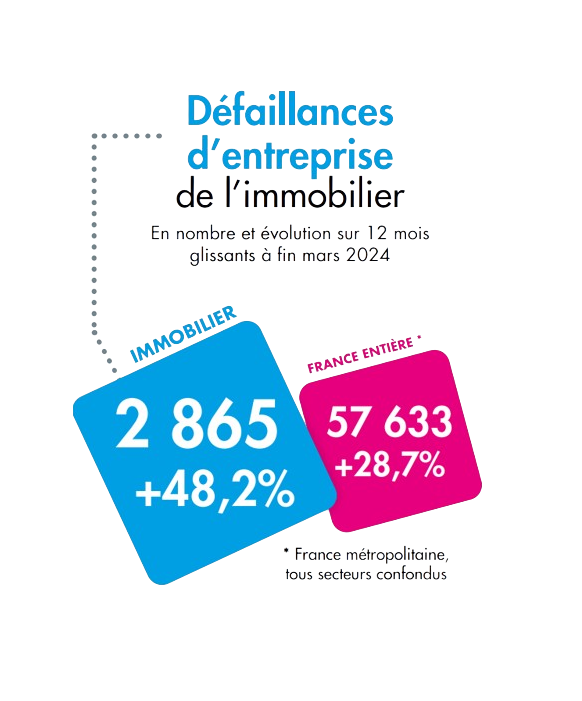

The French real estate sector is currently in the grip of a significant crisis, marked by an alarming increase in business failures*. The number of insolvencies jumped by +48.2% over a 12-month rolling period to the end of March 2024, reaching 2,865 entities concerned.

Overview of business failures

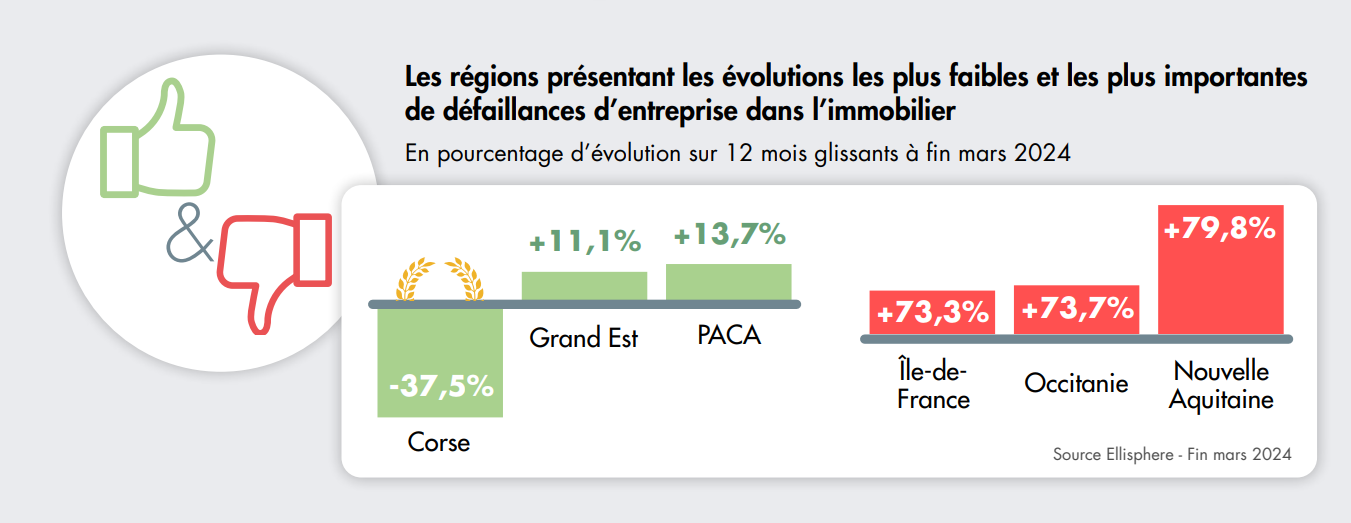

Île-de-France, Nouvelle-Aquitaine and Occitanie were the hardest hit regions, with increases of +73.3%, +73.7% and +79.8% respectively. Corsica, on the other hand, saw a significant decrease in the number of insolvencies, down 37.5%, in stark contrast to the national trend.

Activities most affected

Among the various activities making up the real estate sector, estate agencies were the hardest hit, with an increase of +109.9% in the number of insolvencies, representing 37.1% of total real estate insolvencies. Insolvencies in the property development and real estate brokerage sectors also rose, by 58.1% and 51% respectively. On the other hand, activities such as land and other property leasing saw only a modest increase of +10.5% in the number of insolvencies.

*Bankruptcies: opening of receivership and direct judicial liquidation.

The tensions observed in the real estate sector extend to a wide range of activities, including property development, which has clearly been affected. The redundancy plan announced by NEXITY is symptomatic of the current malaise. While the fall in interest rates offers a glimpse of hope, the issues of cost of materials, home renovation, land availability and therefore home ownership are still very real.

- Max Jammot, Business Unit Manager at Ellisphere

Download our full study now.

Every month, our business unit deciphers the latest news on the entrepreneurial dynamic in mainland France and the French overseas departments and territories, and shares its findings with you.

*Bankruptcies: opening of receiverships and direct judicial liquidations