A sector dependent on tourism and household budgets

The Hotel-Café-Restaurant sector is heavily dependent on tourism and household consumption. It should be noted that France is still one of the world's leading tourist destinations, albeit outstripped by Spain. Fiscal 2022 has been more favorable, with the end of the Covid-19 episode and the return of Western and American tourists. Last year saw a recovery in air traffic (civil aviation) compared with 2021 (+122% for European Union countries). However, air traffic is still down on 2019. In 2022, 174 million air travellers passed through France, 74.4% of them international, even if Asian visitors were still missing. While metropolitan air traffic is up +91.8% on 2021, it remains -18.8% below 2019, the same level as in 2013. The upturn in air traffic benefits the Hotels-Café-Restaurants sector, even if, of course, not all travelers are tourists, and not all tourists use air travel to come to France.

An important sector for the national economy, but not very concentrated

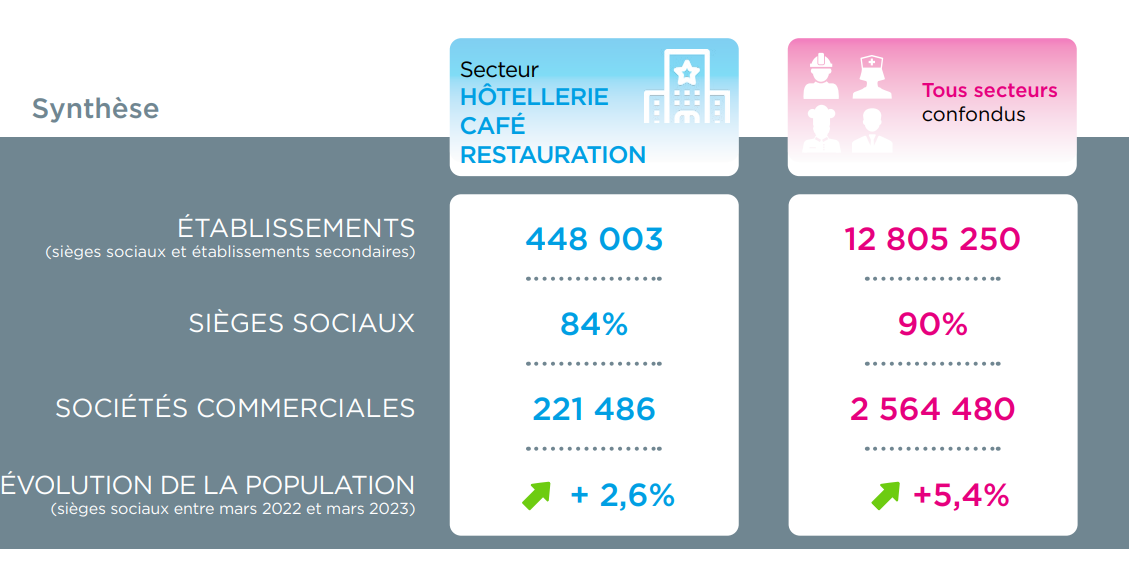

The Hotel-Café-Restaurant sector represents 3.3% of the active economic actors in metropolitan France for 3.9% of the workforce. The majority of operators are commercial companies (58.6%). However, the companies remain small in size, 65% of them being very small enterprises.

In the whole sector, catering activities are predominant with 58.7% of entities and 59% of employees. These activities are driven by the fast food industry, which is now the leading sector in terms of the number of companies (31.3% of entities), ahead of traditional catering (27.4%). Hotel and tourist accommodation is a distant second with 22.8% of entities and 20.7% of employees in the Hotel-Café-Restaurant sector.

Geographically, companies are widely distributed throughout the region. However, in terms of number of entities, the majority of companies (65.3%) and employees (70.3%) are located in the major tourist regions, including Ile-de-France, Auvergne-Rhône-Alpes, PACA, Occitanie and Nouvelle-Aquitaine. Ile-de-France alone accounts for more than a third of the workforce employed in metropolitan France for the entire Hotel-Café-Restaurant sector.

"Despite a satisfactory 2022, restaurateurs remain worried about 2023: labor shortages, inflation, the energy crisis... Many of them have had no choice but to raise prices, modify their menus or reduce opening days or hours. "

- Max Jammot, Business Unit Manager at Ellisphere

Hotels in better shape

2022 was a good year for the French hotel industry, with the return of international tourists. Over 207.3 million overnight stays were recorded in hotels in France, with nearly 66.6 million in the Ile-de-France region. The Auvergne-Rhône-Alpes and Provence-Alpes-Côte d'Azur regions lagged far behind, with 23.8 million and 23.5 million overnight stays respectively. As a reminder, in 2019, a record year for tourism, 215 million overnight stays were recorded. Better performances are expected in 2023, with the return of Asian customers and French tourists who will prefer vacations in France.

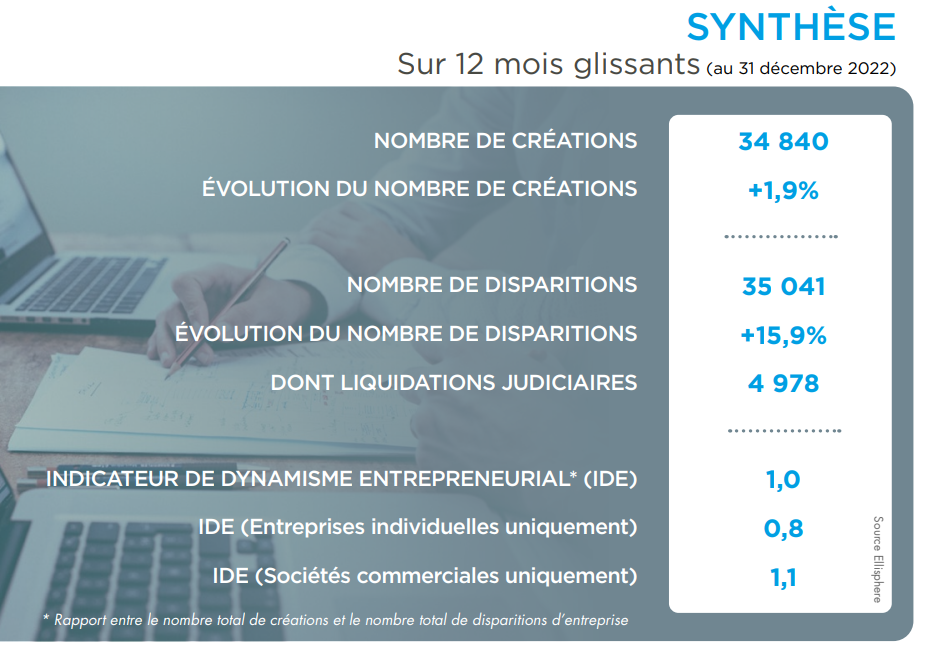

For camping, 136 million overnight stays were recorded in 2022, and a positive trend is expected in 2023. 63 million overnight stays have already been booked at French campsites. In fact, the French outdoor hotel federation has reported a 21% year-on-year increase in bookings. This good health reflects the importance of price/budget criteria in the accommodation choices of both French and European consumers. In terms of entrepreneurial dynamism, the hotel sector was the most active, with +5.1% new businesses in tourist accommodation and other short-term accommodations such as B&Bs driven by rental platforms such as Airbnb. Conventional hotel activities, meanwhile, are marking time with just +1.7% of businesses, as are campsites with a small +0.7% of businesses.

In the classic hotel sector, the number of business failures rose by +33%. For campsites, insolvencies remained contained, with an increase of +14.3% in procedures. Short-stay tourist accommodation suffered a little more, with +43.2% insolvencies over the last 12 months to the end of March 2023.

Cafés and restaurants in dire straits

With soaring energy and raw material prices, state-guaranteed loans and other subsidies having to be repaid, the catering sector is suffering the most as consumers make increasingly clear-cut choices on their budgets.Inflation on menus has put a damper on many private customers, who see these expenses as non-essential.

Recently, the entrepreneurial dynamism of cafés and restaurants appears very limited. Against this backdrop, between January 2022 and January 2023, the fast-food sector came out on top, with +3.8% growth in the number of active businesses. In contrast, traditional cafés and restaurants are stagnating, with +0.7% and +0.3% new businesses respectively. Fiscal 2022 saw the disappearance of almost 2,600 traditional catering businesses and over 800 drinking establishments. Another sign of the crisis in the foodservice sector is the explosion in the number of bankruptcies. The number of business failures rose by +106% in the fast-food sector, +89.6% in the traditional restaurant sector and +76.8% in the drinks sector. These three activities account for 92% of business failures in the entire hotel-café-restaurant sector.

Download our complete study now.

Every month, our economic division decrypts the news of the economic sectors and gives you its lessons.