Open Banking, a vector of transformation for the banking sector

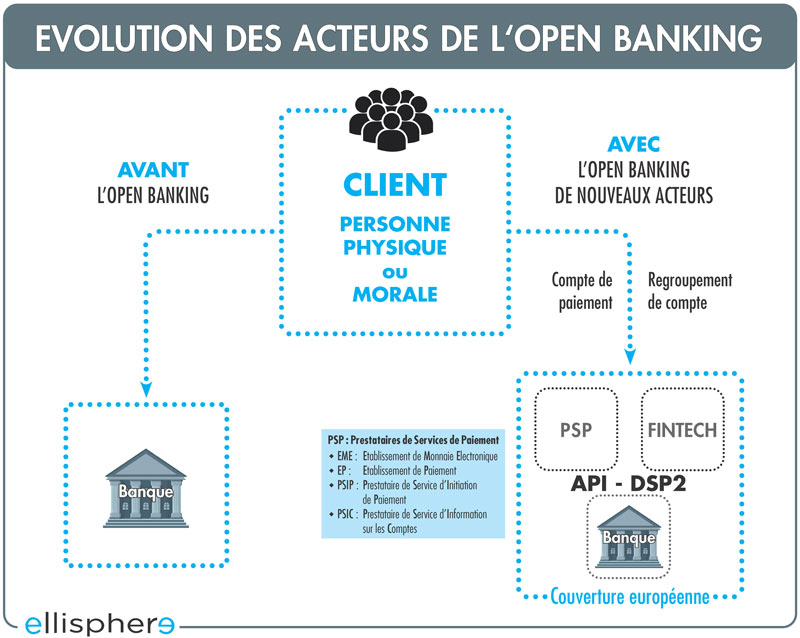

Open Banking is a decentralization of bank control over the use of customer data. It allows new third-party service providers to use customer banking data after authorization. This data sharing includes identity and transaction information. Technically, these exchanges are done through APIs (Application Programming Interfaces) in real time.

This use of APIs improves customer understanding, facilitates online payment processes, and enables bank account consolidation.

This transformation has been made possible by the maturation of the banking industry. Initial reluctance to share customer data has been overcome and banks now see this data openness as an opportunity to strengthen their competitiveness rather than as a threat. Banks are now collaborating with partners to develop new services that meet the new needs and digital lifestyles of their customers:

- Easy-to-access digital tools, omnichannel with fluid paths,

- Immediacy, flexibility, personalization, online interaction and autonomy,

- Products that go beyond the strictly banking sphere, responding to moments in life (housing, health, travel, credit, etc.),

- Optimization of the banking value chain.

This prospect is driving banks to adopt new collaborative models to retain the customer relationship such as:

- Banking-as-a-Service, where they integrate their products and services into the customer journey of their partners,

- Banking-as-a-Platform, where they integrate partner services into their offering,

- Banking-as-infrastructure, where they make their "know-how" available to their partners.

These strategies show the need, regardless of the model chosen, to master data. It is crucial to establish a solid relationship with customers by offering tailor-made products and services with added value.

The new players in Open Banking

In short, Open Banking describes a business model based on the use of APIs to share banking data between different parties. This regulated framework allows customers to share, with their consent, access to their bank accounts and data with trusted third-party service providers. This data sharing is defined by the PSD2 Directive and takes place in an ecosystem of approved partners called TPP (Third Party Provider).

Effective throughout the European Union since January 13, 2018, the Payment Services Directive aims to integrate and improve the European market. It extends the status of payment service provider (PSP) to third-party payment providers, which are distinguished by:

- Account Information Service Prov iders (AISPs). These providers aggregate bank information to provide information "aggregation" services.

- PaymentInitiation Service Providers (PISPs) that can initiate payments from a customer's account with the customer's explicit consent. It provides new types of payment services to process and facilitate transactions between an e-merchant and the buyer's bank.

In France, regulated service providers in this sector are licensed by the Autorité de contrôle prudentiel et de résolution(ACPR), which is responsible for the supervision of banking and insurance.

In this new model, the shared financial data consented to by the client are:

- Bank account data such as account holder name, account type, currency, account opening date, transaction information (e.g. amounts, companies, etc.),

- The data of products and services offered by a banking institution by consulting its website,

- Payment initiation information for a bank account.

Open Banking for new fields in payments and services

Banks' loss of control over their customer data naturally leads to the emergence of new markets and players that aim to offer new services and improve the user experience by exploring new payment approaches. For example:

- RTP -Request-to-Pay: a payment request system that complements the transfer or instant payment. RTP allows companies to include the invoice reference in the message in order to shorten payment times while facilitating accounting reconciliation.

- Pay-by-Link or link payment request through a wide range of payment methods such as payment card, e-wallet, bank transfer, etc.

- BNPL - Buy Now Pay Later. This service presents a real advance in short-term financing, where the customer authorizes access to his bank account(s) to define a credit score to pay for a purchase later, often without interest.

The opening of the banking industry is not limited to payment transactions. In an increasingly globalized and technological world, Open Banking logically extends to new areas, such as accounting, credit and customer knowledge. It also encompasses other financial services, thanks to digitization and the reduction of financial intermediation. Open Banking:

- Integrates traditional banking players, but also "Fintech" as well as payment card providers, credit and savings businesses, accounting software, IBAN verification...

- The disadvantage is that it reinforces the power of BigTech - American GAFAM* and Chinese BATX** - in the financial services sector, attracted by the collection of banking data on their platforms, giving them a significant advantage in customer knowledge.

- poses certain challenges, particularly with respect to cybersecurity, data privacy and the resulting liabilities.

The Open Banking of new uses

Thus, Open Banking offers many benefits to banking and non-banking players through the integration of new value-added services that rely on customers' payment data, with their consent.

Open Banking allows credit providers to automatically assess the income of loan applicants. This method of credit scoring provides a more complete view of an individual's or company's financial situation, enabling the automation of real-time digital loans with competitive interest rates, and a smoother customer experience.

In the equipment rental industry, access to banking information makes the process easier for customers. They no longer have to manually upload their bank statements. Lending organizations can then automatically verify applicants' income to make more informed credit decisions. This speeds up loan applications and makes them simpler, offering a competitive advantage to those who offer this service.

Access to company accounts and bank transaction data by accountants facilitates faster reconciliation of accounting entries and statements. This represents a significant advance in the field of accounting and accounting software.

Companies can improve payment control, reduce fraud, strengthen cash flow and lower receivables management costs by using payment products such as RTB or Pay per Link with payment initiation.