While the Omicron variant continues to grow worldwide, French companies are wondering about the impact on the French economy. On this point, the Minister of the Economy, Bruno Le Maire, says he has no "concerns for French growth", but he fears supply difficulties and "inflationary tensions resulting from these bottlenecks" in a global context. This uncertainty is reshaping risk management, with some of the usual benchmarks disappearing in favor of new threats. The question is how adaptable and resilient companies are in managing these new risks. This management is crucial to their survival and growth. It can be considered as an opportunity. It is the DNA of adaptive companies.

The ability to anticipate change, a factor of resilience and growth for companies

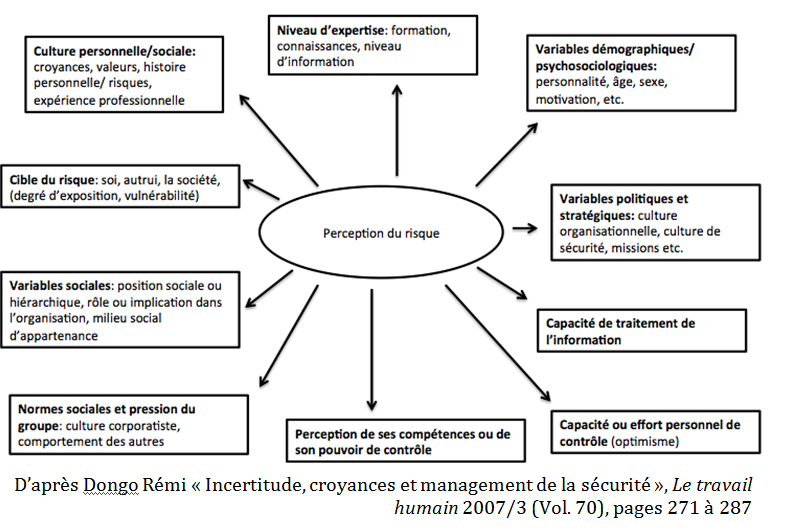

The perception or evaluation of risk is the result of a cognitive construction and is specific to each company or sector of activity. A risk that is acceptable for one company is not necessarily acceptable for another. It may be acceptable today and not tomorrow. It evolves according to different perceptions. Its evaluation is a complex phenomenon and depends on the appreciation of companies to apprehend them. In a situation of uncertainty, representations, beliefs and confidence allow to compensate for the absence of rational explanations in order to give a meaning to events.

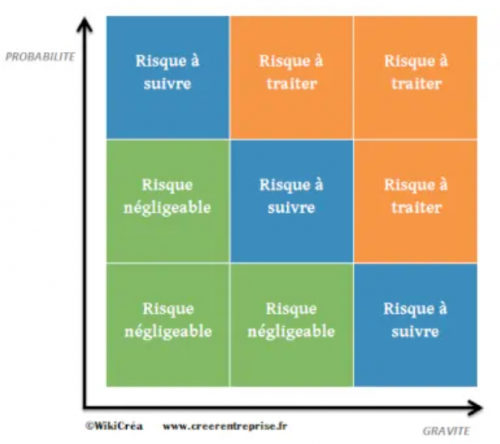

In this uncertain world, the implementation of a risk management policy allows the company to have a more realistic vision of its environment. A rational management through a continuous monitoring allows the company to :

- Prioritize and evaluate the impact of the hazard according to its severity and probability of occurrence

- Reduce their severity through understanding while anticipating their short or long term effect.

Moreover, this approach reassures investors and partners and constitutes a long-term competitive advantage, particularly in the current context of shortage, where companies in certain sectors of the economy are confronted with the logistical vulnerability of their supplies and a desynchronization of work rhythms, where delays accumulate, all amplified by recruitment difficulties.

Risk perception

The new risks in business: procurement, economic transition...

The supply chain encompasses the functions of purchasing raw materials or intermediate products from suppliers, the manufacturing process of the product through subcontractors and the distribution of the product to customers through a network of distributors or retailers.

In a global context of economic recovery, the logistical disorganization caused by the health crisis, accentuated by global warming, and the surge in demand for products under pressure are causing supply disruptions. As a result, the prices of certain raw materials or processed products are skyrocketing and sometimes become unobtainable. As a result, the health crisis has changed the way risks are managed, and some of the usual benchmarks for just-in-time supply, sometimes at the other end of the world, are highlighting new risks in the supply chain.

This reality exposes companies to the mercy of the weakest link in their supply chain. It also reveals the need for companies to get to know and control the suppliers in their supply value chain. While there are companies that know their Tier 1 supplier inside out, few understand what happens to their Tier 2 supplier, and only a few really know the impact of their Tier 3, 4 or more suppliers.

In extreme cases of supply difficulties such as we are currently experiencing, companies can go from good health to insolvency almost overnight. As with customer risk, monitoring and evaluating the financial condition of suppliers is the best preparation for potential shocks. It starts with a thorough assessment of their financial situation before entering into a relationship, complemented by daily monitoring of their solvency and sustainability.

This knowledge of its chain of subcontractors and suppliers, is also applied by obligations and regulatory pressures made to companies in compliance with their duty of care and future environmental regulations on sustainability driven by the "Corporate Sustainability Reporting Directive" (CSRD), the Taxonomy Regulation and the Sustainable Finance Disclosure Regulation (SFDR).

To address these new risks, only organizations at the forefront of their supply chain value management practices have implemented supplier risk management processes that focus on financial and liquidity analysis, compliance, supply chain and sustainability traceability...

Conclusion

Mastering new risks is becoming an essential growth tool and a differentiation factor for companies in the digital revolution, where movement is accelerated and time is shortened. It constitutes new opportunities and is a source of performance in a world in full ecological mutation where traditional business models are being questioned. Taking the measure of these new risks and evaluating their impact is to make the company evolve in a sustainable way in an uncertain world.

Thus, the more a company masters its risks, the more it is transformed and this in an increasingly tense economy linked to the health and supply crisis, inflation, labor shortage, environmental consequences, the proliferation of regulatory constraints, threats linked to the Internet and the propagation of information and data.