The scars of covid-19

The real estate sector studied covers a number of areas: property development, rental, real estate agents, property administration, real estate agencies and legal support.

2019 was a record-breaking year, with the million-transaction mark surpassed. French interest in real estate continues to grow, with low lending rates (1.12% on average, according to theObservatoire Crédit Logement/CSA) and longer loan terms. In addition to acquiring a primary residence, many French people are also investing in rental property to build up assets for their retirement.

Unfortunately, the sudden arrival of Covid-19, which, as we all know, led to confinement and partial or total cessation of activity, inevitably shook the sector. Real estate agencies could no longer carry out visits (especially during the first lockdown), construction sites for new properties came to a standstill and notarial signatures were postponed.

The health crisis also changed buyer behavior. Indeed, the forced isolation of some during the confinements led them to reconsider their lifestyle prospects, in particular by looking for larger homes with an outdoor area and the possibility of fitting out an office to enable them to telecommute.

However, the real estate market in major cities is still being impacted by this crisis, with households turning more towards medium-sized towns or rural areas, which could see more sustained growth of +3% and +5% respectively compared to 2021 and 2022.

We should also note the emergence of new alternatives: offices converted into housing, shops turned into storage space... as well as a permanent shortage of labor that has been noted for several years now.

"Energy renovation is at the heart of the sector's challenges: an influx of properties on the market to be renovated is underway, with the added bonus that, for some, price discounts can prove very attractive... Indeed, soaring costs combined with falling purchasing power may not allow some homeowners to carry out the work required, in view of the new energy standards, among other things..."

- Max Jammot, Business Unit Manager at Ellisphere

The real estate sector in 2023

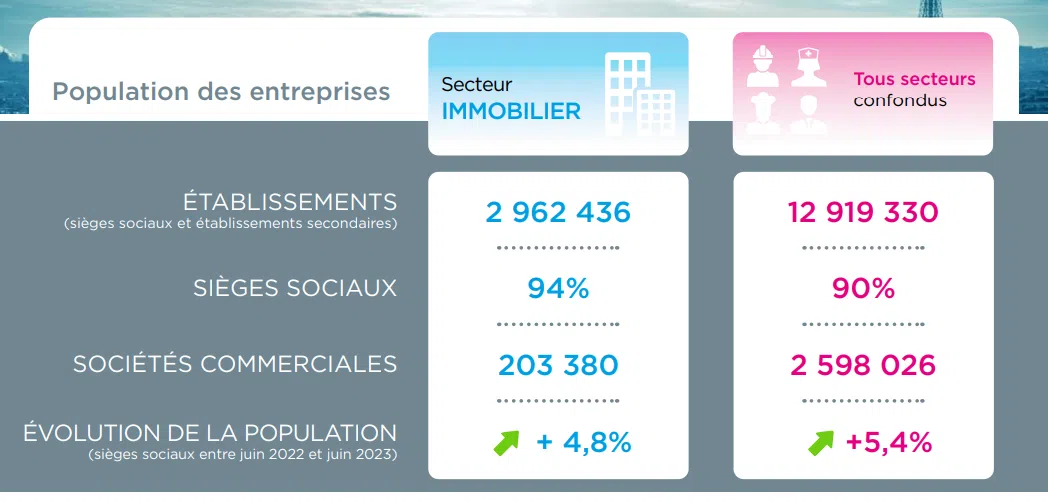

At the end of June 2023, the real estate sector will have 2,962,436 active establishments, a number that will increase by +4.8% between 2022 and 2023. The main employers are located in Paris.

The sector is made up mainly of VSEs (63.9% of entities), grouped in particular in the "rental of land and other real estate" branch of activity.

Over the past 10 years, companies in the sector have been created and closed in the legal form of "other legal entities registered with the RCS". This category essentially corresponds to Sociétés Civiles Immobilières (SCI), which are set up for specific real estate projects and then dissolved once the project is completed. In 2022, the sector studied recorded 1,523 insolvencies, threatening just over 1,800 jobs. By the end of June 2023 (on a rolling 12-month basis), 1,916 insolvencies (up 35.7%) had been recorded, with around 1,800 jobs at risk. These insolvencies mainly concern commercial companies (59.6%), and more particularly VSEs.

Trends and developments

After a tricky 2022, with fewer sales of older homes, a fall in the number of mortgages granted and a rise in mortgage rates, what are the trends in the property market? Despite the extension until the end of 2023 of the zero-rate loan and the simplified cancellation of the insurance contract, the conditions for access to credit are stricter: having a sufficient personal contribution (20% required to date compared with 10% previously), borrowing over 25 years, having a debt ratio limited to 35% of income and the benefits of the Pinel law reduced. These are all important factors to take into consideration when planning your real estate project.

And let's not forget the mandatory energy audit for the sale of energy-guzzling homes, which came into force on April 1, 2023. This means that 5 million homes rated F or G on the DPE* will have to undergo energy renovation if they are not to be excluded from the property rental market. Other factors to take into consideration are the sharp, or even very sharp, rise in property tax in some communes, and the inflationary surge. On the seller's side, to ensure that as many transactions as possible go through, a price reduction of up to -7% is sometimes hoped for.

Download our complete study now.

Every month, our economic division decrypts the news of the economic sectors and gives you its lessons.