Working capital requirement (WCR) is the financing need between the time the company pays its creditors and the time its creditors pay it. It is based on the ratio between the decrease in trade receivables, the increase in supplier debt and inventory management, and reflects the financial impact that a company incurs due to the time lag between cash receipts and cash payments.

In measuring performance, these components make it possible to adapt a cash flow as closely as possible to reality and to find quick and effective adjustment solutions in the search for financing.

The levers to optimize it

By definition, WCR is volatile and depends on the company's activity. In the event of an increase in activity, seasonal or revenue growth, it increases in the same proportions. It is therefore imperative to find short-term financing proportional to this cash flow need, or means to reduce this need.

The WCR is systematically calculated by bankers, financial analysts and investors. Divided into two categories, operating/non-operating, its calculation makes it possible to forecast the cash flows necessary to finance the company's operating cycle. The shorter the cycle, the less time capital remains tied up in the operating process.

As a general rule, better management of working capital involves:

- A reduction in customer credit (shorter invoicing and payment times, customer reminders and time for handling disputes and amicable collection, negotiation of settlement terms for new contracts, automation of the customer collection process, etc.).

- Longer payment terms to suppliers. The longer the payment terms to suppliers, the more the company improves its working capital requirements in compliance with legal and contractual terms.

- Inventory reduction. The more inventory a company has, the more working capital it needs.

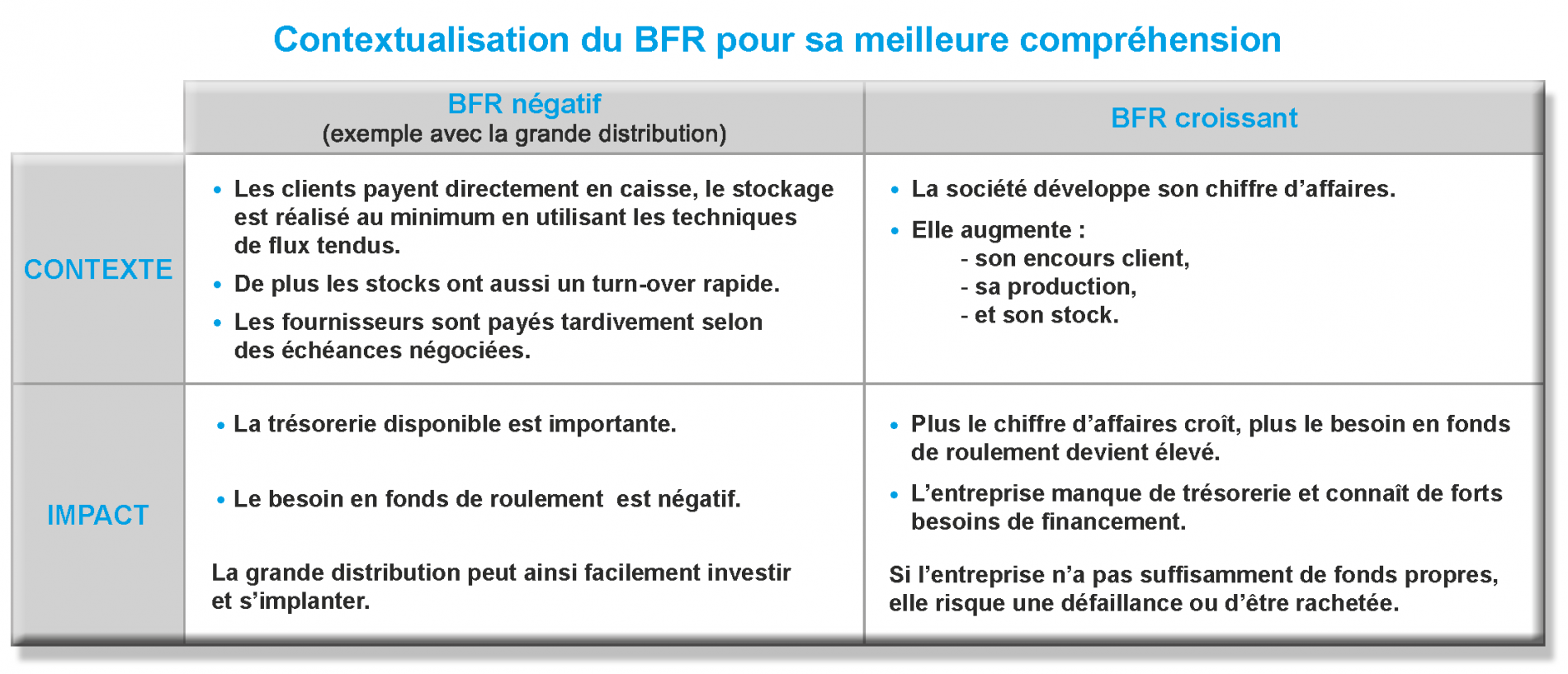

WCR, a contextual indicator of a company's health

Working capital is a very good indicator of a company's health. A high WCR does not necessarily indicate poor financial health. It must be related to the company's sector of activity and compared over time with its evolution.

On the other hand, its deterioration generally heralds cash flow tensions, or even financial difficulties that can go as far as suspension of payments. In the context of a solvency analysis, it is therefore necessary to understand the solutions that the company puts in place to control its cash flow needs. Things are even more complex for companies with seasonal or fast-growing activities, which need a lot of cash to meet their orders.

In conclusion, optimized WCR is linked to operational excellence in the reconciliation dictated by revenue growth and the maintenance of financial balances. It is a crucial indicator in the management of a company.

In order to deepen the subject, we will discuss in a future article the components of the WCR, operating and non-operating.

Read more

Our support in risk management

Discover Ellisphere's expertise on your customer/supplier risk management issues with our dedicated approach.