Risk can be defined as any event whose occurrence affects the ability of an organization to achieve its objectives. We can classify them into risks

- Internal, related to decisions made by the organization.

- External, related to hazards, time or regulations

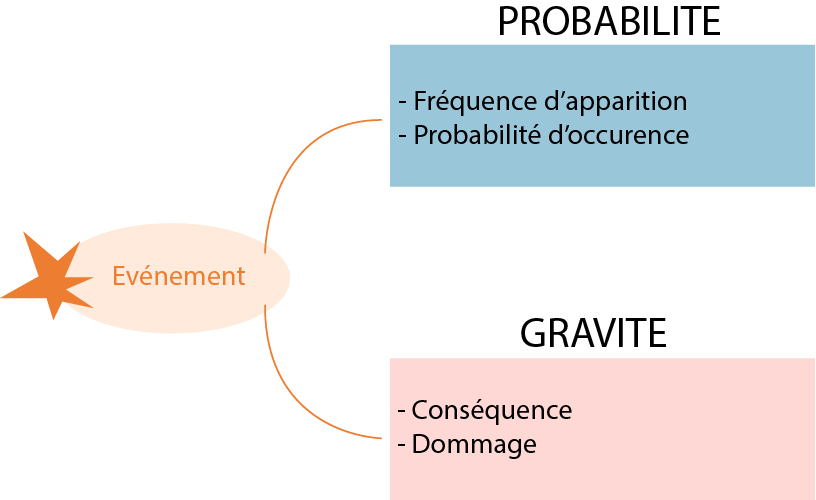

Their appearance is a combination of occurrence expressed around the severity, probability and frequency. Each company faces risks in its management linked to the development of its activity. The risk manager is the person who identifies those that threaten his organization and seeks to prevent them. When there is a high probability of this happening, he must prepare a response.

Interconnected, risk management is the use of processes, methods and tools.

In order to better manage risks, their identification starts with an analysis of strengths and weaknesses, i.e. a SWOT analysis (Strenghts, Weaknesses, Opportunities, Threats) completed by a mapping. The latter indicates the existing links between the major problems and the company's objectives, which are formalized in three stages around :

- Investigation, to determine the potential risks by classifying them according to their importance.

- Evaluation, to measure their severity, their impacts and the damage they can cause

- The implementation of solutions to limit the impacts or simply eliminate them.

This process must be complemented by regular monitoring to control the impact on the business.

Risks to be taken into consideration by companies

The purpose of the business risk review is to enable organizations to face, with lucidity and maturity, the threats of today and tomorrow without avoiding them. Without being exhaustive, the main categories of risks that they must take into consideration are :

| Internal | Strategic | Non-compliance with legislation, technological obsolescence... |

| Financial | Financing of activities, customer counterparty risk, solvency - supplier sustainability, fraud, cash flow, foreign exchange risk, etc. | |

|

Operational |

Recruitment, supply chain, accounting controls, information systems, market evolution, business interruption, health, cybercrime, data theft, supplier dependency, quality of governance and toxic relations between staff, social climate within the company... | |

| External | Regulations and standards | New regulations and policy changes, GDPR, compliance, SRI... |

| Financial markets | Economic environment, instability of commodity markets... | |

| Evolution of the environment | Unpredictable natural disasters, environmental risks, the arrival of a new competitor or a new technology, unpredictable politics, globalization... |

Certainties shaken by sometimes unpredictable scenarios

In an increasingly connected world and faced with a multitude of new risks including health risks, natural disasters, climatic hazards, supply, global market conditions, regulatory changes, reputational damage, geopolitics, ... Companies must in a complicated market

- Invest in risk management and analyze the strength of their business model while remaining optimistic

- Expand their capacity to manage these new risks and adopt a proactive and global approach to better understand their weaknesses in order to anticipate and resolve them

Thus, companies and individuals will emerge stronger and more resilient, emphasizing adaptability.

Below is the 10th Allianz 2021 Risk Barometer on France where cyber incidents, business interruption and pandemic are the top three business risks, all closely related in 2021.