disparités territoriales peuvent également s’interpréter par les différents degrés de recouvrements des Urssaf et également bien entendu, par les spécificités sectorielles propres à chaque département. Dans ce contexte, la Corse enregistre une explosion du nombre de défaillances sur un an : +48,4% ; évolution somme toute à relativiser compte tenu du faible nombre de structures concernées, à savoir 417.

Dans les DROM, le nombre de défaillances a progressé excepté en Guyane (-18,5% sur an) et surtout Mayotte (–32%). Un petit mot sur ce 101ème département français, au sein duquel, globalement, l’économie est dépendante à près de 55% de la valeur ajoutée publique. L’île subit tout à la fois une crise migratoire hors normes aggravée par les pénuries d’eau, les problèmes de sécurité et une démographie incontrôlée ; autant de problèmes structurels qui rendent son économie anémique. La situation y est explosive et là encore, dans ce contexte, la baisse du nombre de défaillances est clairement à relativiser.

AVIS DE NOTRE EXPERT

"Le prix du pétrole a connu une hausse de +9,23% depuis le début de l’année 2024 tandis que le prix des carburants est aujourd’hui largement plus élevé que lors du début du mouvement des gilets jaunes (mi-novembre 2018) lorsqu’il atteignait 1,47€ pour le gazole et 1,46€ pour le SP95. Aujourd’hui, nous en sommes respectivement à 1,81€ et 1,92€, sans être pour autant à l’abri de nouvelles tensions qui pourraient apporter leurs lots de dégradations d’activité, de pertes de chiffre d’affaires et donc potentiellement de nouvelles défaillances…"

-Max Jammot Responsable du pôle économique chez Ellisphere