Our promise

Peaceful decision making

Revolutionize your credit management policy with Ellipro. Our risk management platform allows you to make the right decisions quickly and easily. With our state-of-the-art technology and expertise, you have reliable information to minimize the risk of non-payment and optimize your cash flow.

With Ellipro, you benefit from a personalized approach to effectively manage your customer portfolio and ensure the sustainability of your business. Don't let credit risks jeopardize your business, discover the benefits of Ellipro now!

Our proposal

Quality information for your operational staff

Ellipro is a credit management solution designed to help credit managers improve their customer portfolio management and reduce credit risk. The benefits of the Ellipro solution for credit managers include:

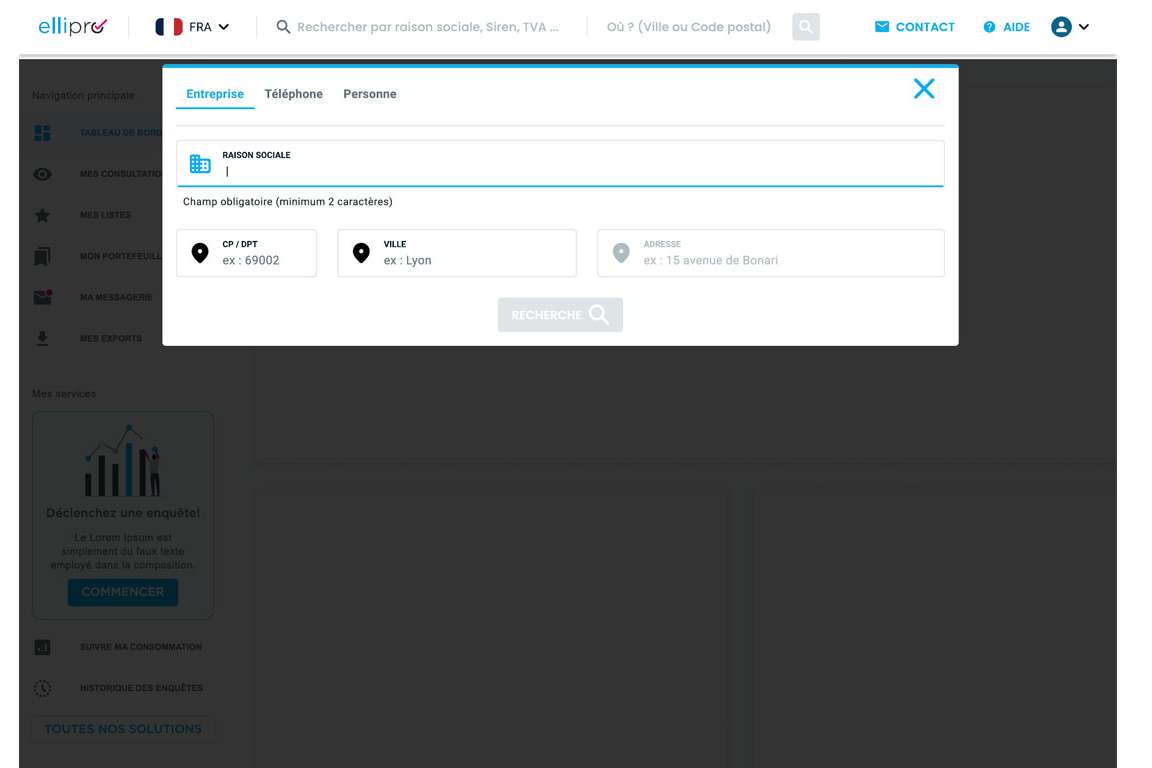

An international database

Access real-time, reliable information on 250 million companies and their executives from over 230 countries.

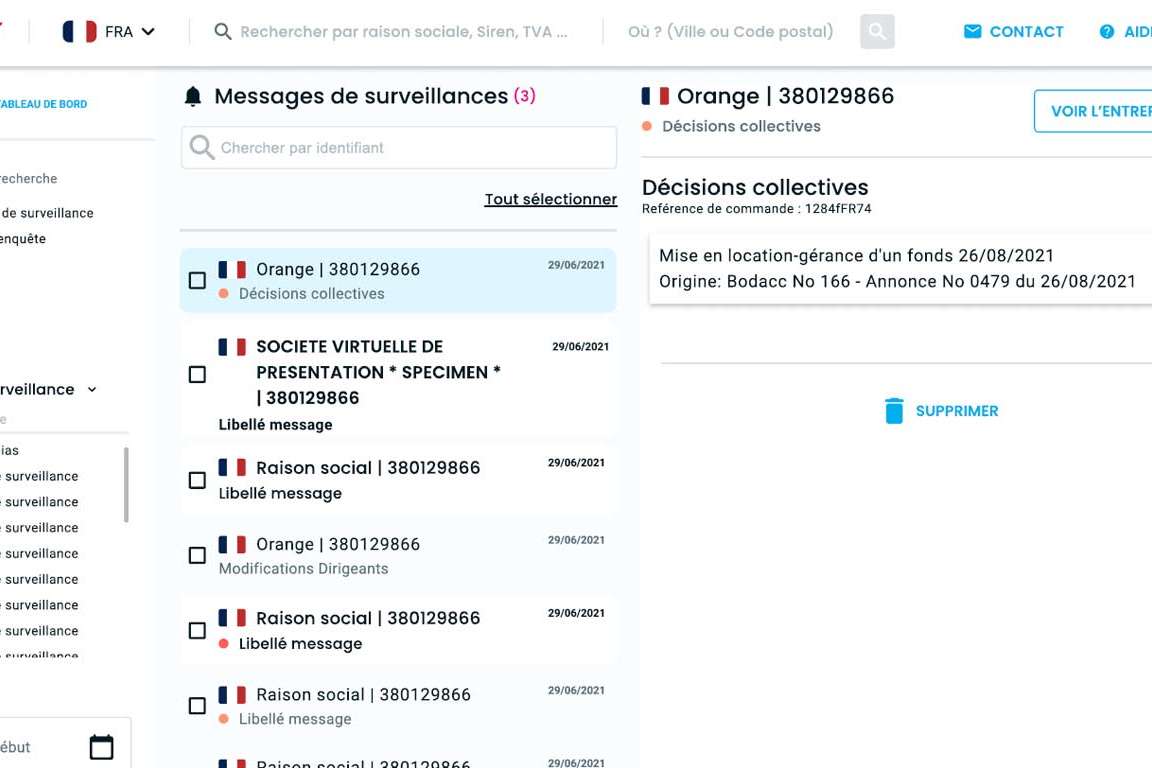

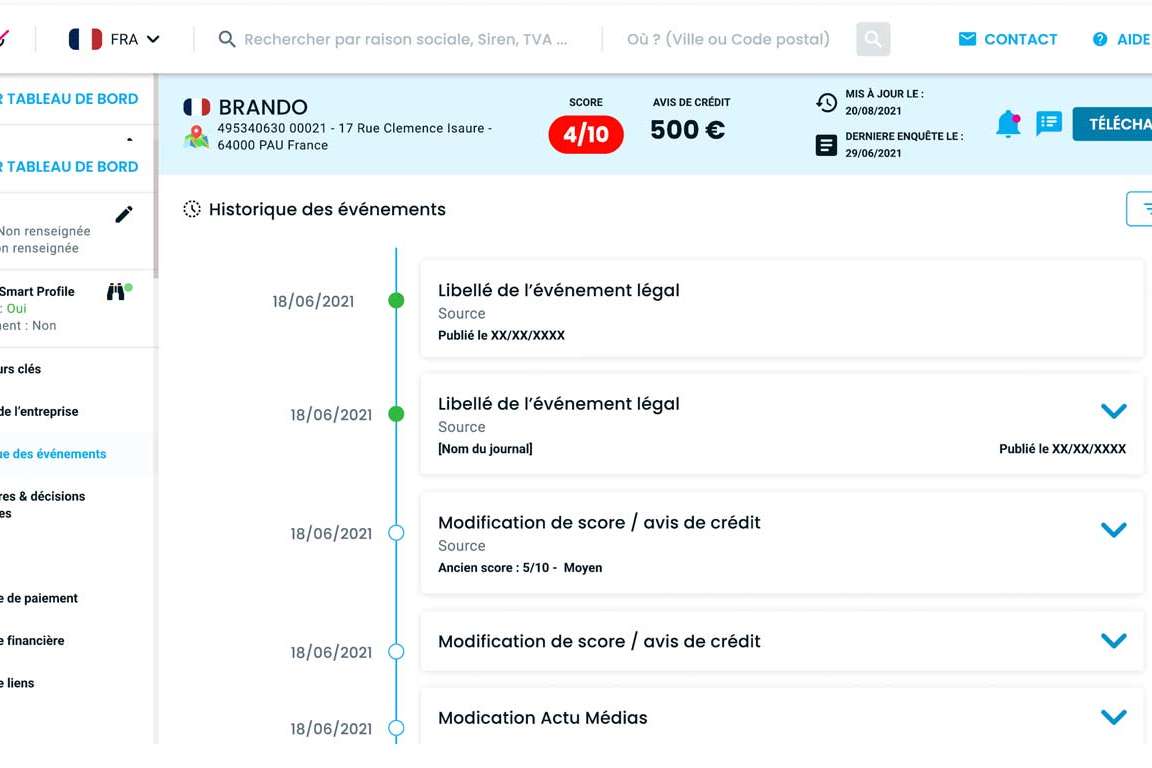

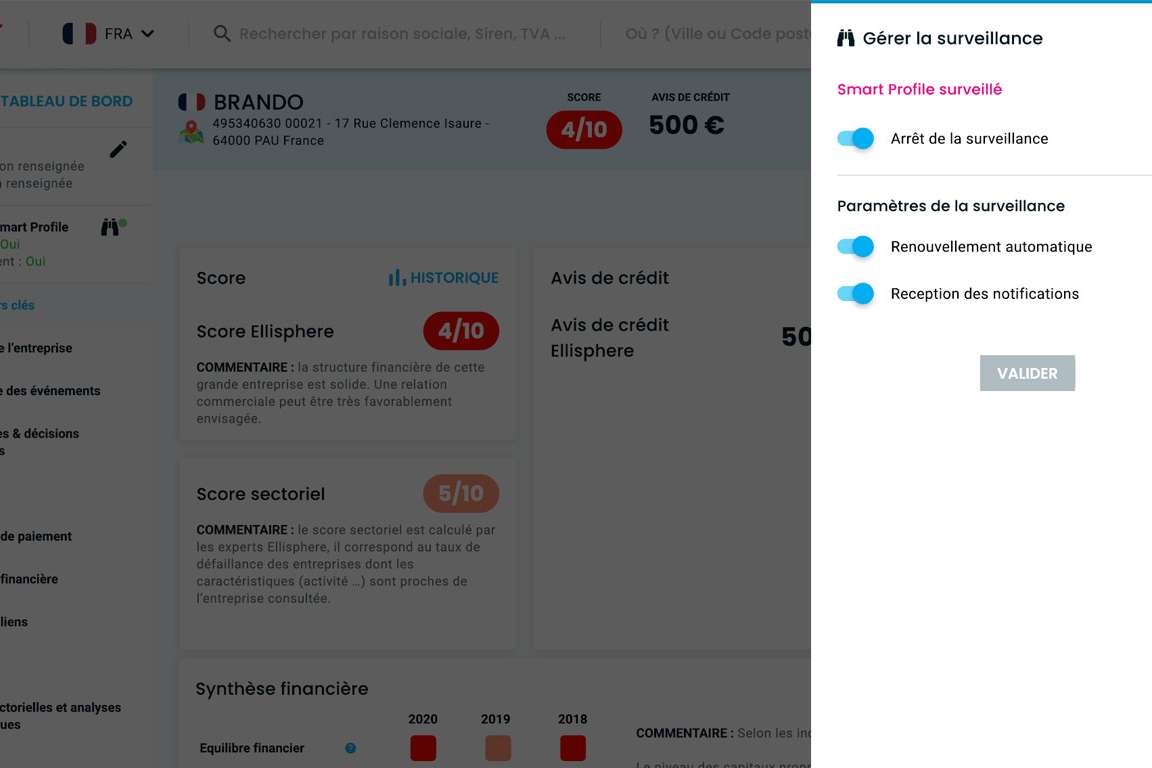

Real-time monitoring

Follow the events of the companies in your ecosystem with customizable e-mail alerts.

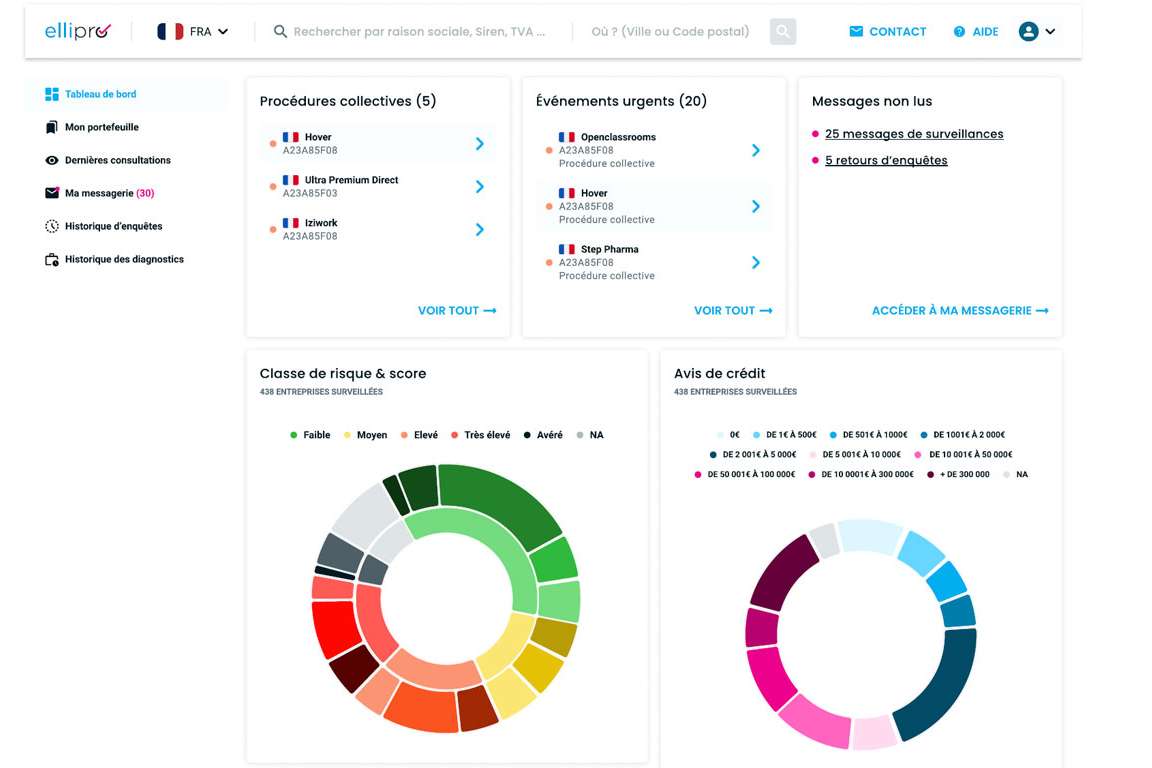

A personalized dashboard

Pilot your credit management actions more efficiently through an analysis and decision support tool.

Our strengths

A platform that meets your needs

Intuitive

A simple interface with an intuitive path that allows you to efficiently assess the risk level of your client/supplier portfolio.

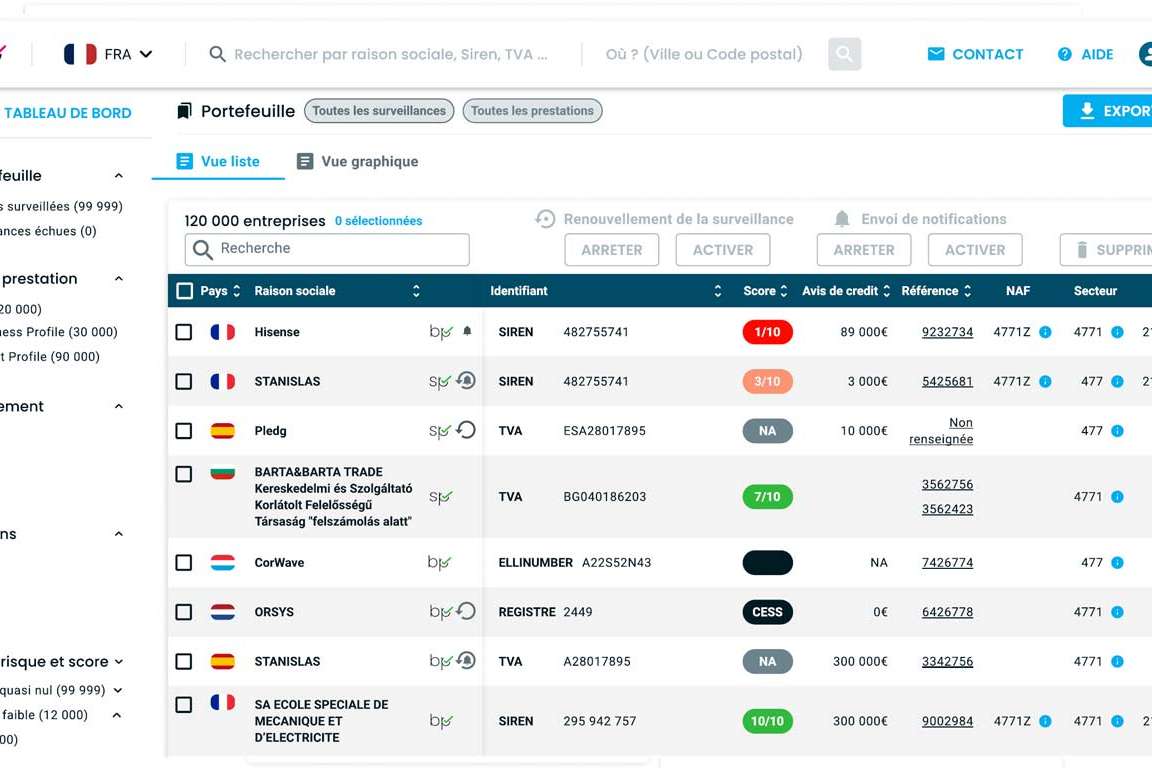

Customizable

Parameterization and customization at the heart of your user experience, to adapt to your different needs.

Innovative

Personalized support for the implementation of the solution in your organizational, technical and technological environment.

Indicators adapted to your decision making

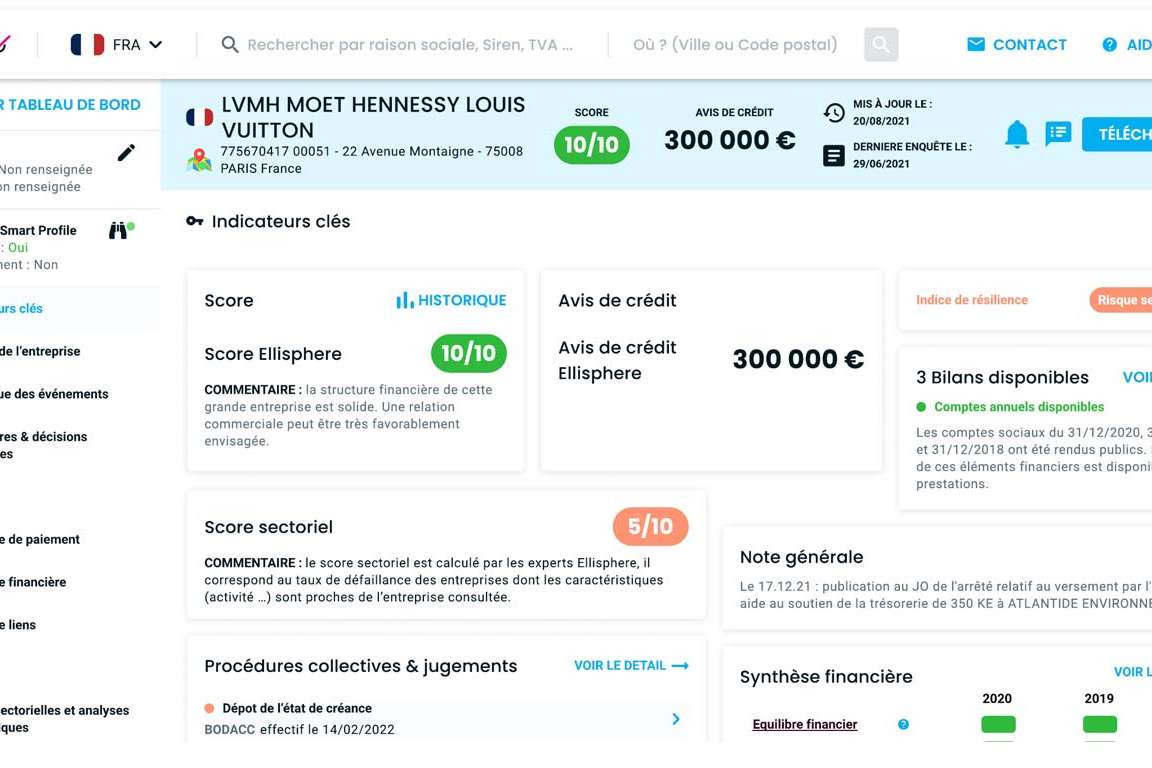

Failure score

The corporate failure probability score measures the risk of a company's failure over various time horizons. It is based on various indicators calculated using a machine learning model.

PayTREND

The PayTREND index aims to detect weak signals of payment behavior. It reflects a number of days of late payment that assesses the quality of companies to pay on time.

Resilience Index

An index that measures a company's ability to withstand economic and financial shocks, based on a statistical analysis of various financial and sectoral indicators.

Credit advice

It recommends a maximum amount outstanding to safely accept a customer by granting an adequate payment term.

Financial analysis

It assesses risks and opportunities by studying specific financial ratios on the solvency and profitability of the company.

Capital links

Ellisphere's solution offers a visualization of data on a company's subsidiaries and shareholders, completed with information on group membership.

"With Ellipro, you can calmly manage your customer accounts on a daily basis thanks to quality indicators that are updated in real time. "

- Sandrine Chardenon, Product Marketing Manager Risk Management

Request a demo now!

To learn more about Ellipro, contact us for a demonstration by our experts.

In accordance with Articles 48 and following of Law No. 78-17 of January 6, 1978 amended in 2018 relating to data processing, files and freedoms, any individual may obtain access, rectification, deletion, limitation of processing, opposition, or portability of personal data concerning him or her by contacting: ELLISPHERE - Relation Client - Immeuble le Murano - 37 rue sergent Michel Berthet - CS 99063 - 69255 LYON Cedex 09 - E-mail : hotline-information@ellisphere.com

To know more about the management of your data and your rights, please consult our personal data protection policy, click here.